Can Trump’s Support Move the Needle on CBD?

Could President Donald Trump's recent endorsement of hemp-derived CBD products provide new momentum for an industry that has struggled in recent years under a patchwork of inconsistent state and federal regulations?

This article first appeared in the November 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In what industry observers have called a surprise move, on Sept. 28, President Donald Trump posted a video on his Truth Social platform promoting the health benefits of cannabinoids, suggesting that covering hemp-derived CBD under Medicare would be a “game changer” and “the most important senior health initiative of the century.” At a time when some members of Congress are pushing for policy changes that could upend the CBD market, Trump’s implied endorsement of CBD is remarkable.

Trump’s post supporting Medicare coverage for CBD products sparked a 36% rise in publicly traded cannabis stocks in the weeks that followed, Yahoo Finance reported. The post also raised hopes that the White House might take a more permissive approach to marijuana regulation following Trump’s statement in August that his administration was exploring a potential reclassification of marijuana — an effort originally proposed under the Biden administration. Removing cannabis from its Schedule I status would mean the federal government acknowledges the plant’s medicinal value.

“I’ve heard great things having to do with medical, and I’ve [heard] bad things having to do with just about everything else,” Trump said during an Aug. 11 White House press conference. “But medical and for pain and various things, I’ve heard some pretty good things.”

The video Trump shared was produced by The Commonwealth Project, an organization dedicated to improving health and longevity for older Americans. It was founded by Howard Kessler, a billionaire and philanthropist with ties to the CBD industry and a longtime friend of Trump’s. According to Independent Voter News, Kessler believes “that medical cannabis could be harnessed to not only provide older Americans with an alternative to traditional prescription painkillers but to reduce soaring health care costs saddling millions of seniors.”

In the video promoted on Truth Social, CBD was described as a way to "revolutionize senior healthcare" by helping reduce disease progression. The narration claimed CBD could help “restore” the body’s endocannabinoid system and ease pain, improve sleep and reduce stress in older adults. It also cited a Fox News segment referencing a Price Waterhouse Coopers report that estimated potential cost savings of “$64 billion a year if cannabis is fully integrated into the healthcare system.”

A Boston- and Palm Beach, Florida-based entrepreneur and philanthropist, Kessler founded Kessler Financial Services, which helped pioneer affinity credit cards. He later obtained one of Massachusetts’ first medical marijuana licenses in 2014, and became the state’s first recreational seller before his company was acquired by a Georgia cannabis firm in 2019. In June 2024, Kessler appeared on Fox News to discuss his efforts to integrate medical cannabis into traditional health care for seniors.

Regulatory Confusion Hinders CBD Market

Regulations around the commercial use of hemp and CBD were significantly eased across the U.S. when industrial hemp was legalized under the 2018 Farm Bill during Trump's first term. However, since its passage, a growing number of state-level battles and lawsuits have emerged regarding the definition of hemp, the “intoxicating hemp” loophole around hemp-derived Delta-8 THC, and the lack of consistent federal and state regulatory frameworks for the cultivation, manufacture, marketing and sale of hemp-derived cannabinoids such as CBD, according to national law firm Buchanan Ingersoll & Rooney.

Trump’s implied endorsement of CBD comes as a bipartisan group of lawmakers pushes back against attempts to ban hemp-derived THC products, arguing that such action would “deal a fatal blow” to the hemp industry and violate congressional rules. In a letter sent to House Speaker Mike Johnson (R-LA) on Sept. 26, House Oversight and Government Reform Committee Chairman James Comer (R-KY) and 26 other members warned that appropriations legislation containing hemp ban provisions would devastate the industry that emerged after hemp’s 2018 legalization.

A group of eight Democratic senators also sent a letter in September urging leadership to pursue regulation rather than prohibition, warning that banning products containing any amount of THC would trigger major upheaval in the hemp market. (Under the 2018 Farm Bill, hemp is legally defined as containing no more than 0.3% THC on a dry weight basis.) Meanwhile, dozens of hemp farmers from Kentucky have urged Senate Minority Leader Mitch McConnell (R-KY) to back away from efforts to re-criminalize certain hemp-derived products, Louisville Public Media reported.

Kentucky Sen. Rand Paul also warned that the cannabis policy movement has “swung hard on the prohibitionist side.” In June, he introduced the Hemp Economic Mobilization Plan (HEMP) Act to counter potential restrictions, proposing to triple the amount of THC allowed in hemp while addressing several other regulatory challenges facing the industry.

For its part, the U.S. Food and Drug Administration (FDA) reaffirmed in January 2020 that it is unlawful to introduce food containing added CBD into interstate commerce, or to market CBD as, or in, dietary supplements. Now, according to Marijuana Moment, while Trump was endorsing CBD on Truth Social, the FDA quietly updated its adverse drug event reporting forms to track incidents related to hemp-derived cannabinoids, including CBD — part of an effort to gather more data on potential health effects associated with such products.

Hemp Industry Responds to President’s Support

In an Oct. 7 letter to President Trump, Jonathan Miller, legal counsel for the U.S. Hemp Roundtable, praised the president’s acknowledgment of hemp’s potential and urged him to oppose the proposed hemp ban:

"The recent video you shared about the extraordinary value of hemp products was important, raising awareness on the positive impact our American-grown and manufactured products have. Here at the U.S. Hemp Roundtable, our members are focused on giving Americans choices in improving their overall health and wellness ... but now we need your help! Congress is close to passing a hemp ban, reversing the work you led in 2018 to make hemp blossom. A proposed definition change to hemp, being touted as protecting Americans, would wipe out 95% of this uniquely American industry that you are so proud of,” Miller stated.

He continued: “A more effective way to protect American consumers and jobs would be to support and demand robust hemp regulation — age restrictions along with uniform testing, labeling, and packaging requirements. Outright prohibition is not the answer, nor would it make anyone safer. Banning legal hemp products that are already regulated at the state level will not protect consumers; it would only shift hemp to the black market and destroy a rising American industry in the process. ... A ban would put American farmers, American businesses, American consumers, our veterans, seniors, and more than 328,000 American workers at risk."

Miller added that "American voters are on your side on this issue. In Texas, a state with a rapidly growing hemp market, 76% of your voters and 78% of seniors favor legal, regulated hemp sales. In fact, more than 62% of Texans say they are more likely to support candidates who back the regulated sale of hemp-derived products."

Bottom line: Trump’s apparent support for CBD could mark a turning point for a sector long constrained by legal uncertainty. Whether the endorsement leads to meaningful policy change remains to be seen — but it has already reignited momentum, investment, and public discourse around hemp-derived wellness products in America’s fast-evolving natural health market.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

After Boom and Bust, Could Hemp Market Be Stabilizing?

This article first appeared in the May 2024 issue of Presence Marketing’s newsletter.

By Steven Hoffman

Could the hemp industry be on the cusp of a turnaround? After several years of volatility for U.S. hemp growers, prices and acreage in many states are beginning to stabilize or are rising modestly, according to the National Hemp Report, published by the U.S. Department of Agriculture (USDA) in April 2024.

According to the USDA, the value of U.S. hemp crop production in 2023 totaled $291 million, up 18% from 2022. Based on a survey sent out in January 2024 to producers across the country as part of USDA’s national agriculture census, the report shows signs of renewed market growth and improved on-farm efficiencies. “There was the big boom, then the big falloff, and this year everything is sort of leveling out,” Joshua Bates, a USDA statistician who wrote the landmark National Hemp Report, told MJBiz Daily.

“The hemp industry is stabilizing into its various categories including: 1) cannabinoids, nutraceuticals and flower; 2) food, feed and nutrition; and 3) fiber and industrial materials and applications. At this time, a much clearer picture is emerging as to where these categories can end up over the next three, five and ten years,” said Morris Beegle, publisher of Let’s Talk Hemp and producer of NoCo Hemp Expo, the leading trade show and conference for the hemp industry.

“The past several years posed significant challenges, starting with the pandemic’s onset and exacerbated by the federal government’s regulatory ambiguity regarding CBD and hemp-derived cannabinoids. Add to that burdensome regulations imposed on farmers endeavoring to cultivate hemp fiber and grain – crops that deserve equitable treatment akin to any other commodity. Such circumstances deter participation in this budding industry. What we truly require are coherent federal regulations applicable universally, instead of disjointed state-level initiatives that render the industry vulnerable and unsupported,” Beegle said.

Recovery on the Horizon

Production of industrial hemp for food, fiber and flower took off after it was legalized in the 2018 federal Farm Bill. In the years before the Covid pandemic, hemp acreage was on the rise, entrepreneurs and investors flocked into the market, and there was an explosion in the number of CBD and other hemp-related brands.

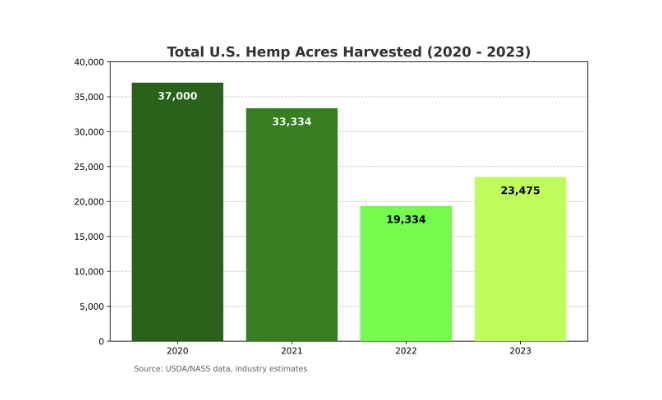

However, since 2020, the market for products made from hemp (defined as containing less than 0.3% THC) experienced a significant downturn, sparked by the pandemic and made worse by a lack of regulatory consistency over CBD and other hemp-derived cannabinoid compounds from the U.S. Food and Drug Administration (FDA) and state regulators. Investors pulled back. Brands did everything they could to survive; some didn’t. Overproduction during this time, too, led to steep drops in the price of hemp. As a result, hemp acreage plummeted from an estimated peak of 37,000 acres harvested in 2020 to a little more than 19,000 acres harvested in 2022.

Now, according to USDA’s hemp report, overall hemp acreage harvested in 2023 increased 21% to a total of 23,475 acres, signaling a potential turnaround in the market.

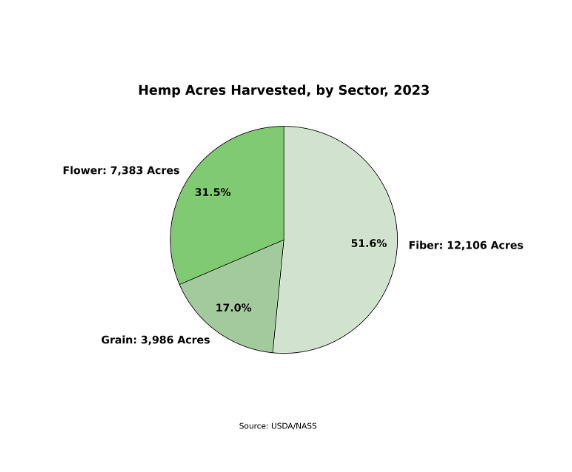

Hemp flowers for CBD and other hemp-derived cannabinoids -- including the intoxicating compounds Delta 8 and Delta 9 – dominated the market in 2023. While flower acreage remained relatively flat at approximately 7,000 acres in 2023, flower producers experienced an income gain of 35%, according to USDA data. Of the $291 million in market value for hemp in 2023, $241 million of that income came from hemp flowers. However, based on regulatory and safety concerns around Delta 8 and other hemp-derived psychoactive compounds, a number of industry observers feel this growth may be unsustainable, as lawmakers could severely limit the sale of these products.

Speaking of the hemp flower sector, economist Beau Whitney of Whitney Economics said, “It is quite possible that the cannabinoid industry has peaked. The excess inventories are mostly depleted and there is not enough acreage, in our view, to backfill with enough supply to sustain the level of sales experienced currently. This is a mistake by legislatures and regulators and now opens the door up for cheaper, but potentially lesser quality imports,” he cautioned.

Hemp grown for fiber – used in textiles and industrial applications – accounted for 52% of all hemp acreage harvested in 2023. While acreage grew, USDA reported that prices dropped and farmers brought in less income. However, says Whitney, “Hemp fiber is where we are forecasting significant growth in the short term, while cannabinoids and grains get sorted out. Hemp for plastics and automotive are already established in the global marketplace and are expanding in the United States. Hemp as a construction material is also increasing, but that growth has been somewhat sluggish in its initial ramp-up.”

Regarding hemp grown for food and grain, Whitney remarked, “The food industry is pretty steady. One major game changer would be FDA approval for hemp grains as an animal feed. It appears that the FDA is setting up unrealistic requirements for cannabinoid content in feed, so much so that consumers/animals would have less strict requirements for heavy metals and poisons than CBD content. There is a huge market for hemp grain internationally, but other supply chain issues and geopolitical tensions are impacting expansion efforts by U.S. hemp operators.”

According to USDA’s National Hemp Report, hemp grown for grain accounted for 17% of all hemp acreage harvested. Canada and China remain the world’s leading countries for hemp grain production, yet, as plant-based foods become more popular, U.S. growers stand to benefit from opportunities in growing hemp for food, as it is one of the richest plant-based sources of protein, essential fatty acids and other key nutrients.

“The use of hemp in automotive, pulp and paper (packaging), and building material applications are all increasing in the pace of growth,” Whitney added. “The major headwind is the narrative that hemp is a drug. The lack of awareness and education by policymakers on the potential of hemp is its limiting factor. Policymakers are using a sledgehammer instead of a scalpel when making hemp policy, and it’s having a ripple effect throughout the industry from an operator, investor and infrastructure perspective,” he said.

Stuck Between FDA and the MJ Industry

“There are two big battles going on in Washington, DC, right now. One is the hemp industry against the FDA. The other is hemp vs. marijuana,” observed Jonathan Miller, General Counsel of the U.S. Hemp Roundtable, the hemp trade’s leading advocacy and lobbying group.

“We’ve been trying to get the FDA to regulate CBD and other extracts. First, they said they were working on it and now they say they need congressional authority. It’s a game of pointing fingers – Congress says it needs guidance from FDA, and FDA says it needs direction from Congress, so we’ve got a stalemate. However, there has been a lot of congressional and public pressure on FDA to act, so that may be a reason why the agency is talking to us now,” Miller said. “We would love to see something resolved this year; there is talk of an interim step where Congress could potentially pass a law to validate existing state programs in the absence of consistent federal regulations. The Farm Bill may not happen until next year; meanwhile our efforts to find a vehicle for this compromise will continue.”

And, Miller said, “As always, we advise companies to act like they are being regulated by the FDA as a dietary supplement or a functional food and beverage product, and to operate within those regulations.”

In referring to competition with operators in the marijuana space, Miller said, “Regarding the marijuana industry, it is not monolithic, but there are a growing number of organizations that have made it their objective to kill the hemp industry as a means to capture competitive gain. This includes ATACH, the American Association for Hemp and Cannabis – though there are no hemp members – and the US Cannabis Council. Both have introduced plans that they would like to see in the Farm Bill to federally criminalize any hemp product that has any level of THC in it. That would criminalize all but CBD isolates,” he said.

“We are fighting both in the public eye and behind the scenes right now, and there’s a big battle going on in California in this regard. This is a threat we have to watch from the left flank. We are hopeful that any effort like this will die in Congress, but we are not banking on it; in fact, we are working very hard to prevent it. Just last week, we met with 55 different members of Congress and staff to discuss these issues and to present the hemp industry's position,” Miller added.

“All sectors of the hemp industry are growing, with the cannabinoid sector growing rapidly, to the point where it is outpacing the marijuana industry,” observed cannabis industry attorney Rod Kight of Kight Law. “The opportunities exist for nimble companies that are willing to take the time to navigate the rapidly evolving regulatory landscape and who can pivot as needed when regulations and markets change. I have hope that hemp can lead the path to true and comprehensive cannabis reform.”

FDA’s Position

When asked if the FDA could envision a scenario in which it would allow the sale of CBD as a dietary supplement without congressional action, Patrick Cournoyer, Senior Science Advisor with the FDA replied with the following:

“The FDA has concluded that the existing regulatory framework for dietary supplements is not appropriate for CBD. Given the available evidence, it is not apparent how CBD products could meet the safety standard for dietary supplements. For example, we have not found adequate evidence to determine how much CBD can be consumed, and for how long, before causing harm. Therefore, we do not intend to pursue rulemaking allowing the use of CBD in dietary supplements.”

Cournoyer’s office referred to FDA’s statement from January 2023, where the agency concluded that “existing regulatory frameworks for foods and supplements are not appropriate for cannabidiol,” and that it will work with Congress on “a new way forward.”

Added Cournoyer, “The FDA supports sound, scientifically based research into the medicinal uses of drug products containing cannabis or cannabis-derived compounds and will continue to work with companies interested in bringing safe, effective, and quality products to market.” Cournoyer referred to guidelines published on FDA’s webpage, “FDA and Cannabis: Research and Drug Approval Process.”

In addition to food, supplements and drugs intended for human consumption, FDA has regulatory oversight of animal feeds. Regarding the use of hemp in animal feed, an FDA spokesperson said, “After comprehensive review of data submitted by a sponsor, in January 2024, the FDA recommended to the Association of American Feed Control Officials (AAFCO) that a proposed ingredient definition for hemp seed meal in the feed of laying hens be included in the AAFCO Official Publication. The FDA has not reviewed any other submissions for the use of hemp seed or hemp seed derived ingredients in animal food.”

Wendy Mosher, VP of the Hemp Feed Coalition, told AgWeb in January 2024 that allowing hemp seed meal into feed mixes for laying hens marks the first hemp feed ingredient to get federal recommendation and interest by AAFCO. “You can’t have a commodity crop without a feed opportunity for that crop,” Mosher said.

In the absence of federal approval of hemp in animal feed, Texas legalized hempseed oil and hempseed meal for chickens and horses in 2023. Kentucky in 2022 allowed a limited amount of hempseed meal and hempseed oil as ingredients in the diets of layer, broiler, and breeder chickens. Montana legalized hemp or hemp-derived products in 2021 for “non-consumption animals,” i.e., pets, specialty pets, and horses, reported Hemp Benchmarks. However, in December 2023, New York Governor Kathy Hochul vetoed bills to allow hemp seed in animal feed, citing the need for more information.

While federal lawmakers and regulators move slowly in allowing the use of hemp in animal feed, USDA is providing grants to universities and others to research the potential use of hempseed, meal and biomass in animal feed. For example, researchers at Prairie View A&M University in Texas in 2023 received a $300,000 grant from USDA to explore hemp as an alternative grain in animal feed.

Building with Hemp

Building with hemp in the United States is increasing year over year, said Jean Lotus, Editor and Publisher of HempBuild Magazine. “Prices on building-grade hemp hurd remain high and the supply chain is neither complete, nor consistent. But hemp building in the United States is capturing the imaginations of developers and motivated owner-builders. Notable projects this year include a multi-unit tip-up hempcrete panel project in Newburyport, MA, and successful attainable hempcrete housing built by the Lower Sioux of Morton, MN,” she said.

“People may say hemp is dying, but it also recently received approval from the IRC (International Residential Codes) for the use of hempcrete in the U.S. for commercial construction,” noted James Johnson, Principal of JJGro in San Antonio, TX. Johnson, who discovered hemp’s healing properties while dealing with PTSD after 21 years of service in the U.S. Air Force, consults with hemp producers throughout the country. “Hemp is starting to be considered as part of the mix in mainstream commercial construction. It’s not going to replace traditional materials, but it will capture between 2% and 5% of the building construction space, Johnson predicted.

Lotus added that research in hemp building materials received significant funding in the past year, including $1.9 million from the U.S. Army; $1.5 million from the Department of Energy; and $1.1 million from the New York State Energy Resource and Development Authority (NYSERTA).

“Meanwhile, the regulatory environment for hempcrete's superior insulation and carbon sequestering properties is improving,” she said. “In April 2024, the U.S. Department of Energy released a roadmap to decarbonize the U.S. building industry. The report, Decarbonizing the U.S. Economy by 2050: A National Blueprint for the Buildings Sector, emphasized building with biogenic, regenerative materials. Hemp-lime and hemp-batt insulation perfectly fit the bill! With new companies developing carbon credits for hempcrete projects, there is more excitement and investment opportunity to come.”

“We are seeing increased interest in hemp across the board from consumers, universities, and large corporations wanting to utilize hemp as an input or ingredient. I think there's opportunities in every sector for savvy, smart business operators. While cannabinoids provide the biggest boom/bust potential, there are long term opportunities in the fiber and grain markets as the regulatory framework within those categories will eventually get to a point of any other commodity crop, for the most part,” said Morris Beegle.

“As to headwinds, it's still all political and bureaucratic,” Beegle added. “The industry needs to be unified in its voice to combat correctly, and I think we have made real progress the last few years with the vast majority of the ‘real’ industry aligning on messaging and action. We’re also seeing progress and persistence of the industry in delivering on the promise of hemp as an alternative resource to many of the world's current and future problems. The future is bright regardless of what some in the media, and some on social media, would like people to believe.”

Save the Date: NoCo Hemp Expo, Aug. 10-12, 2025, Estes Park, CO

U.S. Hemp Leaders Unite on Plan of Action as 2023 Farm Bill Deliberations Approach

FOR IMMEDIATE RELEASE

Key industry stakeholders convened at the NoCo9 Hemp Expo in March to finalize a policy document that 31 nonprofits have now signed.

WASHINGTON, D.C. (April 24, 2023) – As the 2023 Farm Bill deliberations approach, U.S. hemp leaders are united behind a plan of action. And this unprecedented alliance among 31 nonprofit hemp organizations portends promise for congressional enactment of the industry’s agenda.

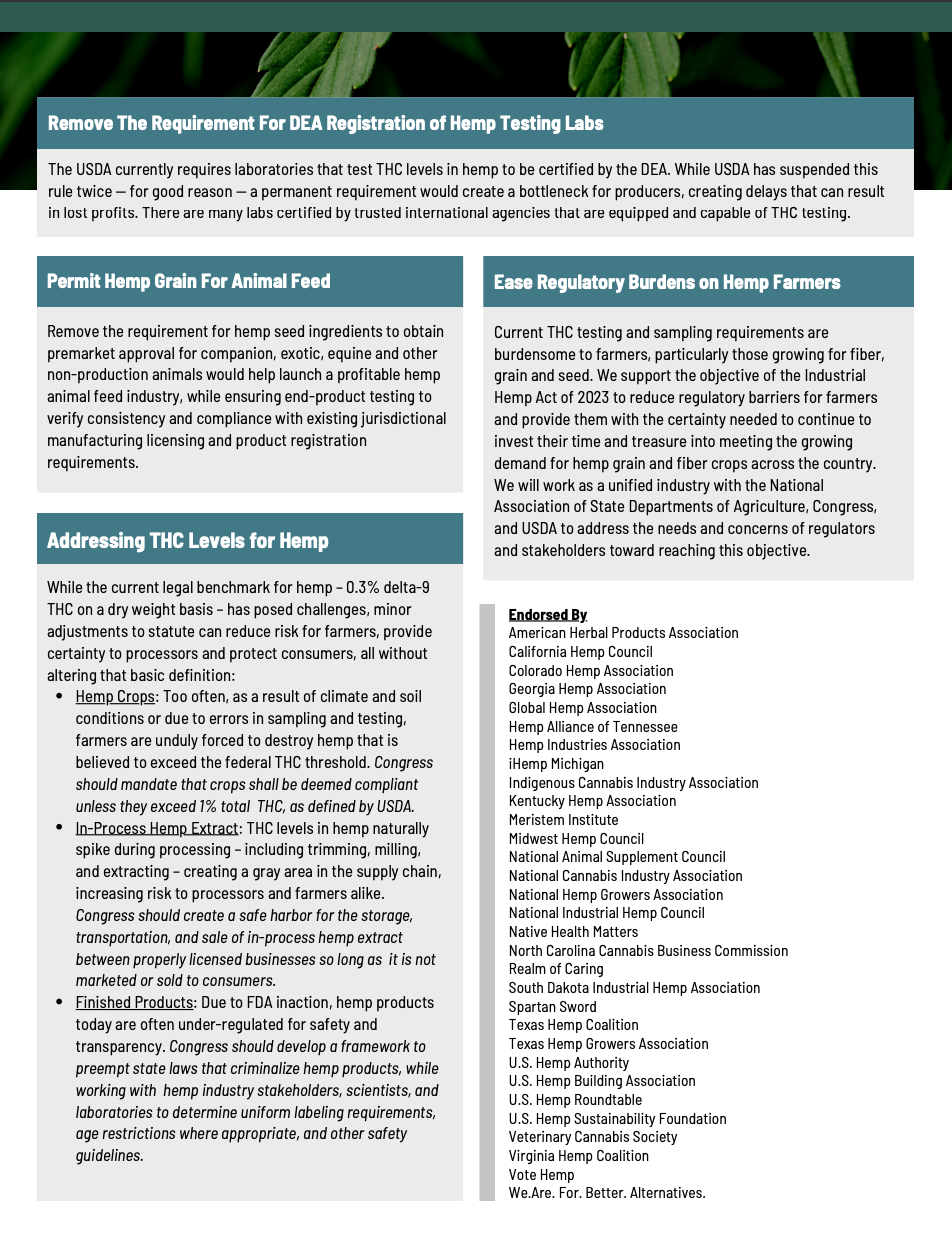

This winter, three of the nation’s leading hemp organizations – Hemp Industries Association (HIA), National Industrial Hemp Council (NIHC) and U.S. Hemp Roundtable (USHR) – joined in collaboration for the very first time to develop a series of policy priorities for enactment in the 2023 Farm Bill. The three groups then asked industry leader Morris Beegle to convene a meeting of more than 75 key hemp stakeholders at the leading national hemp gathering that he produces, the NoCo Hemp Expo. After an intense discussion, and follow-up breakout groups to expound on the deliberations, a priority policy document was finalized. Since then, 31 state, regional and national nonprofit organizations have signed on in support.

The document, attached hereto, lists nine key policy priorities for consideration by Congress. These include requiring FDA to regulate hemp extracts such as CBD; easing the regulatory burden on hemp farmers; repealing the hemp felon ban from the 2018 Farm Bill; and addressing THC limits for hemp. This document is being shared with key members of Congress and will serve as the foundation for drafting legislative language to be included in the Farm Bill.

NIHC President and CEO Patrick Atagi praised the work of the hemp industry for broadly coming together to endorse hemp priorities and hemp-specific Farm Bill priorities. “’Working Together Works’ are true words taught to me by my mentor, former USDA Undersecretary William ‘Bill’ Hawks,” Atagi said. “I am glad to see the hemp industry come together; it is a sign of great things to come.”

“This is an historic moment for hemp,” stated Jonathan Miller, USHR’s General Counsel. “The five years since legalization have been challenging, and the 2023 Farm Bill is our next and best opportunity to take this industry a step forward. The unity within the industry is remarkable and telling: Our shared voice will resonate with Congress and help us turn this opportunity into meaningful progress for hemp farmers and product consumers.”

Said Morris Beegle, co-founder and president of We Are For Better Alternatives, or WAFBA: “The last five years have taught us a lot, and more than anything, that we as stakeholders need to align our interests and our voices going into the 2023 Farm Bill so that we correct the regulatory deficiencies that have plagued the growth and development of this nascent industry. I’m optimistic and encouraged by so many organizations coming together at this time to collaborate and work in unison to improve the future of the hemp industry.”

Contact

Morris Beegle, WAFBA, info@nocohempexpo.com

Steven Hoffman, Compass Natural, steve@compassnaturalmarketing.com, tel 303.807.1042

NoCo9 Speakers Urge Industry Unity Moving Forward

FOR IMMEDIATE RELEASE

The ninth annual NoCo Hemp Expo featured numerous speakers who emphasized the importance of the hemp industry heading into the future with shared goals and values.

LOVELAND, CO (April 4, 2023) – The 9th annual NoCo Hemp Expo, the world’s most comprehensive hemp business conference and trade show, featured speakers from all over the hemp business world, who came together to move the industry forward with examinations of policy, processing, supply chain and opportunity. Over three days of programming, speakers and workshops focused on the need for a united voice if the industry is to achieve its potential.

In his opening remarks, show producer Morris Beegle noted that industry leaders agree on 95% of what needs to be done to advance the hemp supply chain. “We need to leave the 5% behind and join hands to march with one voice to make this hemp industry what we know it can be,” he said.

Longtime industry leader and cannabis legal expert Bob Hoban echoed the message, urging hemp industry participants to look at their competition as “co-opetition” and reminding the audience that the hemp supply chain is complex. “Everyone is under the misconception that they can do things on their own,” he said.

Unprecedented Partnership and Collaboration

Jared Stanley, chief operating officer of CBD company Charlotte’s Web, said partnerships like the one his firm has with Major League Baseball will propel the hemp industry’s success. “Education is the foundation of our partnership,” he said. Stanley also noted that the company’s mission and vision “aligned” with the MLB’s, with both organizations dedicated to player wellness. It is the first such partnership for a CBD brand and a national athletic league.

In an unprecedented meeting, over 50 participants from more than 10 hemp advocacy and policy organizations gathered to emphasize the points where they agree on moving federal policy ahead. U.S. Hemp Roundtable General Counsel Jonathan Miller opened the meeting by saying that he hoped participants would stay positive and work together to gain more policy advantages for the industry.

Expo producer Morris Beegle was upbeat.

“I have always focused on optimism, positivity and bringing industry stakeholders together,” Beegle said. “I’m pleased with the energy and outcome of this year's three-day show.”

NoCo Hemp Expo will take place again next year at The Broadmoor Resort in Colorado Springs, from March 20-22, 2024.

First Citizens Bank, EarthX, Patagonia Led Distinguished Group of Sponsors

NoCo Hemp Expo is pleased to recognize our Sponsors, including Presenting Sponsor First Citizens Bank. “Having a leading, agriculture-focused financial institution such as First Citizens Bank, with its 100-plus-year history of serving farmers and ag-related businesses, step up and serve as Presenting Sponsor of this year’s NoCo Hemp Expo is a huge statement, providing vital credibility and legitimization for the industry at a time when it’s needed most,” said Beegle. “We’re also thrilled to welcome EarthX as our Environmental NGO partner and Patagonia as Sustainable Apparel Sponsor. Additional lead sponsors include Global Fiber Processing, Michael Best, CannaConsortium, Advanced Bio-Materials Technologies, Divita Hemp Block & Weaving Vibes. We are very excited about these categories that bring focus to areas where hemp can make a difference in sustainability and improving the environment.”

2024 NoCo10 Announced

The 10th NoCo event will be held at The Broadmoor from March 20-22, 2024. To exhibit or sponsor, click here.

About NoCo Hemp Expo

For a decade, NoCo Hemp Expo — the world’s most comprehensive industrial hemp exposition and conference — has brought together international business and government leaders, academics, nonprofits, media and the public to collaborate on important initiatives, opportunities and solutions for the future of a crop and an industry that can have significant positive impact on human, animal and planetary health.

NoCo is produced by We Are For Better Alternatives (WAFBA), a leading organization dedicated to the advancement and advocacy of hemp farming, processing, production, innovation, education and legalization. WAFBA also is the publisher of Let’s Talk Hemp, the industry’s leading news source. Learn more about the hemp and cannabis industry and subscribe to the latest news at www.letstalkhemp.com.

Contact

Morris Beegle, WAFBA, info@nocohempexpo.com

Steven Hoffman, Compass Natural, steve@compassnaturalmarketing.com, tel 303.807.1042

Just Released: Hemp Industry 2023 Opportunities Report

FOR IMMEDIATE RELEASE

Let’s Talk Hemp presents the Hemp Industry 2023 Opportunities Report, the third annual overview of the key topics and trends that will affect the hemp industry in the year ahead.

What: Hemp Industry 2023 Opportunities Report

When: January 20, 2023

Where: https://letstalkhemp.com/hemp-industry-opportunities-report/

Free copy with the purchase of 9th Annual NoCo Hemp Expo Platinum or Conference ticket: https://www.nocohempexpo.com/ticket-sales/

Loveland, CO (January 20, 2023) – The third annual Hemp Industry Opportunities Report will be released today and is available for purchase at an introductory rate of $99 – and for free with the purchase of a Platinum or Conference ticket to the 9th Annual NoCo Hemp Expo.

“This report brings together information from all corners of the hemp industry to showcase the opportunities available and guide industry members in the year ahead,” said Morris Beegle, president of We Are for Better Alternatives (WAFBA), whose Let’s Talk Hemp Media outlet published the report.

The hemp industry’s road to success over the past few years has been challenging, compounded by uncertain regulatory oversight, supply issues and a global pandemic. However, a growing number of intrepid producers, entrepreneurs and business leaders are expanding the market and helping it mature. So, what’s in store in 2023 for the industrial hemp marketplace and what opportunities are on the horizon?

Beyond CBD, hemp innovators are hard at work creating more sustainable, regenerative and affordable options for such industries as textiles, manufacturing, transportation, plastics, food and nutrition, building and construction and more. Through science, technology and agricultural advances, equipment makers, producers, processors and others are creating a true renaissance in hemp production and manufacturing. And as the hemp and cannabis industry continues to engage with Congress and policymakers, businesses in the space may see a more favorable regulatory and investment environment in the future. It’s a tale of two industries: CBD faces ongoing market pressures and FDA regulatory challenges, while the food and fiber sectors are emerging with significant support from the USDA and others.

This is a must-read for industry leaders. Order your copy today!

Published by Let’s Talk Hemp Media, the Hemp Industry 2023 Opportunities Report presents a synopsis of the key topics and trends affecting the hemp industry, as well as information to help guide you on the road ahead. This comprehensive annual market overview features the following topics:

Hemp 2022: A Year in Review & A Look to the Future:

U.S. Hemp Market Stumbles in 2022, While EU Ripe With Opportunity,

Regulatory & Legislative Outlook:

Federal and State Legislation Activity in 2022 & What’s on the Horizon for 2023

FDA Warning Letters, Activity and Actions in 2022 & What They Mean for 2023

International Regulatory/Legal Update

The Wellness & Cannabinoid Market:

The CBD Market: A Rocky Road, Yet Bright Spots on the Horizon

The Delta-8 Debate: The Rise of Intoxicating Hemp-Derived Products

The Hemp Food Market (Food, Beverage & Animal Feed)

The Hemp Fiber Market (Woven, Apparel, Textiles & Non-Woven, Insulation, etc.)

The Hemp Building & Construction Market:

A Strong Foundation for Hemp Building Materials in the USA

Financial & Investor Outlook:

Investment in Industrial Hemp: A Tale of Two Cities and One Russian Oligarch

Authors include Beau R. Whitney, Chief Economist, Whitney Economics; Jonathan Miller and Alyssa Erickson, U.S. Hemp Roundtable; Asa Waldstein, Supplement Advisory Group; Xavier Jaillet, Clark Hill PLC; Steven Hoffman, Editor, Let’s Talk Hemp; Eric Singular, International Hemp; and Jean Lotus, Editor and Publisher, HempBuild Magazine.

Contact

Morris Beegle, WAFBA, info@nocohempexpo.com

Steven Hoffman, Compass Natural, steve@compassnaturalmarketing.com, tel 303.807.1042

FDA Objects to CBD Being Sold as a Dietary Supplement; Industry Leaders Speak Out

By Steven Hoffman

FDA’s recent decision to reject New Dietary Ingredient applications for full-spectrum CBD from Charlotte’s Web and Irwin Naturals casts a cloud of market uncertainty; passage of Congressional legislation is only option, say industry leaders

Despite months of diligent communications with the U.S. Food and Drug Administration (FDA), along with the submission of volumes of data demonstrating the safety and efficacy of full-spectrum, hemp-derived cannabidiol (CBD), FDA in a letter posted on August 10 rejected two New Dietary Ingredient notification (NDI or NDIN) applications for CBD submitted by pioneering CBD brand Charlotte’s Web and leading natural supplement brand Irwin Naturals.

The decision, based on the agency’s 2020 ruling to treat CBD as a drug, casts a continuing cloud of uncertainty over the market for dietary supplements and functional food and beverage products made with hemp-derived CBD. FDA’s objection only adds to consumer confusion and investor hesitancy, resulting in stunted market growth, say industry leaders, despite rising interest from U.S. farmers to grow hemp and from consumers in using CBD as a safe and effective dietary supplement and herbal remedy alternative.

It was a disappointing, if not surprising, decision by an agency that has historically shown an aversion to dietary supplements and cannabis-derived products, and that has been criticized for being under the outsized influence of the pharmaceutical lobby.

However, given the FDA’s continuing objection to allowing CBD to be sold as a dietary supplement, the only option left is for the hemp industry to advocate for Congressional legislative action, such as H.R. 841 in the House of Representatives and S. 1698 in the Senate, to mandate the FDA to regulate CBD as a dietary supplement and allow for the growth of the emerging hemp-derived CBD market. See U.S. Hemp Roundtable’s legislative guide to take action.

Writing in New Hope Network, Rick Polito reported, “The agency had signaled willingness to work with brands via the NDI process, but in the end appeared intent on delivering a predetermined verdict that CBD, whether as an isolate or as a component of a full-spectrum hemp supplement, is legally identical to the CBD compound as used in Epidiolex, a pharmaceutical drug used to treat epilepsy. The Food Drug and Cosmetic Act ‘exclusionary clause’ holds that supplements cannot contain pharmaceutical ingredients.”

“Why did the FDA put them through the months of doing this dance back and forth?” Steve Mister, CEO of the Council for Responsible Nutrition, asked New Hope’s Polito, emphasizing that Irwin Naturals and Charlotte’s Web were diligent in the NDI process.

“The FDA’s absence, in all measurable forms of leadership, has not only left the CBD market unregulated, it has also cost the hemp industry hundreds of millions if not billions of dollars in lost revenue and investments, and created obstructive barriers and bottlenecks throughout the entire hemp supply chain,” said Morris Beegle, President of We Are for Better Alternatives and producer of NoCo Hemp Expo.

Read on to hear what Charlotte’s Web and other hemp industry leaders and advocates had to say in response to FDA’s decision.

Charlotte’s Web Official Statement

“Today the U.S. Food & Drug Administration (FDA) published an “objection” to Charlotte’s Web’s New Dietary Ingredient notification (NDI) submitted for our full spectrum hemp extract (FSHE), due largely to its drug preclusion provision. This response from the FDA indicates to Charlotte’s Web that without legislation by Congress, this market will remain unregulated…

Over the last 18 months, Charlotte’s Web collaborated with the FDA, providing information about the cultivation, extraction, manufacturing, use and safety behind our proprietary FSHE with naturally occurring levels of CBD. We also supplied research evidencing our FSHE to be different from purified CBD in isolate form which is an FDA-approved drug.

The FDA letter asserts that a FSHE cannot be used in dietary supplements because it is precluded and expresses safety concerns. Regarding safety, the conclusions drawn by the FDA do not appear to be based on the data provided in our NDI application … We requested the FDA correct the record to reflect that data…

The FDA objection to the NDIN does not impact the existing business operations of Charlotte’s Web but does provide useful guidance about what’s required to secure a regulatory framework for FSHE as a dietary supplement.

Both the House of Representatives and the Senate introduced bills that would legislate hemp CBD as a dietary supplement. We believe this legislation is a critical step to protect consumers and to establish guidance for manufacturers, and Charlotte’s Web intends to stay at the forefront of these efforts. Our vertically integrated supply chain and category leadership uniquely position us to work effectively with Congress, and the FDA, to ensure this critical path forward for the hemp industry.”

See Charlotte’s Web’s full statement here.

Jonathan Miller, General Counsel, U.S. Hemp Roundtable, Member-in-Charge, Frost Brown Todd, Washington, DC

“There has been general support for our legislative efforts at U.S. Hemp Roundtable, but there have been some holdouts saying, ‘Let’s give the FDA time to sort it out.’ But this latest NDIN rejection puts that argument to bed. The FDA is clearly not going to take steps to regulate CBD unless Congress tells it to do so. FDA’s objection makes it clear that our top priority is securing passage of legislation such as H.R. 841 and S. 1698.

The U.S. Hemp Roundtable is deeply disappointed to witness FDA’s rejection of two dietary ingredient notifications (NDINs) recently submitted for full-spectrum hemp extracts. FDA’s actions send a discouraging message to the entire hemp and CBD industry, especially in light of the fact that these firms provided more than ample safety data and cooperated with FDA’s requests throughout the process.

When held to the same regulatory standards as other dietary supplements and food ingredients, hemp-derived CBD products have a strong safety profile; the dangers to consumers are only posed by the unregulated marketplace that FDA continues to propagate. This should be a clarion call to Congress that it is time to step in and pass legislation to ensure that CBD products are held to the same standard as all dietary supplements and food ingredients, and to reject an NDIN-only path.

It’s been more than two and a half years since hemp was legalized by the 2018 Farm Bill, and without congressional intervention, the hemp farming industry will continue to struggle, and consumers stand to lose as well.”

See U.S. Hemp Roundtable’s legislative guide to take action.

Janel Ralph, CEO, RE Botanicals and Founder, Harmony CBD

“It is mind blowing to me that FDA is asking us to prove that something is safe when it’s never been proven to be unsafe. It’s FDA’s job to prove it’s unsafe, and it hasn’t been able to do that. The agency claims it’s a drug. Well, at what dose is it a drug? Epidiolex is like 300 mg a day, while full-spectrum supplements are like 25-50 mg a day. FDA could legally make an exemption, but it is choosing not to.

On a personal note, my child Harmony, who was born with Lissencephaly or smooth brain syndrome, has been taking CBD every day of her life for the past seven years. She gets tested regularly for liver enzymes and it has never once affected her liver, yet it has significantly alleviated her suffering from seizures.

At the end of the day, CBD is improving people’s lives across the country and it should be available to everyone as a supplement. FDA needs to start looking at CBD differently. If FDA is going to block something that benefits people, that’s a problem.”

Rachael Rapinoe, CEO and Co-founder, MENDI Co.

“FDA’s objection results in further disconnection from hemp brands, consumers and the education needed to progress the industry as a whole. It shows many of us that the FDA isn’t prioritizing CBD products and bringing a clear path forward in a timely manner. The implications will result in continued confusion and discontinuity of language between brands in the industry.

The FDA is making it increasingly difficult to properly educate and protect consumers from the various types of products on the market and the benefits associated with them. Education is the key to progress and we need the full support of the FDA and medical community if we want to see this industry and its consumers mature.

We will continue to operate in highly restricted grey zones, which is very frustrating. We have a lot research and education to pull real data to educate and empower consumers in the industry. As a brand, we want to protect the public from harmful or dangerous products and guide them in directions that will be more beneficial to their long term health. Also as a brand, we would like to operate in the same capacity as other CPG companies.”

Michael McGuffin, CEO, American Herbal Products Association

“Last month, the U.S. Food and Drug Administration (FDA) replied to two separate new dietary ingredient notifications (NDINs) submitted for ingredients identified as ‘full-spectrum hemp extracts,’ one filed by Charlotte’s Web, Inc., and the other by Irwin Naturals. In its responses, FDA informed both companies that the subject ingredients ‘cannot be used in dietary supplements pursuant to the dietary supplement exclusion provision in 21 U.S.C. § 321(ff)(3)(B)’ on the basis that each qualifies as a ‘CBD product.’

Significantly, the Charlotte’s Web, Inc., ingredient has a cannabidiol (CBD) content of 19.5 mg per serving, and the Irwin Naturals ingredient has a proposed serving limit of approximately 65 mg/day of CBD. In addition, the agency identified ‘concerns about the adequacy of safety evidence’ included in these notifications ‘as a basis for concluding that a dietary supplement containing [the NDI] will reasonably be expected to be safe when used under the conditions’ described in the notifications.

We are fast approaching the three-year anniversary of the enactment of the 2018 Farm Bill, which reflected the decision by the U.S. Congress to support farmers and consumers by establishing a lawful process for production of hemp, which was broadly defined to include the cannabinoids in hemp, including CBD. But ever since FDA has relied on the cited exclusion provision to keep dietary supplements that contain any amount of CBD in a regulatory gray zone, even though the agency already has authority to create a lawful framework for marketing such products.

No one who has been paying attention to this matter should be in the least surprised to see FDA restate its position in these letters. At the same time, it is disappointing and represents another missed opportunity for the agency to bring clarity to the marketplace while using its existing resources to protect the health of the many Americans who already use hemp-derived products.

There are several bills now pending in the U.S. Congress that would resolve this matter and that are supported by the American Herbal Products Association and other organizations who are seeking a resolution that will simultaneously protect the public and the trade. FDA’s NDIN responses should sharpen the focus of all who share such a goal.

At the same time, FDA’s pointed attention to the content of these two NDINs should not surprise any experienced reviewer of the over one thousand such notifications submitted over the past 25 years, and the agency’s replies should be familiar in their scope and tone. Even if Congress acts to remove the current legal barriers to CBD-containing hemp products, companies that intend to bring a new CBD ingredient to market will need to meet the very high standard established for NDINs. In establishing this standard, it is not uncommon for FDA to identify its own specific safety concerns in its response to an initial notification, and the agency often lays out a roadmap for following up with more safety information – as it did for these two full-spectrum hemp extract submissions. These two companies and others who plan to follow their leadership would be well served to study these letters in detail.”

Asa Waldstein, Principal, Supplement Advisory Group; Chair, AHPA Cannabis Committee

“Conducting studies to prove safety is an important part of responsible herbal commerce and Charlotte’s Web should be commended for its time and financial investment. Charlotte’s Web makes the case that a naturally occurring CBD is different from the CBD isolate used in Epidiolex. The FDA comments highlight the agency’s position that any CBD-containing product, including a full-spectrum hemp extract, is not a lawful dietary ingredient due to the Epidiolex drug preclusion provision.

FDA states the Charlotte’s Web (products) are ‘carefully designed to ensure consistent levels of CBD, and that it is produced from your proprietary cultivar (CW1AS1) hemp plants that provide robust levels of CBD.’ FDA’s case here is even though CBD isolate is not added to the products, they still are designed with CBD content in mind. This is a conundrum, as process control and label accuracy are part of dietary supplement regulations. This discussion is further complicated by state requirements in West Virginia and Utah which require CBD content to be listed on the label.

My concern is the FDA response may inadvertently send a ‘do not proceed’ message to companies on the fence about conducting safety studies. I implore companies to continue to add proving product safety into their budgets and strategies.

During this regulatory holding pattern, I suggest companies continue to collect product safety data, as future regulation will likely include a safety component. Acting like a reputable dietary supplement company is the best way forward for hemp-CBD companies. This includes investing in safety studies, but also CFR 111 & 117 compliance, food facility registration, lot number traceability, recall procedures, adverse event reporting, and common allergen labeling.”

Sander Zagzebski, Attorney and Co-leader of Clark Hill LLP’s Cannabis Industry Team

• What does FDA’s objection mean?

“As a technical matter, it means that the person filing the notice (Charlotte’s Web, Inc.) does not have FDA approval to use the dietary ingredient listed in their notification (full spectrum hemp extract) in food products”.

• Why Now?

“The hemp/CBD industry has been operating in a gray area under federal law. While the Farm Bill has legalized certain hemp and hemp derived products, including CBD isolates and full spectrum CBD extracts, under certain circumstances, it is an exaggeration to say the Farm Bill “legalized CBD” in a wholesale fashion. One of the big questions relating to hemp-derived CBD products generally is whether and to what extent manufacturers can include hemp-derived CBD products in food and beverage products that are generally regulated by the FDA. I’m guessing Charlotte’s Web was hoping the FDA under the new Administration would provide some clarity on this issue for the hemp/CBD industry in general and for Charlotte’s Web in particular. By way of background, the law provides that active ingredients in approved pharmaceutical products cannot be sold as dietary supplements in other products. One of the policy purposes behind this law is to encourage companies to undertake the considerable time and expense necessary to get FDA approval for a new pharmaceutical product. If competitors were allowed to sell the active ingredient to a new pharmaceutical product as a dietary supplement, it obviously dilutes significantly the economic benefit of winning FDA approval for a new drug and acts as a strong disincentive to go through the FDA’s drug approval process. When the FDA approved the drug Epidiolex, which is a CBD oral solution for the treatment of epilepsy, that action meant that the active ingredients of Epidiolex, including the CBD compound, could not then be classified as an approved dietary supplement under the law. Left unclear, however, was whether the exclusion would apply only to the specific CBD chemical compound in Epidiolex, or whether it would be applied more broadly to other CBD compounds including ‘full spectrum’ CBD.”

• What was Charlotte’s Web’s objective in applying to the FDA?

“It is likely that Charlotte’s Web was hoping to get clarity on the FDA’s position regarding CBD and to get the FDA’s blessing that, at a minimum, a “full spectrum” hemp-derived CBD products (as opposed to the specific CBD isolate in Epidiolex) would qualify as a permitted dietary supplement.”

• What are the implications going forward re: FDA’s policy toward CBD?

“The broader implications are so far unclear. The hemp-derived CBD industry has existed in this regulatory gray area regarding the FDA for some time, so one could argue that nothing really has changed. On the other hand, the FDA had an opportunity to do the industry a favor, and it declined to do so. Although I don’t have a crystal ball, I think it is likely that the FDA will continue to focus most of its enforcement energy on suppliers that make what the FDA considers to be unsubstantiated health claims, since that doesn’t involve any significant change in their policy stance from the prior Administration. Most federal agencies are loathe to make major policy adjustments when they don’t have a Senate-approved leader at the helm. Since the FDA is currently operating under an Acting Commissioner, it seems a safe bet that the FDA won’t make a major policy decision regarding hemp or CBD until it has its Senate-approved leader.”

• How does that impact companies, consumers and the market?

“In the immediate term, the impact is probably insignificant. The industry had hoped for some clarity, which the FDA has declined to give it, but otherwise the status quo will continue. That said, the industry will have to digest the fact that the FDA hasn’t gone away, and that legislative action is probably necessary to clear the air.”

• What will it take for FDA to allow for and regulate CBD as a safe ingredient in supplements and food and beverage products?

“It is possible that a new FDA Commissioner will, once confirmed, decide to take a more permissive approach to the industry. Absent direction from the top, however, it feels like the career bureaucrats in the FDA do not want to be put in the position of having to make these policy decisions. So legislative action is probably inevitable, eventually.”

• What actions can hemp industry leaders and advocates take to support free access to CBD products in the dietary supplements market?

“Given the regulatory ambiguity, industry leaders would be well advised to be cautious in how they market their products and to be rigid in otherwise complying with all applicable rules and regulations.

• What other comments would you add?

“One coda to this response: The maker of Epidiolex, GW Pharmaceuticals, was sold to Jazz Pharmaceuticals for $7.2 Billion. While GW undoubtedly had other products in the pipeline, the press release announcing the deal describes Epidiolex as GW’s ‘lead product.’ So FDA approval is big business.”

# # #