Industry Leaders Respond to USDA’s Funding Announcement for Regenerative Agriculture

This article first appeared in the January 2026 issue of Presence Marketing’s newsletter.

By Steven Hoffman

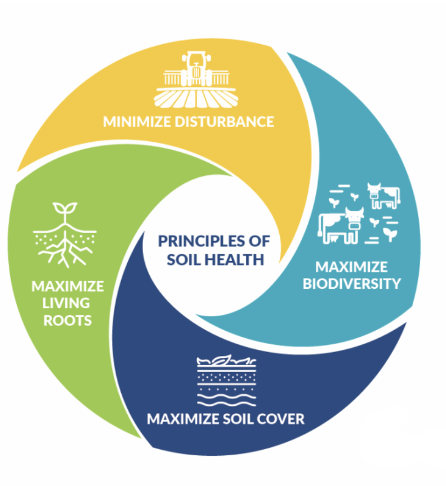

U.S. Secretary of Agriculture Brooke Rollins, alongside U.S. Health and Human Services (HHS) Secretary Robert F. Kennedy, Jr., and Centers for Medicare & Medicaid Services Administrator Mehmet Oz, M.D., on December 10 announced a $700 million Regenerative Pilot Program to help American farmers adopt practices that improve soil health, enhance water quality, and boost long-term productivity, all while building a healthier, more resilient food system, said USDA. According to the release, HHS also is investing in research on the connection between regenerative agriculture and public health, as well as developing messaging to explain this connection.

“Protecting and improving the health of our soil is critical not only for the future viability of farmland, but to the future success of American farmers. In order to continue to be the most productive and efficient growers in the world, we must protect our topsoil from unnecessary erosion and improve soil health and land stewardship. Today’s announcement encourages these priorities while supporting farmers who choose to transition to regenerative agriculture. The Regenerative Pilot Program also puts farmers first and reduces barriers to entry for conservation programs,” said Secretary Rollins.

Administered by USDA’s Natural Resources Conservation Service (NRCS), the new Regenerative Pilot Program is designed to deliver a streamlined, outcome-based conservation model—empowering producers to plan and implement whole-farm regenerative practices through a single application. In FY2026, the Regenerative Pilot Program will focus on whole-farm planning that addresses every major resource concern—soil, water, and natural vitality—under a single conservation framework. USDA said it is dedicating $400 million through the Environmental Quality Incentives Program (EQIP) and $300 million through the Conservation Stewardship Program (CSP) to fund this first year of regenerative agriculture projects. The program is said to be designed for both beginning and advanced producers, ensuring availability for all farmers ready to take the next step in regenerative agriculture.

To support the program, NRCS is establishing a Chief’s Regenerative Agriculture Advisory Council “to keep the Regenerative Pilot Program grounded in practical, producer-led solutions,” USDA said. The Council will meet quarterly, with rotating participants, to advise the Chief of NRCS, review implementation progress, and help guide data and reporting improvements. Its recommendations will shape future USDA conservation delivery and strengthen coordination between the public and private sectors.

USDA also said it is permitting public-private partnerships as part of the Regenerative Agriculture Initiative (RAI), claiming that such partnerships will allow USDA to match private funding, thus stretching taxpayer dollars further, and bringing new capacity to producers interested in adopting regenerative practices.

We asked leaders in regenerative agriculture to weigh in on USDA’s announcement. Here’s what they had to say:

Hannah Tremblay, Policy and Advocacy Manager, Farm Aid

As a strong supporter of regenerative agriculture, Farm Aid welcomes USDA’s funding announcement for regenerative agriculture, but the lack of details about the program's specifics means we're unable to give a full response or analysis. From the few details that have been provided to date, this looks like a streamlining of processes and possible restructuring of existing funding, but does not appear to represent new funding for these programs.

The chronic underfunding and oversubscription of the EQIP and CSP programs – two crucial conservation programs – are ongoing problems that this administration and Congress have not addressed. The recent budget bill passed by Congress makes it easier for large operations to disproportionately use EQIP and CSP dollars by removing payment limits and Adjusted Gross Income (AGI) requirements. Policies like these make these programs less accessible to small and diversified farming operations and do a disservice to family farmers who are trying to enact conservation practices.

This sudden embrace of regenerative agriculture flies in the face of the other policies we've seen from this administration, including canceling the Climate Smart Commodities Program, EPA's fast tracking of pesticides and cuts to USDA's NRCS staff, who are crucial to helping farmers implement soil health practices.

Matthew Dillon, Co-CEO, Organic Trade Association

There are still many details to come in the implementation of the NRCS regenerative program, but the Organic Trade Association (OTA) is always supportive of programs that help farmers transition to improved management of their natural resources. It would appear that it will give farmers an à la carte menu of practices that they can select and create a less burdensome bundled approach with NRCS. If we can make it easier for farmers to better care for natural resources, that’s a good outcome.

The optimal outcome would be for farmers to have integrated and holistic conservation plans, like those that organic farmers do in their annual Organic System Plan. And ideally, that would include pesticide mitigation plans for those farmers who are conventional. Hopefully for some of these farmers it will be an on-ramp to exploring opportunities in organic markets.

At the end of the day, policy incentives will only go so far in rewarding farmers for ecosystem services – markets and consumers are essential. Organic is the only third party, verified, backed-by-law marketplace that does that. We will work to make sure organic farmers have adequate access and get recognition in these programs.

Ken Cook, Executive Director, Environmental Working Group

Basically, I’m pretty skeptical of the Regenerative Pilot Program. If you look at all of Robert F. Kennedy, Jr.’s big talk during the Trump campaign and then during the transition regarding subsidies, $700 million rebranded from existing programs (with multi-billion-dollar budget baselines that a lot of us built and defended) is hardly the bold action he promised. The emphasis on efficiency and red tape is interesting—whole farm plans that originated in the 1930s and 1940s in the old Soil Conservation Service (SCS) are all about paperwork and red tape, and going back, a lot of us in the conservation world (and reformist elements within NRCS) pushed the agency to focus on practices aimed at priority lands/problems. Reformers in NRCS in the 1980s and after always felt whole-farm plans were make-work that resulted in career advancements (and documents on farmers’ shelves) but not necessarily conservation on the ground.

There was no emphasis at the press conference announcing the program on reducing pesticides. Nor was there any emphasis on aiming some of the money at organic, the only system out there that does fulfill the MAHA rhetoric from farm to grocery shelf.

And of course, during the Biden administration there was so much emphasis in regenerative circles on climate progress via carbon farming, carbon sequestration, farmers selling carbon credits, and so on, but those words and objectives have been forbidden by USDA. (We always thought the carbon stuff was way oversold—and not needed to justify lots of benefits from mixed crop-livestock farms, longer more diverse rotations, cover crops and other sensible practices that…have also been around and under-deployed by farmers since the 1930s despite BILLIONS spent by taxpayers on free technical assistance and cost-sharing).

Then of course there are the ‘antithesis-of-MAHA’ cuts to vital programs earlier this year to get local food to schools and food banks, the reductions in NRCS staff to do those whole-farm plans, and the massive, multi-billion-dollar subsidies that have been paid in tariff reparations to big commodity operations—whose payment limits have been generously increased to make sure the biggest operations get the most money.

Christopher Gergen, CEO, Regenerative Organic Alliance

The Regenerative Organic Alliance (ROA) welcomes the USDA’s announcement of a new Regenerative Pilot Program as an important signal of federal commitment to advancing healthier soils, more resilient farms, and stronger rural economies. We applaud this growing recognition that agriculture must go beyond extraction toward restoration, a core belief that has guided our work since the creation of the Regenerative Organic Certified® (ROC™) standard.

As USDA begins shaping the program’s criteria and implementation, ROA encourages alignment with the rigorous, holistic principles that define regenerative organic agriculture: improving soil health, ensuring dignified and fair conditions for farm workers, and supporting the humane treatment of animals. These three pillars are foundational to the ROC framework and have proven essential to achieving long-term ecological, economic and community benefits.

We are encouraged that the USDA acknowledges the role of organic systems in regenerative agriculture. ROC builds on USDA Organic as a necessary baseline for eliminating toxic synthetic pesticides, fertilizers, and GMOs — inputs that undermine soil biology, water quality, pollinator health, and farmworker safety. ROC then goes further by requiring additional soil health practices, pasture-based animal welfare, and fair labor conditions.

As decades of peer-reviewed research and field evidence show, regenerative practices alone cannot fully deliver intended environmental outcomes if they allow routine use of synthetic chemicals. The scientific record also shows that organic systems, including those that strategically use tillage for weed control in lieu of herbicides — consistently build soil carbon, increase water retention, reduce erosion, and improve microbial diversity. We encourage USDA to ensure that any regenerative agriculture program reflects this evidence by prioritizing systems that avoid toxic inputs and protect both ecological and human health.

The rapid expansion of regenerative claims creates both opportunity and risk. Without clear definitions, rigorous standards, and third-party verification, the regenerative category is vulnerable to greenwashing and consumer confusion. Independent analysis has shown that some non-organic regenerative labels allow herbicides, GMOs, synthetic fertilizers, and minimal verification, which could undermine public trust and the credibility of the entire regenerative movement.

With the right structure, USDA’s initiative can accelerate the transition to a food and fiber system that heals the land, strengthens rural communities, and ensures a healthier future for all; a vision that drives our mission every day. ROA looks forward to engaging with USDA as this pilot advances and to contributing our expertise, data, and proven frameworks to help shape a regenerative future rooted in integrity, transparency, and meaningful impact.

Jeff Tkach, Executive Director, Rodale Institute

Rodale Institute welcomes the USDA’s announcement of the new Regenerative Pilot Program and views it as an important signal that soil health, farm resilience, and long-term productivity are increasingly central priorities within American agriculture. This moment reflects a growing federal recognition that healthy soil is foundational to a secure food system, climate resilience, and human health.

For more than 78 years, Rodale Institute has led the science and practice of regenerative organic agriculture, long before “regenerative” entered the policy lexicon. Through the longest-running side-by-side comparison of organic and conventional farming systems in North America, Rodale Institute has demonstrated that regenerative organic agricultural practices can improve soil health, enhance water quality, increase resilience to extreme weather, and support farm profitability.

With a national network of research hubs, education initiatives and farmer training programs, Rodale Institute has helped producers across regions and production systems transition to regenerative organic practices rooted in measurable outcomes and continuous improvement. This experience, coupled with our leadership as a founding member of the Regenerative Organic Alliance, positions Rodale Institute as a critical partner in ensuring that regenerative initiatives are clearly defined, science-based, and deliver real, lasting benefits for farmers, communities, and the environment.

As the USDA advances this pilot program, Rodale Institute stands ready to contribute its decades of research, farmer-centered expertise, and leadership to help guide its success. By keeping soil health at the center of agricultural policy and practice, we can continue building a food system that supports productive farms, nourishing food, and healthy people, now and for future generations.

Paige Mitchum, Executive Director, Regen Circle

This Regenerative Agriculture Pilot Program is not new. It is a carve-out from the existing Farm Bill’s conservation funds using the same forms, rankings and field offices. The key difference is that they were processing proposals differently. Under the Climate Smart Commodities Program the process went USDA ↔ big project ↔ farmer. This pilot now routes money through individual NCRS contracts so the process flows as NRCS ↔ farmer. This sounds cleaner unless the agency in the middle just lost 20% of its staff, as is the case with the NRCS.

By doing away with the big projects intermediaries you lose the support provided by states, tribes and NGOs whose role was to recruit farmers, do measurement verification and reporting, provide technical assistance and handle smaller payments. Without this the NRCS will need significantly more bandwidth to handle a direct to farmer approach. But they aren’t staffing up; the FY2026 plan indicated further personnel reductions, leaving me to draw only one conclusion: The regenerative pilot program will be woefully under resourced, forcing them to accept applications from large well-resourced operations leaving small and vitally important producers on their own.

In a nine‑day window in December, the administration: backed pesticide maker Bayer in court, poured billions into the most glyphosate‑dependent crop systems, and then unveiled a sub‑billion-dollar regenerative agriculture pilot program as its health‑and‑soil solution. Once again this administration has brilliantly cut social infrastructure and meaningful programs that were supporting small farmers in regenerative transition, shielded a flagship herbicide company from liability, bailed out large monocultures, and in exchange handed us a small carve-out of existing programs with zero new infrastructure or any credible way of executing said program. As such, this reads more as a marketing scheme than it does meaningful policy work, and I hope that the private sector can step up and support the small holder farmers at the heart of the regenerative movement.

They took away the mountain we were slowly, imperfectly but intentionally building, they took a shovel and put a small mound of dirt aside and said, take this and enjoy the view.

Read Page’s full article here.

André Leu, D.Sc., BA Com., Grad Dip Ed., International Director, Regeneration International

In theory, this is a great initiative. Improving soil health through regenerative practices has been long overdue. Most farmers, including many organic farmers, need to adopt these methods. In reality, it will depend on who is selected to sit on the Chief’s Regenerative Agriculture Advisory Council. If it is composed of regenerative and organic farmers, it will be credible. If they repeat the NOSB (National Organic Standards Board) model, it will be hijacked by academics, NGOs and agribusiness. It will be an exercise in greenwashing, promoting no-till Roundup-ready GMOs and other degenerative practices. I don't have confidence that, given the USDA's history with the organic sector, they will choose the credible option.

Alexis Baden-Mayer, Political Director, Organic Consumers Association

I've been looking into where the money's coming from for the Regenerative Agriculture Pilot Program and how much has been allocated versus taken away. This is money Congress appropriated for two regenerative agriculture programs (the Environmental Quality Incentives Program and the Conservation Stewardship Program) with a total annual budget of $4.515 billion. So, if $700 million is going to regenerative, that means $3.815 billion (84%) of EQIP and CSP funds will be going to factory farms and pesticide-drenched genetically modified field crops. Admittedly, Trump's USDA isn't the first to misappropriate these funds this way, but it is the first to celebrate it.

Earlier this year, the USDA refused to disburse $6.062 billion appropriated by Congress for family famers adopting regenerative agriculture practices and serving local markets. Now we're now supposed to be happy because the USDA is earmarking $700 million for regenerative agriculture? I feel like they're trying to convince us two pennies is more than a dollar bill because two is more than one.

Max Goldberg, Founder, Editor and Publisher of Organic Insider

The USDA's announcement of about $700 million dedicated to regenerative agriculture puts the spotlight on the importance of soil health at a critical time and is extremely welcome. Yet, whether this program can actually deliver tangible results to America's farmland remains a serious uncertainty, and there are two questions that must be answered.

First, does the USDA have adequate on-the-ground technical staff to assist farmers in executing regenerative practices while also measuring soil health improvements? Second, will this program actually lead to a reduction in pesticide use? Only time will tell, but the level of skepticism is very high that the funds will be spent in an efficient manner and this will result in meaningful progress.

Dan Kane, Lead Scientist, MAD Agriculture

The Regenerative Agriculture Initiative (RAI), also called the Regenerative Pilot Program (RPP), is a program announced by Secretary Rollins on Dec. 10, 2025. The press release from USDA describes it as a $700 million pilot program for FY2026 focused on helping farmers transition to regenerative practices.

The RAI is not a new program but instead a repackaging of existing USDA Natural Resources Conservation Service (NRCS) conservation programs, including the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP). Nor does the RAI designate new funding towards either of these programs and the practices they target. It will likely function as a priority national funding pool producers can apply to with some minor modifications to requirements and the application process. Efforts by the prior administration to increase funding to key regenerative practices and the regenerative agriculture community more broadly through the Inflation Reduction Act (IRA) would have provided greater funding overall in FY2026 and beyond.

The IRA added approximately $19.5 billion into USDA conservation programs above and beyond 2018 Farm Bill funding levels over a period of four fiscal years (FY2023-FY2028). EQIP would’ve been expanded by $8.45 billion over that period, with about $3.45 billion of that coming in FY 2026 for a combined total of $5.5 billion in FY2026. CSP would’ve received $3.25 billion over that period with $1.5 billion coming in FY2026 for a combined total of $2.5 billion in FY2026.

Given all the shifts in funding, and the reallocation of IRA funds to CSP and EQIP baseline spending enacted through the One Big Beautiful Bill Act (OBBB), RAI is effectively funded through the reallocation of IRA funds. But, considering the reduction in total funding, it’s still not net new spending compared to what would’ve happened had IRA stayed in place. Although the OBBB increased baseline EQIP and CSP funding over a longer time period, the Congressional Budget Office still estimates that the rescission and reallocation of IRA funds will result in a net decrease of approximately $2 billion in actual conservation spending through FY2034.

While some of the changes included in this program (bundling applications, whole farm planning, soil testing) are good ideas, they’re ideas that NRCS has already applied through other programs. Major reductions in NRCS staff and proposed changes to how the NRCS is structured are likely to limit total capacity and reduce agency efficiency and function. Last, the elimination of income eligibility caps and the potential integration of public/private partnerships into the program raise concerns that this program and USDA conservation programs writ large will end up primarily serving very large farmers and agribusiness interests.

Any USDA programming focused on regenerative agriculture is a welcome addition to the financial stack for producers. No doubt we at Mad Agriculture will keep this program in mind as a potential option for the producers with whom we work. But this is a small win in comparison to the huge loss that came through the rescission/reallocation of IRA funds.

Read MAD Agriculture’s full analysis of USDA’s Regenerative Agriculture Initiative here.

Charles "Chuck" Benbrook, Ph.D., Founder, Benbrook Consulting Services

Chuck Benbrook is the former Chief Science Officer of The Organic Center; former Research Professor, Center for Sustaining Agriculture and Natural Resources, Washington State University; and former Director, National Academy of Sciences Board on Agriculture

As someone who has been deeply involved in soil conservation policy, I was excited to see this announcement from the USDA Natural Resources Conservation Service (NRCS). With $700 million committed in the next fiscal year, it's a pretty substantial investment in regenerative agriculture. The hope is that it will go on with continued, and hopefully increased, funding.

As I read the announcement for the Regenerative Pilot Program, it seems to be a clear recognition by the USDA that soil health and what is needed to enhance the biological integrity and health of the soil has to be a very high priority. In fact, on par with controlling physical erosion. And I think that's the right direction. That's how we're going to lower the cost of production. That's how we're going to clean up water and start dealing with all these rural areas with ridiculously high levels of nitrate in everybody's drinking water. It's how we're going to deal with resistant weeds. Dealing with soil biology at this point is the most important and lowest hanging fruit for healing what ails us.

I think there are two aspects to the significance of USDA's announcement. One, it recognizes farmers anywhere along the continuum, from conventional, chemical-dependent farmers to regenerative organic producers. Wherever you are along the continuum, if you want to move toward a more diversified, resilient, less chemical-dependent system, you have to make multiple changes simultaneously and timed correctly to succeed.

I also think the NRCS approach of entering into customized contracts with growers that start from where they're at and finance the next round of changes in their farming systems, which could include changes in rotations, tillage, cover crop management and water management, is a good one.

It's also a positive that it's a streamlined administrative process where the farmer basically comes in with a proposal and works with the local NRCS and farm services agency staff to come up with how much the cashier payment will be next year and presumably for subsequent years for the practices that are adopted. Of course, one of the big concerns that people have is how progress is going to be monitored and quantified in a convincing way. Also, like everyone, I'm curious to see the details of how NRCS is going to structure the contracts.

My wish with this program is that smaller producers will have as much access as larger operators, however the fact is, those big commodity farmers tend to get favored when it comes to grants. Yet, I didn't see anything in the announcement to suggest that the NRCS is going to take into account the size of the farm in allocating the available funds. But let's face it, the larger, more sophisticated, often multi-owner, farms are going to be in the door first with well thought out proposals.

Regarding the appointment of an Advisory Council to help oversee the Regenerative Pilot Program, I think (USDA) Secretary Rollins has had a constructive series of conversations with people that come out of the organic and regenerative community. I also think she'll insist that a few folks from that world are on this advisory committee. But, you know, if past is prologue, the soybean growers will have a rep, the cotton council will have a rep and the pesticide industry will have a couple of reps. And it might not be somebody that's working actively for a pesticide manufacturer today, but it could be someone who has deep roots in that community. They may be an academic now. They may work for a consulting firm, but you know, the politics inside these federal agencies is really brutal.

The NRCS regenerative program has great potential to be the fulcrum to start the transition towards more diversified, sustainable regenerative systems, but for it to work in a meaningful way at scale, it has to be combined with a similar negotiated change in how commodity program subsidies and crop insurance subsidies are currently supporting agriculture. And that's the core idea behind what we're working on now called the Farm Economic Viability and Renewal Act, or FEVER Act, to help spark discussion among agriculture community leaders and policymakers of the systemic reforms in policy needed to avoid ever-larger bailouts in the not-too-distant future.

The large sums of taxpayer money at play — over $40 billion in farm support in 2025, and likely even more in 2026 — heighten the urgency of reaching agreement on substantive policy changes. The pressing challenge is to not invest taxpayer dollars during 2026 and beyond in bigger and better band aids, but instead in support of the deeper, systemic changes in farming systems that most farmers, advocates for healthier rural communities, scientists, and policy wonks know are needed.

Companies interested in partnering with USDA NRCS in the Regenerative Pilot Program can email regenerative@usda.gov for more information. Farmers and ranchers interested in regenerative agriculture are encouraged to apply through their local NRCS Service Center by their state’s ranking dates for consideration in FY2026 funding. Applications for both EQIP and CSP can now be submitted under the new single regenerative application process.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Natural, Organic and Regenerative Food and Agriculture Surge in Popularity

This article first appeared in the May/June 2025 issue of GreenMoney Journal

By Steven Hoffman

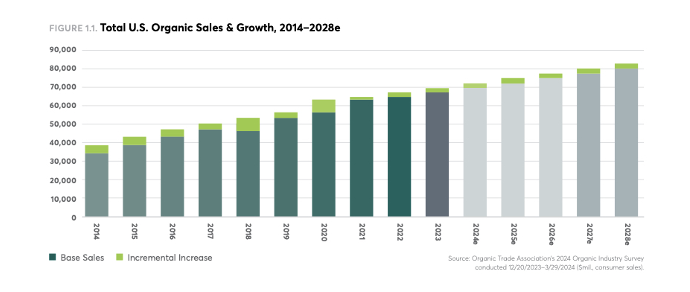

The market for organic food and agriculture has grown significantly since the National Organic Program was first established in 2001, placing the USDA Certified Organic seal on products that qualify for this distinction. Today, it’s a $70 billion market that’s been growing an average of 8% per year. And while it may be maturing, younger consumers, including new parents and their babies, are eating it up. And now, in the post-pandemic era, investors are once again paying attention to the potential of organic and regenerative products and brands that take into account health and the environment, and how the way we produce our food and consumer products affects climate change.

A survey released in February 2025 by the Organic Trade Association (OTA), the industry’s leading trade group, found that organic’s benefits to personal health and nutrition are resonating deeply with millennials and Gen Zers, making them the most committed organic consumers of any generation. Also, a February 2025 study by the Acosta Group, one of the nation’s top natural and organic products sales firms, reflected that 75% of all shoppers purchased at least one natural or organic product in the six months prior to the survey, with 59% responding that they think it’s important that their groceries and/or household products are natural and organic because they “are better for them” and “they tend to have fewer synthetic chemicals and additives.”

Natural and Organic Industry Is a Force

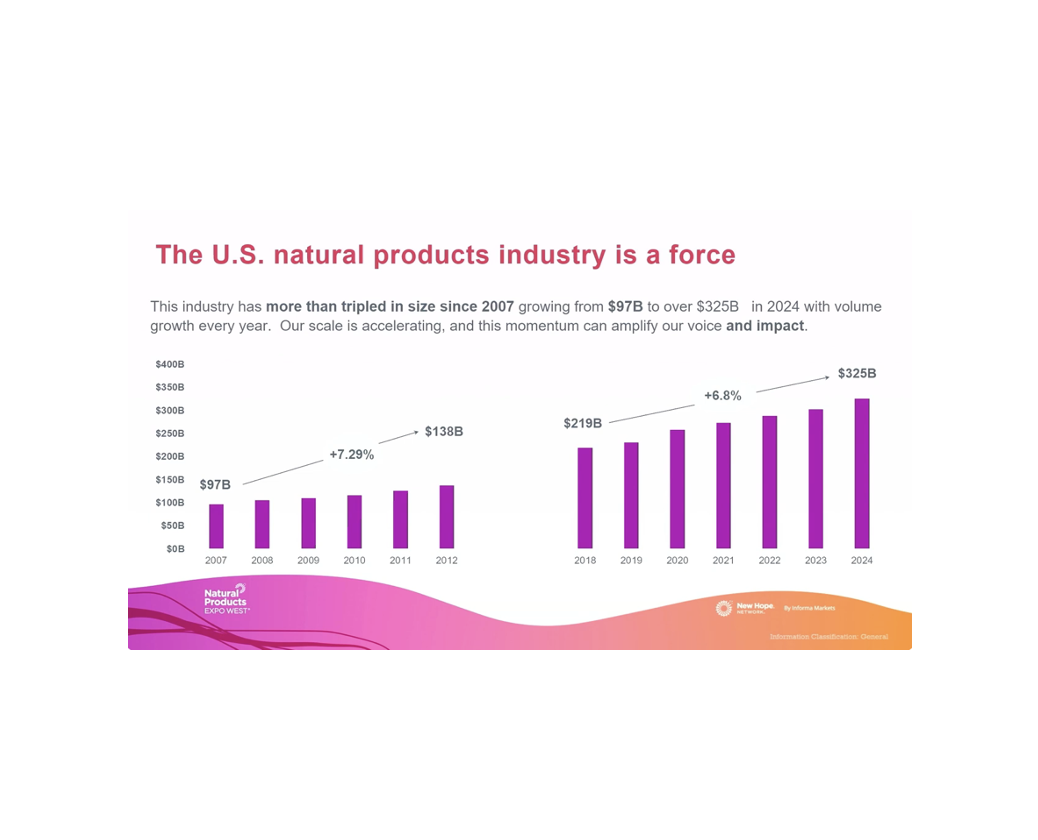

Overall, the natural and organic products industry combined has more than tripled in size since 2007, growing from $97 billion in sales in 2007 to over $325 billion in 2024, according to data compiled by New Hope Network, SPINS (a division of Nielsen), Whipstitch Capital and others, and presented at this year’s State of Natural & Organic keynote presentation at Natural Products Expo West, the world’s largest trade exhibition for the natural, organic, regenerative, nutritional and eco-friendly consumer products industry, held in March 2025.

“Wow, this industry is a force,” said Jessica Rubino, VP of Content & Summits for New Hope Network, at the keynote presentation. “That is a tremendous amount of growth. Today, we’re defining the industry as the natural, organic and functional food and beverage space, dietary supplements and personal care.” According to Rubino, the industry grew 5.7% in 2024, exceeding expectations. “The biggest piece of the pie is food and beverage, followed by dietary supplements and then personal care.” Rubino also said that while personal care is the smallest segment, it is the fastest growing and a category to watch.

“Natural products are absolutely continuing to accelerate again. Of course, they’re all outpacing non-natural products, and that’s even with not a whole lot of new items coming through,” said Kathryn Peters, Head of Industry Relations for SPINS and one of this year’s keynote presenters. “We’re also seeing more buyers coming in. This is being driven across many areas of the store, whether it’s refrigerated, grocery or vitamins and supplements. So, it’s just a resilient, wonderful story of growth we see in the industry. And really importantly, the game is continuing to be all about smart, profitable growth.”

In addition, “Organic is still very solid and strong, moving about the same pace as natural,” Peters said. “Consumers obviously have a strong awareness more than a lot of other certifications and a confidence in organic.” Certified regenerative products, too, showed significant growth of 20% in 2024, the panel noted.

“In just a little over two decades, the USDA Organic label has earned deep trust among consumers and has become one of the most identifiable food labels in our grocery stores,” said Matthew Dillon, Co-CEO of the OTA. According to OTA’s survey, more than half of U.S. consumers bought an organic fruit or vegetable in the last year. Consumers surveyed bought more bread in the last six months than any other food item, and 27% said they chose organic bread. For those surveyed consumers buying baby food, a whopping 93% chose organic. The USDA Organic label is particularly important for younger consumers, with over two-thirds seeking out the organic label in almost every food purchase. The Organic label was most valued in fresh food categories including fruits, vegetables, meat/poultry, baby food, eggs and dairy, and these items were the most likely products to be purchased as organic over the last 12 months.

Regenerative Agriculture Draws Investor Interest

In addition, regenerative agriculture — a system of farming that seeks to sequester carbon by rebuilding healthy soil — is among the sectors attracting more interest from impact investors, despite being an underfunded sector. However, there is growing consensus that the increasing threat to biodiversity is unsustainable and regenerative agriculture urgently needs to scale up. Now, groups such as Regenerative Food Systems Investors Forum and Impact Investor are drawing investor’s interest to the space.

One of the primary challenges to investing in regenerative food and farming is due to the fact that it requires significant upfront investment to transition from conventional farming. As such, many institutional investors remain hesitant due to uncertain returns and long payback periods. “This transition to regenerative farming is a long term one. That’s why intensive agriculture is so widespread, because it’s a very quick win. This is why you need investors to be patient and be willing to take some of the first loss and risk. This then accelerates the amount of private capital that will come in, because risk is protected,” said Harriet Jackson of responsAbility, a Swiss impact investing firm, speaking at Impact Investor’s 2024 conference in The Hague.

“Today…we are at what appears to be a crucial point in the transformation of agriculture and food systems. The momentum for regeneration is distinct,” said Sarah Day Levesque, Managing Director of Regenerative Food Systems Investment Forum, an investor’s organization seeking to build a more resilient food system. “There’s an increasing number of farmers pioneering the transition on the farm and increasing acreage. We can also see it in the incredible growth of organizations like EARA — the European Alliance for Regenerative Agriculture – designed to give rise to the voices of farmers in transition. Governments and public policy makers are acknowledging the very real risk presented by climate change and degradation of nature, including that caused by extractive agricultural practices. We are increasingly seeing policies and public sector investment that seeks to address these risks and support transition. Businesses and asset owners are starting to see and feel the importance of investing in nature and climate positive land use – seeing how critical investments in natural capital will de-risk production and create resilience in business models and investment outcomes.”

One organization seeking to foster investment in regenerative agriculture is the Boulder, CO-based Mad Agriculture, which in March 2024 launched Mad Capital, a $50 million investment fund aiming to de-risk regenerative and organic farming. With commitments from The Rockefeller Foundation, Schmidt Family Foundation and more, Mad Capital established its Perennial Fund II to provide loans to U.S. farmers to help them transition to regenerative and/or organic agriculture. The fund has made two closes and is “actively deploying capital to farmers,” said Mad Capital Co-founder and CEO Brandon Welch.

Natural and Organic Brands Are Outperforming

From an investor’s perspective, the overall natural, organic and regenerative products industry is looking better than it has in some time, asserted Nick McCoy, Managing Director and Cofounder of Whipstitch Capital, at the State of Natural & Organic keynote at Natural Products Expo West. “Over the last couple of years there’s been a lot of talk and a lot of pain for the lack of liquidity in this industry. It’s been very difficult for founders to find money compared to pre-Covid. Right now, we’re sitting in a very similar point as we were in 2010 or 2011 facing the millennial launch and emerging from the great recession…when it was very difficult to raise small checks. So, what's the hand of cards that we're playing in this industry now? Well, we have natural products that are very attractive. They're outperforming…consumers are running to them. We have positive ROI in cash invested. Cash invested is resulting in big revenue gains right now, and ultimately dollars chase dollars,” McCoy said.

“We may not have had as much M&A or fundings over the last two years, but…we've built a tremendous amount of value in this industry. And when you see more consumers spending more money in wellness, investment in M&A and other dollars eventually catch up and that's what's going to happen. CPG investors right now are sitting on a very large pool of illiquid but very attractive assets. There's a lot of viable brands that are growing faster than basically the broader market... Interest rates are starting to stabilize. We're seeing more fund closings and more investors getting more liquid money and the amount of illiquid value locked up is going up.”

According to McCoy, it’s not just the “big strategics" buying natural food brands. The natural products industry itself is seeing companies growing large enough to potentially become buyers themselves. “We’re seeing lots of talk about the IPO market starting again. Before 2021, I could probably count on one hand the number of brands that IPO’d in this industry. Now it sounds like it’s going to come back,” McCoy shared.

“There’re a lot of different ways that people get to liquidity,” McCoy added. “And once it does get liquid, then basically the money will flow from the bigger funds to the smaller funds, and the longer it takes, the more money these individual investors are going to get — surprising amounts. They thought they were going to get five times their money or 10 times their money investing in the company in 2015, and now it's grown so large they get 50X when it sells. And that's a true case of some that recently sold.”

According to McCoy, the $100-$300 million in revenue independent natural CPG brands — a group showing “tremendous growth” — represent major M&A and consolidation opportunity. “If we look at some of these recent high-profile deals, two, two and a half, three times revenue are where some of these things are trading. So, if we apply a two and a half times revenue multiple using SPINS sell-through data, you can see that this kind of locked up illiquid value that was $13 billion two years ago is up to $19 billion now. And when you think about a number like that, when that money starts to go back to investors, if you're an investor and you put $25,000 into a company expecting to get $250,000 and suddenly you get $1.5 million, you're going to be investing a lot more than $25,000 into other companies and that's going to bring the liquidity back over these next few years. It's really exciting to me.”

Resources

● The State of Natural & Organic — Keynote Presentation recorded at Natural Products Expo West 2025; watch here.

● Nutrition Capital Network — With news, resources, and events, NCN brings together active investors and innovative companies in health, nutrition and wellness,, www.nutritioncapital.com

● Whipstitch Capital — A leading investment bank tracking the food & beverage and health & wellness space, www.whipstitchcapital.com

● Big Path Capital — A leading investment bank and annual conference for impact investing and “Impact CEOs,” www.bigpathcapital.com

● MAD Capital — An investment fund for regenerative and organic ranchers and farmers, www.madcapital.com

● Regenerative Food Systems Investment Forum — An investor’s organization seeking to build a more resilient food system, www.rfsi-forum.com

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, regenerative and sustainable products businesses. Contact steve@compassnaturalmarketing.com.

U.S. Organic Product Sales Near $70B; All-Organic Trade Show Set for 2025

By Steven Hoffman

Is it true that the growth rate in sales of certified organic bananas is now outpacing that of conventional bananas? According to the Organic Trade Association (OTA), the answer is yes.

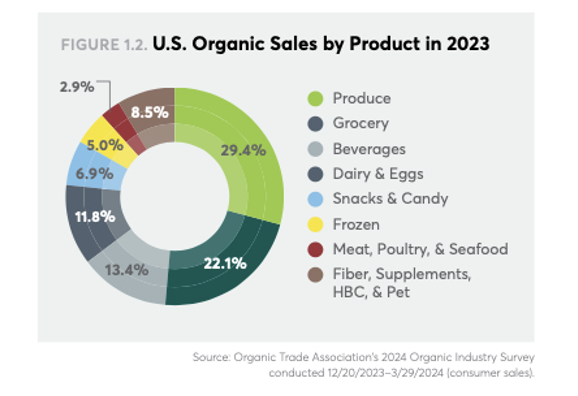

In fact, among an ever-expanding sea of certification seals in the retail sector, and despite inflation, the “Certified Organic” label continues to stand out for consumers who prioritize health, sustainability and clean-label products. So much so that U.S. sales of certified organic products grew 3.4% in 2023 to $69.7 billion, marking a new record for sales in the organic products industry.

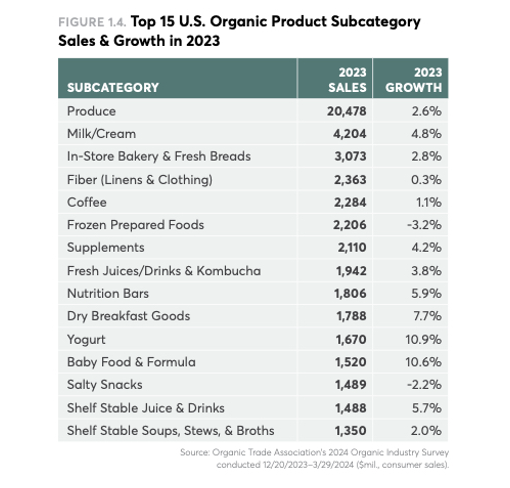

According to the OTA, which conducted the 2024 Organic Industry Survey in collaboration with Nutrition Business Journal, organic food sales in 2023 totaled $63.8 billion, and sales of organic non-food products reached $5.9 billion, with organic personal care products reporting the strongest increase in that category, with growth of 7% in 2023.

On the food side, fresh organic produce continues to dominate as the primary entry point for consumers, who are increasingly knowledgeable about the “Dirty Dozen” — those fruits and vegetables the Environmental Working Group has determined to contain the most synthetic pesticide residues. In 2023, sales of organic produce grew 2.6% to $20.5 billion. Top sellers included avocados, berries, apples, carrots and packaged salads. OTA also noted that, indeed, in 2023, organic bananas recorded greater sales growth than non-organic bananas.

Organic Baby Food Drives Growth in Grocery

The second biggest selling category in the organic sector in 2023 was grocery, comprising breads and grains, condiments, and packaged and prepared foods. Among a diverse group of sub-categories in grocery, three stood out as top performers: in-store bakery and fresh breads, with sales of $3.1 billion and growth of 3%; dry breakfast products, which were up 8% to $1.8 billion in sales; and organic baby food and formula, up an impressive 11% to record $1.5 billion in sales in 2023.

According to the OTA survey, 2023 also saw a surge in functional and non-alcoholic beverages, which helped drive beverages as the third largest category in organics, posting growth of 3.9% and sales of $9.4 billion. In addition to the emergence of organic “mocktails,” organic wine sales were up 2.5% to $377 million, and organic liquor and cocktails showed strength as an emerging category with growth of 13% and sales of $59 million in 2023.

Organic dairy and eggs, the fourth-largest category in the organic food market, based on OTA’s survey, is another entry point for consumers who want clean, ethical sources of protein with lower environmental impacts. In 2023, organic dairy and egg sales were up 5.5%, totaling $8.2 billion. According to OTA, organic dairy and eggs now account for more than 8% of all dairy and egg sales. Milk and cream sales were up nearly 5% to $4.2 billion. Also, the organic dairy alternative category grew almost 14% in 2023 to approximately $700 million.

Leading among organic non-food items were organic supplements, tracking 4% growth and sales of $2.1 billion in 2023. Organic fiber remains the largest segment of U.S. organic non-food product sales, representing 40%, or $2.4 billion, of non-food category sales. According to OTA, growth in organic fiber sales was essentially flat year over year, due to restricted supply chain issues more than lack of buyer interest.

Price Gap Is Narrowing Between Conventional and Organic

According to OTA Co-CEOs Matthew Dillon and Tom Chapman, the increase in overall dollar sales in the organic market in 2023 was driven more by price increases than unit sales as the organic industry recalibrated its supply chain and dealt with retail price increases as necessary. However, they pointed out, consumers increased their purchases of many organic products, and unit sales were up for nearly 40% of the products tracked in this year’s survey.

In addition, the survey indicated that prices for many non-organic products climbed at a faster rate than organic products, meaning that the price gap is narrowing between conventional and organic, which, says OTA, should fuel growth for organic products in the coming year.

“It is encouraging to see that organic is growing at basically the same rate as the total market. In the face of inflation and considering organic is already seen as a premium category, the current growth shows that consumers continue to choose organic amidst economic challenges and price increases. Although organic is now a maturing sector in the marketplace, we still have plenty of room to grow,” said Tom Chapman.

Matthew Dillon added that to achieve this growth, “It is essential to educate consumers that choosing organic is a straightforward way to tackle some of the greatest challenges we face. Whether it's accessing healthy foods, improving transparency in supply chains, mitigating climate change, supporting rural economic resilience, protecting natural resources, or realizing the multitude of other benefits, effectively communicating and delivering on these promises is the key to expanding organic’s share of our dinner plate.”

The future for organic is not without its challenges. However, Chapman and Dillon assert that more consumers are aware of the potential health benefits associated with organic foods. Many consumers, too, especially the Millennial and Gen Z generations, they point out, are increasingly conscious of the ethical implications of their food choices. They are looking for products that align with their values, such as animal welfare, fair trade, and support for organic farmers. That means seeking out products with the USDA certified organic seal on the label.

OTA Members can download the full report here. A summary is available here.

Dedicated All-Organic U.S. Trade Show Announced

Since 1991, people from all over the world have attended, BioFach, the world’s only dedicated, all-organic trade show, held each year in Nuremberg, Germany. Now, targeting the world’s largest market for organic products, the producer of BioFach has announced it will host its first standalone, all-organic trade show in the U.S.

Dubbed BioFach America, the event will take place on June 2-4, 2025, in Atlanta.

“With BioFach America, we will host a purely organic trade show in the US. The whole organic value chain will be covered: from organic farming to retail,” said NürnbergMesse, producer of the event. According to the producer, every product presented at BioFach America must be USDA certified organic or carry an organic certification from an IFOAM Organics International accredited organization. For cosmetics, certifications such as COSMOS or Ecocert, are accepted.

In an interview with Organic Insider, Bill Ingwersen, CEO of NürnbergMesse North America, said, “BioFach America always had a presence, or section, at Natural Products Expo East, and last year in Philadelphia, we brought in 47 companies from around the world. With that show being canceled, it forced us to really ask the question: are people getting what they need at other shows or is there a true need for an organic one? We concluded that there was, in fact, a real need for a dedicated, all-organic platform in the U.S.”

When asked why Atlanta was chosen as the location for the inaugural event, Ingwersen told Organic Insider, “Since this is a U.S. show and not a regional one, people will have to travel, regardless of which city we chose. After many conversations with industry executives, it became clear that we had to make it an affordable show for everyone, including farmers. Atlanta has the world’s largest airport, has an ample supply of low-cost hotel rooms and is a very energetic, accessible city that has great infrastructure. In addition, it can support our growth as we move forward. Also, being able to serve an organic lunch to our attendees was a real hot button topic. All the catering coming out of the Atlanta Convention Center will be organic for the show, and if a city could not guarantee this, that was an immediate disqualification.”

Learn more about BioFach America here.

Cracking Down on Fraud: USDA Organic Enforcement Rules Take Full Effect in March 2024

This article first appeared in Presence Marketing’s September 2023 newsletter.

By Steven Hoffman

Organic food is big business in the U.S. – sales of organic products topped $61 billion in 2022 – and the certified organic label fetches a premium price for producers. So much so that fraud from both domestic and imported sources had become a major concern among organic industry business owners, investors and advocates.

That’s why such leading organizations as the Organic Trade Association (OTA) and others applauded the U.S. Department of Agriculture (USDA) when, earlier this year, the agency announced the Strengthening Organic Enforcement (SOE) final rule, which is set to be fully implemented and enforced in March 2024.

Representing the biggest change to organic regulations since the passage of the Organic Food Production Act in 1990, the SOE Rule was created to crack down on organic fraud. The new rule provides “a significant increase in oversight and enforcement authority to reinforce the trust of consumers, farmers, and those transitioning to organic production. This success is another demonstration that USDA fully stands behind the organic brand,” Jenny Lester Moffitt, USDA Under Secretary for Marketing and Regulatory Programs, said in a statement.

“The rule closes gaps in current organic regulations and builds consistent certification practices to prevent fraud and improve the transparency and traceability of organic products. Fraud in the organic system – wherever it occurs – harms the entire organic sector and shakes the trust of consumers in organic. This regulation will have significant and far-reaching impacts on the organic sector and will do much to deter and detect organic fraud and protect organic integrity throughout the supply chain,” OTA said in support of the new rule.

Liz Figueredo, quality and regulatory director at organic certifier Quality Assurance International (QAI), based in San Diego, California, told Nutritional Outlook in July 2023 that the new SOE Rule closes supply chain loopholes that existed in previous regulations. The new rule requires organic certification for all parts of the supply chain, including handlers and suppliers who were previously exempt, she said.

“This means that certifiers can no longer depend on documentation from uncertified handlers, which was often lacking, to verify the organic status of products. The rule also includes fraud-reduction techniques, such as requiring an Import Certificate for any organic ingredients or products imported into the U.S., which provides the total volume or weight of the imported products,” Figueredo said.

Who Is Affected by the New SOE Rule?

According to USDA, the SOE Rule may affect USDA-accredited certifying agencies; organic inspectors; certified organic operations; handlers of organic products; operations considering organic certification; businesses that import or trade organic products; retailers that sell organic products; and organic supply chain participants who are not currently certified organic.

Exemptions are limited to a few low-risk activities such as very small operations; certain retail establishments that do not process; storage and warehouse facilities that only handle products in sealed, tamper-proof containers or packages; distributors that only handle final retail-packaged products; and customs and logistics brokers that do not take ownership or physical possession of organic products.

However, exempt operations must still follow all other applicable portions of organic regulations, including co-mingling and contamination prevention, labeling requirements and record keeping. Transporters that only move organic products between certified operations, or transload between modes of transportation, do not need to be individually certified, but are the responsibility of the certified operation that loads or receives the product.

To see if your business is affected and for more information, visit the full text of USDA’s SOE Rule in the Federal Register. OTA, too, has a resource page with extensive information regarding preparing for full compliance with the SOE Rule, along with exclusive training materials for association members. OTA also offers a questionnaire for businesses that may not be sure if they need certification.

What Does the SOE Rule Do?

According to USDA, “SOE protects organic integrity and bolsters farmer and consumer confidence in the USDA organic seal by supporting strong organic control systems, improving farm to market traceability, increasing import oversight authority, and providing robust enforcement of the organic regulations.”

Key updates include:

Requiring certification of more of the businesses, like brokers and traders, at critical links in organic supply chains.

Requiring NOP Import Certificates for all organic imports.

Requiring organic identification on non-retail containers.

Increasing authority for more rigorous on-site inspections of certified operations.

Requiring uniform qualification and training standards for organic inspectors and certifying agent personnel.

Requires standardized certificates of organic operation.

Requires additional and more frequent reporting of data on certified operations.

Creates authority for more robust recordkeeping, traceability practices, and fraud prevention procedures.

Specify certification requirements for producer groups.

“SOE complements and supports the many actions that USDA takes to protect the organic label, including the registration of the USDA organic seal trademark with the USPTO. The registered trademark provides authority to deter uncertified entities from falsely using the seal, which together with this new rule provides additional layers of protection to the USDA organic seal,” USDA said.

For producers wanting to learn more about navigating and adhering to these new requirements, the Western Growers Association in partnership with the Organic Produce Network will host a session at its upcoming Organic Grower Summit, Nov. 29-30, 2023, in Monterey, California, entitled “The SOE Deadline Looms–Are You Ready?” The seminar is designed to help growers better understand the upcoming rule changes, which will affect producers, distributors, handlers and importers.

In addition, organic industry and policy veterans Gwendolyn Wyard and Kim Dietz recently founded Strengthening Organic Systems, an advisory firm focused on helping businesses with organic fraud prevention, supply chain investigations and compliance with USDA’s organic anti-fraud regulations.

Read More

How Will USDA’s Organic Regulation Changes Affect the Food and Nutraceutical Industries? – Nutritional Outlook

USDA Launches Organic Integrity Database Module – Organic Insider

Tighter Rules Now in Effect for USDA Organic Seal of Approval – Cosmetics and Toiletries News

Strengthening Organic Enforcement USDA Rule – California Certified Organic Farmers

USDA Bolsters Consumer Confidence in Certified Organic Products with New Enforcement Rule – New Hope Network

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Organic Trade Association to Host Webinar Series on Key Issues in Organic

Photo: Pexels

Originally Appeared in Presence Marketing News, September 2019

By Steven Hoffman

The Organic Trade Association (OTA) will host a series offered free to OTA members and for a registration fee of $149 each for non-members. The webinars, scheduled between now and the end of the year, will focus on a number of issues impacting the organic products market, including: Retail Intel: Best Labeling Practices for Organic Non-food Products; Organic Fraud Prevention Solutions; NOSB Meeting Wrap-up; and Legislative Watch: A Recap of 2019 Achievements. In addition, The Organic Center will host a webinar on September 25 that is open to all with no fee. The Organic Center webinar will focus on The Biodiversity Calculator: A Simple Tool for Tracking and Managing Biodiversity for NOP Compliance. For more information visit https://ota.com/programs-events/upcoming-webinars.