Food Contact Chemicals Used in Production and Packaging Are Finding Their Way Into Humans

This article first appeared in the October 2024 issue of Presence Marketing’s newsletter.

By Steven Hoffman

Researchers working with the Food Packaging Forum discovered that of the roughly 14,000 known chemicals that are used in food manufacturing and packaging, approximately 25% or 3,601 of these food contact chemicals (FCCs) have been found in the human body. The chemicals include bisphenol, PFAS, phthalates, metals, volatile organic compounds, and many others that have been linked to endocrine system disruption, diabetes, obesity, neurodevelopment disorders, cancer and other diseases.

The study, Evidence for Widespread Human Exposure to Food Contact Chemicals, published in September 2024 in the Journal of Exposure Science and Environmental Epidemiology, comprehensively searched biological data collections for detections of FCCs in humans, such as from samples of blood, urine, skin, and breast milk. The data is now assembled and available in a public listing with an interactive search tool.

“Our research helps to establish the link between food contact chemicals and human exposure, highlights chemicals that are overlooked in biomonitoring studies and supports research into safer food contact materials,” lead author Birgit Geueke, Ph.D., and Senior Scientific Officer at the Food Packaging Forum, said in a news release.

When the research team reviewed scientific literature to learn what is known about FCCs detected in humans, they concluded there is a broad lack of knowledge of the effect of these chemicals on human health, and the potential hazards of many of these chemicals have not yet been sufficiently investigated. For other chemicals that migrate from packaging into the food, such as synthetic antioxidants and oligomers (a type of non-intentionally added substance that may be present in plastic food contact materials), the authors pointed out that little is known about their presence in and impact on humans.

“Many of these FCCs have hazard properties of concern, and still others have never been tested for toxicity,” the researchers wrote. “Humans are known to be exposed to FCCs via foods, but the full extent of human exposure to all FCCs is unknown.” It also is likely that the actual number of FCCs in humans is even higher because only a subset of FCCs was investigated in detail, noted the study’s authors.

Dr. Jane Muncke, co-author of the study, expressed concern over such widespread chemical exposure, stating, "This work highlights the fact that food contact materials are not fully safe, even though they may comply with regulations, because they transfer known hazardous chemicals into people. We would like this new evidence base to be used for improving the safety of food contact materials—both in terms of regulations but also in the development of safer alternatives."

The Great Chemical Migration

From shrink wrap and takeout containers to plastic bottles and coated paperboard packaging, scientists have known for years that chemicals can migrate out of food packaging into the food itself. We all know not to microwave food in plastic packaging, as high temperatures can cause the plastic to leach into the food. Foods high in fat or acidity also tend to absorb more chemicals from packaging, reported the Washington Post. Foods packed into smaller containers have increased risk of chemical crossover, too — Muncke shared with the Washington Post that on a recent flight she was given a tiny container of salad dressing. “They served the salad with a 15ml little plastic bottle with olive oil and vinegar that you could pour over. I thought, ‘Well, I’m not doing that,’” she said.

Muncke also shared with the Washington Post that while most of the chemicals leaching from food packaging come from plastics, “Probably the worst one is recycled paper and cardboard. And I know that’s a hard one to stomach.” Recycling paper, cardboard or plastic for food packaging leads to non-food grade inks mixed in next to food, she said, adding to the chemical exposure risks. However, in a positive regulatory move, FDA announced in February 2024 that paper and paperboard food packaging coated with grease-proofing PFAS chemicals would no longer be sold in the U.S.

In January 2024, Consumer Reports published an investigation into plasticizers used in food packaging to make plastic containers softer, more flexible and durable. Phthalate compounds — the ones most commonly used as a plasticizer — are so ubiquitous that it has been reported that 95% of all humans have detectable levels of phthalates in their urine. What Consumer Reports found in tests of nearly 100 foods was that bisphenol and phthalates are widespread in food products. “We found them in almost every food we tested, often at high levels. The levels did not depend on packaging type, and no one particular type of food — say, dairy products or prepared meals — was more likely than another to have them,” Consumer Reports said. From canned sliced fruit to pasta to yogurt containers, the investigation found high levels of phthalates in the packaging. Some organic products the consumer advocacy group tested also were not immune to high levels phthalates detected in product packaging.

In addition to packaging, foods are often subject to chemical exposure in the production, manufacturing and potentially in the transport process. According to Consumer Reports, while early efforts to limit food exposure to such chemicals focused on packaging, “…it’s now clear that phthalates in particular can also get in from the plastic in the tubing, conveyor belts and gloves used during food processing, and can even enter directly into meat and produce via contaminated water and soil.”

Leah Segedie, founder of consumer advocacy group Mamavation, has conducted PFAS investigations into a number of different consumer products, and also to provide consumers with guidance in searching for products free of such chemicals. In 2022, she released a report about PFAS contamination of pasta sauces, both organic and conventional. Out of the 55 different pasta sauces she tested in 2021, 17 were organic and four of those, or approximately 25%, had detectable levels of PFAS.

“I believe that PFAS contamination of organic products is also taking place during the manufacturing process and when products get transported,” Segedie told Max Goldberg, Editor of Organic Insider. “What is touching the food? Was a contaminated lubrication used on a machine? Was food stored in a vat that was fluorinated, as it was crossing the Pacific Ocean in an incredibly hot shipping container? Does the food contain contaminated spices? All of these and many other variables are the reason why the end-product should be tested, not just the ingredient,” she said.

Finding PFAS Free Alternatives

Responding to growing concern over “forever chemicals” in food and consumer packaged goods, a number of natural, organic and conscious CPG companies are offering alternatives for products that contain PFAS. The Environmental Working Group compiled a list, updated in January 2024, of companies that have declared their products have no added PFAS, in including food, fashion, beauty care and other consumer products categories. Online retailer Thrive Market this year announced in a blog on its website that, “Though more research is needed, PFAS are being studied as potential carcinogens. This month, Thrive Market added PFAS to its list of non-compliant chemicals and substances, meaning that you won’t find it in any products on our site.”

Businesses such as HeyBamboo, a toilet paper brand made from 100% bamboo, is committed to using absolutely no plastic in its packaging. “The wrap is made from bamboo, and so is the core of our toilet paper and paper towel products,” said company founder and CEO Joslyn Faust. “We like to say that we’re sustainable to the core,” she said. Another emerging brand, Generation for Change, is committed to making plastic-free health and personal care products, stating that it’s “a company made for the plastic-free generation.” In 2022, FoodTank reported on 19 food and beverage companies looking to move beyond plastic packaging

For natural and organic food brands, Charles Haverfield, CEO of U.S. Packaging and Wrapping, offered this counsel in 2023 in Sustainable Packaging News: “Selecting suitable materials for organic packaging demands a discerning approach. Choose options that minimize the presence of unwanted chemicals while upholding organic and sustainable principles. Materials like compostable plastics, plant-based fibers and paper offer a natural breakdown without leaving behind harmful residues. Glass and metal containers, which are highly recyclable and chemically inert, limit interactions with the packaged goods. Steer clear of some conventional plastics, as they can harbor hazardous additives like phthalates and bisphenol-A. Instead, explore alternatives like bio-based plastics or cellulose-based materials. It's important to note that while aluminum is recyclable, certain aluminum-coated packaging materials may contain additional coatings that clash with organic principles.”

A number of packaging suppliers are offering PFAS free options, such as Good Start Packaging, Delfort, CarePac and others, which offer compostable fiber and paper food packaging with no added PFAS. In January 2024, Organic Produce Network reported that a new third-party packaging standard, GreenScreen Certified — a collaboration between the Center for Environmental Health and Clean Production Action — will certify packaging products that are free from PFAS, as well as “thousands of other chemicals of high concern to human health and the environment.”

Learn More

Video Abstract: Evidence for Widespread Human Exposure to Food Contact Chemicals

Full Study: Evidence for Widespread Human Exposure to Food Contact Chemicals

Summary of Study: Evidence for Widespread Human Exposure to Food Contact Chemicals

Database on Food Contact Chemicals Monitored in Humans (FCChumon)

Food Engineering Magazine: Get the PFAS Out of Food Packaging Materials ASAP

Guide to PFAS Free Food Packaging

Mamavation Guide to Avoiding Products with Forever Chemicals

Environmental Working Group Guide to Companies Marketing Alternatives for Products that Contain PFAS

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Contact steve@compassnaturalmarketing.com.

Cracking Down on Fraud: USDA Organic Enforcement Rules Take Full Effect in March 2024

This article first appeared in Presence Marketing’s September 2023 newsletter.

By Steven Hoffman

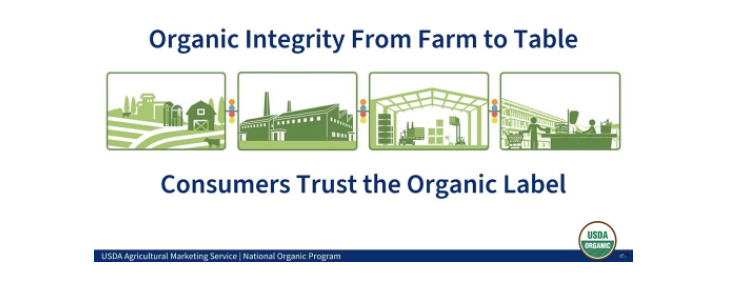

Organic food is big business in the U.S. – sales of organic products topped $61 billion in 2022 – and the certified organic label fetches a premium price for producers. So much so that fraud from both domestic and imported sources had become a major concern among organic industry business owners, investors and advocates.

That’s why such leading organizations as the Organic Trade Association (OTA) and others applauded the U.S. Department of Agriculture (USDA) when, earlier this year, the agency announced the Strengthening Organic Enforcement (SOE) final rule, which is set to be fully implemented and enforced in March 2024.

Representing the biggest change to organic regulations since the passage of the Organic Food Production Act in 1990, the SOE Rule was created to crack down on organic fraud. The new rule provides “a significant increase in oversight and enforcement authority to reinforce the trust of consumers, farmers, and those transitioning to organic production. This success is another demonstration that USDA fully stands behind the organic brand,” Jenny Lester Moffitt, USDA Under Secretary for Marketing and Regulatory Programs, said in a statement.

“The rule closes gaps in current organic regulations and builds consistent certification practices to prevent fraud and improve the transparency and traceability of organic products. Fraud in the organic system – wherever it occurs – harms the entire organic sector and shakes the trust of consumers in organic. This regulation will have significant and far-reaching impacts on the organic sector and will do much to deter and detect organic fraud and protect organic integrity throughout the supply chain,” OTA said in support of the new rule.

Liz Figueredo, quality and regulatory director at organic certifier Quality Assurance International (QAI), based in San Diego, California, told Nutritional Outlook in July 2023 that the new SOE Rule closes supply chain loopholes that existed in previous regulations. The new rule requires organic certification for all parts of the supply chain, including handlers and suppliers who were previously exempt, she said.

“This means that certifiers can no longer depend on documentation from uncertified handlers, which was often lacking, to verify the organic status of products. The rule also includes fraud-reduction techniques, such as requiring an Import Certificate for any organic ingredients or products imported into the U.S., which provides the total volume or weight of the imported products,” Figueredo said.

Who Is Affected by the New SOE Rule?

According to USDA, the SOE Rule may affect USDA-accredited certifying agencies; organic inspectors; certified organic operations; handlers of organic products; operations considering organic certification; businesses that import or trade organic products; retailers that sell organic products; and organic supply chain participants who are not currently certified organic.

Exemptions are limited to a few low-risk activities such as very small operations; certain retail establishments that do not process; storage and warehouse facilities that only handle products in sealed, tamper-proof containers or packages; distributors that only handle final retail-packaged products; and customs and logistics brokers that do not take ownership or physical possession of organic products.

However, exempt operations must still follow all other applicable portions of organic regulations, including co-mingling and contamination prevention, labeling requirements and record keeping. Transporters that only move organic products between certified operations, or transload between modes of transportation, do not need to be individually certified, but are the responsibility of the certified operation that loads or receives the product.

To see if your business is affected and for more information, visit the full text of USDA’s SOE Rule in the Federal Register. OTA, too, has a resource page with extensive information regarding preparing for full compliance with the SOE Rule, along with exclusive training materials for association members. OTA also offers a questionnaire for businesses that may not be sure if they need certification.

What Does the SOE Rule Do?

According to USDA, “SOE protects organic integrity and bolsters farmer and consumer confidence in the USDA organic seal by supporting strong organic control systems, improving farm to market traceability, increasing import oversight authority, and providing robust enforcement of the organic regulations.”

Key updates include:

Requiring certification of more of the businesses, like brokers and traders, at critical links in organic supply chains.

Requiring NOP Import Certificates for all organic imports.

Requiring organic identification on non-retail containers.

Increasing authority for more rigorous on-site inspections of certified operations.

Requiring uniform qualification and training standards for organic inspectors and certifying agent personnel.

Requires standardized certificates of organic operation.

Requires additional and more frequent reporting of data on certified operations.

Creates authority for more robust recordkeeping, traceability practices, and fraud prevention procedures.

Specify certification requirements for producer groups.

“SOE complements and supports the many actions that USDA takes to protect the organic label, including the registration of the USDA organic seal trademark with the USPTO. The registered trademark provides authority to deter uncertified entities from falsely using the seal, which together with this new rule provides additional layers of protection to the USDA organic seal,” USDA said.

For producers wanting to learn more about navigating and adhering to these new requirements, the Western Growers Association in partnership with the Organic Produce Network will host a session at its upcoming Organic Grower Summit, Nov. 29-30, 2023, in Monterey, California, entitled “The SOE Deadline Looms–Are You Ready?” The seminar is designed to help growers better understand the upcoming rule changes, which will affect producers, distributors, handlers and importers.

In addition, organic industry and policy veterans Gwendolyn Wyard and Kim Dietz recently founded Strengthening Organic Systems, an advisory firm focused on helping businesses with organic fraud prevention, supply chain investigations and compliance with USDA’s organic anti-fraud regulations.

Read More

How Will USDA’s Organic Regulation Changes Affect the Food and Nutraceutical Industries? – Nutritional Outlook

USDA Launches Organic Integrity Database Module – Organic Insider

Tighter Rules Now in Effect for USDA Organic Seal of Approval – Cosmetics and Toiletries News

Strengthening Organic Enforcement USDA Rule – California Certified Organic Farmers

USDA Bolsters Consumer Confidence in Certified Organic Products with New Enforcement Rule – New Hope Network

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Natural & Organic Industry Set to Surpass $300 Billion in Sales in 2023, Despite Slower Growth, Inflation

This article first appeared in Presence Marketing’s May 2023 newsletter.

By Steven Hoffman

The U.S. natural and organic products industry is on pace to surpass $300 billion in total industry sales in 2023, despite slower growth and inflation, according to early estimates by Nutrition Business Journal.

Presenting the data at Natural Products Expo West in March, New Hope Network SVP and Market Leader Carlotta Mast said, “This would represent a doubling of industry sales over the last decade. That’s huge. We are a sizeable, impactful, meaningful industry. We’re not a fad anymore. We’re not this niche industry.”

U.S. consumer sales of natural and organic products reached $278 billion in 2022, with growth slowing from 7% in 2021 to 5.4% in 2022, according to preliminary research by Nutrition Business Journal, based on data provided by market research firm SPINS. This follows an unprecedented spike of 10% growth in 2020, as a result of the pandemic. Sales growth is expected to recover somewhat going forward, according to Mast, and is projected to reach 6% in 2024 and 2025.

The bulk of the growth in 2022 was driven by natural, organic and functional food and beverage sales, led by carbonated drinks, dairy alternatives, “better-for-you” sweeteners, baby products and canned and dried soups. These categories outperformed the overall natural and organic products industry, Mast noted. In functional foods and beverages, sports and energy drinks, soft drinks, frozen desserts and snack chips that include functional ingredients such as mushrooms, adaptogens, electrolytes, prebiotics and healthy fats helped drive sales in the category.

Hitting a milestone in 2022, as well, were sales of organic food and beverage products, with sales estimated at more than $50 billion. According to Mast, this figure represents a doubling in organic food and beverage sales since 2014. Product categories that performed strongly in the organic sector last year included organic baby formula, candy, dips, soft drinks and yogurt, according to New Hope and SPINS data.

However, after seeing record growth in 2020, most impacted by inflationary pressures was the dietary supplements category, which rose only 1.7% in 2022 to $60.9 billion in sales, based on the data presented at Expo West and reported on by Food Navigator-USA.

Kathryn Peters, Chief of Staff at SPINS, shared with attendees at Expo West that natural and organic foods are continuing to expand into the mainstream, with sales of natural products in conventional grocery and convenience outpacing growth in traditional natural food stores. Growth in sales of natural products in 2022 increased 9.2% in convenience, followed by a 7.4% increase in “conventional multi-outlet,” and a 4.1% increase in regional grocery, compared to 2.5% growth in the natural channel, based on SPINS data and reported by Food Navigator-USA.

While shoppers continue to look for deals and best prices across multiple channels including supermarkets, mass retailers, club stores and online to help reduce the impact of higher food prices, according to The Hartman Group and FMI — The Food Industry Association, 32% of shoppers concerned about rising food prices reported buying fewer items as a strategy to save money in February 2023. That’s down from 41% of shoppers who reported buying fewer items to save on food costs in October 2022.

“Our national survey reveals persistent consumer concern about food and beverage prices, as the weekly spend for groceries increased in late 2022 and early in 2023,” Leslie G. Sarasin, president and CEO of FMI, said in a statement. “To address higher prices, shoppers are visiting more stores and seeking deals to stretch their dollars but are now less likely to cut back on the number of items purchased compared to six months or a year ago. This is an opportunity for our industry to continue connecting with shoppers on food-inflation-mitigating solutions.”

According to FMI and The Hartman Group’s findings, food price concerns cut across shopper demographics, however, “Boomers are more worried about rising food prices than any other group, with 80% showing concern in February 2023 versus 69% in October 2022. Millennials polled close behind with 76% saying they are concerned, 5% more than one year ago. Such concerns about food costs coincide with an increase in spending in this inflationary environment. In February, on average, consumers spent $164 per week on groceries, up from $148 in both October and February of 2022,” FMI said.

Natural and organic food shoppers, in particular, may be less sensitive to price than traditional shoppers, but they still want quality, taste, nutrition, value … and sustainability. Younger consumers are driving demand toward brands that reduce waste and minimize carbon footprint and environmental impact. “The values-oriented shopper is a really important and valuable shopper,” Peters of SPINS noted, and according to Nutrition Business Journal, organic products are one of the last places consumers say they are willing to trade down to fight food inflation.

In a Chicago Tribune feature article published on April 3, 2023, Tonya Lofgren, Marketing Manager of Ciranda, a leading organic ingredient supplier based in Hudson, WI, said, “What’s cool about the natural and organic shopper is that if they value that, they’ll prioritize it over other ways to adjust spending because they realize how important it is.” Ciranda CEO Doug Audette added, “We are seeing consumers rationalizing their spending decisions. Overall, that has tempered the growth in organic. But we see no letting up in the long-term growth of organic, sustainable and fair-trade ingredients.”

In a March 2023 organic market report, USDA reported that, after a surge in pantry stocking pushed sales to record heights in 2020, organic food sales declined for the first time in decades in 2021 on an inflation-adjusted basis. However, “more than 15 million new customers entered the organic and natural foods market between early March and mid-April 2020,” USDA said. Time will tell if these consumers stick with organic.

According to USDA’s market report, organic consumers are diverse in terms of race, ethnicity, education, and income, though millennials purchase organic food at larger rates than other generations. Households with children are also more likely to purchase organic food than households without children, USDA noted.

Yet, challenging new and dedicated organic consumers alike is the fact that organic foods are seeing some of the steepest price hikes amid stubbornly high food inflation. Prices for organic fruit and vegetables rose 13.1% over the past year, compared with just under 10% for conventional produce, according to a February 2023 analysis of USDA retail pricing data by Lending Tree.

Among all the food groups included in Lending Tree’s analysis, organic chicken prices increased the most, at 19.5%. “That's more than three times the price jump for conventionally raised chicken, which rose 5.9% over the last year, the report shows. For households already struggling with the nation's worst bout of inflation in 40 years, such spikes could force many consumers to opt for nonorganic options instead,” CBS News reported.

Sales data for 2022 show organic fruits and vegetables growing in revenue but declining in sale volume, according to the Organic Produce Network. However, that’s a common theme across the food industry as consumers pay more for less in the face of heavy inflation, the Chicago Tribune noted.

According to the Tribune, a quarter of consumers surveyed by Nutrition Business Journal over the past year said they’re unlikely to stop buying organic produce, packaged food and meat to save money on groceries. Fewer than half of respondents said they are likely to cut those products out.

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We Are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Natural Products Industry Prepares for a Post-COVID Future

By Steven Hoffman

This article originally appeared in New Hope Network’s IdeaXchange and Presence Marketing’s May 2020 newsletter edition.

As the nation continued to battle the COVID-19 pandemic in April, with confirmed cases in the U.S. reaching 1 million and deaths from the disease surpassing 55,000 (more than the total number of U.S. casualties in the Vietnam War), the natural products industry, along with the mainstream food industry, found itself firmly on the frontline of the coronavirus crisis. In helping to keep food on America’s table during an unprecedented time of turmoil, sadly, this came not without some illness and casualties of its own among workers in natural foods stores and in mainstream groceries.

The month also saw farmers dumping tons of eggs, milk and fresh produce bound for restaurants, hotels, schools and other food service operations that were shuttered – product that couldn’t be re-routed – while frustratingly, grocers across the country were still struggling to keep product on the shelf as supply chains were further strained. Food banks, too, experienced long lines and shortages of staple products due in part to the demands of a record 26.5 million Americans who have filed for unemployment since mid-March.

Yet, among a bunch of bad news, retailers, distributors, manufacturers and others in the natural foods industry continued to pivot and do everything they could to serve and protect customers, minimize risk to workers, ensure inventory and respond to ever-evolving local, state and federal guidelines and shelter-in-place rules.

First, in response to a worrying number of employee illnesses, many grocers are now requiring that all workers wear face masks, though they, too, are having to compete with the federal government, hospitals and others to procure scarce Personal Protective Equipment (PPE). In addition, the United Food and Commercial Workers International Union (UFCW) along with Kroger, Stop & Shop and others, issued a joint statement on April 27 calling on federal and state governments to designate grocery store employees as “extended first responders” or “emergency personnel.”

“We are urgently requesting our nation’s state and federal leaders temporarily designate these workers as first responders or emergency personnel,” the joint statement said. “This critical status would help ensure our essential grocery workers have priority access to testing, emergency childcare, and other protections to keep themselves and their families safe and healthy. For the sake of workers, their families, and our nation’s food supply, this action will provide grocery workers with the vital protections they deserve.”

Responding swiftly to the lack of PPE for natural foods employees, Presence Marketing worked with one of its brand partners to manufacture face masks and other protective gear to provide to industry partners in manufacturing, distribution and in stores, “plus we’re working on a retail pack for consumers,” said Christine Tzumas, COO of Presence Marketing. “Our field team has been on the front lines from the beginning of this crisis working fast and furious to serve our customers in any possible way, from helping unload trucks when they show up at the dock to lending a hand stocking store shelves,” she said.

“The biggest thing for us right now is communication – we’re communicating everything going on as quickly as possible,” Tzumas continued. “Our brand partners have been receiving weekly, fact-driven COVID-19 updates, and the response has been so positive that we want to continue it in some fashion. While we’ve been dealing with this crisis, we still can’t lose sight of what’s on the other side and what the world will look like six months out from now. Hopefully, we will be moving beyond this. Our team has blown me away every day making sure to get food on the shelves – we’re blessed to be with the people and companies we work with. You don’t hear those same stories in other industries,” Tzumas added.

Phases of a Crisis

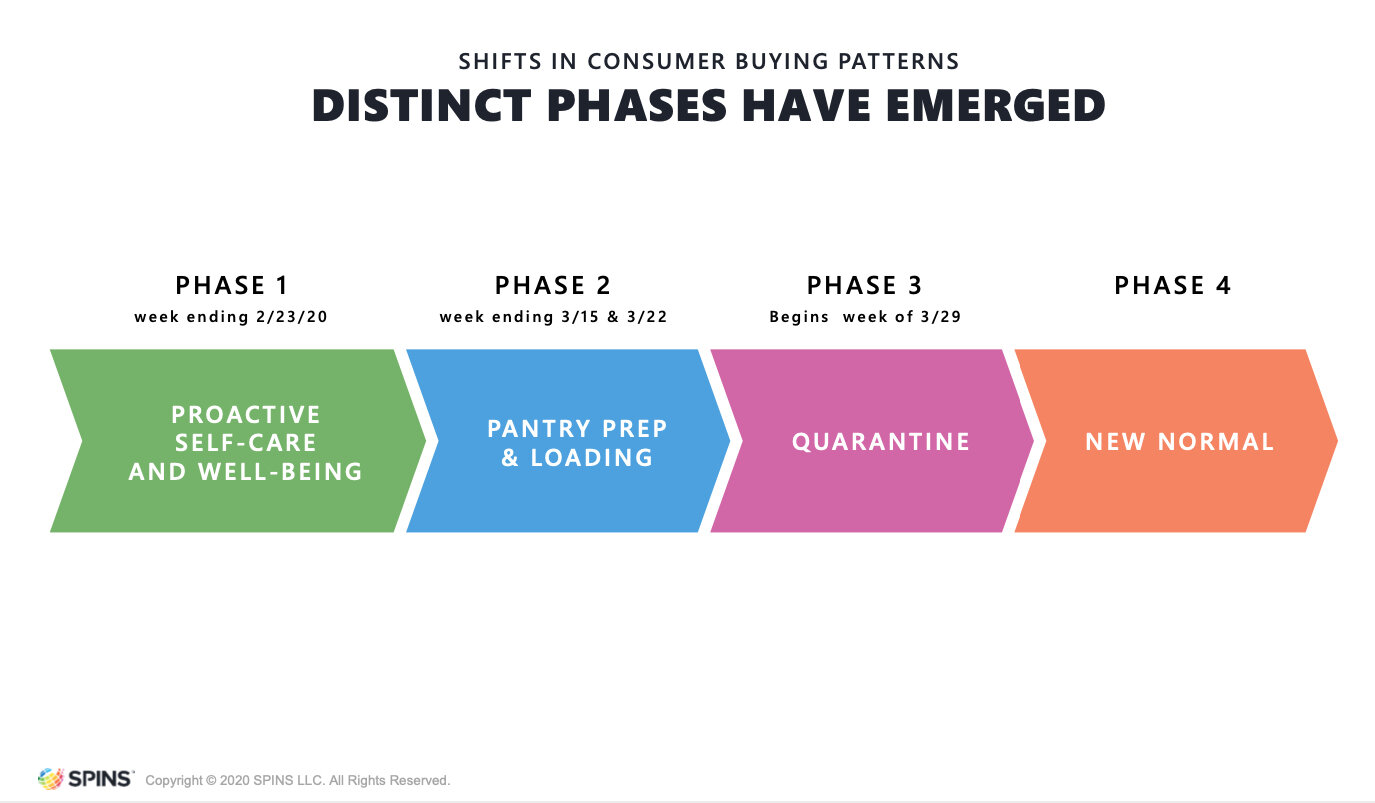

According to natural products market research firm SPINS, we’ve seen three distinct phases in terms of consumer shopping behavior since the coronavirus crisis hit the U.S. in late February. Also, with restaurants and other out-of-home dining options accountable for roughly half of all food expenditures, with their abrupt closure, demand doubled overnight for the nation’s grocers.

By late February, consumers who had an early read on the coming pandemic were responsible for big upticks in sales of preventive care products in natural foods channels, including vitamins, dietary supplements, probiotics, and herbal and homeopathic products. This was what SPINS refers to as Phase One: Proactive Self Care and Wellbeing, according to Kathryn Peters, EVP of Business Development for SPINS, in an April 21 webinar presented by New Hope Network.

“During the weeks of February 16 and 23, when there was still just a small number of confirmed COVID cases in the U.S. and the problems in China still seemed a bit far away, there was an early band of proactive shoppers beginning to stock up in key immunity-related categories beyond the regular cold and flu season type of products. That was when self-care items also started to pop, such as hand wipes and sanitizer. By late February, people were beginning to have a hard time finding hand sanitizer in stores,” she observed.

To provide some perspective, when Phase One began, “from just the previous week, we saw some extraordinary increases in a number of areas for the week ending February 23,” Peters said, noting a 1,285% increase sales of vitamins and supplements and a 211% increase in herbal and homeopathic products sales.

“We all know what Phase Two looked like – during the weeks of March 15 and March 22 – this was the mass stock up,” Peters continued. “During this ‘Pantry Prep & Loading’ phase, virtually everything sold.” Peters noted that during this period, 15 million additional buyers bought natural products. “That is a substantial number of products being bought by shoppers that are now in pantries. Time will tell if they will become continued shoppers; hopefully, there’s been a lot of trial,” she said.

April began Phase Three: Quarantine, according to SPINS data, with upticks in sales of baking mixes, pastas and spa-related items as Americans hunkered down at home and did their best to cook for their families, and pamper themselves while not being allowed to visit salons, massage therapists or other service providers. “Households seem to be bonding over baking, whether it’s bread or desserts – Instagram is full of proud creations,” Peters said.

The New Normal

“And then there’s Phase Four – what life is going to look like on the other side,” Peters said, noting that there will be some lasting shifts in consumer behavior in the “new normal” once the health crisis subsides. With consumers homebound, re-connecting with cooking and seeking more prepared food options, grocers are being presented with an opportunity to capitalize on providing mealtime solutions – something they were having difficulty with before.

Organic produce, too, experienced a resurgence, recording a 22% sales jump in March and an 8% increase overall for the first quarter, outperforming conventional produce sales, according to the 2020 Q1 Organic Produce Performance Report published by the Organic Produce Network and Category Partners. Growth may have been even higher, but was tempered by widespread out of stock conditions during the panic buying period in mid-March. “Organic fresh produce sales in the first quarter were strong, and the impact of COVID-19 in March pushed numbers even more,” Matt Seeley, CEO of the Organic Produce Network, said. “We continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce.”

Another lasting trend will be a continued focus on proactive self-care and personal safety – immunity supplements cleaners, wipes, masks and other related household items will continue at a high level. Also, “while comfort foods are important, we are seeing growing recognition of healthy and nutrient dense food, too. This comes with consumers’ increasing recognition that our body’s immune system is the best line of defense. Even with economic pressures, we see this continuing. We believe that this unfortunate health crisis will be a bright spot in continuing to bring health and wellness even more mainstream,” Peters of SPINS said.

“We are very concerned about those negatively economically impacted by the coronavirus crisis. If there’s one major tectonic shift, it is the march toward more and better value product offerings to lower barriers of entry from a pricing standpoint,” said Ben Nauman, Director of Purchasing for National Co+op Grocers (NCG). Nauman noted that sales in March for its retail members were up nearly 30% compared to March 2019 sales.

NCG has been helping its members coordinate distribution and supply chain issues, take advantage of government stimulus programs, and currently, it is reinvigorating a recession playbook created in 2008 to help members manage cash flow and liquidity during economic downturns. “We’re also beginning to explore what it looks like to retail in a more contactless way going forward,” Nauman added.

For Sprouts Farmers Markets, a publicly traded natural foods retailer with nearly 350 stores and 30,000 employees, “due to our brands and distributor partners, we are in good stock level considering how high our sales are, and our customers are recognizing how good we are about being in stock,” noted John Soukup, Senior Category Manager for Sprouts. The company recently expanded curbside pickup and Instacart service to all its stores. “In addition, we have been very proactive in implementing measures to help our employees feel as safe as possible,” he added, noting that all employees are required to wear masks and gloves chainwide, the stores have installed sneeze shields in all checkout lanes, and store hours have been reduced to allow for deep cleaning. In addition, “we’ve offered bonuses to our employees instead of hourly increases. However, our leadership is doing a good job in compensating – we’ve already given out two to three rounds of bonuses to the front line employees in the warehouse and in the stores,” he said.

Soukup also expressed concern about the manufacturing sector as the health crisis wears on. “We are starting to see SKU rationalization – vendors are having to prioritize what items they’re going to make. That’s going to ramp up over the next four to six weeks that could cause other out of stock issues,” he said. To help counter that, “we communicate daily with our distributors and just about weekly with our vendors. In this unprecedented time, our primary distributors, KeHE and UNFI, have done a phenomenal job. The broker community, too, including Presence Marketing, has done a great job for us in terms of serving as a liaison between the brands and what’s going on in the stores.” In times of crisis, “you understand who your partners are pretty quickly,” Soukup added.

Distributors See Fundamental Shift in Demand

At UNFI, one of the nation’s leading distributors of natural products, EVP of Supplier Services John Raiche has noted some big changes as a result of the pandemic. “The big difference between April and March is we’ve seen a fundamental shift in demand as students come home from college, people are staying home, and the food service expenditure is gone. The infrastructure was not designed to handle a sudden shift of that magnitude,” he said. While retailers are no longer placing such massive orders, there was a period of time at the end of March where on some evenings orders coming in were 400% of capacity, Raiche noted. UNFI, which also has placed a large focus on worker safety and incentives, hired more than 1,500 people since the beginning of March.

For Raiche, flexibility and communication are key right now. “We are trying to be as flexible and creative as possible with our suppliers on purchase orders, and we are trying to communicate with the industry and reach out to suppliers to share with them what we see, to offer to work with them, and to provide updates in terms of demand and opportunity,” he said.

“For the team here internally, from receivers and collectors to drivers and the supply management team, there’s a real sense of purpose. People are open to working longer hours and doing whatever is needed. We’re spending a tremendous amount of time thinking about what the future holds, Raiche shared. “When it started, many people were thinking it would be like a light switch. Everything I read is that any transition back to normalcy will take place over a good amount of time. For our manufacturers, this demand is not going to go back to the old normal anytime soon.”

At KeHE Distributors, “our first priority is the safety of warehouse associates, professional drivers and in-store sales reps – the ones that are so important, the critical essential workers in this situation, said Scott Weber, EVP of Merchandising. “Our second priority is servicing retailers and suppliers to try to keep up with unprecedented demand. We’ve developed partnerships with food service distributors to align all our capacity to meet the massive demand in our industry. The third priority is giving back. Through our KeHE Cares philanthropic program, we are supporting those most affected by the COVID crisis.”

Weber added that while it may be a difficult time to introduce new products, “our overall category management and merchandising team remains heavily focused on innovation because we know that when those retailers get back to new items and category reviews, we’ve got to have a robust line to offer.” As such, KeHE revamped a “Trend Finder” event, originally scheduled for Natural Products Expo West, into a virtual event in order to meet with new suppliers. “The most important thing right now is working with our suppliers to ensure we have the flow of inbound product to KeHE that enables us to serve our customers,” he said.

Blair Kellison, CEO of Traditional Medicinals, a pioneering manufacturer of natural and organic teas, remarked that sales of tea in grocery was up 41% in the last month – “unheard of!” he exclaimed. Kellison often comes to work at 6:00 am to stand in the parking lot “just so I can say thank you to our workers,” he said. “If the workers are coming here every day, I should be here every day. These 120 workers are keeping our entire company going.”