Survey Says: Research Shows Natural, Organic Channel Saw Steady Growth in 2021

This article originally appeared in Presence Marketing’s July 2022 Industry Newsletter.

By Steven Hoffman

Starting out in the natural and organic products industry in the mid 1980s as an associate editor with media and trade show company New Hope Network, there were a few long after-hours sessions spent each summer pouring over completed paper surveys sent in by retailers, and compiling data with company founder Doug Greene to analyze and publish what has since become a milestone marker for the industry, the Natural Foods Merchandiser’s Annual Market Overview Survey.

Photo Credit: Organic Trade Association

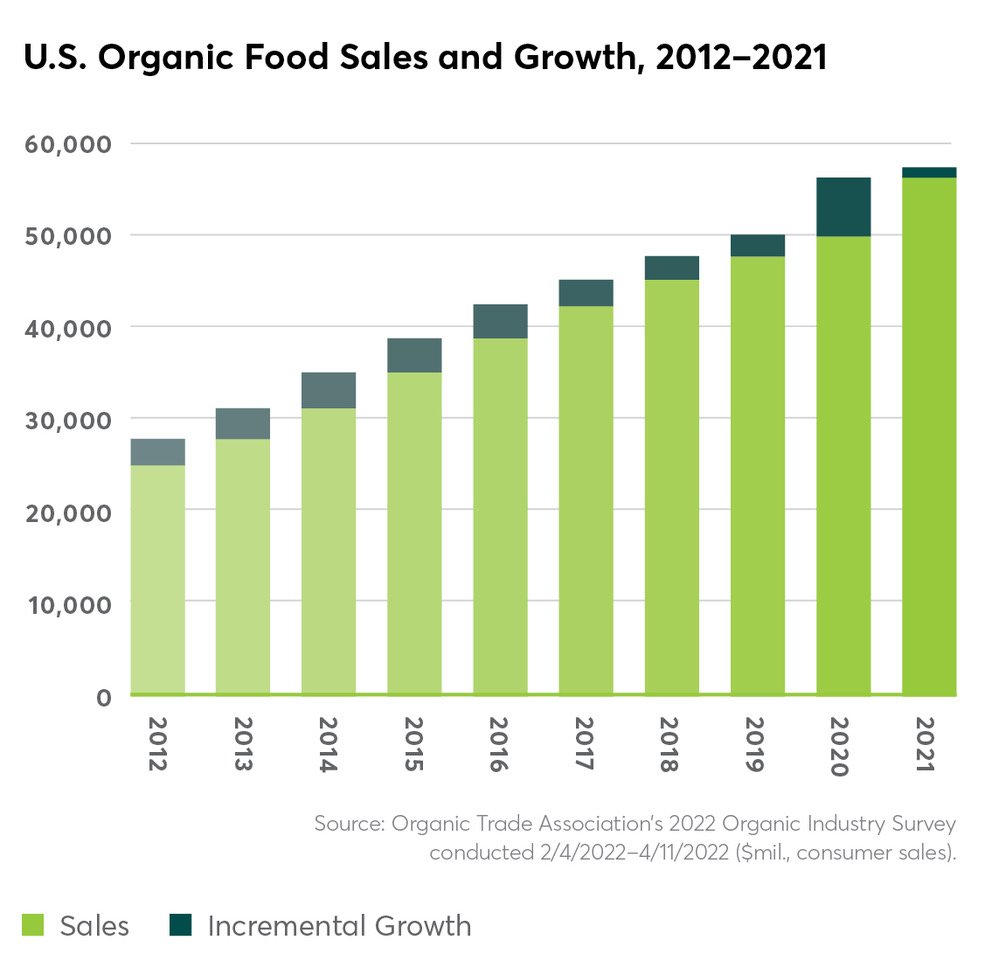

Today, the survey has become much more sophisticated, and so has the market, which has grown 10X since that time to reach $204.6 billion, representing an overall growth rate of 5.5% in 2021, according to this year’s report, published in June 2022.

Once dominated by independent natural products retailers, according to this year’s survey, conventional retailers now command 46.1% of natural products sales, representing growth of 5% in 2021. Combined, independent and large-chain natural products retailers comprised a market share of 31.3% in 2021. However, while independent natural products retailers recorded growth of 4.1%, the large chain and specialty store format saw sales decline by 1.9% in 2021.

Overall, conventional grocers reported natural products sales of $94.4 billion in 2021. Sales were $64 billion among natural products retailers in 2021, comprising independents, small chains and large chain/specialty stores. New Hope estimates there were 21,613 independent and large chain natural channel retail stores in the U.S. in 2021.

Of note, e-commerce sales of natural products continues to grab market share, charting growth of 23.2% in 2021. That’s not surprising, say industry observers, considering consumers were still spending considerable time at home in 2021 during the pandemic. Now, as the world emerges, some of those online consumer shopping behaviors may stick, according to Nutrition Business Journal’s 2022 Supplement Business Report, particularly when it comes to dietary supplement sales. According to NBJ, the supplement industry recorded $59.9 billion in sales in 2021, up from just $43.2 billion five years ago. E-commerce claimed the biggest share of post-pandemic dietary supplements sales growth, reported Rick Polito in the Natural Products Industry Health Monitor.

Photo Credit: Natural Foods Merchandiser 2022 Market Overview Survey, New Hope Network

Across all sales channels, e-commerce “is leading a huge shift in channel dynamics,” according to NBJ Senior Industry Analyst Claire Martin Reynolds. Based on a growth trajectory that is expected to add another $10 billion in dietary supplement sales over the next four years, “2024 is expected to be the record year where e-commerce market share in supplement sales is larger than natural and specialty or mass market retail, coming sooner than previously forecasted given the pandemic-related acceleration,” NBJ reported.

New Hope’s overview also revealed some interesting data regarding the demographic makeup of natural products shoppers.

While a common assumption is that natural channel shoppers are mostly white, well-off moms, that perception is inaccurate, said New Hope’s editors. “In fact, shoppers are fairly evenly divided along gender lines; fewer than half are Caucasian; about 40% are affluent; and more than a third live in households with just two people. Additionally, more than a quarter of natural channel shoppers are Hispanic and more than a third of Asian consumers are significantly more likely to shop at natural grocery stores; 36% of consumers who represent communities of color agree that products at natural retailers were, ‘made with me in mind’ (compared to 32% of all retail customers combined); and Hispanic and Asian consumers specifically are more likely than all natural retail shoppers to agree that they are ‘willing to pay a premium for natural and organic foods and products’ (44% vs. 36%),” New Hope’s researchers reported.

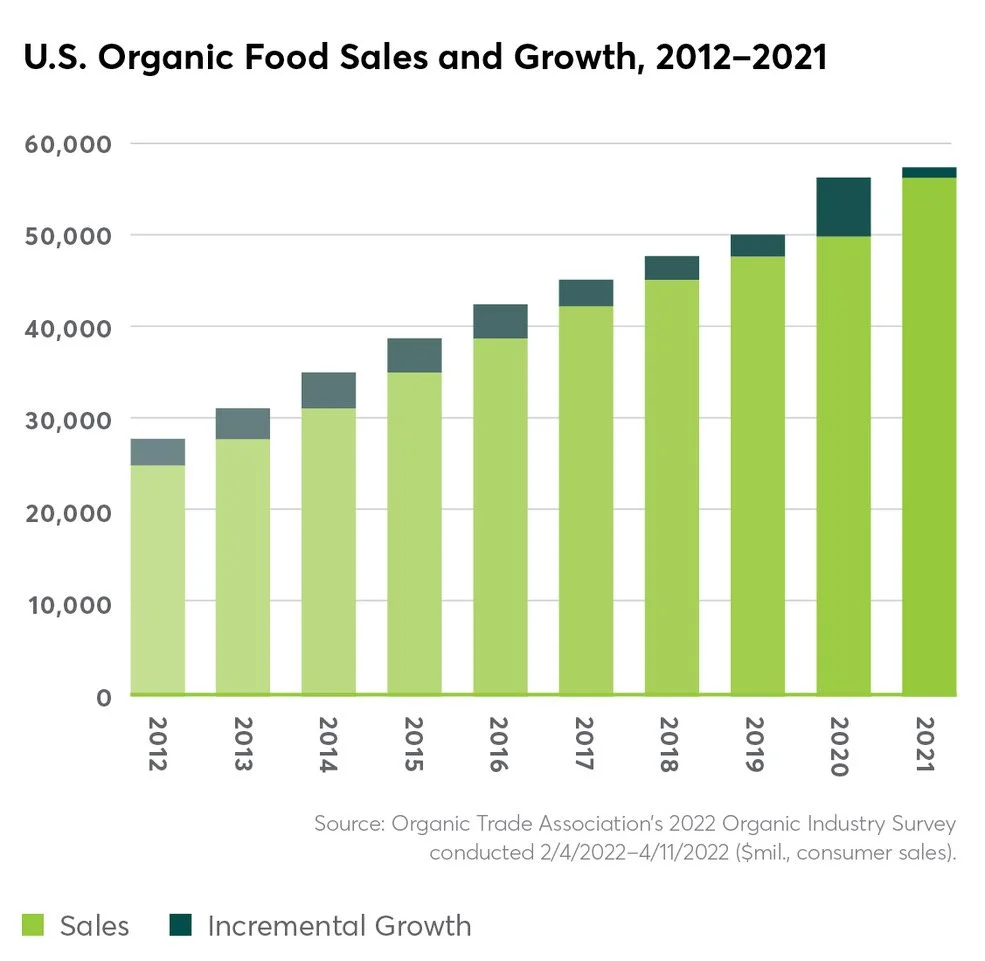

In related news, in its annual Organic Industry Survey, published in June 2022, the Organic Trade Association reported that between 2020 and 2021, sales of organic products surpassed $63 billion, growing 2% during that time period. Food sales, which comprises over 90% of all organic sales, rose 2% to $57.5 billion, and sales of nonfood organic products grew 7% to reach $6 billion in sales.

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA’s CEO and Executive Director Tom Chapman, “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Among the strong performers in organic: organic beverages experienced the highest growth (8%) of all major categories, with organic coffee topping 5% growth and $2 billion in annual sales. Organic produce accounted for 15% of the organic products market, bringing in $21 billion in revenue in 2021, a 4.5% increase over 2020. Fresh produce drove growth in that category, at 6%.

While a decline in packaged and prepared organic food sales in 2021 represents a shift away from the pantry loading of 2020, organic baby foods — traditionally a strong entry point for shoppers new to organic — was a bright spot in 2021 with 11% growth. Organic snack foods, which suffered a decline in 2020, saw healthy growth of 6% in 2021, reflecting a return to active lifestyles and demand for healthy, nutritious on-the-go foods.

Among non-food organic products, fiber, supplements and personal care products were the most dominant performers with growth rates of between 5.5% and 8.5% in 2021, said OTA. Textiles, the largest non-food sub-category, represented 40% of the category’s total sales and brought in $2.3 billion in annual sales. Overall, non-food products saw 6% growth in 2021 and represented nearly $6 billion in sales, OTA reported.

However, industry observers caution that the unprecedented inflation the country is experiencing this year could affect sales of typically higher priced organic products as price-sensitive consumers opt for purchasing conventional foods to save money, according to a recent report in the Organic Produce Network. According to an Economist/YouGov poll taken in June 2022, 69% of Americans say changes in the inflation rate have impacted them negatively. In a June 2022 survey conducted by market research firm The Feedback Group, 24% of consumers are substituting similar, less expensive foods and 12% said they are buying fewer organic items and products to cut costs.

“Organic’s ability to retain the market footholds gained during 2020 and continue to grow despite unprecedented challenges and uncertainty is a testament to the strength of our industry and our products. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritizing efforts to engage and educate organic shoppers and businesses,” said OTA’s Tom Chapman.

The Growth of the Independents – Join Pat Sheridan, INFRA, on Compass Coffee Talk, October 13, 11:30am EDT

The Growth of the Independents: INFRA CEO Pat Sheridan on the Next Compass Coffee Talk

Pat Sheridan, President & CEO of Independent Natural Food Retailers Association (INFRA), to Share Key Insights Into the Role of Retailers in a Changing Market on the Next Compass Coffee Talk, Wednesday, October 13

Wednesday, October 13, 11:30 am – Noon EDT

Zoom, Admission is Free

Natural products retailers continue to see growth despite an unpredictable economic climate and a supply chain in flux, with independent retailers and small chains leading the pack with 6.5% growth in 2020, according to New Hope Network's 2021 Market Overview. On Wednesday, October 13, natural and organic retailing leader Pat Sheridan will join Compass Coffee TalkTM for a lively deep-dive conversation into this current and future retail landscape for naturals. Sheridan will offer unique insights into the opportunities and challenges for retailers and for organic products as we move into a yet-to-be-defined new normal.

Independent Natural Food Retailer Association (INFRA) is a purchasing and business services cooperative of independently owned natural food grocers. INFRA currently represents retailers operating over 400 stores in 45 states with combined annual sales of over $2 billion. With a mission of strengthening its members through collaboration to forge a sustainable future, INFRA focused on key transitions throughout 2020 under Sheridan's leadership. In addition, as Secretary of the Organic Trade Association's Retailer Council, Sheridan participates in the trade association's forum focusing on organic-specific retail issues.

About Pat Sheridan

Pat Sheridan is the President and CEO of Independent Natural Food Retailers Association (INFRA), a purchasing and business services cooperative of independently owned natural food grocers. INFRA currently represents 300 members and 17 associate retailers operating over 400 stores in 45 states with combined annual sales of over $2 billion. Pat joined INFRA in 2018 as its COO & CFO and led its transformation to better serve members by leveraging technology solutions to deliver promotional and consulting opportunities. Pat also serves as Secretary of the Organic Trade Association’s Retailer Council. Prior to joining INFRA, Pat held executive positions in diverse industries such as healthcare, organic milling, and product development.

About Compass Coffee Talk™

Take a 30-minute virtual coffee break with Compass Coffee Talk™. Hosted by natural industry veterans Bill Capsalis and Steve Hoffman, Coffee Talk features lively interactive conversations with industry leaders and experts designed to help guide entrepreneurs and businesses of any size succeed in the market for natural, organic, regenerative, hemp-derived and other eco-friendly products.

Compass Coffee Talk™ is produced by Compass Natural Marketing, a leading PR, branding and business development agency serving the natural and organic products industry. Learn more.

VIEW OUR PAST COMPASS COFFEE TALK EPISODES ON YOUTUBE

Court Rules FDA Violated Environmental Laws in Approving GMO Salmon

Photo: Pixabay

This article originally appeared in the December edition of Presence Marketing’s Industry Newsletter

By Steven Hoffman

A federal judge in San Francisco on November 5 ordered the US. Food and Drug Administration (FDA) to re-evaluate its approval of genetically modified salmon based on ecological concerns if the GMO salmon were to escape into the wild.

FDA in 2015 approved the commercialization of Maynard, MA-based AquaBounty Technologies’ genetically engineered “AquAdvantage” salmon, finding it had no significant impact. Five years later, however, the U.S. District Court for the Northern District of California agreed with environmental groups who shared concern that the GMO salmon could escape to damage wild salmon populations, reported Food Safety News.

According to a statement by Earthjustice, “The court ruled that FDA ignored the serious environmental consequences of approving genetically engineered salmon and the full extent of plans to grow and commercialize the salmon in the U.S. and around the world, violating the National Environmental Policy Act. The court also ruled that FDA’s unilateral decision that genetically engineered salmon could have no possible effect on endangered, wild Atlantic salmon was wrong, in violation of the Endangered Species Act,” Earthjustice said. “FDA must now thoroughly analyze the environmental consequences of an escape of genetically engineered salmon into the wild,” it added.

In a 16-page decision, U.S. District Judge Vince Chhabria rejected FDA’s position that it has no duty to consider environmental impacts when reviewing applications to breed genetically modified animals. “Even if the FDA is correct that environmental considerations writ large were not relevant to its decision, the agency is always required to consider the subset of environmental impacts that directly involve the health of animals or humans,” Judge Chhabria wrote.

“This decision underscores what scientists have been telling FDA for years—that creating genetically engineered salmon poses an unacceptable risk if the fish escape and interact with our wild salmon and that FDA must understand that risk to prevent harm,” said Earthjustice managing attorney Steve Mashuda. “Our efforts should be focused on saving the wild salmon populations we already have—not manufacturing new species that pose yet another threat to their survival.”

According to Alaska Public Media, AquaBounty Technologies President and CEO Sylvia Wulf released a statement saying the company is “disappointed” by the ruling. But she said it won’t impact operations at its egg growing facility on Prince Edward Island, Canada, or its fish farm in Albany, Indiana.

“It’s a terrible idea to design genetically engineered ‘Frankenfish’ which, when they escape into the wild (as they inevitably will), could destroy our irreplaceable salmon runs,” said Mike Conroy, Executive Director of the Pacific Coast Federation of Fishermen's Associations (PCFFA), in the Earthjustice statement. “Once engineered genes are introduced into the wild salmon gene pool, it cannot be undone. This decision is a major victory for wild salmon, salmon fishing families and dependent communities, and salmon conservation efforts everywhere,” he said.

As Pandemic Drags On, Consumers Seeking Health Drive Record Natural & Organic Sales as Retailers Adapt to Change

This article originally appeared in Presence Marketing’s August 2020 newsletter edition and on New Hope Network’s IdeaXchange.

By Steven Hoffman

More than five months have passed since the nation and world have come under the grip of the coronavirus. Today, as Covid-19 continues to surge throughout the U.S., we wait in lines to get into stores, wear face coverings (well, at least most of us), follow floor markers to help ensure social distancing, and shop quickly to get in and out with our groceries. The days of browsing, sampling product, and being entertained by large merchandising displays and the “theater of food” have made way in large part for safety and efficiency as consumers change their shopping behavior in brick and mortar stores, and increasingly turn to options including online ordering, curbside pickup and delivery.

One thing is for sure, though. The coronavirus crisis is bringing out better eating habits, based on recent sales data, as Americans seek to improve their health and immunity, and as core natural and organic consumers double down on healthy, clean food to help ensure the health and safety of their families during these “safer at home” times.

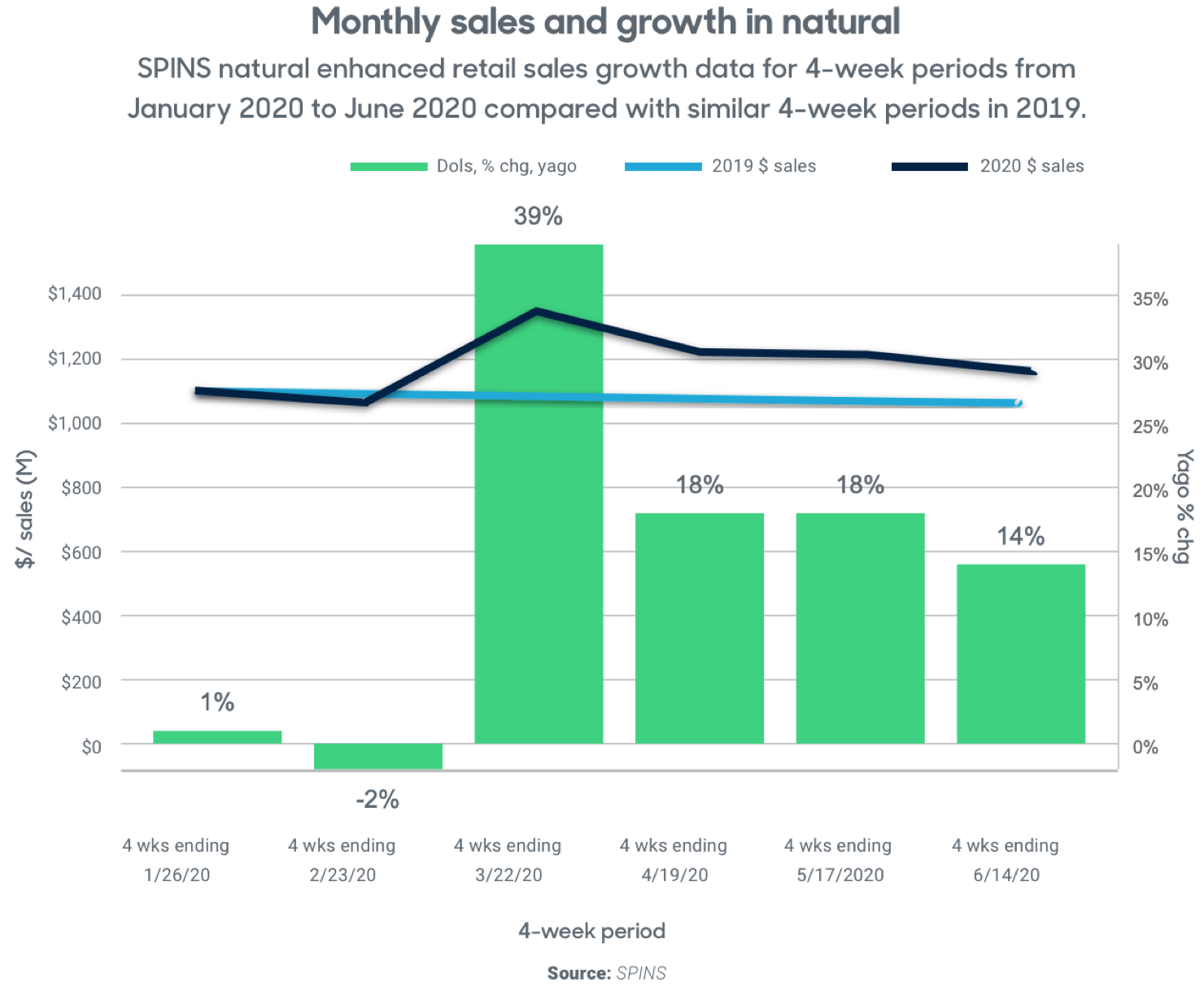

In fact, natural and organic products are experiencing significantly higher sales in 2020, and that trend may continue. After seeing a 39% spike in sales due to stockpiling for the four weeks ending March 22, 2020, compared to the same period in 2019, natural products retail sales for the four weeks ending June 14, 2020, increased 14% over the previous year, according to market research firm SPINS, as reported in New Hope Network’s Natural Products Industry Health Monitor. And that’s after back-to-back 18% increases in the four week periods ending April 19 and May 17, respectively, reported SPINS.

Chart Source: New Hope Network, SPINS

Organic Food and Beverage Sales Surge 25%

Bloomberg reported in July that Americans “are prioritizing nutrition over cost as Covid-19 infections continue to rise across the U.S.,” pointing to Nielsen data showing that sales of organic food and beverages surged 25% for the 17-week period ending June 27, 2020. Organic meat, seafood and frozen food saw the largest increases, Bloomberg reported. “We’re expecting strength to continue in organic and natural food sales,” said Bloomberg Intelligence analyst Jennifer Bartashus in the article. Given the lockdowns to prevent the spread of the virus, “a lot of people have used the opportunity of working from home to really make a lifestyle change – lose weight and exercise,” she said.

At the same time, Bloomberg noted, while unemployment has skyrocketed and value matters more than ever, declines in discretionary spending have allowed more room for premium and specialty foods, including natural and organic products. “People are starting to look at what they’re consuming more thoughtfully now,” Ted Robb, CEO of New Barn Organics, told Bloomberg. “People are not going to fly. They’re not going to the salon. Even though we’re in a recession, and people are trying to be careful, food is one area where they can spend a little bit more,” he said.

Dietary supplements, too, are benefitting from a focus on immunity and health, leading to the highest growth rate in over 20 years for this category, reported Nutrition Business Journal. NBJ projects supplement sales in 2020 will grow 12.1% across all categories, with immunity supplements growing more than 50%, to surpass $50 billion in sales. Of note, NBJ projects that e-commerce sales of nutritional supplements will grow a whopping 61.4% in 2020, compared to 7.1% in brick and mortar stores. Longer term, online sales of supplements could increase from 10% of the market in 2019 to 20% of the overall market by 2023, NBJ predicts.

Other natural and organic categories benefitting from the coronavirus crisis, according to SPINS and New Hope Network, include shelf-stable beans, grains and rice, which took off in March with 160% growth for the four weeks ending March 22, and which still reported a robust 26% growth rate in June. Sales of plant-based meat alternatives have risen significantly, too, as coronavirus cases at meat processing plants may have led to negative perceptions of the conventional meat industry and its supply chain.

Categories in sharp decline, however, as people continue to stay closer to home include cosmetics and beauty products, weight management formulas, water bottles and filtration, body care kits, deodorants and antiperspirants, and shelf-stable jerky and meat snacks, reported SPINS and New Hope.

Fighting for Foot Traffic

In examining how the pandemic is shifting consumer behaviors, research firm Gravy Analytics compared foot traffic at four leading groceries including Wegman’s, Whole Foods Market, Safeway and Publix through June 2020. Foot traffic at these stores was typical in February and early March. This was interrupted by a spike in mid-March when consumers began pantry loading. Subsequently, foot traffic at all four supermarkets in the study declined, reaching its lowest point in mid-April before leveling off in June, according to Gravy Analytics.

While all supermarkets in the study were impacted by the pandemic, Whole Foods Market fared worse, according to the data. For the week of June 14, foot traffic to Safeway and Publix was 28% and 26% lower, respectively, compared to the week of February 2. Yet, Whole Foods Market’s foot traffic was 44% lower.

“However,” the Gravy Analytics researchers emphasized, “while foot traffic is an important indicator, it doesn’t necessarily mean that fewer consumers are shopping at Whole Foods and Wegman’s. Less foot traffic in store could be a reflection of consumers opting to use new curbside and delivery services. Regular Whole Foods customers, for example, might be purchasing their groceries through Amazon instead. Consumers might simply be less familiar with Publix, Safeway, and Wegman’s curbside pickup and delivery services, making them more inclined to go into the store. While convenience isn’t a new consumer behavior trend, it is becoming more prominent as stores find new ways to give consumers a safer shopping experience, and consumers become more familiar with these services,” they said.

In a panel hosted by Winsight Grocery Business in early July, former Whole Foods Co-CEO Walter Robb expressed concern over the reduction in store traffic, and an associated “de-emphasis” on in-store merchandising during the pandemic. “One thing we’re seeing across all retailers is less trips,” Robb told the panel. “And in retail, the trip is precious, just precious. And they have stepped back significantly. The basket is gone up to counter that, so it was supposed to come out even. But the nature of it is that with the way the store is set up now, it becomes more transactional. There’s much less of a value in merchandising, etc., because folks want to get in and get out. And so, you know, whether it’s the reduction of SKUs or whether it’s the fact that you’re flattening or spreading out your displays or whatever, I think, the advantage of physical stores that from a merchandise perspective, particularly a retailer like Whole Foods, is minimized as a result of this.”

Planning When Everything Is Changing

“How do we shape our promotional strategy in a time when everything is changing?” asked Jonathan Lawrence, Senior Director of Grocery & Natural Living for Fresh Thyme Farmers Market. Based in Downers Grove, IL, Fresh Thyme’s hybrid mix of 70% natural/organic to 30% conventional product offerings in its 74 stores located throughout the Midwest help shoppers get everything they need in a value-based, one-stop shopping format, Lawrence said. “How do we provide amazing customer service and promotion and at the same time respect social distancing? How do we reach customers and support them in a safe manner? That’s the challenge, but is absolutely what is needed,” Lawrence mused.

Lawrence confirmed that, like other retailers, the customer count at Fresh Thyme is down, but the average basket purchase is up. “We are ramping up with the idea that this may come back hard in the fall,” he said. “We are starting to plan for the immune season and how we are going to tackle it differently; our responsibility is to be there for our customers. There are categories leading the way that haven’t before, such as zinc, immune support products, hand sanitizer, etc. Now, they are spiking and we are sometimes having to think outside the box with our vendors to get product on the shelf. We might opt for a different size or a different product to have something on the shelf,” he said.

Fresh Thyme plans to open a new store in downtown St. Louis in 2021, and hopes to incorporate what it is learning now into the new concept. “You are going to see the new evolution of Fresh Thyme with the new store and also with planned remodels. We’re going to craft the product mix around the customer and the local community,” Lawrence said.

“How do we change the fluidity of our supply chain and food system? We need a shorter runway in our supply system, and that’s the challenge,” said Corinne Shindelar, founder and former president of the Independent Natural Foods Retail Association (INFRA). “As an industry, we have always been about system changes and trying to make things better. We now have the opportunity to change the system pretty rapidly because we have the ears of society like never before. We could be influencing a more dynamic and robust outcome, but only if we do the work. We don’t know how long this pandemic will last. As such, I would put many contingency plans into the budget,” she advised.

To save money on delivery services – Instacart charges up to 8%, said Shindelar - she recommends that independent retailers could do something as simple as add a line to a cell phone as an ordering hotline. “We overcomplicate things,” she said. Shindelar also advised retailers to consider what to reopen. “If you were losing money at food service, with high labor costs and low margins, now is the time to consider working with local restaurants and food service operators that retailers can feature as grab-and-go meal solutions,” she advised.

Walter Robb, who served as co-CEO of Whole Foods Market when it became one of Instacart’s high profile partners, advised retailers on the Winsight Grocery Business panel to be sure to capture customer data when working with a third party delivery service. “If you don’t capture the data on your customers and know who they are, what they’re buying and be able to look at their basket adjacencies and the analytics, then you’re breathing in the dark in terms of growing business,” he cautioned.

At Cambridge Natural Foods, located in the heart of Boston, the family-owned business felt the shock of universities and colleges nearby closing, and people leaving the city for second homes when they could to escape the pandemic, said cofounder Michael Kanter. Out of an overabundance of caution, the store initially closed for a week in mid-March and then opened for curbside and delivery only. It fully reopened its doors on July 7, to the community’s – and family’s – relief. “In hindsight, it was painful to close, but we also saw that our staff and customers were vulnerable,” said Kanter. “Now, we are limiting the number of customers in the store, we’ve installed plexiglass protection, we’re doing a lot of curbside pickup and delivery, and we’ve limited hours to help keep our staff safe and sane. We’re back to about three-fifths of our normal volume,” he said.

There may be a silver lining in what we learn from the pandemic, Kanter offered. “We weren’t so conscious of public health and hygiene in public places before. We kind of know we are a part of each other but until you experience something like this, you don’t think about it. Now we are much more aware of how what we do affects others. Maybe that will propel us forward into realizing that caring and sharing are paramount in society.”

# # #

European Researchers Concerned About High Levels of Glyphosate in Foods

Photo: Pexels

Originally Appeared in Presence Marketing News, February 2020

By Steven Hoffman

“The toxic pesticide glyphosate should not be in the food chain,” researcher Thomas Bohn of the Institute of Marine Research in Tromso, Norway, told FoodNavigator in January 2020. His concern, along with that of other researchers in Norway and the U.K., is that glyphosate is the most widely used pesticide in the world due to its use on GMO soybeans, resulting, he says in higher levels of glyphosate residues in plants and food products. According to research published in Foods in late 2019, farmers in Argentina and Brazil from 1996 to 2014 have increased application of glyphosate in their fields “more than twice as high as the recommended doses used in most field trials.” Also, reports FoodNavigator, research has shown that late-season spraying of glyphosate – used as a desiccant and harvest aid in GMO and non-GMO soybeans – increases glyphosate residues in harvested soybeans by a factor of 10 or more. “These factors increase adsorption of the herbicide and augment residue levels in the harvested beans,” the researchers wrote. According to Bohn, the current risk assessment system only received data from field trials with soybeans that were sprayed with “much lower” doses compared to “contemporary commercial farms,” reports FoodNavigator. “All possible measures should be taken to reduce consumption of glyphosate, like avoidance of desiccation, reduced used by farmers, etc. Glyphosate should not be in the food chain,” Bohn told FoodNavigator. According to a CNN report, glyphosate increased the cancer risk of those exposed to it by 41%, according to a peer-reviewed study published in 2019.

Dean Foods Bankruptcy Impacts Natural, Organic Brands

Originally Appeared in Presence Marketing News, December 2019

By Steven Hoffman

Uncle Matt’s Organic Inc., a leading organic juice brand, on November 12 filed for Chapter 11 bankruptcy, along with dozens of other businesses owned by Dean Foods Company, the largest milk processor in the U.S.

Dallas-based Dean Foods (NYSE: DF) said the bankruptcy filings by it and all its subsidiaries in U.S. Bankruptcy Court for the Southern District of Texas comes as the company deals with losing its biggest customer, Walmart, which decided to build its own milk plant, and the impact of declining demand for milk as American consumers opt for plant-based beverage alternatives, reported Sustainable Business News, a subscriber-based organic and sustainable food industry online news site.

Founded in 1925, Dean Foods’ brand portfolio includes more than 50 national and regional dairy brands, including Country Fresh, DairyPure, Friendly’s, Garelick Farms, Land O’Lakes, Meadow Gold, Oak Farms Dairy, Swiss Premium, TruMoo, Tuscan Dairy Farms, and others. Among its natural and organic brand holdings, Dean Foods also owns juice maker Uncle Matt’s Organic, based in Clermont, FL, and is a majority stakeholder in flax-based plant beverage brand Good Karma, based in Boulder, CO.

The bankruptcy filing’s effect on those companies is uncertain at this point. Representatives from Uncle Matt’s have not issued comment, to date. In an email to BevNET, Good Karma CEO Doug Radi said Dean Foods’ bankruptcy has “no impact” on the brand, which remains an independent company with a separate leadership team and board of directors. “We remain dedicated to our mission of making dairy alternative food and beverage products that deliver a plant-based mighty bundle of nutrition,” he told BevNET.

In a statement to BevNET, CROPP Cooperative — which includes Organic Valley, Organic Prairie and Mighty Organic — said that, while it is “disheartened” by the bankruptcy, the joint venture it established in March 2017 with Dean Foods, called Organic Valley Fresh, a direct to store distribution system for Organic Valley products, is outside of the Dean Foods filing, meaning “it has no impact on the venture’s customers or vendors. Organic Valley remains strong and our business overall has been bolstered by new innovations we’ve brought to market, including Ultra, the first organic ultra-filtered milk,” the statement read.