Natural, Organic and Regenerative Food and Agriculture Surge in Popularity

This article first appeared in the May/June 2025 issue of GreenMoney Journal

By Steven Hoffman

The market for organic food and agriculture has grown significantly since the National Organic Program was first established in 2001, placing the USDA Certified Organic seal on products that qualify for this distinction. Today, it’s a $70 billion market that’s been growing an average of 8% per year. And while it may be maturing, younger consumers, including new parents and their babies, are eating it up. And now, in the post-pandemic era, investors are once again paying attention to the potential of organic and regenerative products and brands that take into account health and the environment, and how the way we produce our food and consumer products affects climate change.

A survey released in February 2025 by the Organic Trade Association (OTA), the industry’s leading trade group, found that organic’s benefits to personal health and nutrition are resonating deeply with millennials and Gen Zers, making them the most committed organic consumers of any generation. Also, a February 2025 study by the Acosta Group, one of the nation’s top natural and organic products sales firms, reflected that 75% of all shoppers purchased at least one natural or organic product in the six months prior to the survey, with 59% responding that they think it’s important that their groceries and/or household products are natural and organic because they “are better for them” and “they tend to have fewer synthetic chemicals and additives.”

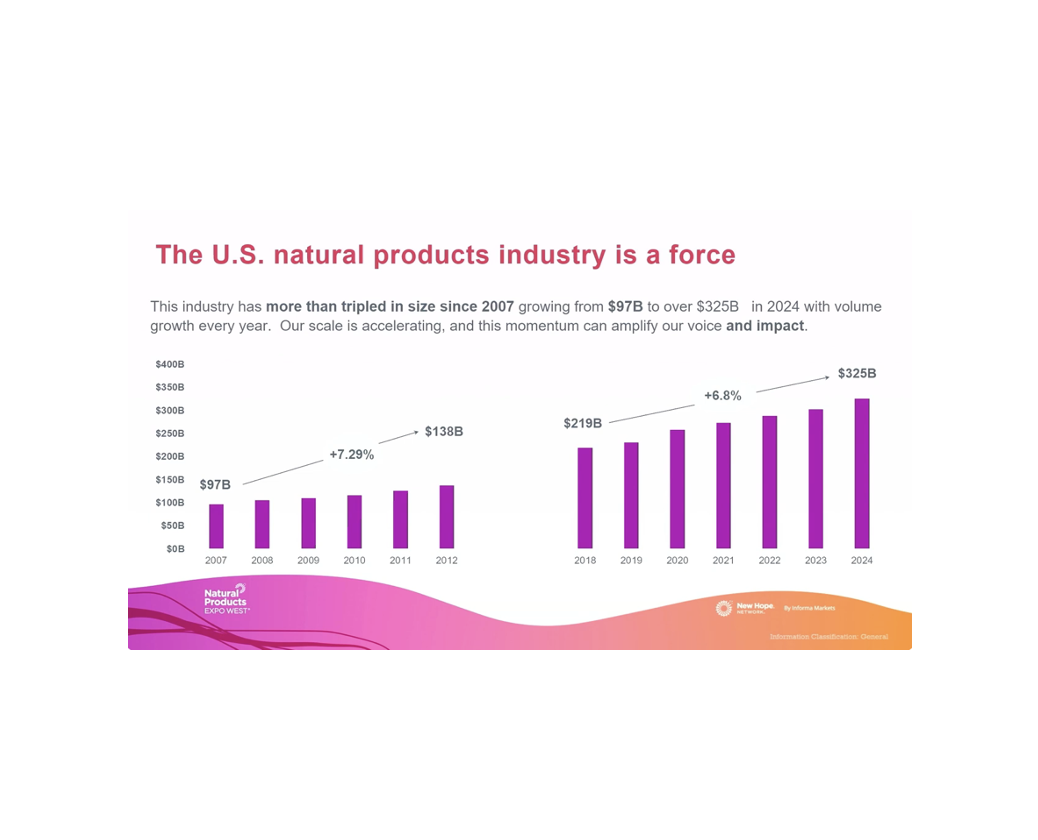

Natural and Organic Industry Is a Force

Overall, the natural and organic products industry combined has more than tripled in size since 2007, growing from $97 billion in sales in 2007 to over $325 billion in 2024, according to data compiled by New Hope Network, SPINS (a division of Nielsen), Whipstitch Capital and others, and presented at this year’s State of Natural & Organic keynote presentation at Natural Products Expo West, the world’s largest trade exhibition for the natural, organic, regenerative, nutritional and eco-friendly consumer products industry, held in March 2025.

“Wow, this industry is a force,” said Jessica Rubino, VP of Content & Summits for New Hope Network, at the keynote presentation. “That is a tremendous amount of growth. Today, we’re defining the industry as the natural, organic and functional food and beverage space, dietary supplements and personal care.” According to Rubino, the industry grew 5.7% in 2024, exceeding expectations. “The biggest piece of the pie is food and beverage, followed by dietary supplements and then personal care.” Rubino also said that while personal care is the smallest segment, it is the fastest growing and a category to watch.

“Natural products are absolutely continuing to accelerate again. Of course, they’re all outpacing non-natural products, and that’s even with not a whole lot of new items coming through,” said Kathryn Peters, Head of Industry Relations for SPINS and one of this year’s keynote presenters. “We’re also seeing more buyers coming in. This is being driven across many areas of the store, whether it’s refrigerated, grocery or vitamins and supplements. So, it’s just a resilient, wonderful story of growth we see in the industry. And really importantly, the game is continuing to be all about smart, profitable growth.”

In addition, “Organic is still very solid and strong, moving about the same pace as natural,” Peters said. “Consumers obviously have a strong awareness more than a lot of other certifications and a confidence in organic.” Certified regenerative products, too, showed significant growth of 20% in 2024, the panel noted.

“In just a little over two decades, the USDA Organic label has earned deep trust among consumers and has become one of the most identifiable food labels in our grocery stores,” said Matthew Dillon, Co-CEO of the OTA. According to OTA’s survey, more than half of U.S. consumers bought an organic fruit or vegetable in the last year. Consumers surveyed bought more bread in the last six months than any other food item, and 27% said they chose organic bread. For those surveyed consumers buying baby food, a whopping 93% chose organic. The USDA Organic label is particularly important for younger consumers, with over two-thirds seeking out the organic label in almost every food purchase. The Organic label was most valued in fresh food categories including fruits, vegetables, meat/poultry, baby food, eggs and dairy, and these items were the most likely products to be purchased as organic over the last 12 months.

Regenerative Agriculture Draws Investor Interest

In addition, regenerative agriculture — a system of farming that seeks to sequester carbon by rebuilding healthy soil — is among the sectors attracting more interest from impact investors, despite being an underfunded sector. However, there is growing consensus that the increasing threat to biodiversity is unsustainable and regenerative agriculture urgently needs to scale up. Now, groups such as Regenerative Food Systems Investors Forum and Impact Investor are drawing investor’s interest to the space.

One of the primary challenges to investing in regenerative food and farming is due to the fact that it requires significant upfront investment to transition from conventional farming. As such, many institutional investors remain hesitant due to uncertain returns and long payback periods. “This transition to regenerative farming is a long term one. That’s why intensive agriculture is so widespread, because it’s a very quick win. This is why you need investors to be patient and be willing to take some of the first loss and risk. This then accelerates the amount of private capital that will come in, because risk is protected,” said Harriet Jackson of responsAbility, a Swiss impact investing firm, speaking at Impact Investor’s 2024 conference in The Hague.

“Today…we are at what appears to be a crucial point in the transformation of agriculture and food systems. The momentum for regeneration is distinct,” said Sarah Day Levesque, Managing Director of Regenerative Food Systems Investment Forum, an investor’s organization seeking to build a more resilient food system. “There’s an increasing number of farmers pioneering the transition on the farm and increasing acreage. We can also see it in the incredible growth of organizations like EARA — the European Alliance for Regenerative Agriculture – designed to give rise to the voices of farmers in transition. Governments and public policy makers are acknowledging the very real risk presented by climate change and degradation of nature, including that caused by extractive agricultural practices. We are increasingly seeing policies and public sector investment that seeks to address these risks and support transition. Businesses and asset owners are starting to see and feel the importance of investing in nature and climate positive land use – seeing how critical investments in natural capital will de-risk production and create resilience in business models and investment outcomes.”

One organization seeking to foster investment in regenerative agriculture is the Boulder, CO-based Mad Agriculture, which in March 2024 launched Mad Capital, a $50 million investment fund aiming to de-risk regenerative and organic farming. With commitments from The Rockefeller Foundation, Schmidt Family Foundation and more, Mad Capital established its Perennial Fund II to provide loans to U.S. farmers to help them transition to regenerative and/or organic agriculture. The fund has made two closes and is “actively deploying capital to farmers,” said Mad Capital Co-founder and CEO Brandon Welch.

Natural and Organic Brands Are Outperforming

From an investor’s perspective, the overall natural, organic and regenerative products industry is looking better than it has in some time, asserted Nick McCoy, Managing Director and Cofounder of Whipstitch Capital, at the State of Natural & Organic keynote at Natural Products Expo West. “Over the last couple of years there’s been a lot of talk and a lot of pain for the lack of liquidity in this industry. It’s been very difficult for founders to find money compared to pre-Covid. Right now, we’re sitting in a very similar point as we were in 2010 or 2011 facing the millennial launch and emerging from the great recession…when it was very difficult to raise small checks. So, what's the hand of cards that we're playing in this industry now? Well, we have natural products that are very attractive. They're outperforming…consumers are running to them. We have positive ROI in cash invested. Cash invested is resulting in big revenue gains right now, and ultimately dollars chase dollars,” McCoy said.

“We may not have had as much M&A or fundings over the last two years, but…we've built a tremendous amount of value in this industry. And when you see more consumers spending more money in wellness, investment in M&A and other dollars eventually catch up and that's what's going to happen. CPG investors right now are sitting on a very large pool of illiquid but very attractive assets. There's a lot of viable brands that are growing faster than basically the broader market... Interest rates are starting to stabilize. We're seeing more fund closings and more investors getting more liquid money and the amount of illiquid value locked up is going up.”

According to McCoy, it’s not just the “big strategics" buying natural food brands. The natural products industry itself is seeing companies growing large enough to potentially become buyers themselves. “We’re seeing lots of talk about the IPO market starting again. Before 2021, I could probably count on one hand the number of brands that IPO’d in this industry. Now it sounds like it’s going to come back,” McCoy shared.

“There’re a lot of different ways that people get to liquidity,” McCoy added. “And once it does get liquid, then basically the money will flow from the bigger funds to the smaller funds, and the longer it takes, the more money these individual investors are going to get — surprising amounts. They thought they were going to get five times their money or 10 times their money investing in the company in 2015, and now it's grown so large they get 50X when it sells. And that's a true case of some that recently sold.”

According to McCoy, the $100-$300 million in revenue independent natural CPG brands — a group showing “tremendous growth” — represent major M&A and consolidation opportunity. “If we look at some of these recent high-profile deals, two, two and a half, three times revenue are where some of these things are trading. So, if we apply a two and a half times revenue multiple using SPINS sell-through data, you can see that this kind of locked up illiquid value that was $13 billion two years ago is up to $19 billion now. And when you think about a number like that, when that money starts to go back to investors, if you're an investor and you put $25,000 into a company expecting to get $250,000 and suddenly you get $1.5 million, you're going to be investing a lot more than $25,000 into other companies and that's going to bring the liquidity back over these next few years. It's really exciting to me.”

Resources

● The State of Natural & Organic — Keynote Presentation recorded at Natural Products Expo West 2025; watch here.

● Nutrition Capital Network — With news, resources, and events, NCN brings together active investors and innovative companies in health, nutrition and wellness,, www.nutritioncapital.com

● Whipstitch Capital — A leading investment bank tracking the food & beverage and health & wellness space, www.whipstitchcapital.com

● Big Path Capital — A leading investment bank and annual conference for impact investing and “Impact CEOs,” www.bigpathcapital.com

● MAD Capital — An investment fund for regenerative and organic ranchers and farmers, www.madcapital.com

● Regenerative Food Systems Investment Forum — An investor’s organization seeking to build a more resilient food system, www.rfsi-forum.com

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, regenerative and sustainable products businesses. Contact steve@compassnaturalmarketing.com.

World-Renowned Agricultural Experts to Gather for ‘Focus on the Farmer’ Symposium in Denver

Event will educate farmers and producers on all aspects of navigating the organic certification process

BOULDER, Colo. (Oct. 24, 2023) — Farmers, agriculturists, producers and others interested in best practices for transitioning to organic are invited to attend the Focus on the Farmer Live educational and networking symposium in Denver on Nov. 9.

This free, daylong event is presented by Boulder, Colorado-based communications agency Compass Natural in partnership with the Colorado Department of Agriculture (CDA), Colorado State University (CSU) and the USDA’s Transition to Organic Partnership Program (TOPP). The symposium will bring together world-renowned experts in organic agriculture to share must-have information and resources with anyone on the journey of transitioning to organic production.

Focus on the Farmer Live, which will be held from 9 a.m. to 4:30 p.m. Thursday, Nov. 9 at the new, state-of-the-art CSU Spur Campus at the National Western Center in Denver, is the culmination of the four-part Focus on the Farmer series presented in 2023 by Compass Natural and TOPP.

“We’re honored to have been selected as one of the partners working with TOPP in the Plains States, and are thrilled to be working closely with the CDA’s organic program and leading researchers and educators at CSU to deliver a content-dense Focus educational program,” said Steven Hoffman, founder of Compass Natural.

Focus on the Farmer Live will feature keynote speaker Dr. Gene Kelly, professor of pedology at CSU and director of the U.S. National Committee for Soil Sciences. Panelists include CDA inspector Brad Spelts, Colorado manager of the New Agrarian Program Taylor Muglia, CDA soil and health expert Kristen Boysen, Bish Enterprises owner Andrew Bish, Rocky Mountain Hemp President Ryan Loflin and experts from Rodale, FSA, the Savory Institute and other top agencies.

This robust educational program will cover the following topics:

~ Navigating the Certification Process

~ Tech Innovation

~ Soil & Crop Health

~ Resiliency & Climate Change

~ Alternative Crops

~ Livestock & Plains Agriculture

~ Financial Resources

Lunch provided by the Organic Sandwich Company and tours of the Spur TERRA building will be available. The event will conclude with happy hour at the Sundown Saloon. Livestream will be available for participants who would like to join virtually.

Read more about Focus on the Farmer Live and register for free here.

About Compass Natural

Based in Boulder, Colorado, Compass Natural is a communications agency serving the market for organic food and agriculture, as well as businesses and brands providing natural, socially responsible, eco-friendly and other healthy lifestyles products and services. Founded in 2001 and driven by a commitment to create a better world through business, Compass Natural is a leader in the Lifestyles of Health and Sustainability (LOHAS) market.

About TOPP

The Transition to Organic Partnership Program (TOPP) is part of the USDA Organic Transition Initiative and is administered by the USDA Agricultural Marketing Service (AMS) National Organic Program (NOP). The $100 million, five-year TOPP initiative is designed to foster organic agriculture and make much-needed technical assistance available to transitioning and existing organic farmers.

Media Contact

Steven Hoffman, Compass Natural, steve@compassnatural.com, tel 303.807.1042

‘From Tractors to Drones’ – Latest Webinar in Educational Series Focuses on State-of-the-Art Technology for Farmers Transitioning to Organic

BOULDER, Colo. (Oct. 16, 2023) – The third free webinar in the Focus on the Farmer series, hosted by Compass Natural as part of USDA’s Transition to Organic Partnership Program (TOPP), will be held Oct. 26. All farmers transitioning to organic are welcome and encouraged to attend.

The free webinar will gather top experts in organic agriculture to discuss cutting-edge tools, production methods and technological innovations that can support farmers making the transition to organic.

Webinar: ‘From Tractors to Drones’

Date: Thursday, Oct. 26, 2023, 10:30 am - 12 pm MDT

Register: Register for free here. All registrants will receive a copy of the speaker presentations and a link to the Zoom video recording.

Panelists:

Sarah Hinkley, CEO and Co-Founder, Barn Owl Precision Agriculture

As CEO and co-founder of Barn Owl Precision Agriculture (BOPA) in La Junta, Colorado, Sarah Hinkley and her team help small to midsize farmers — and in particular farmers seeking to transition to organic and regenerative agriculture — with information technology equipment and services to help more closely monitor crops and fields. Working with organic farmers, hemp farmers and other producers, BOPA utilizes autonomous micro-tractors, drones and other on-farm robotics to compile and analyze on-field data, helping to create savings in inputs, labor and time.

Haley Nagle, Lead Outreach & Education Specialist, Comet Farm, a Project of USDA’s Natural Resources Conservation Service and CSU

Haley Nagle conducts lead outreach for COMET Farm, a tool developed by Colorado State University and the USDA Natural Resources Conservation Service. Using detailed, location-specific data on climate and soil conditions, COMET Farm helps farmers estimate the carbon footprint for all or part of a farm/ranch operation, allowing operators to evaluate options for reducing GHG emissions and sequestering carbon in the soil.

Andrew Bish, COO, Bish Enterprises

Andrew Bish is COO of family-owned Bish Enterprises, based in Giltner, Nebraska. The company is a leading manufacturer of equipment and accessories for tractors and combines, from custom “Bish Built” row crop headers to corn reels to products for harvesting industrial hemp. Andrew’s expertise spans a range of crops, from commodities such as sorghum, soybeans and cereal grains to specialty crops including hops, wild rice, hemp and seed grasses. He also brings a passion for organic production to this webinar.

“We are thrilled with the interest our Focus on the Farmer series has generated," says Steven Hoffman, founder of Compass Natural. ”We’re all dependent on technology today to help run our businesses, and that goes for agriculture too. Our panelists will share about state-of-the-art technology that is specifically focused on helping farmers succeed in the transition to organic and beyond."

About Compass Natural

Based in Boulder, Colorado, Compass Natural is a communications agency serving the market for organic food and agriculture, as well as businesses and brands providing natural, socially responsible, eco-friendly and other healthy lifestyles products and services. Founded in 2001 and driven by a commitment to create a better world through business, Compass Natural is a leader in the Lifestyles of Health and Sustainability (LOHAS) market.

The Focus on the Farmer educational series is produced by Compass Natural in partnership with USDA’s Transition to Organic Partnership Program (TOPP) in the Plains States region. TOPP is designed to foster organic agriculture and make much-needed technical assistance available to transitioning and existing organic farmers.

About TOPP

The Transition to Organic Partnership Program (TOPP) is a program of the USDA Organic Transition Initiative and is administered by the USDA Agricultural Marketing Service (AMS) National Organic Program (NOP).

Media Contact

Steven Hoffman, Compass Natural, steve@compassnatural.com, 303.807.1042

‘Where’s the Money?’ – Focus on the Farmer Educational Series to Cover Financial Assistance for Farmers Transitioning to Organic

BOULDER, Colo. (Sept. 15, 2023) – As part of USDA’s Transition to Organic Partnership Program (TOPP), Compass Natural’s Focus on the Farmer educational series will offer a free webinar on Sept. 28 to support farmers transitioning to organic.

The webinar, the second in a series of four events hosted by Compass Natural in 2023, will gather top experts in organic agriculture, investment and finance to discuss investment, loan and funding opportunities for transitional and organic farmers, including government and grant programs to help cover the costs of transition and obtaining organic certification.

Webinar: WHERE’S THE MONEY?

Date: Thursday, Sept. 28, 2023, 10:30 am-12 pm MDT

Register: Register for free here. All registrants will receive a copy of the speaker presentations and a link to the Zoom video recording.

Panelists include:

Jayce Hafner, Co-Founder and CEO, FarmRaise

Co-founder and CEO of FarmRaise, Jayce Hafner grew up on a small livestock farm. She created FarmRaise to provide “farmer-friendly financial tools” and to help find funding and grants to support the transition to organic agriculture and more. Tracking tax and carbon credits, USDA grants and other programs, FarmRaise keeps farmers apprised of funding opportunities and helps them manage their business and finances.

Brandon Welch, Co-Founder and CEO, Mad Capital

Brandon Welch is co-founder and CEO of Mad Capital, providing customized loans and financing created for transitioning, organic and regenerative farmers. Replacing traditional loans and farm debt with capital that enables the transition to organic, Brandon is working to regenerate land at scale by providing long-term and tailor-fit credit to help farmers navigate the challenges of transitioning. He has experience in underwriting, credit, raising private funds, portfolio management and business building.

Emma Fuller, Co-Founder, Fractal Ag

Dr. Emma Fuller helped co-found Fractal Ag, which invests alongside farmers by taking passive, minority stakes in land that farmers already own. Farmers receive needed capital to invest in their operations, while investors access high-quality farmland that remains in the hands of the farmer. Farmers decide how to use the capital to best grow their business. Fractal discounts the cost of capital for farmers who have introduced regenerative practices, regardless of when they adopted them. Emma received her Ph.D. in Ecology and Evolutionary Biology from Princeton.

Claire Mesesan, Chief of Staff, Iroquois Valley Farmland REIT

Claire Mesesan is chief of staff at Iroquois Valley Farmland REIT, a public benefit corporation. Iroquois Valley provides land security to organic farmers through long-term leases, mortgages and operating lines of credit. Iroquois Valley supports the organic transition through its products, offering a discounted lease rate during the organic transition and interest-only mortgages for the first five years, and supports soil health and conservation projects through its in-house grant program.

Mark Retzloff, former president of the Organic Trade Association and co-founder of Horizon Organic Dairy, Greenmont Capital Partners and Alfalfa’s Market, and Steven Hoffman, founder of Compass Natural and a former Peace Corps volunteer and USDA agriculture extension agent, will serve as co-moderators.

“Our ultimate goal is to support and educate farmers during their journey to organic certification,” says Steven Hoffman, founder of Compass Natural. ”Financing is inevitably a top concern and we are thrilled to have such seasoned leaders sharing information with farmers and producers to help them navigate the process.”

About Compass Natural

Based in Boulder, Colo., Compass Natural is a communications agency serving the market for organic food and agriculture, as well as businesses and brands providing natural, socially responsible, eco-friendly and other healthy lifestyles products and services. Founded in 2001 and driven by a commitment to create a better world through business, Compass Natural is a leader in the Lifestyles of Health and Sustainability (LOHAS) market.

The “Focus on the Farmer” educational series is produced by Compass Natural in partnership with USDA’s Transition to Organic Partnership Program (TOPP) in the Plains States region. TOPP is designed to foster organic agriculture and make much-needed technical assistance available to transitioning and existing organic farmers.

About TOPP

The Transition to Organic Partnership Program (TOPP) is a program of the USDA Organic Transition Initiative and is administered by the USDA Agricultural Marketing Service (AMS) National Organic Program (NOP).

Media Contact

Steven Hoffman, Compass Natural, steve@compassnatural.com, 303.807.1042

Compass Natural Marketing Partners With USDA in Major Organic Farming Initiative

Leading natural and organic marketing communications agency selected to manage a series of key events to support farmers transitioning to organic

BOULDER, Colo. (Aug. 11, 2023) — Compass Natural, a Boulder, Colo.-based PR and communications agency with a deep commitment to organic and regenerative food, agriculture and the environment, has entered into a cooperative agreement to support the USDA’s Transition to Organic Partnership Program (TOPP). This $100 million, five-year program is a critical part of the USDA’s Organic Transition Initiative — the largest single investment in organic agriculture ever made by the USDA.

TOPP is designed to foster organic agriculture and make much-needed technical assistance available to transitioning and existing organic farmers. TOPP is building partnership networks in six regions across the U.S., working with trusted organizations like Compass Natural to create and administer farmer mentorship, education and community-building programs.

“We are thrilled to partner with Compass Natural on the Transition to Organic Partnership Program,” says Brandon Hill, OCIA International’s program director for the Plains Region TOPP. “As the agency has a deep connection to organic markets, it is a great fit to help make the connections producers will need to successfully transition to organic.”

Compass Natural is one of 16 select organizations partnering with OCIA International in TOPP’s Plains Region, encompassing Colorado, North Dakota, South Dakota, Nebraska, Kansas and Oklahoma. Compass Natural will manage a series of key events for farmers throughout the Plains Region during the second half of 2023. Using a contact list of more than 25,000 industry leaders, decision-makers, producers and major media members involved in organic food and agriculture, Compass Natural will bring together key experts and farmers to support the mission of the TOPP program.

‘Focus on the Farmer’ Fall Series Kicks Off With Aug. 29 Webinar

Compass Natural will kick off a Fall “Focus on the Farmer” education program on Aug. 29, 2023, with the first of a series of monthly webinars. Registration is now open. Farmers can sign up here.

August panelists will include:

· Dr. Gene Kelly, professor of pedology, deputy director of the Colorado Agricultural Experiment Station and the associate director for research in the School of Global Environmental Sustainability at Colorado State University (CSU).

· Tina Owens, senior fellow of Regenerative Agriculture, leading the Nutrient Density Alliance, a program within the Soil & Climate Alliance at Green America. Tina has been working as a sustainability leader within the organic sector since 2008 for several of the largest organic brands in the world, including enabling on-farm transition to organic and regenerative practices.

· Mark Retzloff, a pioneer in the organic and natural foods industry with a 47-year career including co-founder of Alfalfa’s Markets, co-founder of Aurora Organic Dairy, co-founder of Horizon Organic Dairy and former chairman of the Organic Food Alliance.

Live Symposium Planned for November 2023

The Fall Series will conclude with a live, one-day networking and education event in November. It will bring together world-class experts and farmers to discuss subjects related to transitioning to organic. Topics will include key organic resources, the regeneration of soil and carbon sequestration, best practices in pest control, organic farming and ranching production, and handling, financing alternatives, value-added product development and more.

Upcoming events will also highlight community-building initiatives like TOPP for Indigenous Producers; Linking Organic Consumer Packaged Goods Brands With Organic Producers in Transition; and Financing, Grant and Funding Options for Organic Producers. Technical assistance and training initiatives include TOPP for Hemp/Grain Farmers in the Plains Region, TOPP for Specialty and Produce Growers, and TOPP for Western Slope Fruit and Specialty Crop Producers.

“Compass Natural is honored, grateful and excited to be partnering with TOPP on such an important program focusing on supporting farmers as they transition to organic,” says Steven Hoffman, founder of Compass Natural. A former agricultural extension agent and graduate of Penn State University, a land grant college, Hoffman adds, “We look forward to educating farmers about the true value of organic in building resiliency in their farm operations.”

About Compass Natural

Based in Boulder, Colo., the “Epicenter of the Natural Products Industry,” Compass Natural is a boutique communications agency serving the rapidly growing market for natural, organic, socially responsible, eco-friendly and other healthy lifestyles products. Founded in 2001 and driven by a commitment to create a better world through business, Compass Natural is a leader in the Lifestyles of Health and Sustainability (LOHAS) market.

About TOPP

Transition to Organic Partnership Program (TOPP) is a program of the USDA Organic Transition Initiative and is administered by the USDA Agricultural Marketing Service (AMS) National Organic Program (NOP).

Media Contact

Steven Hoffman, Compass Natural, steve@compassnatural.com, tel 303.807.1042

Trader Convicted in Organic Fraud Scheme Commits Suicide Before Serving 10-Year Prison Sentence

Photo: Pexels

Originally Appeared in Presence Marketing News, September 2019

By Steven Hoffman

Facing incarceration for his role in masterminding a $142 million organic grain fraud scheme, organic farmer and trader Randy Constant was found dead by suicide on August 19 at his home in Chillicothe, MO. Constant was sentenced on August 16 by a federal court judge to 10 years in prison for knowingly marketing and selling non-organic corn and soybeans as organic. Federal prosecutors called the scheme “one of the largest, if not the largest, organic fraud schemes in the history of the United States.” Police officers found Constant dead from carbon monoxide poisoning weeks before he was to report to federal prison. Prosecutors alleged that Constant falsely marketed non-organic grains as certified organic on a massive scale, reported Time Magazine. Sales through his Iowa grain brokerage equaled up to 7% of the organic corn grown in the U.S. in 2016 and 8% of organic soybeans. From 2010 to 2017, Constant was reported to have sold over 11.5 million bushels of grain, primarily used as feed for chickens and cattle, which would then be unwittingly marketed as organic meat products by the respective producers. Constant’s death came as authorities publicized his prison term, which they hoped would deter other farmers from defrauding the National Organic Program, reported Time Magazine. Judge C.J. Williams said during the sentencing hearing that Constant’s fraud did “extreme and incalculable damage” to consumers and undermined public confidence in the nation’s organic food industry.