Natural Grocers Wins GMO Labeling Appeal; Supplement Industry Under Pressure

This article first appeared in the February 2026 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In January 2026, the regulatory framework governing the natural products industry encountered significant developments affecting how food and dietary supplements are labeled and regulated. Through a combination of judicial rulings, agency guidance, and legislative proposals, the requirements for transparency and product disclosure are shifting, presenting new compliance considerations for manufacturers and retailers alike.

For CPG brands, ingredient suppliers, and compliance officers, these updates signal a continued move toward explicit, on-package disclosure. Recent events indicate that both the courts and legislators are increasingly prioritizing clear, accessible information for consumers, challenging previous standards that allowed for digital or abbreviated disclosures.

This report outlines two primary developments from the start of the year: the U.S. Court of Appeals ruling in favor of Natural Grocers regarding Bioengineered (BE) disclosures, and a dual-front regulatory discussion involving the FDA and Senator Dick Durbin (D-IL) regarding the dietary supplement sector.

Federal Appeals Court Sides with Natural Grocers in GMO Ruling

In a decision delivered on Jan. 6, 2026, the U.S. Court of Appeals for the Ninth Circuit ruled in favor of a coalition of plaintiffs led by the Lakewood, CO-based retailer Natural Grocers by Vitamin Cottage (NYSE: NGVC) and the Center for Food Safety (CFS). The court’s decision effectively strikes down key portions of the USDA’s Bioengineered Food Disclosure Standard, addressing industry arguments that the previous rules contained exemptions that limited consumer access to information.

The "National Bioengineered Food Disclosure Standard" (NBFDS) has been a subject of debate since its inception. Critics, including the plaintiffs, argued that the USDA’s implementation allowed manufacturers to obscure the presence of genetically modified organisms (GMOs) through the use of digital links and unfamiliar terminology.

According to a Natural Grocers press release, the court’s ruling necessitates a significant revision of USDA rules. The outcome aligns with a long-standing position of Natural Grocers, the nation’s largest family-operated organic and natural grocery retailer, which has prohibited most GMO ingredients in its stores since 2012 and advocated for clearer labeling standards.

The court’s decision focused on three specific areas where the USDA’s previous rules were found to be insufficient or unlawful. Food and beverage manufacturers must now prepare for a regulatory environment that will likely require strategic adjustments in the next rulemaking cycle.

The "Bioengineered" Terminology Battle

First among the court's findings was the rejection of the USDA’s mandate that strictly required the use of the term "bioengineered." Plaintiffs successfully argued that this term is unfamiliar to the average shopper and infringed on free speech rights by prohibiting the use of terms consumers actually understand.

Under the overturned rules, a manufacturer was forced to use "bioengineered" even if their customer base was far more familiar with "GMO" or "Genetically Engineered." According to the Non-GMO Project, recent market research indicates that while 63% of consumers recognize the term "GMO," only 36% are familiar with "bioengineering." By mandating the lesser-known term, the USDA was seen as complicating disclosure. The ruling now paves the way for retailers and brands to use terms that resonate more clearly with their customers, potentially returning the familiar "GMO" acronym to federal disclosures.

Closing the Digital Divide: The End of QR Code Exclusivity

Operationally, a significant aspect of the ruling is the rejection of standalone QR codes as a sufficient means of disclosure. The USDA had previously allowed companies to forgo on-package text disclosures entirely in favor of a scannable code. Natural Grocers and the Center for Food Safety argued that this practice excluded consumers without smartphones, reliable internet access, or technical literacy—demographics that often include the elderly and rural populations.

The court agreed, ruling that companies cannot rely solely on digital disclosures. This decision impacts the "scan to learn more" approach that some large CPG companies had adopted. Brands that utilized digital links to manage label space must now redesign packaging to include clear, on-pack text or symbols accessible to the naked eye.

Highly Processed Ingredients: No More Hiding

Finally, the court found the USDA was incorrect in exempting highly processed foods—such as sugar from sugar beets or oil from canola—simply because the genetic material might not be detectable in the final refined product.

This "highly refined" exemption had been a major point of contention. Natural Grocers argued that even if the DNA is denatured or removed during processing, the ingredient still originates from a bioengineered crop system. The environmental and agricultural impacts remain, regardless of the final chemical structure of the sugar or oil.

"The court’s rejection of the ‘highly refined’ exemption reinforces an important principle: how food is made matters," noted Charlene Guzman, Communications Director of the Non-GMO Project, in a statement to Nosh. Brands that have relied on this exemption should expect closer scrutiny as the USDA revises its rules, particularly for ubiquitous ingredients like oils, sugars, and starches derived from GMO crops.

Heather Isely, Executive Vice President of Natural Grocers, stated that the decision reflects congressional intent. "Congress never intended to require the use of specific terms, the sole use of QR codes, or the exclusion of ingredients made from highly processed GMO crops," she said. "We are pleased the court recognized the shortcomings of the final rule and mandated corrections. Natural Grocers will remain actively engaged in the GMO regulatory process."

George Kimbrell, Legal Director of the Center for Food Safety, added that the ruling ensures consumers will eventually see "clear and accurate GMO label information."

The legal victory is consistent with Natural Grocers' long history of rigorous product standards. Founded in 1955 and with 168 stores across 21 states, the company has utilized a dynamic list—"Things We Won't Carry and Why"—to screen products. As stated in WholeFoods Magazine, if a company cannot verify non-GMO status, Natural Grocers will not stock the item.

The Supplement Industry’s Regulatory Tug-of-War

While the food industry assesses the implications of the GMO ruling, the dietary supplement sector is navigating a complex regulatory landscape. On one hand, the FDA is signaling potential flexibility regarding labeling requirements. On the other, Senator Dick Durbin has reintroduced legislation that could impose new registration requirements.

In a letter to the industry issued on Dec. 11, 2025, the FDA announced it is considering amendments to 21 C.F.R. § 101.93(d). This regulation currently governs the placement of the disclaimer required for structure/function claims under the Dietary Supplement Health and Education Act of 1994 (DSHEA).

Under current rules, supplements making claims such as "Supports heart health" must carry the standard disclaimer: "This statement has not been evaluated by the FDA. This product is not intended to diagnose, treat, cure, or prevent any disease." Regulations have historically required this disclaimer to appear on every single panel where a claim is made. For small bottles, this often leads to "label clutter," where the same disclaimer is repeated multiple times.

According to the National Law Review, the FDA is looking to remove the "each panel" requirement. Kyle Diamantas, FDA Deputy Commissioner for Human Foods, noted in the letter that revising this regulation would "reduce label clutter and unnecessary costs," aligning with the agency's historical enforcement posture.

Effective immediately, the FDA is exercising "enforcement discretion." The agency will not prioritize penalizing companies that do not repeat the disclaimer on every panel, provided the disclaimer appears at least once and is properly linked to the claims. However, companies should proceed with caution; this is a relaxation of placement frequency, not a removal of the disclaimer itself.

Not all experts view this relaxation as positive. Pieter Cohen, M.D., Associate Professor of Medicine at Harvard Medical School expressed concern to Nutraceutical Business Review, warning that reducing disclaimer visibility could mislead consumers. "Then you start saying things such as, ‘We only need it on the actual bottle.’ Then you let the print get smaller," Cohen noted, highlighting the tension between industry simplification and consumer protection.

Durbin Reintroduces the Dietary Supplement Listing Act

While the FDA offers potential labeling flexibility, Congress is considering increased oversight. On Jan. 17, 2026, Senator Dick Durbin reintroduced the Dietary Supplement Listing Act, aimed at modernizing FDA oversight through Mandatory Product Listing (MPL).

The core of the bill would require manufacturers to register products with the FDA, providing product names, ingredient lists, electronic copies of labels, allergen statements, and structure/function claims. This data would populate a public database accessible to consumers.

Senator Durbin’s argument is rooted in the growth of the sector. When DSHEA passed in 1994, there were approximately 4,000 supplements on the market. Today, the FDA estimates there are over 100,000. Durbin argues that the FDA cannot effectively regulate a market it cannot track. "FDA—and consumers—should know what dietary supplements are on the market and what ingredients are included in them. This is FDA’s most basic function," Durbin stated.

As reported by RiverBender, the bill has garnered endorsements from the American Medical Association, US Pharmacopeia, and Consumer Reports. However, the industry itself remains divided, illustrating a strategic difference between its two major trade associations.

A House Divided: CRN vs. NPA

The reintroduction of the Listing Act has reignited a debate between the Council for Responsible Nutrition (CRN) and the Natural Products Association (NPA).

The CRN supports the legislation, viewing transparency as a path to legitimacy and consumer trust. Steve Mister, President and CEO of CRN, stated, "In an era when the Administration has rightly called for more transparency about what we eat and how food is made, it makes sense to apply that same transparency to dietary supplements." The CRN views the registry as a tool to distinguish legitimate, responsible brands from "fly-by-night" actors selling tainted products, arguing that a federal registry is "a transparency tool—not a barrier to innovation."

Conversely, the NPA opposes the bill. Daniel Fabricant, Ph.D., President and CEO of NPA, characterizes it as unnecessary bureaucracy that burdens lawful companies while failing to stop bad actors. Fabricant argues that DSHEA already gives the FDA ample authority; the agency simply fails to use it.

As detailed in Nutrition Insight, NPA fears that the FDA could use the list to arbitrarily challenge ingredients, citing the recent (and reversed) attempt to ban NMN (nicotinamide mononucleotide) as an example of regulatory overreach. "This proposal will hand bureaucrats new leverage over lawful products, cool innovation, and punish companies investing in new science," Fabricant warned.

Conclusion: The Transparency Mandate

As the year progresses, the common thread connecting the Natural Grocers victory and the Durbin bill is transparency. In the food aisle, the courts have ruled that accessibility is key—labels must be readable without a smartphone and use terms the public understands. In the supplement aisle, the debate continues over whether transparency requires a federal database of every product on the market.

For business leaders, the takeaway is operational agility. Packaging workflows must be adaptable, supply chain documentation must be robust, and regulatory monitoring must be constant. The "clean label" trend is extending beyond ingredients to include the regulatory integrity of the package itself.

Natural Grocers has signaled it will remain active, with executive Heather Isely stating, "Natural Grocers will remain actively engaged in the GMO regulatory process." Brands wishing to remain on the shelves of such high-standard retailers must ensure their transparency efforts meet these rising expectations.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Industry Leaders Respond to USDA’s Funding Announcement for Regenerative Agriculture

This article first appeared in the January 2026 issue of Presence Marketing’s newsletter.

By Steven Hoffman

U.S. Secretary of Agriculture Brooke Rollins, alongside U.S. Health and Human Services (HHS) Secretary Robert F. Kennedy, Jr., and Centers for Medicare & Medicaid Services Administrator Mehmet Oz, M.D., on December 10 announced a $700 million Regenerative Pilot Program to help American farmers adopt practices that improve soil health, enhance water quality, and boost long-term productivity, all while building a healthier, more resilient food system, said USDA. According to the release, HHS also is investing in research on the connection between regenerative agriculture and public health, as well as developing messaging to explain this connection.

“Protecting and improving the health of our soil is critical not only for the future viability of farmland, but to the future success of American farmers. In order to continue to be the most productive and efficient growers in the world, we must protect our topsoil from unnecessary erosion and improve soil health and land stewardship. Today’s announcement encourages these priorities while supporting farmers who choose to transition to regenerative agriculture. The Regenerative Pilot Program also puts farmers first and reduces barriers to entry for conservation programs,” said Secretary Rollins.

Administered by USDA’s Natural Resources Conservation Service (NRCS), the new Regenerative Pilot Program is designed to deliver a streamlined, outcome-based conservation model—empowering producers to plan and implement whole-farm regenerative practices through a single application. In FY2026, the Regenerative Pilot Program will focus on whole-farm planning that addresses every major resource concern—soil, water, and natural vitality—under a single conservation framework. USDA said it is dedicating $400 million through the Environmental Quality Incentives Program (EQIP) and $300 million through the Conservation Stewardship Program (CSP) to fund this first year of regenerative agriculture projects. The program is said to be designed for both beginning and advanced producers, ensuring availability for all farmers ready to take the next step in regenerative agriculture.

To support the program, NRCS is establishing a Chief’s Regenerative Agriculture Advisory Council “to keep the Regenerative Pilot Program grounded in practical, producer-led solutions,” USDA said. The Council will meet quarterly, with rotating participants, to advise the Chief of NRCS, review implementation progress, and help guide data and reporting improvements. Its recommendations will shape future USDA conservation delivery and strengthen coordination between the public and private sectors.

USDA also said it is permitting public-private partnerships as part of the Regenerative Agriculture Initiative (RAI), claiming that such partnerships will allow USDA to match private funding, thus stretching taxpayer dollars further, and bringing new capacity to producers interested in adopting regenerative practices.

We asked leaders in regenerative agriculture to weigh in on USDA’s announcement. Here’s what they had to say:

Hannah Tremblay, Policy and Advocacy Manager, Farm Aid

As a strong supporter of regenerative agriculture, Farm Aid welcomes USDA’s funding announcement for regenerative agriculture, but the lack of details about the program's specifics means we're unable to give a full response or analysis. From the few details that have been provided to date, this looks like a streamlining of processes and possible restructuring of existing funding, but does not appear to represent new funding for these programs.

The chronic underfunding and oversubscription of the EQIP and CSP programs – two crucial conservation programs – are ongoing problems that this administration and Congress have not addressed. The recent budget bill passed by Congress makes it easier for large operations to disproportionately use EQIP and CSP dollars by removing payment limits and Adjusted Gross Income (AGI) requirements. Policies like these make these programs less accessible to small and diversified farming operations and do a disservice to family farmers who are trying to enact conservation practices.

This sudden embrace of regenerative agriculture flies in the face of the other policies we've seen from this administration, including canceling the Climate Smart Commodities Program, EPA's fast tracking of pesticides and cuts to USDA's NRCS staff, who are crucial to helping farmers implement soil health practices.

Matthew Dillon, Co-CEO, Organic Trade Association

There are still many details to come in the implementation of the NRCS regenerative program, but the Organic Trade Association (OTA) is always supportive of programs that help farmers transition to improved management of their natural resources. It would appear that it will give farmers an à la carte menu of practices that they can select and create a less burdensome bundled approach with NRCS. If we can make it easier for farmers to better care for natural resources, that’s a good outcome.

The optimal outcome would be for farmers to have integrated and holistic conservation plans, like those that organic farmers do in their annual Organic System Plan. And ideally, that would include pesticide mitigation plans for those farmers who are conventional. Hopefully for some of these farmers it will be an on-ramp to exploring opportunities in organic markets.

At the end of the day, policy incentives will only go so far in rewarding farmers for ecosystem services – markets and consumers are essential. Organic is the only third party, verified, backed-by-law marketplace that does that. We will work to make sure organic farmers have adequate access and get recognition in these programs.

Ken Cook, Executive Director, Environmental Working Group

Basically, I’m pretty skeptical of the Regenerative Pilot Program. If you look at all of Robert F. Kennedy, Jr.’s big talk during the Trump campaign and then during the transition regarding subsidies, $700 million rebranded from existing programs (with multi-billion-dollar budget baselines that a lot of us built and defended) is hardly the bold action he promised. The emphasis on efficiency and red tape is interesting—whole farm plans that originated in the 1930s and 1940s in the old Soil Conservation Service (SCS) are all about paperwork and red tape, and going back, a lot of us in the conservation world (and reformist elements within NRCS) pushed the agency to focus on practices aimed at priority lands/problems. Reformers in NRCS in the 1980s and after always felt whole-farm plans were make-work that resulted in career advancements (and documents on farmers’ shelves) but not necessarily conservation on the ground.

There was no emphasis at the press conference announcing the program on reducing pesticides. Nor was there any emphasis on aiming some of the money at organic, the only system out there that does fulfill the MAHA rhetoric from farm to grocery shelf.

And of course, during the Biden administration there was so much emphasis in regenerative circles on climate progress via carbon farming, carbon sequestration, farmers selling carbon credits, and so on, but those words and objectives have been forbidden by USDA. (We always thought the carbon stuff was way oversold—and not needed to justify lots of benefits from mixed crop-livestock farms, longer more diverse rotations, cover crops and other sensible practices that…have also been around and under-deployed by farmers since the 1930s despite BILLIONS spent by taxpayers on free technical assistance and cost-sharing).

Then of course there are the ‘antithesis-of-MAHA’ cuts to vital programs earlier this year to get local food to schools and food banks, the reductions in NRCS staff to do those whole-farm plans, and the massive, multi-billion-dollar subsidies that have been paid in tariff reparations to big commodity operations—whose payment limits have been generously increased to make sure the biggest operations get the most money.

Christopher Gergen, CEO, Regenerative Organic Alliance

The Regenerative Organic Alliance (ROA) welcomes the USDA’s announcement of a new Regenerative Pilot Program as an important signal of federal commitment to advancing healthier soils, more resilient farms, and stronger rural economies. We applaud this growing recognition that agriculture must go beyond extraction toward restoration, a core belief that has guided our work since the creation of the Regenerative Organic Certified® (ROC™) standard.

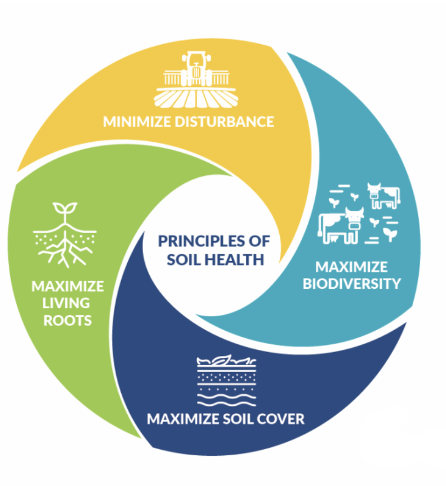

As USDA begins shaping the program’s criteria and implementation, ROA encourages alignment with the rigorous, holistic principles that define regenerative organic agriculture: improving soil health, ensuring dignified and fair conditions for farm workers, and supporting the humane treatment of animals. These three pillars are foundational to the ROC framework and have proven essential to achieving long-term ecological, economic and community benefits.

We are encouraged that the USDA acknowledges the role of organic systems in regenerative agriculture. ROC builds on USDA Organic as a necessary baseline for eliminating toxic synthetic pesticides, fertilizers, and GMOs — inputs that undermine soil biology, water quality, pollinator health, and farmworker safety. ROC then goes further by requiring additional soil health practices, pasture-based animal welfare, and fair labor conditions.

As decades of peer-reviewed research and field evidence show, regenerative practices alone cannot fully deliver intended environmental outcomes if they allow routine use of synthetic chemicals. The scientific record also shows that organic systems, including those that strategically use tillage for weed control in lieu of herbicides — consistently build soil carbon, increase water retention, reduce erosion, and improve microbial diversity. We encourage USDA to ensure that any regenerative agriculture program reflects this evidence by prioritizing systems that avoid toxic inputs and protect both ecological and human health.

The rapid expansion of regenerative claims creates both opportunity and risk. Without clear definitions, rigorous standards, and third-party verification, the regenerative category is vulnerable to greenwashing and consumer confusion. Independent analysis has shown that some non-organic regenerative labels allow herbicides, GMOs, synthetic fertilizers, and minimal verification, which could undermine public trust and the credibility of the entire regenerative movement.

With the right structure, USDA’s initiative can accelerate the transition to a food and fiber system that heals the land, strengthens rural communities, and ensures a healthier future for all; a vision that drives our mission every day. ROA looks forward to engaging with USDA as this pilot advances and to contributing our expertise, data, and proven frameworks to help shape a regenerative future rooted in integrity, transparency, and meaningful impact.

Jeff Tkach, Executive Director, Rodale Institute

Rodale Institute welcomes the USDA’s announcement of the new Regenerative Pilot Program and views it as an important signal that soil health, farm resilience, and long-term productivity are increasingly central priorities within American agriculture. This moment reflects a growing federal recognition that healthy soil is foundational to a secure food system, climate resilience, and human health.

For more than 78 years, Rodale Institute has led the science and practice of regenerative organic agriculture, long before “regenerative” entered the policy lexicon. Through the longest-running side-by-side comparison of organic and conventional farming systems in North America, Rodale Institute has demonstrated that regenerative organic agricultural practices can improve soil health, enhance water quality, increase resilience to extreme weather, and support farm profitability.

With a national network of research hubs, education initiatives and farmer training programs, Rodale Institute has helped producers across regions and production systems transition to regenerative organic practices rooted in measurable outcomes and continuous improvement. This experience, coupled with our leadership as a founding member of the Regenerative Organic Alliance, positions Rodale Institute as a critical partner in ensuring that regenerative initiatives are clearly defined, science-based, and deliver real, lasting benefits for farmers, communities, and the environment.

As the USDA advances this pilot program, Rodale Institute stands ready to contribute its decades of research, farmer-centered expertise, and leadership to help guide its success. By keeping soil health at the center of agricultural policy and practice, we can continue building a food system that supports productive farms, nourishing food, and healthy people, now and for future generations.

Paige Mitchum, Executive Director, Regen Circle

This Regenerative Agriculture Pilot Program is not new. It is a carve-out from the existing Farm Bill’s conservation funds using the same forms, rankings and field offices. The key difference is that they were processing proposals differently. Under the Climate Smart Commodities Program the process went USDA ↔ big project ↔ farmer. This pilot now routes money through individual NCRS contracts so the process flows as NRCS ↔ farmer. This sounds cleaner unless the agency in the middle just lost 20% of its staff, as is the case with the NRCS.

By doing away with the big projects intermediaries you lose the support provided by states, tribes and NGOs whose role was to recruit farmers, do measurement verification and reporting, provide technical assistance and handle smaller payments. Without this the NRCS will need significantly more bandwidth to handle a direct to farmer approach. But they aren’t staffing up; the FY2026 plan indicated further personnel reductions, leaving me to draw only one conclusion: The regenerative pilot program will be woefully under resourced, forcing them to accept applications from large well-resourced operations leaving small and vitally important producers on their own.

In a nine‑day window in December, the administration: backed pesticide maker Bayer in court, poured billions into the most glyphosate‑dependent crop systems, and then unveiled a sub‑billion-dollar regenerative agriculture pilot program as its health‑and‑soil solution. Once again this administration has brilliantly cut social infrastructure and meaningful programs that were supporting small farmers in regenerative transition, shielded a flagship herbicide company from liability, bailed out large monocultures, and in exchange handed us a small carve-out of existing programs with zero new infrastructure or any credible way of executing said program. As such, this reads more as a marketing scheme than it does meaningful policy work, and I hope that the private sector can step up and support the small holder farmers at the heart of the regenerative movement.

They took away the mountain we were slowly, imperfectly but intentionally building, they took a shovel and put a small mound of dirt aside and said, take this and enjoy the view.

Read Page’s full article here.

André Leu, D.Sc., BA Com., Grad Dip Ed., International Director, Regeneration International

In theory, this is a great initiative. Improving soil health through regenerative practices has been long overdue. Most farmers, including many organic farmers, need to adopt these methods. In reality, it will depend on who is selected to sit on the Chief’s Regenerative Agriculture Advisory Council. If it is composed of regenerative and organic farmers, it will be credible. If they repeat the NOSB (National Organic Standards Board) model, it will be hijacked by academics, NGOs and agribusiness. It will be an exercise in greenwashing, promoting no-till Roundup-ready GMOs and other degenerative practices. I don't have confidence that, given the USDA's history with the organic sector, they will choose the credible option.

Alexis Baden-Mayer, Political Director, Organic Consumers Association

I've been looking into where the money's coming from for the Regenerative Agriculture Pilot Program and how much has been allocated versus taken away. This is money Congress appropriated for two regenerative agriculture programs (the Environmental Quality Incentives Program and the Conservation Stewardship Program) with a total annual budget of $4.515 billion. So, if $700 million is going to regenerative, that means $3.815 billion (84%) of EQIP and CSP funds will be going to factory farms and pesticide-drenched genetically modified field crops. Admittedly, Trump's USDA isn't the first to misappropriate these funds this way, but it is the first to celebrate it.

Earlier this year, the USDA refused to disburse $6.062 billion appropriated by Congress for family famers adopting regenerative agriculture practices and serving local markets. Now we're now supposed to be happy because the USDA is earmarking $700 million for regenerative agriculture? I feel like they're trying to convince us two pennies is more than a dollar bill because two is more than one.

Max Goldberg, Founder, Editor and Publisher of Organic Insider

The USDA's announcement of about $700 million dedicated to regenerative agriculture puts the spotlight on the importance of soil health at a critical time and is extremely welcome. Yet, whether this program can actually deliver tangible results to America's farmland remains a serious uncertainty, and there are two questions that must be answered.

First, does the USDA have adequate on-the-ground technical staff to assist farmers in executing regenerative practices while also measuring soil health improvements? Second, will this program actually lead to a reduction in pesticide use? Only time will tell, but the level of skepticism is very high that the funds will be spent in an efficient manner and this will result in meaningful progress.

Dan Kane, Lead Scientist, MAD Agriculture

The Regenerative Agriculture Initiative (RAI), also called the Regenerative Pilot Program (RPP), is a program announced by Secretary Rollins on Dec. 10, 2025. The press release from USDA describes it as a $700 million pilot program for FY2026 focused on helping farmers transition to regenerative practices.

The RAI is not a new program but instead a repackaging of existing USDA Natural Resources Conservation Service (NRCS) conservation programs, including the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP). Nor does the RAI designate new funding towards either of these programs and the practices they target. It will likely function as a priority national funding pool producers can apply to with some minor modifications to requirements and the application process. Efforts by the prior administration to increase funding to key regenerative practices and the regenerative agriculture community more broadly through the Inflation Reduction Act (IRA) would have provided greater funding overall in FY2026 and beyond.

The IRA added approximately $19.5 billion into USDA conservation programs above and beyond 2018 Farm Bill funding levels over a period of four fiscal years (FY2023-FY2028). EQIP would’ve been expanded by $8.45 billion over that period, with about $3.45 billion of that coming in FY 2026 for a combined total of $5.5 billion in FY2026. CSP would’ve received $3.25 billion over that period with $1.5 billion coming in FY2026 for a combined total of $2.5 billion in FY2026.

Given all the shifts in funding, and the reallocation of IRA funds to CSP and EQIP baseline spending enacted through the One Big Beautiful Bill Act (OBBB), RAI is effectively funded through the reallocation of IRA funds. But, considering the reduction in total funding, it’s still not net new spending compared to what would’ve happened had IRA stayed in place. Although the OBBB increased baseline EQIP and CSP funding over a longer time period, the Congressional Budget Office still estimates that the rescission and reallocation of IRA funds will result in a net decrease of approximately $2 billion in actual conservation spending through FY2034.

While some of the changes included in this program (bundling applications, whole farm planning, soil testing) are good ideas, they’re ideas that NRCS has already applied through other programs. Major reductions in NRCS staff and proposed changes to how the NRCS is structured are likely to limit total capacity and reduce agency efficiency and function. Last, the elimination of income eligibility caps and the potential integration of public/private partnerships into the program raise concerns that this program and USDA conservation programs writ large will end up primarily serving very large farmers and agribusiness interests.

Any USDA programming focused on regenerative agriculture is a welcome addition to the financial stack for producers. No doubt we at Mad Agriculture will keep this program in mind as a potential option for the producers with whom we work. But this is a small win in comparison to the huge loss that came through the rescission/reallocation of IRA funds.

Read MAD Agriculture’s full analysis of USDA’s Regenerative Agriculture Initiative here.

Charles "Chuck" Benbrook, Ph.D., Founder, Benbrook Consulting Services

Chuck Benbrook is the former Chief Science Officer of The Organic Center; former Research Professor, Center for Sustaining Agriculture and Natural Resources, Washington State University; and former Director, National Academy of Sciences Board on Agriculture

As someone who has been deeply involved in soil conservation policy, I was excited to see this announcement from the USDA Natural Resources Conservation Service (NRCS). With $700 million committed in the next fiscal year, it's a pretty substantial investment in regenerative agriculture. The hope is that it will go on with continued, and hopefully increased, funding.

As I read the announcement for the Regenerative Pilot Program, it seems to be a clear recognition by the USDA that soil health and what is needed to enhance the biological integrity and health of the soil has to be a very high priority. In fact, on par with controlling physical erosion. And I think that's the right direction. That's how we're going to lower the cost of production. That's how we're going to clean up water and start dealing with all these rural areas with ridiculously high levels of nitrate in everybody's drinking water. It's how we're going to deal with resistant weeds. Dealing with soil biology at this point is the most important and lowest hanging fruit for healing what ails us.

I think there are two aspects to the significance of USDA's announcement. One, it recognizes farmers anywhere along the continuum, from conventional, chemical-dependent farmers to regenerative organic producers. Wherever you are along the continuum, if you want to move toward a more diversified, resilient, less chemical-dependent system, you have to make multiple changes simultaneously and timed correctly to succeed.

I also think the NRCS approach of entering into customized contracts with growers that start from where they're at and finance the next round of changes in their farming systems, which could include changes in rotations, tillage, cover crop management and water management, is a good one.

It's also a positive that it's a streamlined administrative process where the farmer basically comes in with a proposal and works with the local NRCS and farm services agency staff to come up with how much the cashier payment will be next year and presumably for subsequent years for the practices that are adopted. Of course, one of the big concerns that people have is how progress is going to be monitored and quantified in a convincing way. Also, like everyone, I'm curious to see the details of how NRCS is going to structure the contracts.

My wish with this program is that smaller producers will have as much access as larger operators, however the fact is, those big commodity farmers tend to get favored when it comes to grants. Yet, I didn't see anything in the announcement to suggest that the NRCS is going to take into account the size of the farm in allocating the available funds. But let's face it, the larger, more sophisticated, often multi-owner, farms are going to be in the door first with well thought out proposals.

Regarding the appointment of an Advisory Council to help oversee the Regenerative Pilot Program, I think (USDA) Secretary Rollins has had a constructive series of conversations with people that come out of the organic and regenerative community. I also think she'll insist that a few folks from that world are on this advisory committee. But, you know, if past is prologue, the soybean growers will have a rep, the cotton council will have a rep and the pesticide industry will have a couple of reps. And it might not be somebody that's working actively for a pesticide manufacturer today, but it could be someone who has deep roots in that community. They may be an academic now. They may work for a consulting firm, but you know, the politics inside these federal agencies is really brutal.

The NRCS regenerative program has great potential to be the fulcrum to start the transition towards more diversified, sustainable regenerative systems, but for it to work in a meaningful way at scale, it has to be combined with a similar negotiated change in how commodity program subsidies and crop insurance subsidies are currently supporting agriculture. And that's the core idea behind what we're working on now called the Farm Economic Viability and Renewal Act, or FEVER Act, to help spark discussion among agriculture community leaders and policymakers of the systemic reforms in policy needed to avoid ever-larger bailouts in the not-too-distant future.

The large sums of taxpayer money at play — over $40 billion in farm support in 2025, and likely even more in 2026 — heighten the urgency of reaching agreement on substantive policy changes. The pressing challenge is to not invest taxpayer dollars during 2026 and beyond in bigger and better band aids, but instead in support of the deeper, systemic changes in farming systems that most farmers, advocates for healthier rural communities, scientists, and policy wonks know are needed.

Companies interested in partnering with USDA NRCS in the Regenerative Pilot Program can email regenerative@usda.gov for more information. Farmers and ranchers interested in regenerative agriculture are encouraged to apply through their local NRCS Service Center by their state’s ranking dates for consideration in FY2026 funding. Applications for both EQIP and CSP can now be submitted under the new single regenerative application process.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Non-UPF Verified Sets a New Standard for Ultra-Processed Foods

This article first appeared in the December 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In mid-November, an international team of 43 scientists released a landmark series of papers in The Lancet concluding that ultra-processed foods (UPFs) now pose a “clear global threat” to public health. Drawing on more than 100 long-term studies, Reuters reported that the series links higher UPF intake to increased risk of obesity, Type 2 diabetes, cardiovascular disease, cancer, depression, and all-cause mortality.

Coverage in outlets from The Guardian and ABC News to NPR underscores the gravity of the findings. One analysis noted that UPFs are associated with harm to every major organ system in the body, and that these products are rapidly displacing fresh and minimally processed foods worldwide. University of North Carolina nutrition researcher and Lancet series coauthor Barry Popkin told NPR, “We can say now that truly ultra-processed food represents a clear global threat to our health—not only our physical health but also mental health in terms of its impacts on depression.”

At the same time, a growing body of consumer and market research points to a widening trust gap. Many shoppers want to avoid UPFs but say they can’t easily tell what qualifies. A recent New York Times Well column explored why ultra-processed products are so hard to resist and so ubiquitous in modern diets, and highlighted the way industrial formulations can override normal satiety signals and blur the line between “food” and “edible product.”

Against this backdrop, the Non-GMO Project’s new Non-UPF Verified Standard lands at a pivotal moment for CPG brands, retailers, and the entire natural and organic products ecosystem.

From GMOs to UPFs: The Non-GMO Project widens its lens

On Nov. 12, the Non-GMO Project formally announced Version 1.0 of its Non-UPF Verified Standard, described as “the nation’s first comprehensive framework” for defining and verifying foods that are not ultra-processed, and called it the “first Non-UPF Verified standard to address the ultra-processed foods crisis.”

The new certification builds on the Non-GMO Project’s 18-year record of third-party verification and its iconic butterfly seal, now found on more than 63,000 products that represent an estimated $50 billion in annual sales.

“Around the world, more people are waking up to the realization that much of what fills our grocery carts is no longer truly food,” said Megan Westgate, founder and CEO of the Non-GMO Project and Non-UPF Verified, at a recent webinar unveiling the new standard. “Doctors and researchers increasingly describe these products as ‘processed edible substances’—industrial formulations engineered for palatability and shelf life rather than nutrition.”

Westgate is careful to say this is not an attack on processing per se. As she told Food Business News: “Processing itself isn’t the enemy. It’s how and why it’s done that matters. The Non-UPF Standard defines a middle ground where convenience and nourishment can genuinely coexist.”

In practice, that “middle ground” is defined by a rigorous ingredient and processing criteria, which are detailed in the Non-UPF Verified Standard v1.0.

Why ultra-processed foods are under fire

The Lancet series and surrounding news coverage sharpen a distinction many in the natural channel have understood for decades: It’s not just what’s in food, but also how it’s made.

The Guardian’s coverage of the Lancet research noted that more than half of the average diet in the U.S. and U.K. now consists of UPFs, with some low-income and younger populations getting up to 80% of their calories from these products. Citing CDC data, ABC News reported that Americans on average consume over half of their daily calories from UPFs.

The Lancet authors point to several mechanisms by which UPFs drive harm:

Disrupted food structure and “hyper-palatability” that encourage overeating and rapid absorption of refined starches and sugars.

High levels of added sugar, sodium, and unhealthy fats.

Widespread use of cosmetic additives and ultra-refined ingredients, some of which may alter gut microbiota or expose consumers to contaminants such as phthalates.

Aggressive marketing and product design that exploit biological reward pathways, particularly in children (MAHA Commission).

In the NPR report, Lancet series coauthor Marion Nestle, professor emerita of nutrition and food studies at NYU and author of “Food Politics,” drew a direct line between the science and the need for policy and marketplace action. She noted that some countries, including Chile, have already shown that warning labels, marketing restrictions, and school food reforms can curb UPF intake. “It’s time to take on the industry,” Nestle said. “They’ve got to stop.”

The Lancet series and recent media reporting all make the point: Ultra-processed foods are not just one more dietary risk factor. They are a structural driver of global chronic disease—and the food system will not change without clear definitions, strong incentives, and credible labels.

‘Disconnected’: What consumers are telling us

In October, the Non-GMO Project released a consumer research report titled “Disconnected,” which summarized the attitudes of U.S. shoppers toward UPFs and the modern food system. Some of the topline numbers from “Disconnected” and related research are striking:

A 2024 Non-GMO Project survey found that 85% of Americans want to avoid ultra-processed foods, but most say they feel overwhelmed and unsupported in trying to do so.

Internal research from the Non-GMO Project’s Food Integrity Collective showed that 68% of shoppers actively try to avoid UPFs, and 70% say they need clearer labeling or third-party verification.

New Hope Network reported that 72% of Americans say they are trying to avoid ultra-processed foods, signaling a powerful demand across mainstream and natural retail.

“Disconnected” emphasized that consumers feel the food system is “out of their hands” — dominated by large corporations using engineered ingredients that are disconnected from natural food sources.

In other words, shoppers are ahead of policy. They are already looking for ways to opt out of UPFs, but they lack tools they can trust. That, more than anything, is the market gap the Non-UPF Verified Standard aims to fill.

The architecture of the Non-UPF Verified Standard

The Non-UPF Verified Standard approaches ultra-processing through two essential frameworks: ingredient integrity and formulation, and processing limits.

1. Ingredient integrity and formulation

The standard targets ingredients that are either emblematic of ultra-processed formulations or under scientific scrutiny for metabolic, neurological, or gut impacts. Collectively, these criteria are designed to protect what the standard calls structural integrity, nourishment, and transparency, steering innovation away from “cosmetic” ingredients and toward minimally processed building blocks:

Non-nutritive and bio-transformed sweeteners (such as aspartame, sucralose, stevia extracts, erythritol, and other sugar alcohols) are prohibited as sugar substitutes. Minimally processed stevia leaf preparations may be allowed only at flavor-level use, not as a core sweetener.

Added sugars are capped by category, typically ranging from low single-digit percentages (by dry weight) for soups, sauces, snack foods, and proteins, to stricter limits for beverages and breakfast foods, and up to roughly 20% for desserts and 40% for some confectionery categories.

Gums, thickeners, hydrocolloids, and texturizers produced via industrial degradation or fermentation—such as carrageenan, microcrystalline cellulose, polysorbates, polydextrose, xanthan gum, and maltodextrin— are largely prohibited.

Artificial colors and certain processed oils are excluded.

Natural flavors are confined to use cases where the corresponding “real” ingredient is present and may not be used to mask the absence of whole foods.

2. Processing limits and food structure

Not all processing is equal. The Non-UPF Verified Standard distinguishes among permissible, conditional, and prohibited methods and requires that:

At least 70% of a product’s weight (or dry weight, for certain categories) must be minimally or moderately processed using permissible methods that preserve the food matrix.

Up to 30% may be “conditionally processed”—for example, certain protein isolates or powders—if they meet specific criteria.

High-impact chemical, structural, thermal, or biological modifications are not allowed, including synthetic biology and 3D-printed ingredients.

The intent is to address the very features UPF critics highlight: extensive fractionation and recombination of ingredients, aggressive “engineering” of texture and flavor, and techniques that break down food structure to the point where the body no longer recognizes the substance as food.

As the standard notes, UPF is as much about the degree and purpose of processing as about individual ingredients. The Non-UPF framework is one of the first to operationalize that insight in a way that is auditable at the product level.

The full standard is publicly posted at NonUltraProcessed.org. The Project has signaled that it will update its prohibited ingredient list annually based on emerging science and pilot feedback.

Pilot brands, early adopters and the reformulation challenge

If Non-UPF Verified is to matter, it has to show up on shelves. The early signs are promising.

A pilot cohort of 16 brands—including both mission-driven emerging companies and established names—has been working with the Non-GMO Project and independent technical administrators to test the Non-UPF verification model across nearly every aisle. In addition, New Hope Network reported that 200 brands are already on the wait list, and that the Non-UPF Verified seal is expected to begin appearing on packages in 2026.

In Douglas Brown’s New Hope Network feature, “Non-UPF Verified: Must-Knows for Natural Brands,” Westgate characterized the program as “a movement, not just a mark,” and noted that reformulation will be essential in categories dependent on gums, stabilizers, and added sugars. “We have some cleaning up to do in this industry,” she said. “Reformulations are needed. We need less sugars and gums. It’s going to be a process. But it does seem like brands are really paying attention.”

For many natural and organic manufacturers, the reformulation challenge may feel familiar. Non-GMO and organic standards forced reevaluation of supply chains and ingredient decks; Non-UPF now pushes deeper into how those ingredients are combined and processed.

For mission-driven brands backed by retailers that cater to ingredient-savvy shoppers, the upside could be substantial:

Differentiation in crowded categories such as ready-to-eat meals, plant-based meats, beverages, and snacks, where formulations can drift toward UPF territory even in “natural” sets.

Alignment with policy trends, as HHS, USDA, and FDA explore definitions and potential regulatory approaches to UPFs.

Deeper consumer trust, particularly among shoppers who already use Non-GMO Project and organic seals as navigational tools in the aisle.

For contract manufacturers and ingredient suppliers, however, this is more than a marketing play—it’s a roadmap for where formulation business is likely headed.

Industry response: Caution, criticism, and opportunity

The Non-UPF standard does not exist in a vacuum. Trade groups and conventional food manufacturers are watching closely and some are pushing back.

Food Business News noted that while states such as California have begun to legislate around certain additives and ultra-processed foods, groups like the Grain Foods Foundation argue that some UPFs can fit into healthy dietary patterns, especially when fortified or reformulated.

More broadly, many industry stakeholders have urged federal agencies to avoid definitions that hinge on processing intensity, arguing that frameworks like the NOVA classification system paint with too broad a brush and risk demonizing shelf-stable, affordable foods.

Westgate and her team acknowledge these debates. In FoodNavigator-USA’s report on the standard, she described the NOVA system as foundational but “not built to solve at the product level,” and emphasized that Non-UPF Verified is designed to be auditable, enforceable, and feasible within current food system realities.

At the same time, the Lancet series and global media coverage are shifting the terms of the debate. ABC News quoted experts who warn that global UPF proliferation is a major public health threat and that voluntary, incremental steps are unlikely to be enough.

In that context, voluntary third-party standards such as Non-UPF Verified may serve a dual role as a pre-regulatory signal to policymakers that industry is capable of responding to the science, and as a competitive differentiator for brands and retailers.

What it means for natural & organic CPG leadership

For marketers in the natural and organic products community, the Non-UPF Verified Standard is not just another badge on the front of the pack. It is a concrete response to three converging forces:

Escalating science: The Lancet series, joined by years of epidemiology, clinical research, and meta-analyses, makes a compelling case that UPFs are a unique risk category and that their impact is global.

Consumer anxiety and demand for coherence: Shoppers are hungry for standards that make sense of conflicting information and give them real agency.

Regulatory and reputational risk: As HHS and USDA gather input on UPF definitions, and as advocacy groups press for action, companies that stay tethered to hyper-processed formulations may find themselves on the wrong side of both policy and public opinion.

For natural and organic brands—many of which built their identity on getting ahead of GMO, pesticide, and synthetic additive concerns—Non-UPF Verified is an invitation to lead again. That leadership could take several forms:

Portfolio mapping: Assess where current SKUs fall on the processing spectrum, and identify quick wins for reformulation versus long-term R&D projects.

Supplier engagement: Challenge ingredient partners to develop minimally processed alternatives to emulsifiers, texturizers, and refined oils that violate the Non-UPF criteria.

Retailer collaboration: Work with retailers to pilot Non-UPF assortments, shelf tags, and consumer education in key categories.

Storytelling and transparency: Use packaging, digital channels, PR, and in-store activations to explain how Non-UPF Verified complements existing organic, non-GMO, regenerative and other claims.

A call to action

The publication of the Non-UPF Verified Standard is not the final word on ultra-processed foods; however, it is the opening of a new chapter. Science will continue to evolve. Policymakers will debate definitions and regulatory levers. Industry groups will push back, negotiate, and in some cases innovate.

But the direction is clear. When The Lancet, The New York Times, The Guardian, NPR, ABC News, and the natural products trade press all make the same point—that ultra-processed foods are undermining global health and consumer trust—the question for our industry is not whether to respond, but how quickly.

For brands that built their business on “better for you,” Non-UPF Verified offers a unique opportunity to help redefine what “better” means at the level of processing itself, and to align product portfolios with a future in which real food—and the integrity of how it’s made—once again takes center stage.

For more information on the standard, please refer to the full Non-UPF Verified Standard v1.0, the Non-GMO Project’s launch announcement, and the Disconnected research report, available via the Non-UPF team’s Google Drive link.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Can Trump’s Support Move the Needle on CBD?

Could President Donald Trump's recent endorsement of hemp-derived CBD products provide new momentum for an industry that has struggled in recent years under a patchwork of inconsistent state and federal regulations?

This article first appeared in the November 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In what industry observers have called a surprise move, on Sept. 28, President Donald Trump posted a video on his Truth Social platform promoting the health benefits of cannabinoids, suggesting that covering hemp-derived CBD under Medicare would be a “game changer” and “the most important senior health initiative of the century.” At a time when some members of Congress are pushing for policy changes that could upend the CBD market, Trump’s implied endorsement of CBD is remarkable.

Trump’s post supporting Medicare coverage for CBD products sparked a 36% rise in publicly traded cannabis stocks in the weeks that followed, Yahoo Finance reported. The post also raised hopes that the White House might take a more permissive approach to marijuana regulation following Trump’s statement in August that his administration was exploring a potential reclassification of marijuana — an effort originally proposed under the Biden administration. Removing cannabis from its Schedule I status would mean the federal government acknowledges the plant’s medicinal value.

“I’ve heard great things having to do with medical, and I’ve [heard] bad things having to do with just about everything else,” Trump said during an Aug. 11 White House press conference. “But medical and for pain and various things, I’ve heard some pretty good things.”

The video Trump shared was produced by The Commonwealth Project, an organization dedicated to improving health and longevity for older Americans. It was founded by Howard Kessler, a billionaire and philanthropist with ties to the CBD industry and a longtime friend of Trump’s. According to Independent Voter News, Kessler believes “that medical cannabis could be harnessed to not only provide older Americans with an alternative to traditional prescription painkillers but to reduce soaring health care costs saddling millions of seniors.”

In the video promoted on Truth Social, CBD was described as a way to "revolutionize senior healthcare" by helping reduce disease progression. The narration claimed CBD could help “restore” the body’s endocannabinoid system and ease pain, improve sleep and reduce stress in older adults. It also cited a Fox News segment referencing a Price Waterhouse Coopers report that estimated potential cost savings of “$64 billion a year if cannabis is fully integrated into the healthcare system.”

A Boston- and Palm Beach, Florida-based entrepreneur and philanthropist, Kessler founded Kessler Financial Services, which helped pioneer affinity credit cards. He later obtained one of Massachusetts’ first medical marijuana licenses in 2014, and became the state’s first recreational seller before his company was acquired by a Georgia cannabis firm in 2019. In June 2024, Kessler appeared on Fox News to discuss his efforts to integrate medical cannabis into traditional health care for seniors.

Regulatory Confusion Hinders CBD Market

Regulations around the commercial use of hemp and CBD were significantly eased across the U.S. when industrial hemp was legalized under the 2018 Farm Bill during Trump's first term. However, since its passage, a growing number of state-level battles and lawsuits have emerged regarding the definition of hemp, the “intoxicating hemp” loophole around hemp-derived Delta-8 THC, and the lack of consistent federal and state regulatory frameworks for the cultivation, manufacture, marketing and sale of hemp-derived cannabinoids such as CBD, according to national law firm Buchanan Ingersoll & Rooney.

Trump’s implied endorsement of CBD comes as a bipartisan group of lawmakers pushes back against attempts to ban hemp-derived THC products, arguing that such action would “deal a fatal blow” to the hemp industry and violate congressional rules. In a letter sent to House Speaker Mike Johnson (R-LA) on Sept. 26, House Oversight and Government Reform Committee Chairman James Comer (R-KY) and 26 other members warned that appropriations legislation containing hemp ban provisions would devastate the industry that emerged after hemp’s 2018 legalization.

A group of eight Democratic senators also sent a letter in September urging leadership to pursue regulation rather than prohibition, warning that banning products containing any amount of THC would trigger major upheaval in the hemp market. (Under the 2018 Farm Bill, hemp is legally defined as containing no more than 0.3% THC on a dry weight basis.) Meanwhile, dozens of hemp farmers from Kentucky have urged Senate Minority Leader Mitch McConnell (R-KY) to back away from efforts to re-criminalize certain hemp-derived products, Louisville Public Media reported.

Kentucky Sen. Rand Paul also warned that the cannabis policy movement has “swung hard on the prohibitionist side.” In June, he introduced the Hemp Economic Mobilization Plan (HEMP) Act to counter potential restrictions, proposing to triple the amount of THC allowed in hemp while addressing several other regulatory challenges facing the industry.

For its part, the U.S. Food and Drug Administration (FDA) reaffirmed in January 2020 that it is unlawful to introduce food containing added CBD into interstate commerce, or to market CBD as, or in, dietary supplements. Now, according to Marijuana Moment, while Trump was endorsing CBD on Truth Social, the FDA quietly updated its adverse drug event reporting forms to track incidents related to hemp-derived cannabinoids, including CBD — part of an effort to gather more data on potential health effects associated with such products.

Hemp Industry Responds to President’s Support

In an Oct. 7 letter to President Trump, Jonathan Miller, legal counsel for the U.S. Hemp Roundtable, praised the president’s acknowledgment of hemp’s potential and urged him to oppose the proposed hemp ban:

"The recent video you shared about the extraordinary value of hemp products was important, raising awareness on the positive impact our American-grown and manufactured products have. Here at the U.S. Hemp Roundtable, our members are focused on giving Americans choices in improving their overall health and wellness ... but now we need your help! Congress is close to passing a hemp ban, reversing the work you led in 2018 to make hemp blossom. A proposed definition change to hemp, being touted as protecting Americans, would wipe out 95% of this uniquely American industry that you are so proud of,” Miller stated.

He continued: “A more effective way to protect American consumers and jobs would be to support and demand robust hemp regulation — age restrictions along with uniform testing, labeling, and packaging requirements. Outright prohibition is not the answer, nor would it make anyone safer. Banning legal hemp products that are already regulated at the state level will not protect consumers; it would only shift hemp to the black market and destroy a rising American industry in the process. ... A ban would put American farmers, American businesses, American consumers, our veterans, seniors, and more than 328,000 American workers at risk."

Miller added that "American voters are on your side on this issue. In Texas, a state with a rapidly growing hemp market, 76% of your voters and 78% of seniors favor legal, regulated hemp sales. In fact, more than 62% of Texans say they are more likely to support candidates who back the regulated sale of hemp-derived products."

Bottom line: Trump’s apparent support for CBD could mark a turning point for a sector long constrained by legal uncertainty. Whether the endorsement leads to meaningful policy change remains to be seen — but it has already reignited momentum, investment, and public discourse around hemp-derived wellness products in America’s fast-evolving natural health market.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Food Inflation in the U.S.: A Strategic Reckoning for Food Sector Leaders

This article first appeared in the September 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In 2025, food inflation in the United States has transformed from a passing concern into a defining business challenge—and opportunity—for leaders across the food ecosystem. A 3% year-over‑year increase in overall food prices, including 2.4% for groceries and 3.8% for restaurant meals, may seem modest. Yet beneath those figures lie sharper, more disruptive trends: surging prices in staples such as coffee, ground beef, and eggs; strategic responses from consumers and retailers; and structural pressures that demand both resilience and reimagining. Business strategists in the food sector must now lead with insight, not just facts.

A Collision of Climate, Cost, and Policy

Climate volatility continues to drag on food supply and costs. Extreme drought in U.S. cattle belts, heat waves in crop regions, and pest outbreaks such as avian flu have propelled food inflation beyond headline figures. Coffee is up 13.4%, ground beef 10.3%, while eggs have spiked 27.3%, putting extraordinary strain on manufacturers and squeezing household budgets (Axios).

Adding to the upward pressure are sweeping tariffs introduced by the Trump administration, with tariffs on imports from Brazil and India reaching 50%. The tariffs are already working their way into the cost of everything from meat and produce to metals used in cans and packaging (The Washington Post). According to the Yale Budget Lab’s estimates as of August 7, 2025, consumers face an overall average effective tariff rate of 18.6% – the highest since 1933 – and the impact is projected to cost U.S. households an extra $2,400 per year.

Meanwhile, immigration enforcement over the past several months has destabilized farm labor. In California’s Oxnard region, intensified ICE activity has slashed agricultural labor by 20-40%, leading to $3-7 billion in crop losses and driving produce prices up 5% to 12%, according to research published in August 2025 from Cornell University. Simultaneously, cuts in SNAP and other supports have strained both consumer access and farm revenue—especially for smaller producers—plus, grocers in rural communities and elsewhere that depend on SNAP programs feel that impact much harder (Climate and Capital Media).

Beyond cost drivers, the retail margin picture is fraught. Analysis from the White House Council of Economic Advisers showed grocers’ profit margins rising 2 percentage points since before the pandemic—reaching two-decade highs—while “shrinkflation” and package downsizing quietly preserve profitability (Grocery Dive).

FMI—The Food Industry Association’s study released in July 2025, “The Food Retailing Industry Speaks 2025,” reveals an industry struggling to navigate challenging economic conditions, largely due to policies implemented during the Trump administration. According to FMI, about 80% of both retailers and suppliers anticipate that trade policies and tariffs will continue to affect pricing and disrupt supply chains. Most grocers expect operating costs to remain high (Supermarket News).

Consumers Are Stressed About Rising Prices

Recent polling reveals that nearly 90% of U.S. adults are stressed about grocery prices—with half calling it a major stressor. As a result, Americans are responding to these pressures with pragmatic and inventive shifts. Consumers across income levels are tightening the belt, leveraging buy-now-pay-later options, getting creative with savings, and turning to food banks when they must (AInvest).

Shopping behavior reflects this anxiety—and innovation. RDSolutions reports that 86% of consumers now buy private-label products, with price cited as the primary decision factor; 42% opt for cheaper alternatives; while 20% skip items altogether. Data from The Feedback Group shows 61% of supermarket shoppers use sale-driven habits—buying on promotion, eating more at home, and choosing store brands over national names (Progressive Grocer). Meanwhile, many households lean on grocery hacks such as careful list-making, midweek shopping, loyalty programs, and bulk purchases to maximize savings (Times of India).

Even amid tightening budgets, shoppers haven’t completely abandoned pleasure, however. KCI’s “stress index” reveals that consumers crave “affordable luxuries” and product discovery—seeking balance between taste and value. In fact, 68% of consumers surveyed prioritize taste over price, while one-third still prioritize lowest-priced options (Food Dive).

In a fresh produce market reeling from the effects of inflation and immigration enforcement, one consumer trend remains strong: Health continues to drive purchases of fresh fruits and vegetables. According to The Packer Fresh Trends 2025 report, published in August 2025, 72% of shoppers say their primary reason for buying produce is to support a healthy lifestyle. However, price pressures loom larger than ever, with 44% of consumers now saying that cost is the top factor in deciding what to buy, up from 39% last year. As households juggle tighter budgets, they’re opting for familiar staples over experimenting with newer or higher-priced options (Farm Journal).

For lower income individuals and families, higher food prices are resulting in less consumption of healthier food options, with the result that Americans are not eating enough fruits, vegetables, and other nutrient-dense foods. Instead, they are choosing sugary and ultra-processed foods, which tend to be cheaper and last longer.

"There's evidence that inflation continues to shape food choices, particularly for low-income Americans who prioritize price over healthfulness," Constance Brown-Riggs, a registered nurse and nutritionist specializing in diabetes care, told Northwell Health. "These results highlight the disparity in how income influences food priorities," she continued, adding that higher food prices often increase food insecurity. "These shifts increase the risk of chronic diseases such as diabetes, heart disease and obesity."

Even so, there is some opportunity on the horizon. The Packer Fresh Trends 2025 report shared some bright spots, including the fact that Millennials and Gen Z are leading the way on trying new products, exploring organic options, and prioritizing convenience, including prepped veggies and grab-and-go fruit packs. In addition, interest in organic remains strong, with 22% of consumers purchasing organic always or most of the time, particularly among younger and higher-income households.

Grocers, Brands, and Manufacturers Corral Cost Pressures

The reaction from retailers and manufacturers has been tactical and dynamic. Major chains are reevaluating supplier cost increase requests, pushing back aggressively against inflation on branded items. Meanwhile, grocers are ramping up private-label assortments (Investopedia).

Businesses like Aldi are demonstrating how cost leadership can go viral: A summer discount campaign across 2,550 stores marked down 400 items by up to 33%, estimated to save shoppers $100 million. Fast-food chains are responding with value menu bundles—their way of catering to cash-strapped consumers without sacrificing frequency (The Wall Street Journal).

In the natural channel, retailers such as Natural Grocers are emphasizing value, loyalty programs and sales to draw shoppers. For its 70th anniversary in August, Natural Grocers leveraged deep discounts across its nearly 170 stores in 21 states—up to 60% off on more than 500 products—to tap into consumer demand for affordability and quality. According to AInvest, the campaign “sets a benchmark for value-driven retail” by blending “nostalgia, discounts and loyalty incentives to boost sales and customer retention.”

As demand for better-for-you foods remains strong among health-conscious consumers, Jay Jacobowitz, president and founder of Retail Insights, told Supermarket News that many retailers in the natural and independent space experienced a strengthened second half of 2024 and first quarter of 2025, as less price-sensitive consumers make personal health and wellness a priority. Smaller retailers “are going to have increased (economic) pressure, but it’s not pressure that they’re unfamiliar with dealing with,” he said.

Manufacturers are similarly pressured. They face rising raw material, labor, and energy costs, yet retailers limit how much of that inflation they pass through. Many are resorting to smaller or reformulated packaging, trimming promotions, and optimizing sourcing strategies to protect shelf placement (Columbus CEO).

Yet even in the last few weeks, food makers are succumbing to the need to raise prices as the longer-term effects of tariffs, economic policies, and supply chain disruption kick in. On Aug. 7, 2025, Forager Project co-founders Stephen Williamson and John-Charles Hanley announced the following on Instagram:

“Like many food makers, we’ve been feeling the effects of rising ingredient costs—especially for our beloved cashews (up 52%) and coconuts (up 113%). We’ve held off as long as we could, but to keep making food the right way, a price increase was necessary. What hasn’t changed? Organic ingredients, ethical sourcing, planet-healthy practices.”

At the agricultural level, the disconnect is acute. Farmers receive only about 16 cents back from every retail food dollar spent—and that fraction must cover skyrocketing seed, fertilizer, and machinery costs (Washington Post). Some farmers still support tariffs, believing they will yield long-term trade gains; others see them as a short‑term hit to margins (Investigate Midwest).

Strategy: Adaptation, Advocacy, and Resilience

Current forecasts from the USDA suggest moderate gains: food-at-home prices rising around 2.2% for 2025 and restaurant prices about 4%. But the structural challenges—climate, policy, labor, and pricing power—carry implications far richer and more urgent than those figures alone (Food & Wine).

For food-sector professionals, the directive is clear: Strategies must be multidimensional.

1. Reinvent Pricing & Perceived Value

Offer tiered, smaller, or private-label packaging; highlight affordable luxuries and discovery moments in-store and online. Aldi’s shelf reset, Sprouts Farmers Market’s value-based positioning, and Natural Grocers’ emphasis on savings and its frequent buyer program demonstrate ways to drive loyalty and savings.

2. Strengthen Supply Chain Flexibility

Diversify sourcing, invest in climate-resilient inputs, and forecast for volatility. Manufacturers need contingency plans for both weather and trade disruptions.

3. Align Expectations & Margins

Increase analytics around cost impacts and pass-through capabilities. Supplier–retailer partnerships should define fair margin boundaries and shared value strategies for inflation periods.

4. Advocate for Systemic Support

Engage policymakers to safeguard labor stability—through H-2A visa expansions or by regularizing undocumented workers—and to secure tariff relief for food essentials and farm inputs.

5. Build Resilient Retail Formats

Simplify offerings to reduce shopper anxiety and stock-outs. Grocery models like Aldi or Sprouts’ curated “innovation centers” help drive discovery while managing complexity.

A New Epoch for Food-Business Leadership

Food inflation in 2025 is less an anecdote than a wake-up call. When climate shocks strike, tariffs bite, and labor becomes unstable overnight, businesses that only react are left behind. But those that blend adaptive execution, strategic policymaking, and bold market positioning are building enduring advantage.

Consumers may feel squeezed, but they’re still looking for experiences that feel smart, authentic, and human. Retailers, suppliers, processors, and farmers must each meet them there—delivering value, stability, and insight. Because in this new era, food-sector leadership is not just about pricing; it’s about crafting trust in uncertain times—and reshaping food systems to weather today’s storms and make the most of tomorrow’s opportunities.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Can Publicly Run Grocery Stores Solve Food Deserts — and Deliver on Nutrition Equity?

As New York and Chicago explore city-run supermarkets, new models — public, nonprofit and cooperative — are reshaping the business of feeding underserved communities.

This article first appeared in the August 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

When New York Assembly member and mayoral candidate Zohran Mamdani proposed opening five city-run grocery stores—one in each borough—he reignited a debate that cuts to the heart of capitalism, food justice, and municipal responsibility. Critics labeled it a socialist fantasy. Proponents called it long overdue. But behind the political theater lies a legitimate question: Can publicly operated grocery stores succeed where the private market has failed?

Across America, millions live in low income, low access (LILA) markets—communities without easy access to affordable, nutritious food, or what many in the media refer to as food deserts. In these neighborhoods, fast-food outlets and corner stores predominate, while supermarkets are few and far between. For decades, policy solutions have focused on tax incentives or subsidies to lure grocery chains into underserved areas. Often, those stores don’t last. Mamdani’s proposal dares to flip the script: If the private sector won’t meet the need, let the public sector step in.