Food Inflation in the U.S.: A Strategic Reckoning for Food Sector Leaders

This article first appeared in the September 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In 2025, food inflation in the United States has transformed from a passing concern into a defining business challenge—and opportunity—for leaders across the food ecosystem. A 3% year-over‑year increase in overall food prices, including 2.4% for groceries and 3.8% for restaurant meals, may seem modest. Yet beneath those figures lie sharper, more disruptive trends: surging prices in staples such as coffee, ground beef, and eggs; strategic responses from consumers and retailers; and structural pressures that demand both resilience and reimagining. Business strategists in the food sector must now lead with insight, not just facts.

A Collision of Climate, Cost, and Policy

Climate volatility continues to drag on food supply and costs. Extreme drought in U.S. cattle belts, heat waves in crop regions, and pest outbreaks such as avian flu have propelled food inflation beyond headline figures. Coffee is up 13.4%, ground beef 10.3%, while eggs have spiked 27.3%, putting extraordinary strain on manufacturers and squeezing household budgets (Axios).

Adding to the upward pressure are sweeping tariffs introduced by the Trump administration, with tariffs on imports from Brazil and India reaching 50%. The tariffs are already working their way into the cost of everything from meat and produce to metals used in cans and packaging (The Washington Post). According to the Yale Budget Lab’s estimates as of August 7, 2025, consumers face an overall average effective tariff rate of 18.6% – the highest since 1933 – and the impact is projected to cost U.S. households an extra $2,400 per year.

Meanwhile, immigration enforcement over the past several months has destabilized farm labor. In California’s Oxnard region, intensified ICE activity has slashed agricultural labor by 20-40%, leading to $3-7 billion in crop losses and driving produce prices up 5% to 12%, according to research published in August 2025 from Cornell University. Simultaneously, cuts in SNAP and other supports have strained both consumer access and farm revenue—especially for smaller producers—plus, grocers in rural communities and elsewhere that depend on SNAP programs feel that impact much harder (Climate and Capital Media).

Beyond cost drivers, the retail margin picture is fraught. Analysis from the White House Council of Economic Advisers showed grocers’ profit margins rising 2 percentage points since before the pandemic—reaching two-decade highs—while “shrinkflation” and package downsizing quietly preserve profitability (Grocery Dive).

FMI—The Food Industry Association’s study released in July 2025, “The Food Retailing Industry Speaks 2025,” reveals an industry struggling to navigate challenging economic conditions, largely due to policies implemented during the Trump administration. According to FMI, about 80% of both retailers and suppliers anticipate that trade policies and tariffs will continue to affect pricing and disrupt supply chains. Most grocers expect operating costs to remain high (Supermarket News).

Consumers Are Stressed About Rising Prices

Recent polling reveals that nearly 90% of U.S. adults are stressed about grocery prices—with half calling it a major stressor. As a result, Americans are responding to these pressures with pragmatic and inventive shifts. Consumers across income levels are tightening the belt, leveraging buy-now-pay-later options, getting creative with savings, and turning to food banks when they must (AInvest).

Shopping behavior reflects this anxiety—and innovation. RDSolutions reports that 86% of consumers now buy private-label products, with price cited as the primary decision factor; 42% opt for cheaper alternatives; while 20% skip items altogether. Data from The Feedback Group shows 61% of supermarket shoppers use sale-driven habits—buying on promotion, eating more at home, and choosing store brands over national names (Progressive Grocer). Meanwhile, many households lean on grocery hacks such as careful list-making, midweek shopping, loyalty programs, and bulk purchases to maximize savings (Times of India).

Even amid tightening budgets, shoppers haven’t completely abandoned pleasure, however. KCI’s “stress index” reveals that consumers crave “affordable luxuries” and product discovery—seeking balance between taste and value. In fact, 68% of consumers surveyed prioritize taste over price, while one-third still prioritize lowest-priced options (Food Dive).

In a fresh produce market reeling from the effects of inflation and immigration enforcement, one consumer trend remains strong: Health continues to drive purchases of fresh fruits and vegetables. According to The Packer Fresh Trends 2025 report, published in August 2025, 72% of shoppers say their primary reason for buying produce is to support a healthy lifestyle. However, price pressures loom larger than ever, with 44% of consumers now saying that cost is the top factor in deciding what to buy, up from 39% last year. As households juggle tighter budgets, they’re opting for familiar staples over experimenting with newer or higher-priced options (Farm Journal).

For lower income individuals and families, higher food prices are resulting in less consumption of healthier food options, with the result that Americans are not eating enough fruits, vegetables, and other nutrient-dense foods. Instead, they are choosing sugary and ultra-processed foods, which tend to be cheaper and last longer.

"There's evidence that inflation continues to shape food choices, particularly for low-income Americans who prioritize price over healthfulness," Constance Brown-Riggs, a registered nurse and nutritionist specializing in diabetes care, told Northwell Health. "These results highlight the disparity in how income influences food priorities," she continued, adding that higher food prices often increase food insecurity. "These shifts increase the risk of chronic diseases such as diabetes, heart disease and obesity."

Even so, there is some opportunity on the horizon. The Packer Fresh Trends 2025 report shared some bright spots, including the fact that Millennials and Gen Z are leading the way on trying new products, exploring organic options, and prioritizing convenience, including prepped veggies and grab-and-go fruit packs. In addition, interest in organic remains strong, with 22% of consumers purchasing organic always or most of the time, particularly among younger and higher-income households.

Grocers, Brands, and Manufacturers Corral Cost Pressures

The reaction from retailers and manufacturers has been tactical and dynamic. Major chains are reevaluating supplier cost increase requests, pushing back aggressively against inflation on branded items. Meanwhile, grocers are ramping up private-label assortments (Investopedia).

Businesses like Aldi are demonstrating how cost leadership can go viral: A summer discount campaign across 2,550 stores marked down 400 items by up to 33%, estimated to save shoppers $100 million. Fast-food chains are responding with value menu bundles—their way of catering to cash-strapped consumers without sacrificing frequency (The Wall Street Journal).

In the natural channel, retailers such as Natural Grocers are emphasizing value, loyalty programs and sales to draw shoppers. For its 70th anniversary in August, Natural Grocers leveraged deep discounts across its nearly 170 stores in 21 states—up to 60% off on more than 500 products—to tap into consumer demand for affordability and quality. According to AInvest, the campaign “sets a benchmark for value-driven retail” by blending “nostalgia, discounts and loyalty incentives to boost sales and customer retention.”

As demand for better-for-you foods remains strong among health-conscious consumers, Jay Jacobowitz, president and founder of Retail Insights, told Supermarket News that many retailers in the natural and independent space experienced a strengthened second half of 2024 and first quarter of 2025, as less price-sensitive consumers make personal health and wellness a priority. Smaller retailers “are going to have increased (economic) pressure, but it’s not pressure that they’re unfamiliar with dealing with,” he said.

Manufacturers are similarly pressured. They face rising raw material, labor, and energy costs, yet retailers limit how much of that inflation they pass through. Many are resorting to smaller or reformulated packaging, trimming promotions, and optimizing sourcing strategies to protect shelf placement (Columbus CEO).

Yet even in the last few weeks, food makers are succumbing to the need to raise prices as the longer-term effects of tariffs, economic policies, and supply chain disruption kick in. On Aug. 7, 2025, Forager Project co-founders Stephen Williamson and John-Charles Hanley announced the following on Instagram:

“Like many food makers, we’ve been feeling the effects of rising ingredient costs—especially for our beloved cashews (up 52%) and coconuts (up 113%). We’ve held off as long as we could, but to keep making food the right way, a price increase was necessary. What hasn’t changed? Organic ingredients, ethical sourcing, planet-healthy practices.”

At the agricultural level, the disconnect is acute. Farmers receive only about 16 cents back from every retail food dollar spent—and that fraction must cover skyrocketing seed, fertilizer, and machinery costs (Washington Post). Some farmers still support tariffs, believing they will yield long-term trade gains; others see them as a short‑term hit to margins (Investigate Midwest).

Strategy: Adaptation, Advocacy, and Resilience

Current forecasts from the USDA suggest moderate gains: food-at-home prices rising around 2.2% for 2025 and restaurant prices about 4%. But the structural challenges—climate, policy, labor, and pricing power—carry implications far richer and more urgent than those figures alone (Food & Wine).

For food-sector professionals, the directive is clear: Strategies must be multidimensional.

1. Reinvent Pricing & Perceived Value

Offer tiered, smaller, or private-label packaging; highlight affordable luxuries and discovery moments in-store and online. Aldi’s shelf reset, Sprouts Farmers Market’s value-based positioning, and Natural Grocers’ emphasis on savings and its frequent buyer program demonstrate ways to drive loyalty and savings.

2. Strengthen Supply Chain Flexibility

Diversify sourcing, invest in climate-resilient inputs, and forecast for volatility. Manufacturers need contingency plans for both weather and trade disruptions.

3. Align Expectations & Margins

Increase analytics around cost impacts and pass-through capabilities. Supplier–retailer partnerships should define fair margin boundaries and shared value strategies for inflation periods.

4. Advocate for Systemic Support

Engage policymakers to safeguard labor stability—through H-2A visa expansions or by regularizing undocumented workers—and to secure tariff relief for food essentials and farm inputs.

5. Build Resilient Retail Formats

Simplify offerings to reduce shopper anxiety and stock-outs. Grocery models like Aldi or Sprouts’ curated “innovation centers” help drive discovery while managing complexity.

A New Epoch for Food-Business Leadership

Food inflation in 2025 is less an anecdote than a wake-up call. When climate shocks strike, tariffs bite, and labor becomes unstable overnight, businesses that only react are left behind. But those that blend adaptive execution, strategic policymaking, and bold market positioning are building enduring advantage.

Consumers may feel squeezed, but they’re still looking for experiences that feel smart, authentic, and human. Retailers, suppliers, processors, and farmers must each meet them there—delivering value, stability, and insight. Because in this new era, food-sector leadership is not just about pricing; it’s about crafting trust in uncertain times—and reshaping food systems to weather today’s storms and make the most of tomorrow’s opportunities.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

AI Leads Tech Transformation in Natural Foods

This article first appeared in Presence Marketing’s August 2023 newsletter.

By Steven Hoffman

While 2023 may not be the year the singularity took place, with the launch of the first user-friendly artificial intelligence (AI) chat bot, ChatGPT, it could well go down in history as the Year of AI.*

From regenerative organic agriculture and nutrition research to product development, marketing, distribution and retail operations, business leaders in the natural channel are already finding multiple uses for this nascent yet transformative technology. A growing number of natural and organic products companies are taking the lead in employing AI automation, and such uses across the supply chain are growing as exponentially as the technology upon which it is based.

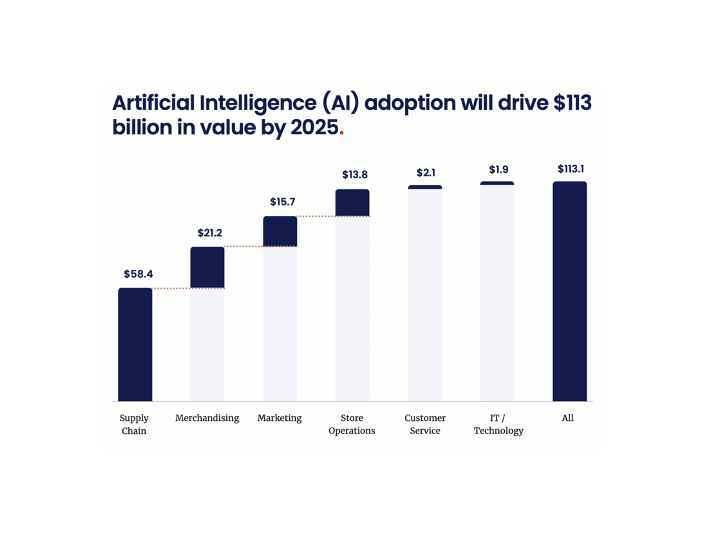

For the grocery industry, AI is projected to generate $113 billion in operational efficiency and new revenue by 2025. In a June 2023 study by data analytics firm Grocery Doppio, conducted in partnership with FMI – The Food Industry Association, and based on interviews with 152 grocery executives, implementation of artificial intelligence in supermarkets is expected to grow by 400% by the end of 2024. In addition AI “could eliminate 18% of store associate positions, 73% of store tasks and 53% of shopper queries,” reported Winsight Grocery Business.

AI adoption will deliver $113 billion in operational efficiency and new revenue opportunities for the grocery industry by 2025. Source: The Times They Are A-Changing: Impact of AI in Grocery. Source: Grocery Doppio

According to Grocery Doppio’s findings, inventory management savings could account for more than half of the estimated $113 billion in value. AI also will help grocers save billions in merchandising costs through advancements in product assortment and pricing optimization. Other savings include marketing, store operation costs, and IT technology.

While AI is not necessarily a new area for the grocery industry, grocers are focusing more on the “responsible, ethical use” of artificial intelligence,” said Mark Baum of FMI in a July 13th, 2023, Grocery Dive report. One quarter of retailers and more than a third of suppliers are using artificial intelligence (AI) to track product preferences and spending to anticipate consumer wants and needs, according to FMI’s 74th annual survey, The Food Retailing Industry Speaks 2023. “Every CEO needs to at least think like a CIO, if not act like a CIO, going forward. We’d like to say these days if you’re not technology enabled, you’re competitively disadvantaged,” Baum said.

Yet, a major concern among grocery and other workers is that AI could automate or partially automate up to 300 million jobs over the next decade, according to a study by Goldman Sachs. The industries most impacted by AI-driven automation will be “office and administrative support” and “legal.” However, according to Goldman Sach’s findings, “Once AI is implemented, workers will be more productive leading to an overall increase in output. This could lead to a 7% increase in annual GDP, equivalent to an astounding $7 trillion.”

Read on to learn how some early adopters in the natural and organic products industry are making innovative use of AI technology.

Research and Product Development

Dietary supplement companies have been utilizing AI to speed up the research of nutritional compounds. Companies like Brightseed employ machine learning to develop bio-active phytonutrient compounds to support gut health. Supplement maker Nuritas, recipient of Nutrition Business Journal’s 2023 Science and Innovation Award, employs artificial intelligence to identify “novel health-benefitting ingredients” and “the best plant-sourced, cell-signaling peptides,” said Nuritas founder Nora Khaldi.

In a July 2023 podcast, The Natural List, Aadit Patel, VP of Product Engineering at NotCo, a plant-based food technology company, shared how it uses AI and “the right balance of technology and humanity” to bring novel plant-based meat and dairy alternatives to market.

In related news, researchers at Northeastern University have developed an AI algorithm, FoodProX, that can predict the level of processing in food products and if a food has been “ultra-processed.” Such information is important for researchers in examining the health impacts of processed foods, Neuroscience News reported in June 2023.

Marketing

In an in-depth interview in Strategy Magazine, Arjan Stephens, President of leading organic food manufacturer Nature’s Path, shared that AI helps the company deal with inflation and competition by creating more targeted messaging in a quicker timeframe.

“The aim is to educate consumers on our commitment to fueling healthy communities as well as the inherent value of supporting and investing in a triple bottom line business like ours. A.I. has been a huge part of driving efficiencies in getting more strategic content to market more quickly. It not only enables us to swiftly create and distribute content, but to also respond more efficiently to consumer feedback and shopping behavior changes. This will continue to be critical to competing in a market that is oversaturated in greenwashing and misinformation,” Stephens said.

Distribution

Distributors, in particular, are looking to AI – and even AI-powered robots – to optimize supply chain and transportation logistics. Leading natural foods distributor UNFI in June 2023 announced a partnership with Finnish firm RELEX Solutions. Driven by AI and machine learning, RELEX will work with UNFI to consolidate and replace multiple UNFI buying systems into “one enhanced process, combining a more robust analysis of demand with a more granular approach to procurement,” UNFI said in a statement.

UNFI’s new AI platform is expected to become operational over the next 12 to 18 months. “As part of UNFI’s multi-faceted transformation agenda, we’re continuing to implement cutting-edge technology to improve the customer and supplier experience, while increasing operating efficiency,” said Erin Horvath, Chief Operating Officer at UNFI. In March 2023, UNFI announced that it would utilize robots powered by artificial intelligence and software automation and new scanning technology at its distribution center in Centralia, Washington.

Grocery wholesale cooperative Associated Food Stores (AFS) also plans to deploy robotics and AI-powered automation technology at is distribution center in Farr West, Utah, according to a May 9th, 2023, report in Winsight Grocery Business. Working with technology company Symbotic, AFS’s end-to-end automation system will include robotic case-pick capabilities “to enhance a range of retail-facing experiences,” including supply, expanded assortment and product delivery to stores.

Seeking to disrupt the traditional natural products distribution sector, Pod Foods claims it offers the first truly “infinite” warehouse for food procurement in the industry while providing retailers with data-driven, relevant access. The engine is powered by the company’s “Pod Bytes” data platform, which synthesizes data from its B2B marketplace, economic indicators, and other grocery-adjacent and third-party sources, the company said. The built-for-grocery models provide retailers with personalized, AI-enabled insights across all areas of discovery, including product placement, procurement, inventory optimization and market opportunity. The result is access to an endless yet personalized assortment of products, targeted to each retailer based on consumer purchasing behavior, desired retail margins, local trends, and more, the company says. Pod Foods in April 2023 appointed former VP executive and CPG veteran Michael Schall as President.

Retail

At The Fresh Market, which operates 160 stores in 22 states, longtime marketing partner Firework is implementing a patent-pending artificial intelligence platform to enhance The Fresh Market’s video content for consumers. The technology will allow shoppers to ask questions and receive sophisticated, real-time answers in The Fresh Market’s in-video chat feature. Viewers will be able to ask such questions as, “What is the recipe for the salad being made in this video?” and the AI chatbot will list the ingredients.

“The new AI engine makes use of a large language model (LLM), can understand and respond in a wide range of languages, and can be customized to reflect each brand’s unique voice,” The Fresh Market said in a statement. The new technology will be available on The Fresh Market’s website and its shoppable video live commerce retail media network. “Our customers are looking to engage with our brand in real time, both online and in store. With Firework’s generative AI technology, we can be certain that customers will receive prompt, friendly and personalized support whenever they choose to engage with our video commerce content,” said Kevin Miller, CMO at The Fresh Market.

Shoppers at Sprouts Farmers Market can now use an AI-based shopping assistant called Quin. The phone-based app from New York-based developer Verneek can answer spoken or typed questions about items sold in the stores and provide information about recipes, keto-friendly options, nutritional value and more. “As technology continues to evolve, Sprouts is always exploring new and innovative ways to improve our customer experience while providing joy in healthy living,” Sprouts said in a statement. Nasrin Mostafazadeh, Cofounder of Quin, said in ArcaMarx Magazine in April 2023 that the timing was right to launch Quin in grocery stores. However, he noted, Quin is not intended to replace grocery workers but to supplement them, giving them more time to focus on their job responsibilities, such as stocking shelves, doing inventory or checking out customers.

On THRIVE Market’s blog, the online retailer helps customers evaluate the best AI recipe generators. “There are now lots of websites that use AI machine learning to populate recipes based on ingredients, dietary restrictions, and even cooking skill level,” wrote THRIVE blogger Amy Roberts. “Some create a recipe based on ingredients you have on hand, while others churn out a recipe based on a query, like ‘Make a gluten-free chicken parmesan.’” Roberts reviewed ChatGPT for a vegan cheesecake recipe, Let’s Foodie for a red cabbage slaw, and PlantJammer for lasagna. “Did it work?” Roberts asked. “Surprisingly yes! The cheesecakes were a hit!” Though, Roberts admits she continues to refer to Pinterest for her own recipe ideas.

Using an organic food store as an example, AI platform Business Name Generator cites the following case study: “Consider the case of a budding entrepreneur, John, who planned to start an organic food store. He wanted a name that conveyed freshness, health, and sustainability. After struggling with brainstorming sessions, he turned to an online business name generator. He entered keywords such as ‘organic,’ ‘fresh,’ ‘healthy’ and ‘green.’ In seconds, the tool provided him with a list of potential names like ‘Freshly Organic,’ ‘Green Harvest,’ “Healthful Bounty’ and ‘SustainaBite.’ John was able to choose a unique and meaningful name for his store.”

Agriculture

For regenerative and organic farmers, AI technologies including machine learning and data analytics are being used to develop sophisticated monitoring systems that can provide farmers with real-time information about factors that affect soil health, including nutrient deficiencies and moisture levels. Combined with the use of sensors, drones and satellite imagery, AI algorithms are being used to analyze massive amounts of data to determine the optimal amount of water needed for each crop, reducing water waste, and ensuring that plants receive necessary nutrients for healthy growth. This not only conserves water resources but also helps to prevent soil degradation caused by overwatering, reported Marcin Frackiewicz in TS2 in May 2023.

At the University of California Davis, the AI Institute for Next Generation Food Systems (AIFS), funded in part by USDA, was launched in 2020 with a mission of meeting growing demand in the food supply by increasing efficiencies using AI and “bioinformatics” spanning the entire system from seed to shelf. Bringing more than 40 researchers together, AIFS says it aims to “bring artificial intelligence technology to the entire food system from crop breeding and farming to food production and nutrition. The institute will combine the development of the latest breakthroughs in artificial intelligence with preparing the food and agriculture industries to rapidly adopt them and ready the workforce.”

In addition, leading technology companies including IBM, Microsoft, Intel and others are focusing on developing artificial intelligence for use in agriculture and food production. Microsoft’s Project FarmVibes seeks to foster sustainable agriculture by collecting and analyzing data in from drones, sensors and other equipment to help farmers make real-time decisions about their crops. Intel and the National Science Foundation in 2022 invested $220 million in a number of AI ventures, including research in AI-Driven Innovation in Agriculture and Food Systems. Focusing on regenerative agriculture, IBM in 2022 launched IBM Regenerative Agriculture, which uses AI, data analytics, cloud technology and predictive insights to interpret agricultural and weather data and help farmers make decisions about crops.

“The food chain is a complex ecosystem that touches our everyday lives, and this is where AI has an advantage – by navigating the complex web of information, from farming to food distribution,” said Bryton Shang, CEO of Aquabyte in Forbes in July 2023. “It can help ensure higher-quality decision-making every step of the way.”

* Written and researched by a real human, with 40+ years’ experience in natural and organic foods and sustainable agriculture.

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.