Survey Says: Research Shows Natural, Organic Channel Saw Steady Growth in 2021

This article originally appeared in Presence Marketing’s July 2022 Industry Newsletter.

By Steven Hoffman

Starting out in the natural and organic products industry in the mid 1980s as an associate editor with media and trade show company New Hope Network, there were a few long after-hours sessions spent each summer pouring over completed paper surveys sent in by retailers, and compiling data with company founder Doug Greene to analyze and publish what has since become a milestone marker for the industry, the Natural Foods Merchandiser’s Annual Market Overview Survey.

Photo Credit: Organic Trade Association

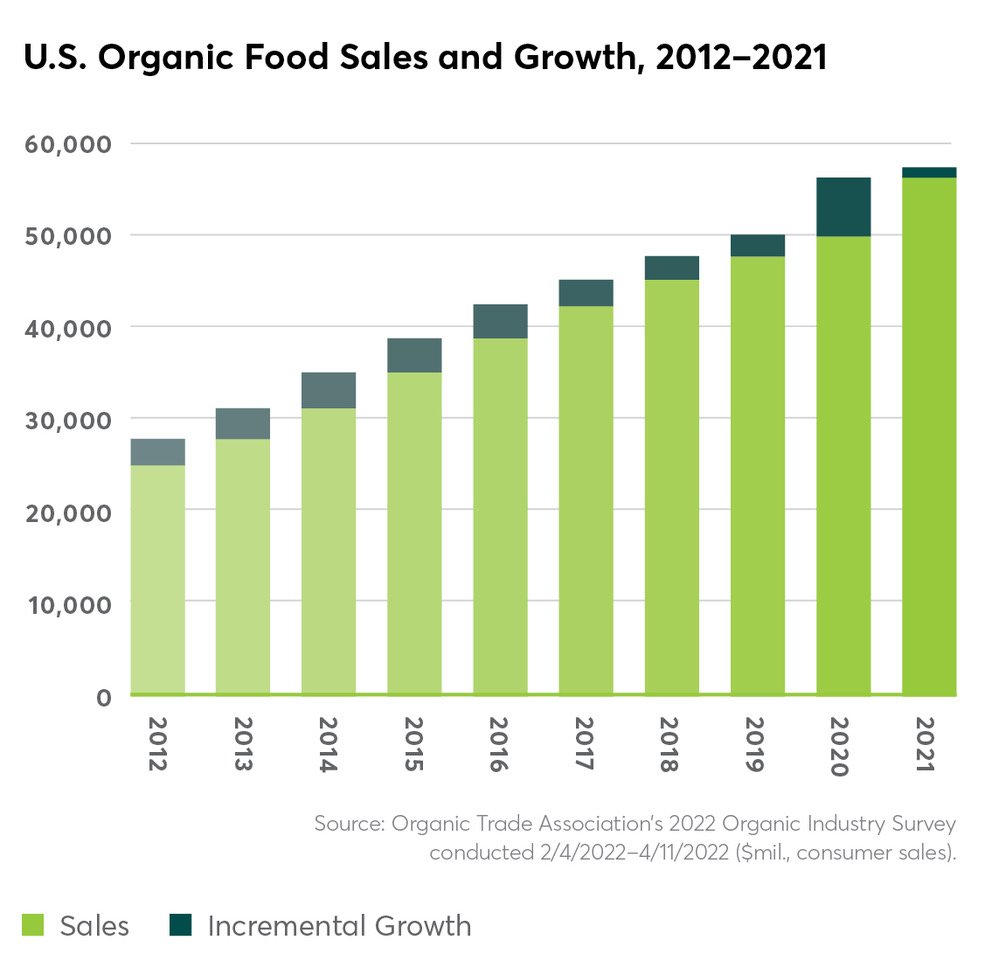

Today, the survey has become much more sophisticated, and so has the market, which has grown 10X since that time to reach $204.6 billion, representing an overall growth rate of 5.5% in 2021, according to this year’s report, published in June 2022.

Once dominated by independent natural products retailers, according to this year’s survey, conventional retailers now command 46.1% of natural products sales, representing growth of 5% in 2021. Combined, independent and large-chain natural products retailers comprised a market share of 31.3% in 2021. However, while independent natural products retailers recorded growth of 4.1%, the large chain and specialty store format saw sales decline by 1.9% in 2021.

Overall, conventional grocers reported natural products sales of $94.4 billion in 2021. Sales were $64 billion among natural products retailers in 2021, comprising independents, small chains and large chain/specialty stores. New Hope estimates there were 21,613 independent and large chain natural channel retail stores in the U.S. in 2021.

Of note, e-commerce sales of natural products continues to grab market share, charting growth of 23.2% in 2021. That’s not surprising, say industry observers, considering consumers were still spending considerable time at home in 2021 during the pandemic. Now, as the world emerges, some of those online consumer shopping behaviors may stick, according to Nutrition Business Journal’s 2022 Supplement Business Report, particularly when it comes to dietary supplement sales. According to NBJ, the supplement industry recorded $59.9 billion in sales in 2021, up from just $43.2 billion five years ago. E-commerce claimed the biggest share of post-pandemic dietary supplements sales growth, reported Rick Polito in the Natural Products Industry Health Monitor.

Photo Credit: Natural Foods Merchandiser 2022 Market Overview Survey, New Hope Network

Across all sales channels, e-commerce “is leading a huge shift in channel dynamics,” according to NBJ Senior Industry Analyst Claire Martin Reynolds. Based on a growth trajectory that is expected to add another $10 billion in dietary supplement sales over the next four years, “2024 is expected to be the record year where e-commerce market share in supplement sales is larger than natural and specialty or mass market retail, coming sooner than previously forecasted given the pandemic-related acceleration,” NBJ reported.

New Hope’s overview also revealed some interesting data regarding the demographic makeup of natural products shoppers.

While a common assumption is that natural channel shoppers are mostly white, well-off moms, that perception is inaccurate, said New Hope’s editors. “In fact, shoppers are fairly evenly divided along gender lines; fewer than half are Caucasian; about 40% are affluent; and more than a third live in households with just two people. Additionally, more than a quarter of natural channel shoppers are Hispanic and more than a third of Asian consumers are significantly more likely to shop at natural grocery stores; 36% of consumers who represent communities of color agree that products at natural retailers were, ‘made with me in mind’ (compared to 32% of all retail customers combined); and Hispanic and Asian consumers specifically are more likely than all natural retail shoppers to agree that they are ‘willing to pay a premium for natural and organic foods and products’ (44% vs. 36%),” New Hope’s researchers reported.

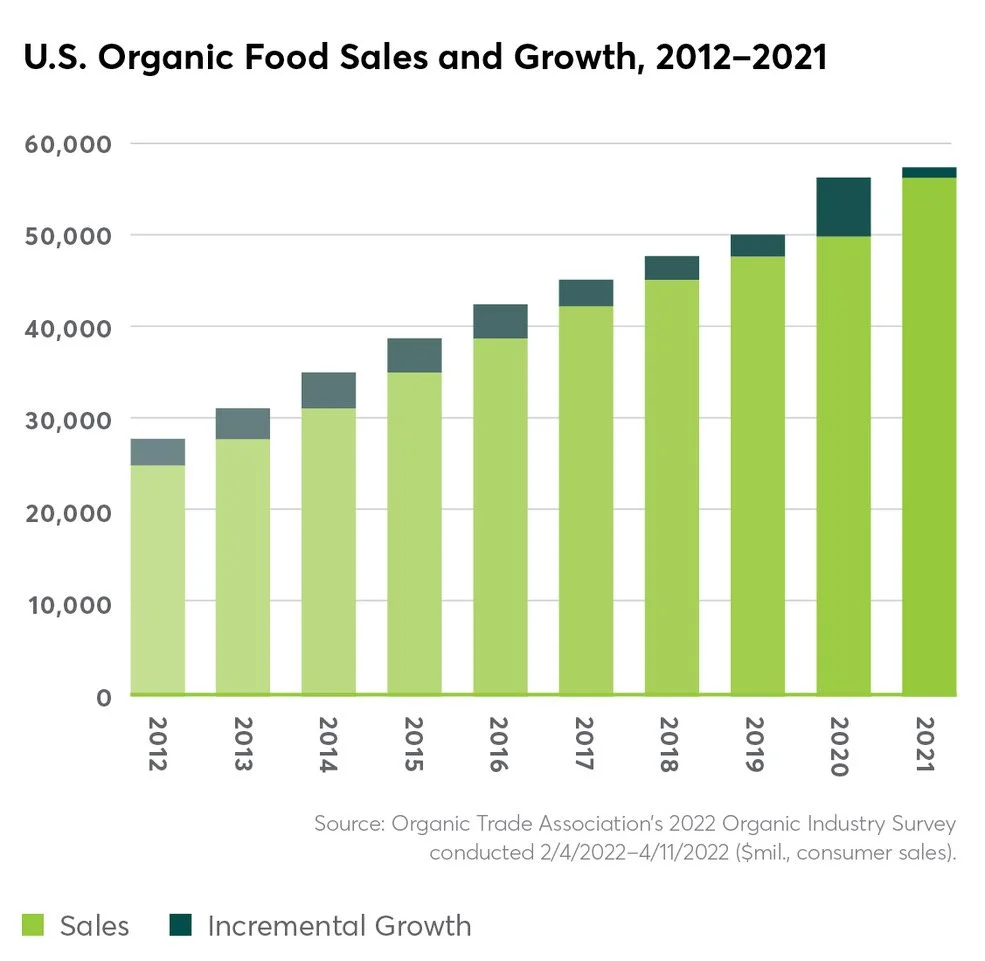

In related news, in its annual Organic Industry Survey, published in June 2022, the Organic Trade Association reported that between 2020 and 2021, sales of organic products surpassed $63 billion, growing 2% during that time period. Food sales, which comprises over 90% of all organic sales, rose 2% to $57.5 billion, and sales of nonfood organic products grew 7% to reach $6 billion in sales.

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA’s CEO and Executive Director Tom Chapman, “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Among the strong performers in organic: organic beverages experienced the highest growth (8%) of all major categories, with organic coffee topping 5% growth and $2 billion in annual sales. Organic produce accounted for 15% of the organic products market, bringing in $21 billion in revenue in 2021, a 4.5% increase over 2020. Fresh produce drove growth in that category, at 6%.

While a decline in packaged and prepared organic food sales in 2021 represents a shift away from the pantry loading of 2020, organic baby foods — traditionally a strong entry point for shoppers new to organic — was a bright spot in 2021 with 11% growth. Organic snack foods, which suffered a decline in 2020, saw healthy growth of 6% in 2021, reflecting a return to active lifestyles and demand for healthy, nutritious on-the-go foods.

Among non-food organic products, fiber, supplements and personal care products were the most dominant performers with growth rates of between 5.5% and 8.5% in 2021, said OTA. Textiles, the largest non-food sub-category, represented 40% of the category’s total sales and brought in $2.3 billion in annual sales. Overall, non-food products saw 6% growth in 2021 and represented nearly $6 billion in sales, OTA reported.

However, industry observers caution that the unprecedented inflation the country is experiencing this year could affect sales of typically higher priced organic products as price-sensitive consumers opt for purchasing conventional foods to save money, according to a recent report in the Organic Produce Network. According to an Economist/YouGov poll taken in June 2022, 69% of Americans say changes in the inflation rate have impacted them negatively. In a June 2022 survey conducted by market research firm The Feedback Group, 24% of consumers are substituting similar, less expensive foods and 12% said they are buying fewer organic items and products to cut costs.

“Organic’s ability to retain the market footholds gained during 2020 and continue to grow despite unprecedented challenges and uncertainty is a testament to the strength of our industry and our products. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritizing efforts to engage and educate organic shoppers and businesses,” said OTA’s Tom Chapman.

Organic Packaged Foods Contain Fewer Ingredients Linked to Negative Health Effects

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Processed, packaged foods labeled as organic have a more healthful profile than their conventional counterparts, says a new analysis of 80,000 food products conducted by the Environmental Working Group (EWG) and published in the journal Nutrients.

The study focused on packaged foods, which EWG said accounts for more than 60% of the calories consumed in the U.S. The study analyzed nutrition and ingredient information for 8,240 organic and 72,205 conventional foods sold in the U.S. in 2019 and 2020. It is the most comprehensive study to date of the differences between non-organic, or conventional, packaged foods and those labeled as Certified Organic, said EWG.

According to the EWG study, organic packaged foods have fewer ultra-processed ingredients and additives that may promote overeating. EWG reported that the overall nutritional profile of organic foods is better, too, with less added sugar, saturated fat and sodium. Organic packaged foods contain more potassium, a heart-healthy nutrient found in fruits, vegetables and other unprocessed or minimally processed foods, EWG reported.

Nearly three-quarters of the U.S. packaged food and beverage supply in 2018 was ultra-processed, claimed EWG. This category of food makes up a significant source of calories for people over the age of two, and even higher for kids ages two to 19, EWG noted.

Gene editing, celery powder and organic enforcement: A roundup from the NOSB’s fall meeting

Originally Appeared in New Hope Network’s Idea Xchange, November 2019

By Steven Hoffman

The National Organic Standards Board recently addressed some of the industry’s critical issues: protecting small-scale organic dairy farmers; strengthening fraud enforcement; and gene editing.

From protecting small-scale organic dairy farmers and strengthening enforcement over organic fraud, to expressing concern over the use of celery powder in processed organic meats and the threat of gene editing in organic production, the National Organic Standards Board addressed several critical issues surrounding the integrity of the organic seal during its recent fall meeting.

The board voted to prioritize four areas of organic research: ecosystem services and biodiversity of organic systems; managing cover crops for on-farm fertility; identifying barriers and developing protocols for organic nurseries; and assessing the genetic integrity of organic crops at risk.

Approximately 150 advocates, producers, farmers, manufacturers and others attended the fall meeting of the National Organic Standards Board Oct. 23-25 in Pittsburgh, Pennsylvania, according to a USDA spokeswoman. During the 12 hours of public comment, about 115 people spoke to the board members about their concerns, she said.

“Farmers are some of the most innovative people in the world when we need to be,” said Jeff Dean, an organic farmer and member of the Ohio Ecological Food and Farm Association. “Please keep our standards strong and give our proud, innovative farmers the chance to provide organic products to the consumers who want them,” he appealed to the NOSB board members.

This overview of the meeting was collected from published accounts and Twitter feeds from Organic Trade Association, Cornucopia Institute, Organic Insider, Ohio Ecological Food and Farm Foundation and other organizations attending the event.

Strengthening organic enforcement

Preventing fraud in organic trade is critical to maintaining product integrity and consumer confidence. Jennifer Tucker, deputy administrator of the USDA’s National Organic Program (NOP), presented a proposed NOP Enforcement and Oversight Rule that will be issued later this year for public comment, and improvements already underway to strengthen enforcement.

Those improvements include additional training resources focused on oversight of complex domestic operations; traceback and mass balance audits; and research into risk-based certification models for accreditation and certifier oversight. The National Organic program accredits and oversees more than 80 independent certification organizations, examining and verifying how these organizations document, certify and inspect more than 37,000 organic farms and businesses around the world.

In the realm of imports, farm-level yield analysis has been a valuable tool in taking enforcement action, Tucker said. In the Black Sea region, the NOP examined records from organic grain and oilseed producers, data from regional producers and weather models and found many organic farms reported yields far higher than regional averages. As a result, more than 275 operations in that area have lost their organic certification, according to the agency.

The NOP has continued country commodity studies and ship surveillance, increased the number of unannounced visits it makes, Tucker said. Follow-up investigations have led to certifiers and operators adverse actions, she said.

Tucker shared that new training on dairy compliance is available for certifiers and inspectors at the online Organic Integrity Learning Center, which continually offers new courses since its launch in May.

Also, the comment period for the Origin of Livestock rule—a proposal to change how farmers may transition their dairy animals to organic—has been reopened. Written comments must be received or postmarked on or before Dec. 2.

What’s the deal with celery powder?

To the relief of organic meat producers but to the chagrin of those concerned about the potential health hazards of nitrates and nitrites in processed foods, the NOSB board voted 11-1, with one abstention, to allow the continued use of celery powder in organic food production. Dave Mortensen, chair of the Department of Agriculture, Nutrition and Food Systems at the University of New Hampshire, voted against keeping celery powder on the list, and Emily Oakley, founding partner of Three Springs Farm in Oaks, Oklahoma, abstained from voting.

Used in the curing of processed meats such as hot dogs, sausages, bacon and deli meats, celery powder is a key processing ingredient in the organic meat industry, as it is the only allowed alternative to synthetic nitrates and nitrites used in conventional meat production. At issue, reports New Food Economy, is the fact that a significant amount of processing goes into producing celery powder for use in cured meats, and that the celery itself does not have to be organic, which brings with it the concomitant use of synthetic pesticides and fertilizers. Non-organic celery is ranked 11th on the Environmental Working Group’s Dirty Dozen list of vegetables that, when grown conventionally, absorb the highest levels of pesticides.

Additionally, whereas the amount of synthetic nitrates is limited in conventionally processed meats, unlimited quantities of celery powder are allowed in meats that are labeled “uncured” or “nitrate free,” New Food Economy reports, which has been cause for concern among some health advocates.

“There is little evidence that preserving meats using celery … is any healthier than other added nitrites,” Dariush Mozaffarian, dean of the Friedman School of Nutrition Science & Policy at Tufts University, told New Food Economy. “Until industry provides strong evidence that nitrites in celery juice have different biologic effects than nitrites from other sources, it’s very misleading to label these [products] as ‘nitrite free’ or to consider such processed meats as being healthier.”

The Organic Trade Association supported continuing the allowance of non-organic celery powder at the Fall NOSB 2019 Meeting so as not to disrupt the organic meat industry. However, the trade association, in collaboration with the Organic Center, submitted a $2 million proposal to the USDA and convened a working group to find organic sources of celery powder and research alternatives to celery powder in organic meat processing. NOSB members expressed hope that when the ingredient comes up for review again in five years, their successors may be presented with more alternatives.

Gene editing in organic

Gene editing, which the organic industry considers GMO technology, remains a prohibited method in organic agriculture, Tucker said, adding that gene editing is not on USDA’s regulatory agenda for organics. However, according to Informa’s IEG Policy News, Tucker also noted that USDA does encourage “continued robust dialogue about the role of new technologies and innovations in organic agriculture.”

That idea alarmed a number of organic advocates concerned that USDA might try to influence the NOSB’s position on gene editing. In response, Mortensen criticized USDA NOP officials. “It’s clear from the many comments that we received that organic consumers and organic farmers do not want genetically modified practices as any part of our production system, end of story,” he said. “And I don’t think we should be encouraging or suggesting that we need robust dialogue. I think this is just one example of where we get ourselves into trouble and compromise the policies that we were charged to do.”

Consistent with its gene-editing position, NOSB voted unanimously to exclude induced mutagenesis via in vitro nucleic acid techniques as a method in organic production, reported the Organic Seed Alliance in its Twitter feed. According to the organic advocacy organization IFOAM Organics International, such mutagenesis technology—as well as CRISPR, grafting onto transgene root stock and other related practices—“are genetic engineering techniques that are not compatible with organic farming and that must not be used in organic breeding or organic production.”

Other board activity

On Oct. 24, the USDA published a final rule in the Federal Register to amend the National List of Allowed and Prohibited Substances based on public input and the April 2018 recommendations from the National Organic Standards Board. This final rule allows elemental sulfur to be used as a slug or snail bait to reduce crop losses; allows polyoxin D zinc salt for plant disease control; and reclassifies magnesium chloride from a synthetic to a non-synthetic substance. The final rule is effective Nov. 22.

During the fall meeting, new NOSB officers, who serve 1-year terms, were elected:

Chair—Steve Ela (Producer), Ela Family Farms, Hotchkiss, Colorado.

Vice chair—Scott Rice (Certifier), Washington State Department of Agriculture, Olympia, Washington.

Secretary—Jessie Buie (Producer), Ole Brook Organics, Jackson, Mississippi.

In addition, outgoing NOSB members Harriet Behar, Ashley Swaffer, Tom Chapman and Lisa de Lima were recognized for their public service.

The next NOSB meeting is scheduled for April 29-May 1 in Crystal City, Virginia.

Target, Kroger Enjoying Growing Sales of Organic and Natural Foods

Photo: Pexels

Originally Appeared in Presence Marketing News, September 2019

By Steven Hoffman

Target Corporation (NYSE: TGT), based in Minneapolis, MN, on August 19 announced the launch of a new flagship private label brand, Good & Gather. The in-house brand will focus on four categories: organic; kids; seasonal; and premium products. More than 2,000 products including dairy, produce, ready-made pastas, meats, granola bars and sparkling water, are expected to roll out under the Good & Gather brand over the next 18 months. Good & Gather will become Target’s largest brand, replacing existing house brands Archer Farms and Simply Balanced and reducing the number of products under Target’s Market Pantry Brand, reports Sustainable Food News. In related news, Cincinnati, OH-based grocery giant Kroger (NYSE: KR) claims its Simple Truth brand now offers more Fair Trade Certified products than any other U.S. private label brand. The company reported on August 20 in its 2019 Sustainability Report that it sold $17.6 billion worth of natural and organic products in 2018. Kroger’s natural and organic private label brand, Simple Truth and Simple Truth Organic, achieved sales of $2.3 billion in 2018, making it the second largest brand sold in its stores, the company reported. Kroger said it purchased 17.2 million pounds of Fair Trade certified ingredients for its private label products, and also said it sold more than $1 billion worth of organic produce in 2018. Kroger operates 2,800 supermarkets and multi-department stores in 35 states. Each store carries on average 4,000 natural and organic items, reports Sustainable Food News.

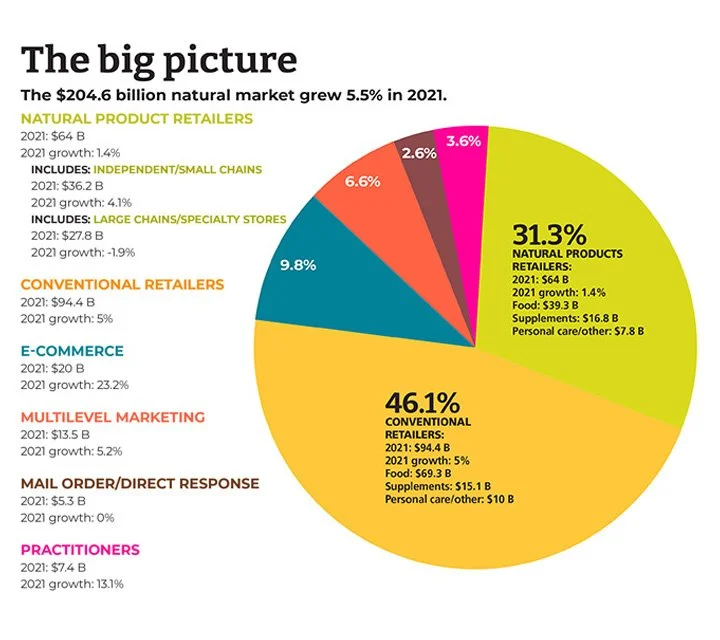

Proposed Tariffs on European Products Would Devastate Specialty Food Sales

Photo: Pexels

Originally Appeared in Presence Marketing News, September 2019

By Steven Hoffman

The Trump administration is currently considering adding tariffs this fall to a large number of items imported into the U.S. from the European Union (EU), including most foreign cheeses. Many top-selling and popular cheeses including Italian Parmigiano-Reggiano and Dutch Gouda could become twice as expensive, reports Modern Farmer. The tariff proposal would increase duties on hundreds of EU products by as much as 100%. Originating from a trade dispute in the aviation industry, the proposed tariffs, supposedly meant to punish the EU, will end up directly impacting specialty food retailers who are already operating on thin margins. According to the Specialty Foods Association, the latest list of proposed tariffs includes 100% levies on a range of pork products, cheeses, pastas, coffee, olives and other goods. “If something happens, we are insulated for a time,” Bob Marcelli, owner of specialty food importer Marcelli Formaggi in Clifton, NJ, told Specialty Food News. “But long term, it would be just devastating. Everybody’s going to pay more; that’s the bottom line, he said.

Trader Convicted in Organic Fraud Scheme Commits Suicide Before Serving 10-Year Prison Sentence

Photo: Pexels

Originally Appeared in Presence Marketing News, September 2019

By Steven Hoffman

Facing incarceration for his role in masterminding a $142 million organic grain fraud scheme, organic farmer and trader Randy Constant was found dead by suicide on August 19 at his home in Chillicothe, MO. Constant was sentenced on August 16 by a federal court judge to 10 years in prison for knowingly marketing and selling non-organic corn and soybeans as organic. Federal prosecutors called the scheme “one of the largest, if not the largest, organic fraud schemes in the history of the United States.” Police officers found Constant dead from carbon monoxide poisoning weeks before he was to report to federal prison. Prosecutors alleged that Constant falsely marketed non-organic grains as certified organic on a massive scale, reported Time Magazine. Sales through his Iowa grain brokerage equaled up to 7% of the organic corn grown in the U.S. in 2016 and 8% of organic soybeans. From 2010 to 2017, Constant was reported to have sold over 11.5 million bushels of grain, primarily used as feed for chickens and cattle, which would then be unwittingly marketed as organic meat products by the respective producers. Constant’s death came as authorities publicized his prison term, which they hoped would deter other farmers from defrauding the National Organic Program, reported Time Magazine. Judge C.J. Williams said during the sentencing hearing that Constant’s fraud did “extreme and incalculable damage” to consumers and undermined public confidence in the nation’s organic food industry.