Survey Says: Research Shows Natural, Organic Channel Saw Steady Growth in 2021

This article originally appeared in Presence Marketing’s July 2022 Industry Newsletter.

By Steven Hoffman

Starting out in the natural and organic products industry in the mid 1980s as an associate editor with media and trade show company New Hope Network, there were a few long after-hours sessions spent each summer pouring over completed paper surveys sent in by retailers, and compiling data with company founder Doug Greene to analyze and publish what has since become a milestone marker for the industry, the Natural Foods Merchandiser’s Annual Market Overview Survey.

Photo Credit: Organic Trade Association

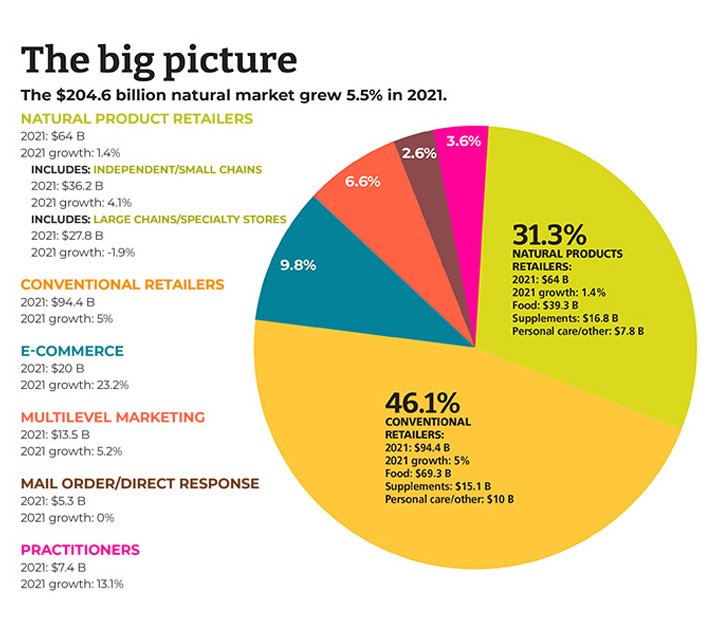

Today, the survey has become much more sophisticated, and so has the market, which has grown 10X since that time to reach $204.6 billion, representing an overall growth rate of 5.5% in 2021, according to this year’s report, published in June 2022.

Once dominated by independent natural products retailers, according to this year’s survey, conventional retailers now command 46.1% of natural products sales, representing growth of 5% in 2021. Combined, independent and large-chain natural products retailers comprised a market share of 31.3% in 2021. However, while independent natural products retailers recorded growth of 4.1%, the large chain and specialty store format saw sales decline by 1.9% in 2021.

Overall, conventional grocers reported natural products sales of $94.4 billion in 2021. Sales were $64 billion among natural products retailers in 2021, comprising independents, small chains and large chain/specialty stores. New Hope estimates there were 21,613 independent and large chain natural channel retail stores in the U.S. in 2021.

Of note, e-commerce sales of natural products continues to grab market share, charting growth of 23.2% in 2021. That’s not surprising, say industry observers, considering consumers were still spending considerable time at home in 2021 during the pandemic. Now, as the world emerges, some of those online consumer shopping behaviors may stick, according to Nutrition Business Journal’s 2022 Supplement Business Report, particularly when it comes to dietary supplement sales. According to NBJ, the supplement industry recorded $59.9 billion in sales in 2021, up from just $43.2 billion five years ago. E-commerce claimed the biggest share of post-pandemic dietary supplements sales growth, reported Rick Polito in the Natural Products Industry Health Monitor.

Photo Credit: Natural Foods Merchandiser 2022 Market Overview Survey, New Hope Network

Across all sales channels, e-commerce “is leading a huge shift in channel dynamics,” according to NBJ Senior Industry Analyst Claire Martin Reynolds. Based on a growth trajectory that is expected to add another $10 billion in dietary supplement sales over the next four years, “2024 is expected to be the record year where e-commerce market share in supplement sales is larger than natural and specialty or mass market retail, coming sooner than previously forecasted given the pandemic-related acceleration,” NBJ reported.

New Hope’s overview also revealed some interesting data regarding the demographic makeup of natural products shoppers.

While a common assumption is that natural channel shoppers are mostly white, well-off moms, that perception is inaccurate, said New Hope’s editors. “In fact, shoppers are fairly evenly divided along gender lines; fewer than half are Caucasian; about 40% are affluent; and more than a third live in households with just two people. Additionally, more than a quarter of natural channel shoppers are Hispanic and more than a third of Asian consumers are significantly more likely to shop at natural grocery stores; 36% of consumers who represent communities of color agree that products at natural retailers were, ‘made with me in mind’ (compared to 32% of all retail customers combined); and Hispanic and Asian consumers specifically are more likely than all natural retail shoppers to agree that they are ‘willing to pay a premium for natural and organic foods and products’ (44% vs. 36%),” New Hope’s researchers reported.

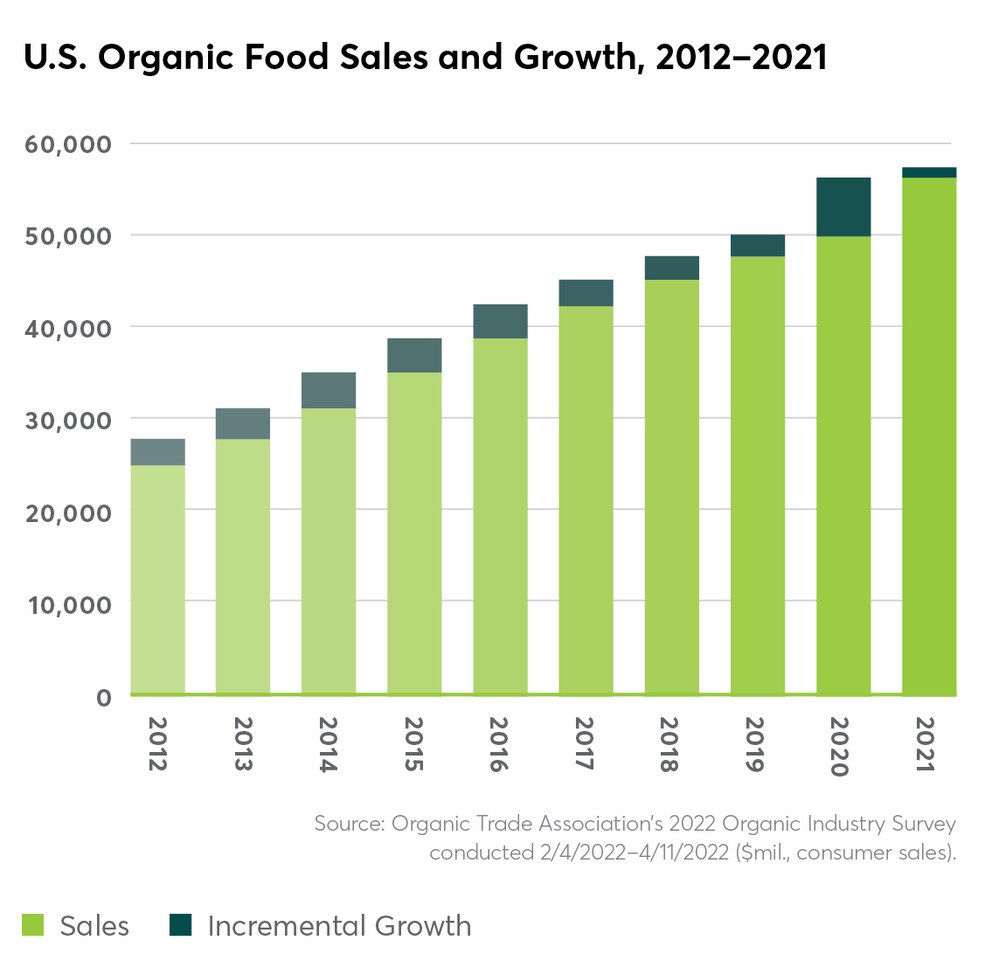

In related news, in its annual Organic Industry Survey, published in June 2022, the Organic Trade Association reported that between 2020 and 2021, sales of organic products surpassed $63 billion, growing 2% during that time period. Food sales, which comprises over 90% of all organic sales, rose 2% to $57.5 billion, and sales of nonfood organic products grew 7% to reach $6 billion in sales.

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA’s CEO and Executive Director Tom Chapman, “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Among the strong performers in organic: organic beverages experienced the highest growth (8%) of all major categories, with organic coffee topping 5% growth and $2 billion in annual sales. Organic produce accounted for 15% of the organic products market, bringing in $21 billion in revenue in 2021, a 4.5% increase over 2020. Fresh produce drove growth in that category, at 6%.

While a decline in packaged and prepared organic food sales in 2021 represents a shift away from the pantry loading of 2020, organic baby foods — traditionally a strong entry point for shoppers new to organic — was a bright spot in 2021 with 11% growth. Organic snack foods, which suffered a decline in 2020, saw healthy growth of 6% in 2021, reflecting a return to active lifestyles and demand for healthy, nutritious on-the-go foods.

Among non-food organic products, fiber, supplements and personal care products were the most dominant performers with growth rates of between 5.5% and 8.5% in 2021, said OTA. Textiles, the largest non-food sub-category, represented 40% of the category’s total sales and brought in $2.3 billion in annual sales. Overall, non-food products saw 6% growth in 2021 and represented nearly $6 billion in sales, OTA reported.

However, industry observers caution that the unprecedented inflation the country is experiencing this year could affect sales of typically higher priced organic products as price-sensitive consumers opt for purchasing conventional foods to save money, according to a recent report in the Organic Produce Network. According to an Economist/YouGov poll taken in June 2022, 69% of Americans say changes in the inflation rate have impacted them negatively. In a June 2022 survey conducted by market research firm The Feedback Group, 24% of consumers are substituting similar, less expensive foods and 12% said they are buying fewer organic items and products to cut costs.

“Organic’s ability to retain the market footholds gained during 2020 and continue to grow despite unprecedented challenges and uncertainty is a testament to the strength of our industry and our products. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritizing efforts to engage and educate organic shoppers and businesses,” said OTA’s Tom Chapman.

How Erewhon Has Become the Stamp of Approval for CPG Startups

Photo: Pexels

This article originally appeared in Presence Marketing’s February 2022 Industry Newsletter

By Steve Hoffman

Founded in 1966 in Boston, MA by Michio and Aveline Kushi, Japanese immigrants and pioneers of the macrobiotic movement, Erewhon Market eventually made its way out west and has been expanding in the Los Angeles area under its current owners, husband and wife team Tony and Josephine Antoci, who took over the business in 2011.

Since then, the retailer has expanded to seven stores. It received investment capital in 2019 from New York-based Stripes Group, and the stores have become known as the trendy place to shop for natural and organic products, and to hang out. A fanbase of young consumers, health and wellness influencers and Hollywood celebrities from Gwyneth Paltrow to members of the Kardashian-Jenner family have been seen shopping at Erewhon.

As a result of its growing popularity and accessibility, young food and beverage brands are flocking to Erewhon in hopes of being discovered. “It’s a good-sized grocery chain to supply without being overwhelmed, Mayssa Chehata, founder and CEO of Behave candy told Modern Retail.

Jennifer Ross, co-founder of beverage brand Swoon told Modern Retailer that Erewhon was the company’s “retail north star.” As a smaller CPG brand, Ross said it can be hard to work with big retailers like Whole Foods and Sprouts from the very beginning because of capacity constraints. “With Erewhon, you can literally FedEx them small batches of inventory,” she said.

DTC and CPG brand consultant Kendall Dickieson told Modern Retailer that for emerging companies, it can take years to get on Erewhon’s shelves. But it can be worth it, she noted. “And if it’s your first location, it usually paves the way for the rest of your wholesale trajectory,” she said. “As someone who’s always looking for new trends, Erewhon is the holy land,” Dickieson added. “If you’re on the shelf, it means you’ve been vetted by the top of the top when it comes to health grocers.”

Erewhon’s status as a health food discovery hub has been a source of free promo for brands among not only consumers and influencers, but other retail buyers. “It’s got a trickle-down effect among other buyers and brand influencers,” said Chehata of Behave. She said the brand saw a big uptick in organic customer and influencer posts during its first week on Erewhon’s shelves. In addition, Chehata credited the brand’s presence in Erewhon in securing other partnerships. “I can’t say we got further interest solely because of Erewhon,” she told Modern Retailer. “But every buyer conversation since has had a sense of the ‘Erewhon stamp of approval.’”

FMI Survey: 80% of Food Retailers Say Hiring Issues Are Hurting Business

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Eighteen months into the COVID-19 pandemic, 80% of food retailers surveyed by the Food Marketing Institute (FMI) said difficulties attracting and retaining employees is having a negative impact on their businesses. In its report released Sept. 15, 2021, The Food Retailing Industry Speaks 2021, 42% of retailers surveyed also indicated that supply chain disruptions continue to hurt their businesses. These constraints are happening at the same time that consumer demand for groceries increased 50% in the last year, resulting in unprecedented 15.8% growth in same-store sales, said FMI.

FMI’s 2021 survey represents over 38,000 food retail stores. The survey also found that 95% of food retailers with e-commerce options experienced an increase in online sales in 2020 as a result of changes in consumer behaviors related to the pandemic.

“The pandemic transformed almost every aspect of the food retail industry – from the way consumers shop for groceries and consume their meals to how food is grown, produced and transported to supermarket shelves, to our ability to staff our stores and serve our communities,” said Leslie Sarasin, President and CEO of FMI. “Throughout the past year and a half, the food retail industry has been adapting to meet the shifting needs of the communities they serve. This year’s ‘Speaks’ report outlines the resilience and transformation of the food retail industry amid the COVID-19 pandemic and examines the proactive strategies and investments retailers have made to adapt to the changing food retail landscape.”

“Frontline workers have been lauded as heroes in the face of the pandemic, but recruitment and retention became growing challenges as turnover rose sharply. Retailers have pursued many strategies to resolve these challenges, including increased wages and benefits, flextime and training/skills development”, FMI outlined in a 10 Key Takeaways summary excerpted from the retail report.

Regarding supply chain challenges, FMI said, “Perhaps more than ever before, supply chain is front and center in food retail. Pandemic shortages have led retailers to reassess their supply chains and their engagement strategies with trading partners. Trucking and transportation capacity represents one of the biggest hot-button issues, with some two-thirds of responding retailers saying it is having a negative impact on their businesses.”

Market Overview: Pandemic Boosts Natural Products Sales 12.6% in 2020

Photo: Natural Foods Merchandiser, New Hope Network

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

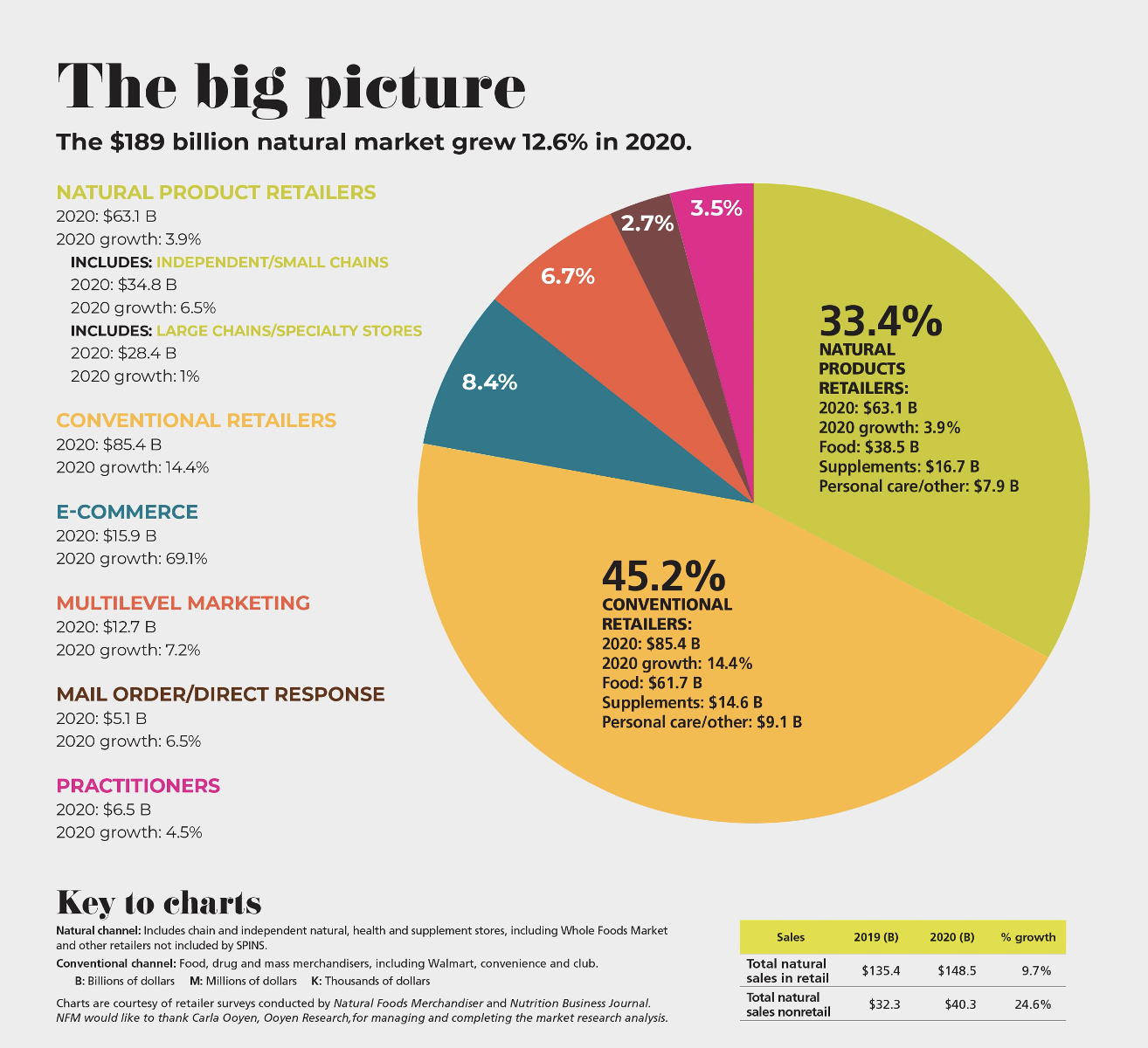

Many of the changes independent natural foods retailers adopted during the pandemic, such as digital ordering, curbside pickup, click-and-collect capabilities, traffic flow changes and more, may better help them compete going forward, writes Mark Hamstra in New Hope Network’s 2021 Market Overview Survey. And while natural foods retailers, like retailers everywhere, saw a decline in traffic, the uptick in basket size more than made up for it.

The average sales gain in 2020 among independent retailers surveyed was 6.5%, compared to 1% growth for large natural products chains. In particular, conventional retailers experienced 14.4% sales growth in 2020, and online retailers saw a whopping 69.1% sales growth in 2020. Of note, sales of natural products among health practitioners grew 4.5% in 2020.

Overall, the natural products market, estimated at $189 billion, grew 12.6% in 2020. Product categories leading the growth included meat, fish and poultry, condiments, dairy, fruit and vegetables, breads and grains, packaged/prepared foods and vitamins.

Natural Products Leaders Share their Outlook for 2021

Photo: Pixabay

This article originally appeared in Presence Marketing's January Newsletter and New Hope Network's IdeaXchange

By Steven Hoffman

If hindsight is 2020, then it’s anybody’s guess what 2021 will bring. And yet, that’s exactly what we asked these natural and organic products business leaders. Because if we can’t learn anything from the tsunami of the year that was 2020, then what’s it all for, one might ask? Read on to help prepare for a coming year of challenge and opportunity.

The Natural Industry is Primed to Serve – Russ Forester, SVP, Analytics and Insights, Hain Celestial Group

Russ Forester is an 18-year veteran at the Hain Celestial Group where, as SVP of Analytics and Insights, he provides category management expertise and consumer insights to help drive the company’s growth strategy. The publicly held company, with more than $2 billion in annual sales, owns a number of leading natural and organic brands, and has benefitted from the pandemic-driven shift to at-home eating and the consumer’s renewed focus on health and wellness.

“This past year, we’ve seen a shift to e-commerce, but where we’re really seeing the growth is not in ship-to-home from UPS or FedEx, for example. It’s coming from ordering from local grocers; sales are shifting 10-15% to this model, whether it’s curbside pickup or Instacart-style delivery, even to the point where certain retailers’ in-store sales may be down, but when you add in the online ordering channels, the overall sales are growing,” Forester observed.

“To paraphrase the CEO of Instacart, what we thought would take five years of adoption rates happened in five weeks. The pandemic, while creating a financial crisis, is driven by health concerns, and our industry is primed to serve that. Food is medicine, and products with a functional or immunity benefit, such as the wellness tea category, are doing very well,” he said.

Forester noted that premium brands are doing well across all income levels. “People are not traveling or dining out as much, so they are treating themselves to premium food at home. For those who are doing well, they’ve got more disposable income. We’re also seeing lower income shoppers are increasing their dollars in premium products. People are trying to find new ways to keep their families fed and healthy,” he added.

For smaller brands, the pandemic has created greater challenges for product discovery. “How do you use marketing tools today to create trials?” Forester asks. “Traditional methods of trade and promotions may not be as impactful, making it harder to break out. It may be best to reach consumers through digital outreach,” he advises.

“Our industry has always looked to the health and wellness of consumers and the planet. The pandemic has brought health and immunity to the forefront, and it’s mainstreaming the natural and organic industry more than ever before…in a good way,” Forester said.

Back to the Future – Steve Hughes, Co-founder and CEO, Sunrise Strategic Partners

As Co-founder and CEO of Sunrise Strategic Partners, Steve Hughes guides investments in such leading healthy lifestyles brands as Vital Farms, Maple Hill Organic, Coolhaus Ice Cream, Kodiak Cakes, Little Secrets, Teton Waters Ranch, Pact, Kill Cliff and Califlor. The unprecedented pandemic has created a portfolio-wide inflection point for the company. “We sell eggs, milk, pancake mixes, comfortable clothing you buy online…we’ve seen some extraordinary acceleration in our portfolio – from growth of 50% over the past three years, the Covid-19 pandemic has added about 20 points of growth this past year,” Hughes said. “People are going back to the future, and that will have stickiness; our better-for-you brands in three months got 18 months-worth of trial,” he said.

“For many big-box retailers right now, it’s about in-stock, not innovation,” Hughes quipped. “We’re seeing cutbacks so they can spread out on the essentials. That will be a headwind for emerging brands in 2021,” he observed.

“With that said, the real game changer for the future is what’s happening with direct to consumer (D2C) sales. D2C gives the consumer the option to buy not just what they want, but also what they may have never heard about. It’s going to be triple or quadruple what the growth was last year,” Hughes predicted.

“It’s going to be harder for a brand to break into natural products retail the old-fashioned way in the next 12-18 months. However, the next generation of brands is more likely to happen online, and when they get to be $10-20 million online businesses, then they can go to Whole Foods Market or other grocers and say we have so many people buying in your respective markets. It’s a whole new innovation model,” Hughes said. “Brick and mortar used to be the channel that led. Now, people will order online, and brick and mortar will follow.”

People Remember How They Were Treated – Gabe Nabors, CEO, Mustard Seed Market

“People are going to remember how they were treated in these times,” said Gabe Nabors, CEO of the two-store independent, family-owned natural products retailer Mustard Seed Market in Akron, OH. “It could be the simplest thing of talking with someone or thanking people. At the end of the day, it’s about being transparent with your staff and customers.”

Mustard Seed has had to continually pivot to serve its community while responding to the pandemic and safety and public health demands. Known for outstanding foodservice offerings, the retailer temporarily closed its restaurant when the county heightened safety restrictions, and converted the salad bar to a grab and go bakery set in its downtown location when nearby offices closed and lunch business dropped off.

The independent retailer also has had to contend with a lack of consistent product availability, Nabors shared. “We were getting an insane amount of out of stocks, so we reset aisles based on what’s selling well and what’s available. Out of stock items are still a problem, but we’ve mitigated it by changing up the sets and finding comparable products – and by communicating constantly with our partners. I would say communications with manufacturers and distributors are at an all-time high right now. And what worked last month doesn’t mean it will work next month – you have to monitor your own in-store trends faster than you ever had to before,” Nabors said.

Not one to stand still, Mustard Seed recently launched MustardSeedWellness.com to expand its ecommerce presence, plus plans are in the works to remodel its flagship store. “The focus will be on fresh new floors, redesigned prepared foods areas to allow for more grab and go, and an expanded meat department. We’re investing in some store improvements in 2021,” Nabors added.

Building Resilience on the Shelves – John Raiche, EVP, Supplier Services, UNFI

“Coming out of Thanksgiving week, consumers saw the grocery shelves were much more resilient than earlier in the year when the pandemic hit,” noted John Raiche, Executive Vice President of Supplier Services at leading natural products distributor UNFI.

“Consumers have maintained pantry loads since the early days, so that may be a reason why the effect is more subdued. However, when consumers see a fully stocked shelf, they feel better than if they see empty shelf space, which may prompt them to panic buy. Going into 2021, we are seeing suppliers doing a much better job of meeting elevated in-home consumer demand,” Raiche observed. “Beyond that, the critical questions for our retailers will be what happens when in-home demand returns to more normal levels.”

Raiche, who shared he is responsible at UNFI for “looking at all the what ifs,” noted that everyone – suppliers, distributors and retailers – is working at elevated levels, allowing much less room for day-to-day hiccoughs, such as weather and delays. He shared his concern that worker health could impact supplier production. “Manufacturers are doing everything they can, but if community spread of Covid-19 is widespread, they can’t control what happens outside their walls,” he said.

To better prepare, UNFI has altered its targeted safety stocks, bolstered inventory and is in close communication with its suppliers, Raiche said. “We stand ready at a moment’s notice to pivot and give suppliers the ability to deliver product. We host cross-functional team meetings focused on service level and how can we solve today’s challenge. Also, we are personally giving presentations to our retail customers to share what we’re seeing and projecting in the next week, month, six months, etc., so our customers understand what we’re seeing in the moment.”

Raiche predicts that demand will steady and service levels will continue to improve. “This week and last week have been the best service levels from suppliers we’ve seen since March – that’s a good sign. The good news for our country is that the vaccines are rolling out, but we don’t see it as a light switch. There is going to be a lengthy transition, and the increased level of in-home demand will last well into 2021,” Raiche predicted. “In the long run, if more consumers get comfortable with cooking from home, that’s great for our industry.”

Changing Food Consciousness – Tracy Miedema, VP of Innovation and Brand Development, Presence Marketing

“Even though we’re still in the midst of the pandemic, we know now that healthy food is critical to our health and wellness going forward,” said Tracy Miedema, VP of Innovation and Brand Development at leading independent natural products brokerage Presence Marketing.

Speaking of the huge spikes in absolute dollar growth of such mature categories as produce, baked goods, meat and dairy (plant-based meat and dairy alternatives, too, enjoyed unprecedented growth in 2020), “It’s hard to overstate how massive these changes are – the taxing and pushing of the food system. But the system has been able to adjust, shift volume from other places and produce this much more. The feat involved to flex and adjust our grocery system at this scale to adapt to the pandemic should leave us all in a state of awe,” Miedema said.

“How people think about groceries has radically changed since the pre-pandemic days when 50% of our food dollars were spent away from home. People have plowed that money into grocery shopping, and it has changed their minds about what food is worth. To me, that’s more than a little bit of upside – it points the way toward a growing consciousness of food that is vital,” she said.

“In the past, food was dominated by a small number of conglomerates and we were forced to eat middling food with simple carbs and processed oils. However, there’s been a massive fragmentation in food types and brands that’s been part of a 20-year trajectory. That fragmentation has led to the creation of nutritionally dense foods with features and benefits tailored to the consumer. Some of these upstart brand are less resilient and are being severely challenged during the pandemic. They should take heart that long-term wellness trends are on their side.”

Miedema also said that smaller and emerging brands that can learn to navigate change – and that can adapt to become “digitally native brands” may find new ways to succeed. “If you’re a small brand, you’re hoping that the right person finds you on the shelf, but if you’re also online, that person is searching for you. It can flip the ‘foot traffic’ in your favor,” she advised.

View from a SuperNatural – Anonymous, from a Major Natural Retail Chain

“The tough thing about 2021 is that the first six to eight months are going to look very similar to 2020,” said a senior executive with a prominent natural products retail chain who asked not to be named. “The at-home trends are going to last, at least for that time, and the categories that went gangbusters are still doing well. Given that the next two to three months are going to be among the most challenging days of the pandemic, I don’t know if we’ll see the rush buying of the past, but retailers will see a solid January and February,” the individual said.

“However, the supply chain is still damaged, especially in paper and cleaning products,” the individual noted. Major cleaning products companies including Clorox, Seventh Generation and others have advised retailers and distributors that they may not see supply chain recovery until mid to late 2021. “The problem is compounded when a lot of these products are required for front-line healthcare needs,” the individual observed.

Also, of concern is an aluminum can shortage that will be an issue throughout 2021, the senior manager noted. “The reason being that for the last five years, the soda business has been declining and all the domestic can producers moved their production offshore. Right now, these companies are building out new plants in the U.S. to fulfill increased demand, but they will not be on line until late 2021 or 2022,” the individual projected.

“All of grocery is in a better spot today because we’ve been dealing with these elevated levels for so long, but it’s still a fragile ecosystem. Grocery stores were not designed to accommodate people eating 90% of their meals at home,” the individual said. “We are definitely trying to figure out how we can change the look of the stores to cater to the categories that are doing so well, such as baked goods, frozen foods, ethnic foods, spices and more. We’ve been going through this long enough that there will be muscle memory as we evolve. While we may know in 2021 what’s coming, 2022, however, is wide open in terms of how we emerge in the new normal.”

Serving Changing Distribution Needs – Jeremy Adams, Director of Category Management, KeHE Distributors

“As a distributor our goal is to service retailers and suppliers. Even with unprecedented demand, we were able to stabilize service levels in the summer and fall. As our industry spiked in demand, we were able to develop partnerships with food service distributors. As our demand increased and theirs declined, those partnerships to help with transport were key in helping us meet demand,” said Jeremy Adams, Director of Category Management for KeHE Distributors.

“Also, as we got more into the quarantine phase we witnessed the emergence of the home chef and home baristas. With restaurants and travel shut down, the only indulgence was things people could prepare at home. As such, we saw a huge spike in high-end foods, international cuisine, spices, premium coffee and more,” Adams said.

With a heightened winter demand for soup and broth and other pantry basics, Adams noted that suppliers are doing everything they can to catch up with demand. “Some were able to ramp up, depending on how they source, if they manufacture themselves, or work with a co-packer,” he said. Also, while interest in home cooking has grown, “there is a need for quick and convenient meal solutions. From research we’ve seen, 40% of shoppers are interested in trying meal kits sold in stores. In the fresh aisle, in particular, there was a major shift from salad and olive bars to pre-packaged. The biggest trend is that people want contactless options,” Adams observed.

Adams also noted, with an increase in pet ownership in 2020, the pet products category has seen a lift in sales. “The jump in pet ownership will bolster demand in 2021 not just for pet food, but for all related products, such as supplements and toys,” he said.

“We were already seeing growth in healthy products; the pandemic just accelerated that. In some cases consumers may have been forced to try new products due to out of stocks, the good news is they’re becoming repeat customers. Like never before, shoppers are looking at brands in terms of their mission and vision – are they sustainable, woman or minority owned, do they give back, etc. That will continue in the future,” he said.

Compared to What? Analyzing the Data – Jerry Stroobosscher, Director of Data Services and Analytics, Presence Marketing

After the initial panic buying peaks in March and April, both conventional and natural grocery stores have seen sustained growth averaging 10-15%, “and we are continuing to see this growth in both channels weekly as we compare year-over-year growth,” said Jerry Stroobosscher, Director of Data Services and Analytics for leading independent natural and organic products brokerage Presence Marketing. “As we know, people are staying at home more, cooking at home more, and while it is conversely affecting the restaurants, realistically, we are going to see this continue through the winter,” he said.

As a data analyst, Stroobosscher and his SPINS cohort Michael Murphy are warning decision makers not to “freak out when we see negative growth numbers as we cycle against this past year’s numbers come March and April.” Given all the unprecedented growth in 2020, comparing year over year growth in 2021 may be negatively impacted in both channels as the markets stabilize, they cautioned. “Once we start matching against a year ago, we are going to see some challenging numbers. The published growth rates may be worrisome to some, but understand that the channels themselves have expanded over this time frame, and we envision this to continue for a long time,” Stroobosscher said.

“The pandemic has broadened the definition of better for you products and how consumers look at the natural space in terms of building health and immunity,” said Michael Murphy, SPINS Onsite Manager with Presence Marketing. “We’ve seen a progression of consumers moving toward supplements, herbs and homeopathy.”

Of note, while data indicates that dietary supplement sales have dipped since March in the natural retail channel, conventional grocers have expanded their sales of vitamins and supplements. “Natural retailers may need to reevaluate their approach to dietary supplement sales as conventional grocers become a stronger player,” they advised.

The Challenge at Retail – Pat Sheridan, Interim President and CEO, INFRA

“One of the core reasons independent retail associations like INFRA (Independent Natural Food Retailers Association) and NCG (National Cooperative Grocers) exist is consolidating buying power. Our combined buying power certainly has been a differentiator during the pandemic,” said Pat Sheridan, Interim President and CEO of INFRA.

With 280 independent retail members across the country, “supply chain disruption has been one of the largest issues for members,” Sheridan said. “Regionally, things are different every day. It eased in the summer, but has been picking up again this fall and winter,” he shared.

INFRA has helped its members find product and alternatives to replace what’s missing. “We’re rounding out the year successfully, but there are still a lot of challenges. There’s light at the end of the tunnel, but realism and science say we have a ways to go, which means we’ll continue to see disruptions in the supply chain,” said Sheridan.

Sheridan shared that INFRA has a national supply agreement with KeHE Distributors for center store categories, “and we have other supplementary national agreements specifically in wellness, and we also have some regional relationships in place that allow us to negotiate and manage supply chain on behalf of a larger group. Most of our members would have little leverage otherwise,” he noted.

INFRA also focused on increased communications with members, including education, webinars and updates. “Our communications allowed us to hear which regions the pandemic was hitting early on to help our members better prepare.” In addition, the consumer’s focus on wellness presents an opportunity for independent retailers.

“Before the pandemic, we identified a number of stores that were at risk, and now they are still in business. My hope is that the pandemic provided a lifeline to these retailers where they have been able to adjust and grow and hopefully have a longer life span. Our job as a cooperative of independents is to provide the relationships and tools for our members not just to survive, but to thrive,” Sheridan said.

Meeting Demand, Keeping Workers Safe – Robert Agnew, SVP, Sales, Bob’s Red Mill

At Bob’s Red Mill, one of the nation’s leading providers of natural and organic pantry staples from baking flours to hot cereals, since the pandemic began, the company has been balancing 25-30% sales growth with worker safety and morale, said Senior VP of Sales Robert Agnew. “By February, we will have added six new production lines. While we are at an 80% fill rate, we plan to be back up in the 90-95% fill rate range by then,” he said. “Fortunately, we had been planning to get ahead of capacity; however, the demand was so great that it has been a challenge to keep up,” he said.

Regarding worker safety, “We take it very seriously and do everything we can to keep our workers safe. It does affect your efficiency; everything slows down with social distancing,” he said. However, Agnew pointed out that the entire factory has been retooled over the last six years and the company is designing its production lines to be more efficient. “With 400 SKUs, we paused some items to be more efficient, including slow movers and duplications in size,” he shared.

Anticipating that the in-home cooking trend will continue, “We are very transparent with our customers and distributor partners,” Agnew noted. “Our company is able to get through this because of the relationships we’ve built over the years. That comes from founder Bob Moore all the way through the organization. I manage the sales team and it’s important to keep morale high and be in close communications with my team and the entire company, reminding them that everything does pass and we’ll get through this together. It sounds trite, but it’s true,” he said.

Agnew also looks forward to a return to trade shows in the future. “I’m looking forward to sore feet and knees, and interacting with my customers, colleagues and industry friends again.”

Our People Are Heroes – Blair Kellison, CEO, Traditional Medicinals

Looking back at 2020, Blair Kellison, CEO of wellness tea brand Traditional Medicinals, referred to a quote in a holiday card he received from KeHE CEO Brandon Barnholt: “2020 was the year we learned our business is essential and our people are heroes.” “That quote summarizes the year for me,” Kellison said.

“If you’re a manufacturer, you were on the front line. Manufacturing businesses had to come to work every day – many of us could not work from home, we took no time off, and sales were skyrocketing. Whether it’s an economic downturn or the pandemic, when these things happen, people gravitate toward health and wellness products. When push comes to shove, people care about their health and are willing to spend money on it. That has supported our industry all these years, and when times are tough, it drives it faster,” Kellison said.

Kellison admits top brands are getting disproportionate attention from retailers right now. “Fill rates are important; retailers don’t have time and they seek reliability.” However, he also noted that for many companies, including Traditional Medicinals, it’s getting harder to introduce new products as retailers focus on best sellers and category leaders during the pandemic. “The hallmark of our industry is small companies, and yet it’s a hard time to launch innovation.” What Traditional Medicinals is doing is investing in IT and improving infrastructure. “You can’t get complacent; things will change back and you have to be ready,” he advised.

While Kellison anticipates that companies should prepare for more remote working in the future, he and Traditional Medicinals founder Drake Sadler have spent much more time connected and in the factory. “As the CEO, I began to work at the plant again, like the old days. Also, Drake and I were communicating much more, and being at the plant helped reinforce the connection with the front line workers,” he noted.

Kellison also predicted, “In-person appointments aren’t going away. They may be less often, but they’ll be more meaningful. As CEO, I would go on a lot of sales calls. I’ve flown, sat in lobbies for a 30-minute meeting. Now, with the digital tools at hand, I’m going on more sales calls than ever.”

Financing Soil Health – Robyn O’Brien, Co-founder, RePlant Capital

“Covid exposed vulnerability in the system and it is forcing us to build a better one. That starts with capital and how you deploy it,” said Robyn O’Brien, author of The Unhealthy Truth and Co-founder of RePlant Capital. Launched with co-founders David Haynes and Don Shaffer, the $250 million fund is focused on providing loans direct to farmers and incentivizing adoption of regenerative agricultural practices that rebuild healthy soils and help mitigate climate change.

“Initially, we thought we’d create a fund to invest in projects from soil to shelf, but the more we understood the crisis in agriculture, not only can we provide financing for farmers transitioning to organic and regenerative methods, we can have a positive impact on financial, climate and human health. If, for example, a farmer transitions 7,000 acres in Indiana from chemical agriculture to regenerative, that farmer can save up to half a million dollars a year. Currently, we are working on an almond project in California’s Central Valley that will generate significant water savings. We need to do this at scale and with alacrity,” O’Brien said.

O’Brien pointed out that while 80% of consumers are trying organic products, only 1% of U.S. farmland is organic. “It became clear there’s a bottleneck in the supply chain, leading to manufacturers importing organic grains from such countries as Romania and Bulgaria. The majority of our farmland is chemically grown; the organic supply chain in America barely exists,” she said.

O’Brien shared that the lead investors in the RePlant fund are women – “From the food industry and the tech industry, most are mothers; also, some early investors, both male and female, are CEOs from the food industry. In addition, according to O’Brien’s research, “Five times more women than men are moving into regenerative farming. Also, parents are realizing that if they want their kids to come back to the farm, regenerative, organic agriculture and financial resiliency are ways to attract them. There hasn’t been a financial services firm focused on climate solutions through soil health. We want to focus on progress, not perfection, and meet the farmers where they are,” she said.

# # #

Chain, Chain, Chain: Natural Products Companies Take Necessary Steps to Assure Supply Chain Consistency Amid Covid-19 Crisis

Photo: Pexels

By Steven Hoffman, Compass Natural Marketing, Managing Director

This article originally appeared in Presence Marketing’s June 2020 newsletter edition and on New Hope Network’s IdeaXchange.

As the coronavirus crisis entered its third month in May, the U.S. saw concerns about its food system’s supply chain come to the fore. The media’s dramatic coverage of workers falling ill in the nation’s conventional meatpacking plants, crops wasting in the fields, and dairy farmers dumping milk continues to alarm Americans, and justifiably so, even as the country begins to open up in fits and starts.

Despite – or perhaps as a result of – President Trump’s invocation of the Defense Production Act to keep the nation’s meat packing plants open, the nonprofit Food & Environment Reporting Network (FERN) reported on May 22 that in the U.S., “at least 220 meatpacking and food processing plants and 20 farms and production facilities have confirmed cases of Covid-19, and at least four food processing plants are currently closed.” In addition, FERN estimated that “at least 19,160 workers (17,360 meatpacking workers, 1,134 food processing workers, and 666 farm workers) have tested positive for Covid-19 and at least 72 workers (66 meatpacking workers and 6 food processing workers) have died.”

The outbreaks may be even more extensive, but large-scale meat processors and state and local officials are hesitant to provide data due to a “stigma associated with the virus,” the New York Times reported on May 25.

The problem is so severe for farmers that have been producing for the institutional food service market that in mid-May, USDA Secretary Sonny Perdue appeared on National Public Radio (NPR) to promote a $3 billion plan to establish a national “CSA” style Farmers to Family Food Box Program in an attempt to distribute food direct from farmers to low income families.

"When you have the shutdown very suddenly of institutional food settings such as restaurants, schools, colleges and others, then that causes a misalignment in supply," Perdue told NPR’s Morning Edition. "And we've had to scramble in order to try to readjust that, and this food box program is one of those things which we've tried to do."

Helping Both Sides of the Equation

When asked by NPR why not give people more money through the SNAP program to help people pay for food, Perdue responded, “That may help one side of the equation…it does not help those farmers and producers who have grown this food. They cannot make it to market because the supply chain they’ve been used to dealing with – the institutional food market – is no longer there.”

In seeking to reassure Americans that their food supply is safe, Perdue told NPR, “One of the challenges we had in protein – meat, poultry, beef, pork – had been the closure of some of our processing plants there. And we've had infections in those plants that caused some temporary closures. Essentially all those plants are back open. We've turned the corner, and while some retailers are suggesting they may not have the degree of variety that they once had, we expect that to be cured very quickly. I do expect us to be back up to 85-90% production in probably a very few days or weeks,” he said.

While USDA attempts to fast-track a direct distribution program, traditional CSA (Community Supported Agriculture) programs, where consumer members buy a “share” of the farm’s “often organic” harvest, are surging everywhere across the country, including record membership signups and waiting lists, reported NPR on May 10.

Food Prices on the Rise

Of greater concern, as nearly 40 million Americans have lost their jobs since the pandemic took hold in the U.S. in mid-March, the U.S. Bureau of Labor Statistics Consumer Price Index (CPI) announced that food prices in April recorded their highest monthly increase in nearly 50 years, reported USA Today on May 21. “Though overall, the April CPI declined 0.8%, consumers on average paid 2.6% more for groceries. It's the largest one-month increase since February 1974. During the past 12 months, grocery prices rose 4.1%. Price increases in the meat, poultry, fish and egg category were the steepest,” USA Today reported.

In addition, the Department of Justice and the USDA are reported to be investigating the four largest U.S. meat packers – Tyson Foods, JBS, National Beef and Cargill, who collectively control about 85% of the U.S. beef market – for price fixing. According to Politico, supermarket consumers are paying more for beef than they have in decades, but at the same time, the processing companies are paying farmers and ranchers “staggeringly low prices for cattle.”

Is the Supply Chain Broken or Stressed?

After Tyson Foods’ Chairman John Tyson warned in late April that “the food supply chain is breaking,” Abe Eshkenazi, CEO of the Association for Supply Chain Management, in mid-May told Supermarket News, “From our perspective we don’t think the food supply chain is broken as much as it is stressed. We’re entering a different frontier, relative to food right now, and that’s food scarcity. We started to see it in the beginning of the pandemic with consumer packaged goods, specifically toilet paper and paper towels. We saw a significant run on those particular products, but what we've also seen is that the supply chain has responded, so those gaps in the supply for those particular items are being filled,” he said.

“It's taken a while for the supply chains to respond to the spike in demand, but it's also critical that we recognize that this is a spike, Eshkenazi told Supermarket News. “This is not a new demand signal at that level. When we take a look at utilization, we're not looking at an increase in terms of food or consumer packaged goods…It's just that we're seeing a shift in terms of where the demand is being sensed right now, and that is in a home-based environment.”

When asked about shortages where retailers placed limits on consumer purchases, Eshkenazi shared with Supermarket News, “As the system catches up, I think we'll see an easing of that but it also does present a problem because the quotas are not relative to family size. They're relative to the buyer. So, a family of five or six has the same quota as a family of two. We have to be aware of the current circumstances that these individuals are facing. It's not a one size fits all.”

Natural Products Manufacturers: Necessity is the Mother of Invention

Meanwhile, in the natural and organic products industry, producers and manufacturers are being driven by the rule, “necessity is the mother of invention.” By being nimble, companies are working hard to ensure a consistent supply chain for their retail and distribution customers. We talked with a few leading manufacturers and industry experts on how they are handling supply chain challenges during the coronavirus crisis. Here’s what they shared with us:

Carla Bartolucci, CEO, Bionaturae and Jovial

U.S.-born Carla Bartolucci and her husband Rodolfo are the founders of the certified organic brands Jovial and Bionaturae. The company is based in Connecticut but the main ingredients – wheat, the ancient grain Einkorn, tomatoes and other raw materials – are sourced in Italy, where the finished products are manufactured. As a provider of pastas, tomato sauces, juices, fruit spreads, cookies and other products, the brands have been in high demand during the pantry loading and subsequent shelter in place phases the U.S. has experienced during the pandemic.

“We were coming off of big months in January and February, and suddenly, here comes March. We were definitely caught off guard with the increase in sales we saw in flour, pasta and shelf-stable products. I can tell you for the first time in 25 years there was a day when our warehouse in Connecticut was completely empty,” said Carla Bartolucci.

The company could have sold more, but was limited by availability of a special compostable window used in the product packaging, and by having to queue up with contract manufacturers in Europe who were experiencing increased demand from all their customers. “Also, we blew through the contracts with our farmers already in June (contracts normally last until October), so we will be sourcing from outside of our network come July and August,” Bartolucci said.

During the peak, the company was shipping out so many container loads each week that there was no time to fill them completely. “The volume of demand made us ship out containers that weren’t completely full, so there were some losses with that, but we had to get the product out. We are still producing and loading twice as much product as we normally would have, but not three times as much, so we can fill the containers more efficiently again,” she said.

Seeing a longer term impact to consumers’ purchasing patterns, Bartolucci observed, “Suddenly, the new facility we built four years ago in Connecticut now may not be big enough. I can see the future right here in front of me – people will be home more and cooking more. We are responding and preparing for the future much more quickly than we normally would have.”

Scott Jensen, CEO, Rhythm Superfoods

Rhythm Superfoods, an innovator in plant-based fruit and vegetable snacks, did a lot of groundwork to secure its supply chain well before the Covid-19 crisis hit, and it’s paying off, says founder and CEO Scott Jensen. The company, which requires the freshest product delivered consistently for its dried kale, beet, carrot, dried fruit and other certified organic snacks, made a strategic decision to shift its sourcing from the U.S., where weather and crops proved to be uncertain for the company, to working with four farming families in the north central region of Mexico. It is there, a good day’s drive from the Texas border, where the Austin-based company grows and manufactures all its products.

“We own two facilities in Guadalajara. Our farmers are all within a two- to three-hour drive to our production plant, and they are situated at different elevations, so we are able to produce all we need,” Jensen said. “Overall, the U.S. gets so much of its produce from South of the Border; it could be 30-50% of all produce sold in the U.S., depending on the season, and there are no tariffs on food. For Rhythm Superfoods, we need fresh, consistent, organic deliveries, and in that particular region of Mexico, they grow year round and our farmers are really good at growing a mix of crops,” he said.

“Our vertical integration also gives us the ability to sell beyond the U.S. market and to deal directly in pesos, which is a strong currency. We can ship to Asia and the EU and be competitive price-wise,” Jensen said. He also noted that the company has seen no slowdown in shipping at the border. “The crisis has prevented us from traveling to our farms for a few months, but we are getting everything we need from our producers.”

For its workers, the company has expanded cleaning protocols, implemented temperature checks, provided face masks, emphasized multiple hand-washing and continues to pay workers if they have to be sent home, among other heightened safety measures.

Jensen shared that his farmers have been impacted by the pandemic, as they grow for the food service market, too. “If we lost 50% of consumption of vegetables in food service, that hasn’t all shifted to retail; consumers don’t cook as many fresh vegetables at home as the chefs and restaurants who use a lot of fresh produce. As a result, all our farmers are recalibrating their plans for the growing season. I don’t think anyone can oracle out what’s happening in the next weeks and months, however, we are attentive to things going on daily and a slew of data, and we are communicating constantly with our leadership team,” he said.

Pete Speranza, Cofounder, 301INC / General Mills

A former professional hockey player, Pete Speranza brings a competitive, team spirit as Cofounder of 301INC, the “brand elevator” arm of General Mills. As Director of New Business Development, Pete helped create a national scouting network for emerging natural and organic products brands, where he works closely with the entrepreneurs behind them.

“What we’ve been telling our brands is that while external forces have changed, food values aren’t changing,” Speranza said. “Coming out of this, people will still eat more at home, and they may be looking for more nutrient-dense foods to support healthy immune systems. From a supply chain perspective, from the meat to the grain industry, we are moving beyond a commodity approach, where the farmer got paid the same price per bushel no matter the quality. Today, businesses are having to create supply chains that are nimbler to handle smaller producers. This will accelerate. People want transparency, higher quality and nutritious foods,” he added.

Speranza noted that a challenge smaller brands face today is that consumers are spending less time in grocery stores. “People are not browsing right now. They’re creating a list, getting their essentials, and there’s less impulse buying and discovery, which is what these new brands need.” Speranza is advising the brands he works with to be open to all sales channels and social media to reach and educate consumers about their products.

“Before Covid, everyone had their own zone and the supply chain was much more transactional,” he observed. “Yet, every part of that supply chain became nimble overnight. As a result, our brands will come out with stronger relationships with ingredient suppliers, co-packers and customers. This will bring some advantages in the future, as people may see they were more rigid than they needed to be, and that it may be more resilient to be nimble. It has reminded me how important a secure, transparent food supply chain system we will need in the future for people at any income level.”

Speranza also noted that “while forecasting tools were never dead on, in the old model, you weren’t off by more than 10%. In the next 10 months, efficiencies may be less because forecasts won’t be as accurate. We will need to build new data sets,” he said.

Cole Daily, EVP, Operations, Frontier Co-op

For more than 40 years, Frontier Co-op has been a leader in natural and organic herbs and spices, sourcing over 800 raw materials from more than 50 countries. “Needless to say, it made for a fluid, dynamic situation when Covid-19 hit; it was almost like watching dominoes fall when it hit China, then Southeast Asia, then Europe and then the U.S.,” said Cole Daily, Frontier’s EVP of Operations.

“Because the spice industry is uniquely vulnerable to outside forces, we have built a resilient supply chain by having alternative sources,” Daily said. “We’ve built some redundancy into our supply chain because, as they say, when Russia Sneezes, Poland gets a cold, which is very poignant right now. When you are sourcing from over 50 countries, something is bound to go wrong. As such, we are always planning for contingencies, but this is at a scale that is absolutely unprecedented.”

Daily noted that it hasn’t been so much a raw materials issue as it has been skyrocketing demand – company sales were up 100% for the latest four weeks in April, based on SPINS data, “and we are still tracking strongly, up over 36%, based on anecdotal IRI tracking data,” he said.

“The squeeze has been on the packaging side of things. After everyone emptied the shelves during the pantry loading period, refilling them has been a bit of a challenge. There’ve been short delays but we are beginning to normalize now. We’ve added new manufacturing lines and we are pretty much working nonstop to meet the overwhelming demand,” Daily said.

Frontier Co-op deals directly with farmers because, said Daily, who has been with the company 28 years, “We don’t want the inventory sitting overseas. We want it in our warehouse. In general, we go a little heavier on our inventories, which has helped in the current situation. Our suppliers are increasing their capacity right along with us and making sure they do it in a safe manner, but the $64,000 question is how do we forecast right now? We’re doing our best to plan now for all types of products and to make sure we are out ahead of the demand. The resiliency we’ve built into our supply chain helps us, as we can go to these sources to increase buying, if needed.

For Daily, he has learned a few things during the coronavirus crisis. “The resiliency of people throughout the world, not just outside your front door, but the farmers throughout the world, the processors, and here in Iowa, the work ethic is incredible. Everyone is trying to do their best; we’re continuing to work through it, sometimes alone, but everyone together.”

Nikki Nolbertowicz, Midwest Regional VP, Presence Marketing

“Before the Covid crisis, products including soup and cereal were slow. Now, there’s a joke that there’s no ramen available in the distribution centers,” said Nikki Nolbertowicz. As Midwest Regional VP for Presence Marketing, she manages distributor relations nationwide for the leading independent sales brokerage firm, which celebrates its 30th anniversary in business this year.

When distributors have to solve out of stock situations, it can create opportunities for other brands, Nolbertowicz noted. “For example, a distributor might try to bring other rice brands in, or find alternative products to fulfill current demand,” she said. “Consumers, too, are either trying other brands or new products, or looking online.” Over the past few months, distributors Nikki works with in ecommerce sales have seen an uptick three times their standard volume, and could have sold more if it were not for being out of stock on certain items, she said.

For brick and mortar stores, shopping habits have changed – consumers want to make less stops, so the average basket amount has gone up, Nikki observed. “There’ll be limited travel this summer and the kids will be home more with many activities being cancelled or delayed, so there will be more meals at home. For people whose jobs have not been impacted, they are beginning to splurge in grocery stores again, with an emphasis on self-care. For consumers that have been negatively impacted financially from the pandemic, they are looking at value products. Later in the year, many people will look to do more with less for the upcoming holidays with their families. Distributors are starting to think about that now,” she said.

Acknowledging that the concern is real for manufacturers in making sure they can meet the needs of retailers and distributors, Nolbertowicz noted that the industry overall has done an impressive job in responding to the pandemic. “I give everyone we work with – distributors, retailers, manufacturers – a lot of credit. Under the circumstances, they’ve done an amazing job and have been flexible, nimble and have upped their communications game. Getting the message out is more important than ever; with none, there is chaos.”

For Nikki, she believes that this has been an optimistic time for the natural products industry. “It has given new life to manufacturers and independent retailers, and has changed some consumer behaviors where people will be focused on cooking meals in the home and more time with family. Life will go back to some sort of normalcy, but the experience of family meals and quality time – people will want that to continue, which just helps our industry. This experience has given us all a chance to pause, refocus, and reprioritize in our work and personal lives what is most important. That will resonate for more than just the short term,” she said.

Bill Evans, CEO, Kalona SuperNatural

As a small scale, certified organic, grass fed dairy producer, Kalona SuperNatural has built resiliency into its supply chain by working not only with its own community of Amish and Mennonite dairy farmers in Eastern Iowa, but also by becoming expert in sourcing and brokering organic milk from throughout the nation, said Bill Evans, CEO and founder of the company.

Also, the brand, which is growing, found itself at an advantage when the Covid-19 crisis struck because its sales are primarily in natural products grocery stores. “The conventional guys are having issues because they’ve got a large portion of their manufacturing set up for food service; there’s no place for that to go right now,” Evans said.

Since the pandemic began, Kalona has been filling distributors’ large orders. “We’ve been able to accommodate a 25-30% increase in sales volume, whereas larger producers are shorting people. Kalona SuperNatural has been more successful than others in balancing our organic milk supply,” he said.

In addition, to its own production facilities, where workers have ample space for social distancing, Kalona owns its own trucking company, which has been a big advantage in getting deliveries out during the crisis. “We have the capacity to secure additional trucking when we need it. We provide dated, perishable product, and it needs to turn quickly; that means distributors will get us unloaded, even when their docks are crowded,” Evans noted.

“We have workers that have to be here to bottle milk and load and drive trucks. We’ve been taking all precautions and those folks have felt safe coming to work. What I’m most proud about is that our team has stuck together and gotten the job done,” he said.

Brad Barnhorn, Board Member and Business Advisor

After successfully building Fantasia, a leading natural juice brand that merged with Naked Juice and was subsequently acquired by PepsiCo, Brad Barnhorn has been advising CEOs and serving on numerous boards in the natural products industry, giving him a unique perspective on what’s happening with emerging and established brands during the pandemic.

“During this period, though there may be different dimensions, the questions are the same – how do you treat your customers, employees, supply chain and other partners?” Barnhorn asked. And how do you respond to the pressure to focus on performing items, Barnhorn also asked, referring to the compulsion for companies to do “SKU rationalization” as manufacturers, as well as retailers, focus their resources on the products most in demand.

“If you’re a company with sales north of $50 million or $100 million that has great brand equity, that allows for flexibility to temporarily stop some SKUs. The tough space is when you are a mid-sized company, say in the $15 million to $20 million range, odds are if you take some SKUs out, you might not get them back in the stores. That might not be the right decision, strategically. If you’re a small brand, you might not have the market power to bring the SKUs back,” Barnhorn said.

Instead, he offers, “I might make the decision as a small company to change my production schedules. Maybe I produce the item less frequently but with higher inventory levels, try to find ways to reduce complexity, have more efficient runs, and take a risk on higher inventory. Many distributors have been more flexible with brands on their standard requirements for the amount of shelf life that needs to be remaining on the product when they receive it into their warehouses. For example, UNFI typically requires 75% of shelf life remaining, but it has been making exceptions to that. It is essential to be in close contact with your distributors on an ongoing basis to understand this dynamic, as well as other elements of working with them that may have been altered in this unique period to provide companies a measure of operating flexibility ... but also, are more than likely to change back to the previous rules of engagement in the future,” he said.

Barnhorn advises, “If you have not audited your supply chain in the past two to three years because things have been going on as normal, it’s time to analyze, talk to other manufacturers and co-packers, get up to date on the flexibility and options you have in your supply chain. Take this moment of urgency to have these conversations.”

Daniel Fabricant, CEO, Natural Products Association

As CEO of the largest trade association representing the natural products industry, Daniel Fabricant, Ph.D., is concerned about fraudulent products as consumer flock to dietary supplements to strengthen immunity and health. “Elderberry is very popular right now. There is such consumer demand and the margins are so big that we are starting to see adulterated product come out. We may see many more fakes in the market because that’s where the demand is,” Fabricant warned. “If it sounds too good to be true, it probably is. It may be best to stick with the brands you’ve always seen in your natural products retail store – they’re well established and trusted,” he advised.

On the plus side, Fabricant noted that 70% of Americans use supplements, though many of those have been casual users. “But now many of those consumers will take extra supplements, such as zinc and Vitamins C and D. These products will stay part of people’s regimen,” he said. However, Fabricant noted that the sports nutrition category has taken a big hit as gyms have closed down.

“The biggest thing for us as an organization was when the Department of Homeland Security issued their first guidance, there was no mention of supplement manufacturers. However, in the second guidance, we were successful in getting the language in to protect the supplements supply chain. We wanted to keep as many channels of distribution open as possible, said Fabricant.

“The supply chain in the next five to 10 years is going to be a very fast moving target. We can do manufacturing smarter and cleaner now, and there is strong interest in vertically integrating in the U.S. Also, while people say that everything is going to the Internet, there is still strong interest in going to stores; people want to go to independent retailers. Most importantly, “Fabricant advised, “as an industry, we always have to stay engaged. We are an essential business, and that messaging should never stop.”

Grab Your Mug: Join Us for Episode 2 of Compass Coffee Talk, May 13, 11:30am EDT

Compass Coffee Talk™

COMMUNITY | CONVERSATION | IDEAS | INSPIRATION

Take a 30-minute virtual coffee break with Compass Coffee Talk™. Hosted by natural industry veterans Bill Capsalis and Steve Hoffman, Coffee Talk features lively interactive conversations with industry leaders and experts designed to help guide entrepreneurs and businesses of any size succeed in the market for natural, organic, regenerative, hemp-derived and other eco-friendly products.

Diana Mercer of ForceBrands Discusses the Job Market in the Natural Products Industry

Episode 2 - Wednesday, May 13, 11:30 am – Noon EDT

Zoom, Admission is Free

If you have lost your job, are seeking a career change during this pandemic, or have a company and need to hire more people - installment #2 of the Compass Coffee Talk series will focus on effective job transition strategies and creative approaches with Diana Mercer from Force Brands. Steven Hoffman and Bill Capsalis will talk with Diana about all the ways Force Brands helps employers find great people and job seekers find their perfect career paths. Diana is a veteran of the Natural Products Industry and has a great deal of experience and knowledge of the types of companies and positions currently available. Do your self and your career a favor and tune in to learn more!

Diana is a lifelong, passionate wellness educator, entrepreneur, and natural & organic brands expert with more than 15 years’ experience in the better-for-you space Currently, Diana is a Senior Client Strategist and Executive Recruiter with ForceBrands, the leading recruitment firm and job board for consumer brands. Diana and ForceBrands specialize in hiring and growth strategies for food, beverage, beauty, cannabis, and pet companies, connecting the best CPG talent, at all levels, to fulfilling careers.

About Compass Coffee Talk™

Compass Coffee Talk™ is hosted by natural and organic products industry veterans Bill Capsalis and Steve Hoffman, and is produced by Compass Natural Marketing, a leading PR, branding and business development agency serving the natural and organic products industry. Learn more.

Natural Products Industry Prepares for a Post-COVID Future

By Steven Hoffman

This article originally appeared in New Hope Network’s IdeaXchange and Presence Marketing’s May 2020 newsletter edition.

As the nation continued to battle the COVID-19 pandemic in April, with confirmed cases in the U.S. reaching 1 million and deaths from the disease surpassing 55,000 (more than the total number of U.S. casualties in the Vietnam War), the natural products industry, along with the mainstream food industry, found itself firmly on the frontline of the coronavirus crisis. In helping to keep food on America’s table during an unprecedented time of turmoil, sadly, this came not without some illness and casualties of its own among workers in natural foods stores and in mainstream groceries.

The month also saw farmers dumping tons of eggs, milk and fresh produce bound for restaurants, hotels, schools and other food service operations that were shuttered – product that couldn’t be re-routed – while frustratingly, grocers across the country were still struggling to keep product on the shelf as supply chains were further strained. Food banks, too, experienced long lines and shortages of staple products due in part to the demands of a record 26.5 million Americans who have filed for unemployment since mid-March.

Yet, among a bunch of bad news, retailers, distributors, manufacturers and others in the natural foods industry continued to pivot and do everything they could to serve and protect customers, minimize risk to workers, ensure inventory and respond to ever-evolving local, state and federal guidelines and shelter-in-place rules.

First, in response to a worrying number of employee illnesses, many grocers are now requiring that all workers wear face masks, though they, too, are having to compete with the federal government, hospitals and others to procure scarce Personal Protective Equipment (PPE). In addition, the United Food and Commercial Workers International Union (UFCW) along with Kroger, Stop & Shop and others, issued a joint statement on April 27 calling on federal and state governments to designate grocery store employees as “extended first responders” or “emergency personnel.”

“We are urgently requesting our nation’s state and federal leaders temporarily designate these workers as first responders or emergency personnel,” the joint statement said. “This critical status would help ensure our essential grocery workers have priority access to testing, emergency childcare, and other protections to keep themselves and their families safe and healthy. For the sake of workers, their families, and our nation’s food supply, this action will provide grocery workers with the vital protections they deserve.”

Responding swiftly to the lack of PPE for natural foods employees, Presence Marketing worked with one of its brand partners to manufacture face masks and other protective gear to provide to industry partners in manufacturing, distribution and in stores, “plus we’re working on a retail pack for consumers,” said Christine Tzumas, COO of Presence Marketing. “Our field team has been on the front lines from the beginning of this crisis working fast and furious to serve our customers in any possible way, from helping unload trucks when they show up at the dock to lending a hand stocking store shelves,” she said.

“The biggest thing for us right now is communication – we’re communicating everything going on as quickly as possible,” Tzumas continued. “Our brand partners have been receiving weekly, fact-driven COVID-19 updates, and the response has been so positive that we want to continue it in some fashion. While we’ve been dealing with this crisis, we still can’t lose sight of what’s on the other side and what the world will look like six months out from now. Hopefully, we will be moving beyond this. Our team has blown me away every day making sure to get food on the shelves – we’re blessed to be with the people and companies we work with. You don’t hear those same stories in other industries,” Tzumas added.

Phases of a Crisis

According to natural products market research firm SPINS, we’ve seen three distinct phases in terms of consumer shopping behavior since the coronavirus crisis hit the U.S. in late February. Also, with restaurants and other out-of-home dining options accountable for roughly half of all food expenditures, with their abrupt closure, demand doubled overnight for the nation’s grocers.

By late February, consumers who had an early read on the coming pandemic were responsible for big upticks in sales of preventive care products in natural foods channels, including vitamins, dietary supplements, probiotics, and herbal and homeopathic products. This was what SPINS refers to as Phase One: Proactive Self Care and Wellbeing, according to Kathryn Peters, EVP of Business Development for SPINS, in an April 21 webinar presented by New Hope Network.

“During the weeks of February 16 and 23, when there was still just a small number of confirmed COVID cases in the U.S. and the problems in China still seemed a bit far away, there was an early band of proactive shoppers beginning to stock up in key immunity-related categories beyond the regular cold and flu season type of products. That was when self-care items also started to pop, such as hand wipes and sanitizer. By late February, people were beginning to have a hard time finding hand sanitizer in stores,” she observed.

To provide some perspective, when Phase One began, “from just the previous week, we saw some extraordinary increases in a number of areas for the week ending February 23,” Peters said, noting a 1,285% increase sales of vitamins and supplements and a 211% increase in herbal and homeopathic products sales.

“We all know what Phase Two looked like – during the weeks of March 15 and March 22 – this was the mass stock up,” Peters continued. “During this ‘Pantry Prep & Loading’ phase, virtually everything sold.” Peters noted that during this period, 15 million additional buyers bought natural products. “That is a substantial number of products being bought by shoppers that are now in pantries. Time will tell if they will become continued shoppers; hopefully, there’s been a lot of trial,” she said.

April began Phase Three: Quarantine, according to SPINS data, with upticks in sales of baking mixes, pastas and spa-related items as Americans hunkered down at home and did their best to cook for their families, and pamper themselves while not being allowed to visit salons, massage therapists or other service providers. “Households seem to be bonding over baking, whether it’s bread or desserts – Instagram is full of proud creations,” Peters said.

The New Normal

“And then there’s Phase Four – what life is going to look like on the other side,” Peters said, noting that there will be some lasting shifts in consumer behavior in the “new normal” once the health crisis subsides. With consumers homebound, re-connecting with cooking and seeking more prepared food options, grocers are being presented with an opportunity to capitalize on providing mealtime solutions – something they were having difficulty with before.

Organic produce, too, experienced a resurgence, recording a 22% sales jump in March and an 8% increase overall for the first quarter, outperforming conventional produce sales, according to the 2020 Q1 Organic Produce Performance Report published by the Organic Produce Network and Category Partners. Growth may have been even higher, but was tempered by widespread out of stock conditions during the panic buying period in mid-March. “Organic fresh produce sales in the first quarter were strong, and the impact of COVID-19 in March pushed numbers even more,” Matt Seeley, CEO of the Organic Produce Network, said. “We continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce.”

Another lasting trend will be a continued focus on proactive self-care and personal safety – immunity supplements cleaners, wipes, masks and other related household items will continue at a high level. Also, “while comfort foods are important, we are seeing growing recognition of healthy and nutrient dense food, too. This comes with consumers’ increasing recognition that our body’s immune system is the best line of defense. Even with economic pressures, we see this continuing. We believe that this unfortunate health crisis will be a bright spot in continuing to bring health and wellness even more mainstream,” Peters of SPINS said.

“We are very concerned about those negatively economically impacted by the coronavirus crisis. If there’s one major tectonic shift, it is the march toward more and better value product offerings to lower barriers of entry from a pricing standpoint,” said Ben Nauman, Director of Purchasing for National Co+op Grocers (NCG). Nauman noted that sales in March for its retail members were up nearly 30% compared to March 2019 sales.

NCG has been helping its members coordinate distribution and supply chain issues, take advantage of government stimulus programs, and currently, it is reinvigorating a recession playbook created in 2008 to help members manage cash flow and liquidity during economic downturns. “We’re also beginning to explore what it looks like to retail in a more contactless way going forward,” Nauman added.