Natural, Organic and Regenerative Food and Agriculture Surge in Popularity

This article first appeared in the May/June 2025 issue of GreenMoney Journal

By Steven Hoffman

The market for organic food and agriculture has grown significantly since the National Organic Program was first established in 2001, placing the USDA Certified Organic seal on products that qualify for this distinction. Today, it’s a $70 billion market that’s been growing an average of 8% per year. And while it may be maturing, younger consumers, including new parents and their babies, are eating it up. And now, in the post-pandemic era, investors are once again paying attention to the potential of organic and regenerative products and brands that take into account health and the environment, and how the way we produce our food and consumer products affects climate change.

A survey released in February 2025 by the Organic Trade Association (OTA), the industry’s leading trade group, found that organic’s benefits to personal health and nutrition are resonating deeply with millennials and Gen Zers, making them the most committed organic consumers of any generation. Also, a February 2025 study by the Acosta Group, one of the nation’s top natural and organic products sales firms, reflected that 75% of all shoppers purchased at least one natural or organic product in the six months prior to the survey, with 59% responding that they think it’s important that their groceries and/or household products are natural and organic because they “are better for them” and “they tend to have fewer synthetic chemicals and additives.”

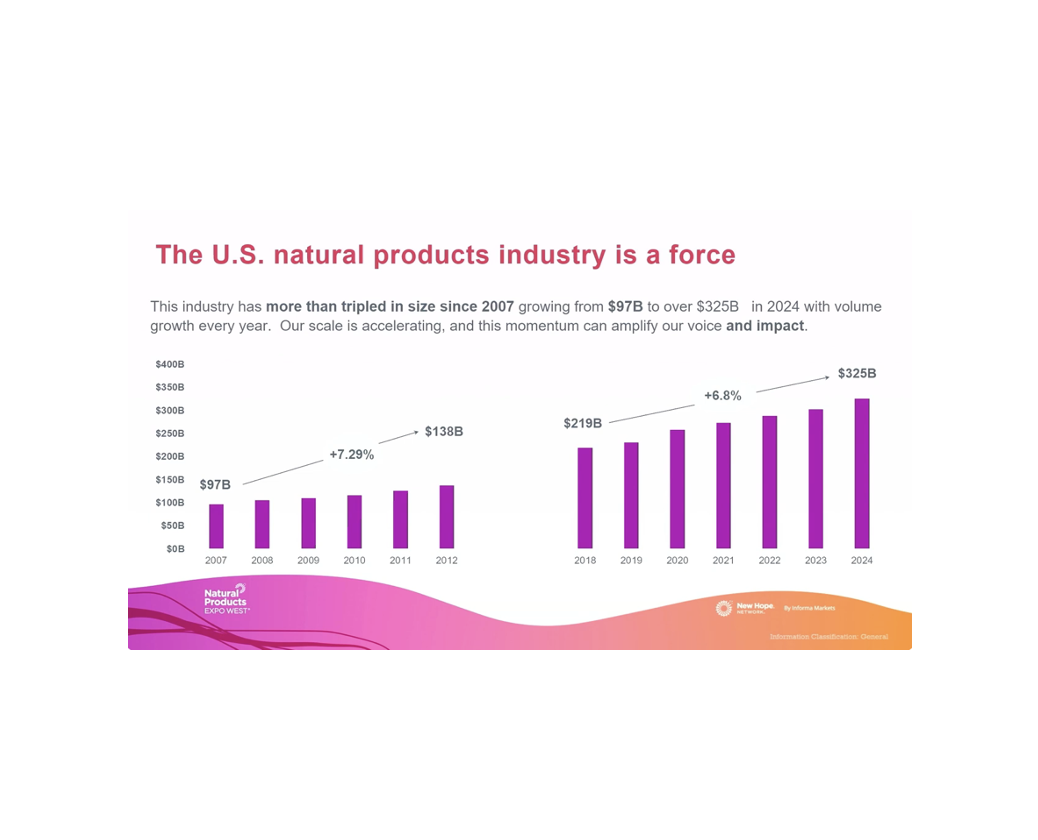

Natural and Organic Industry Is a Force

Overall, the natural and organic products industry combined has more than tripled in size since 2007, growing from $97 billion in sales in 2007 to over $325 billion in 2024, according to data compiled by New Hope Network, SPINS (a division of Nielsen), Whipstitch Capital and others, and presented at this year’s State of Natural & Organic keynote presentation at Natural Products Expo West, the world’s largest trade exhibition for the natural, organic, regenerative, nutritional and eco-friendly consumer products industry, held in March 2025.

“Wow, this industry is a force,” said Jessica Rubino, VP of Content & Summits for New Hope Network, at the keynote presentation. “That is a tremendous amount of growth. Today, we’re defining the industry as the natural, organic and functional food and beverage space, dietary supplements and personal care.” According to Rubino, the industry grew 5.7% in 2024, exceeding expectations. “The biggest piece of the pie is food and beverage, followed by dietary supplements and then personal care.” Rubino also said that while personal care is the smallest segment, it is the fastest growing and a category to watch.

“Natural products are absolutely continuing to accelerate again. Of course, they’re all outpacing non-natural products, and that’s even with not a whole lot of new items coming through,” said Kathryn Peters, Head of Industry Relations for SPINS and one of this year’s keynote presenters. “We’re also seeing more buyers coming in. This is being driven across many areas of the store, whether it’s refrigerated, grocery or vitamins and supplements. So, it’s just a resilient, wonderful story of growth we see in the industry. And really importantly, the game is continuing to be all about smart, profitable growth.”

In addition, “Organic is still very solid and strong, moving about the same pace as natural,” Peters said. “Consumers obviously have a strong awareness more than a lot of other certifications and a confidence in organic.” Certified regenerative products, too, showed significant growth of 20% in 2024, the panel noted.

“In just a little over two decades, the USDA Organic label has earned deep trust among consumers and has become one of the most identifiable food labels in our grocery stores,” said Matthew Dillon, Co-CEO of the OTA. According to OTA’s survey, more than half of U.S. consumers bought an organic fruit or vegetable in the last year. Consumers surveyed bought more bread in the last six months than any other food item, and 27% said they chose organic bread. For those surveyed consumers buying baby food, a whopping 93% chose organic. The USDA Organic label is particularly important for younger consumers, with over two-thirds seeking out the organic label in almost every food purchase. The Organic label was most valued in fresh food categories including fruits, vegetables, meat/poultry, baby food, eggs and dairy, and these items were the most likely products to be purchased as organic over the last 12 months.

Regenerative Agriculture Draws Investor Interest

In addition, regenerative agriculture — a system of farming that seeks to sequester carbon by rebuilding healthy soil — is among the sectors attracting more interest from impact investors, despite being an underfunded sector. However, there is growing consensus that the increasing threat to biodiversity is unsustainable and regenerative agriculture urgently needs to scale up. Now, groups such as Regenerative Food Systems Investors Forum and Impact Investor are drawing investor’s interest to the space.

One of the primary challenges to investing in regenerative food and farming is due to the fact that it requires significant upfront investment to transition from conventional farming. As such, many institutional investors remain hesitant due to uncertain returns and long payback periods. “This transition to regenerative farming is a long term one. That’s why intensive agriculture is so widespread, because it’s a very quick win. This is why you need investors to be patient and be willing to take some of the first loss and risk. This then accelerates the amount of private capital that will come in, because risk is protected,” said Harriet Jackson of responsAbility, a Swiss impact investing firm, speaking at Impact Investor’s 2024 conference in The Hague.

“Today…we are at what appears to be a crucial point in the transformation of agriculture and food systems. The momentum for regeneration is distinct,” said Sarah Day Levesque, Managing Director of Regenerative Food Systems Investment Forum, an investor’s organization seeking to build a more resilient food system. “There’s an increasing number of farmers pioneering the transition on the farm and increasing acreage. We can also see it in the incredible growth of organizations like EARA — the European Alliance for Regenerative Agriculture – designed to give rise to the voices of farmers in transition. Governments and public policy makers are acknowledging the very real risk presented by climate change and degradation of nature, including that caused by extractive agricultural practices. We are increasingly seeing policies and public sector investment that seeks to address these risks and support transition. Businesses and asset owners are starting to see and feel the importance of investing in nature and climate positive land use – seeing how critical investments in natural capital will de-risk production and create resilience in business models and investment outcomes.”

One organization seeking to foster investment in regenerative agriculture is the Boulder, CO-based Mad Agriculture, which in March 2024 launched Mad Capital, a $50 million investment fund aiming to de-risk regenerative and organic farming. With commitments from The Rockefeller Foundation, Schmidt Family Foundation and more, Mad Capital established its Perennial Fund II to provide loans to U.S. farmers to help them transition to regenerative and/or organic agriculture. The fund has made two closes and is “actively deploying capital to farmers,” said Mad Capital Co-founder and CEO Brandon Welch.

Natural and Organic Brands Are Outperforming

From an investor’s perspective, the overall natural, organic and regenerative products industry is looking better than it has in some time, asserted Nick McCoy, Managing Director and Cofounder of Whipstitch Capital, at the State of Natural & Organic keynote at Natural Products Expo West. “Over the last couple of years there’s been a lot of talk and a lot of pain for the lack of liquidity in this industry. It’s been very difficult for founders to find money compared to pre-Covid. Right now, we’re sitting in a very similar point as we were in 2010 or 2011 facing the millennial launch and emerging from the great recession…when it was very difficult to raise small checks. So, what's the hand of cards that we're playing in this industry now? Well, we have natural products that are very attractive. They're outperforming…consumers are running to them. We have positive ROI in cash invested. Cash invested is resulting in big revenue gains right now, and ultimately dollars chase dollars,” McCoy said.

“We may not have had as much M&A or fundings over the last two years, but…we've built a tremendous amount of value in this industry. And when you see more consumers spending more money in wellness, investment in M&A and other dollars eventually catch up and that's what's going to happen. CPG investors right now are sitting on a very large pool of illiquid but very attractive assets. There's a lot of viable brands that are growing faster than basically the broader market... Interest rates are starting to stabilize. We're seeing more fund closings and more investors getting more liquid money and the amount of illiquid value locked up is going up.”

According to McCoy, it’s not just the “big strategics" buying natural food brands. The natural products industry itself is seeing companies growing large enough to potentially become buyers themselves. “We’re seeing lots of talk about the IPO market starting again. Before 2021, I could probably count on one hand the number of brands that IPO’d in this industry. Now it sounds like it’s going to come back,” McCoy shared.

“There’re a lot of different ways that people get to liquidity,” McCoy added. “And once it does get liquid, then basically the money will flow from the bigger funds to the smaller funds, and the longer it takes, the more money these individual investors are going to get — surprising amounts. They thought they were going to get five times their money or 10 times their money investing in the company in 2015, and now it's grown so large they get 50X when it sells. And that's a true case of some that recently sold.”

According to McCoy, the $100-$300 million in revenue independent natural CPG brands — a group showing “tremendous growth” — represent major M&A and consolidation opportunity. “If we look at some of these recent high-profile deals, two, two and a half, three times revenue are where some of these things are trading. So, if we apply a two and a half times revenue multiple using SPINS sell-through data, you can see that this kind of locked up illiquid value that was $13 billion two years ago is up to $19 billion now. And when you think about a number like that, when that money starts to go back to investors, if you're an investor and you put $25,000 into a company expecting to get $250,000 and suddenly you get $1.5 million, you're going to be investing a lot more than $25,000 into other companies and that's going to bring the liquidity back over these next few years. It's really exciting to me.”

Resources

● The State of Natural & Organic — Keynote Presentation recorded at Natural Products Expo West 2025; watch here.

● Nutrition Capital Network — With news, resources, and events, NCN brings together active investors and innovative companies in health, nutrition and wellness,, www.nutritioncapital.com

● Whipstitch Capital — A leading investment bank tracking the food & beverage and health & wellness space, www.whipstitchcapital.com

● Big Path Capital — A leading investment bank and annual conference for impact investing and “Impact CEOs,” www.bigpathcapital.com

● MAD Capital — An investment fund for regenerative and organic ranchers and farmers, www.madcapital.com

● Regenerative Food Systems Investment Forum — An investor’s organization seeking to build a more resilient food system, www.rfsi-forum.com

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, regenerative and sustainable products businesses. Contact steve@compassnaturalmarketing.com.