Natural Grocers Wins GMO Labeling Appeal; Supplement Industry Under Pressure

This article first appeared in the February 2026 issue of Presence Marketing’s newsletter.

By Steven Hoffman

In January 2026, the regulatory framework governing the natural products industry encountered significant developments affecting how food and dietary supplements are labeled and regulated. Through a combination of judicial rulings, agency guidance, and legislative proposals, the requirements for transparency and product disclosure are shifting, presenting new compliance considerations for manufacturers and retailers alike.

For CPG brands, ingredient suppliers, and compliance officers, these updates signal a continued move toward explicit, on-package disclosure. Recent events indicate that both the courts and legislators are increasingly prioritizing clear, accessible information for consumers, challenging previous standards that allowed for digital or abbreviated disclosures.

This report outlines two primary developments from the start of the year: the U.S. Court of Appeals ruling in favor of Natural Grocers regarding Bioengineered (BE) disclosures, and a dual-front regulatory discussion involving the FDA and Senator Dick Durbin (D-IL) regarding the dietary supplement sector.

Federal Appeals Court Sides with Natural Grocers in GMO Ruling

In a decision delivered on Jan. 6, 2026, the U.S. Court of Appeals for the Ninth Circuit ruled in favor of a coalition of plaintiffs led by the Lakewood, CO-based retailer Natural Grocers by Vitamin Cottage (NYSE: NGVC) and the Center for Food Safety (CFS). The court’s decision effectively strikes down key portions of the USDA’s Bioengineered Food Disclosure Standard, addressing industry arguments that the previous rules contained exemptions that limited consumer access to information.

The "National Bioengineered Food Disclosure Standard" (NBFDS) has been a subject of debate since its inception. Critics, including the plaintiffs, argued that the USDA’s implementation allowed manufacturers to obscure the presence of genetically modified organisms (GMOs) through the use of digital links and unfamiliar terminology.

According to a Natural Grocers press release, the court’s ruling necessitates a significant revision of USDA rules. The outcome aligns with a long-standing position of Natural Grocers, the nation’s largest family-operated organic and natural grocery retailer, which has prohibited most GMO ingredients in its stores since 2012 and advocated for clearer labeling standards.

The court’s decision focused on three specific areas where the USDA’s previous rules were found to be insufficient or unlawful. Food and beverage manufacturers must now prepare for a regulatory environment that will likely require strategic adjustments in the next rulemaking cycle.

The "Bioengineered" Terminology Battle

First among the court's findings was the rejection of the USDA’s mandate that strictly required the use of the term "bioengineered." Plaintiffs successfully argued that this term is unfamiliar to the average shopper and infringed on free speech rights by prohibiting the use of terms consumers actually understand.

Under the overturned rules, a manufacturer was forced to use "bioengineered" even if their customer base was far more familiar with "GMO" or "Genetically Engineered." According to the Non-GMO Project, recent market research indicates that while 63% of consumers recognize the term "GMO," only 36% are familiar with "bioengineering." By mandating the lesser-known term, the USDA was seen as complicating disclosure. The ruling now paves the way for retailers and brands to use terms that resonate more clearly with their customers, potentially returning the familiar "GMO" acronym to federal disclosures.

Closing the Digital Divide: The End of QR Code Exclusivity

Operationally, a significant aspect of the ruling is the rejection of standalone QR codes as a sufficient means of disclosure. The USDA had previously allowed companies to forgo on-package text disclosures entirely in favor of a scannable code. Natural Grocers and the Center for Food Safety argued that this practice excluded consumers without smartphones, reliable internet access, or technical literacy—demographics that often include the elderly and rural populations.

The court agreed, ruling that companies cannot rely solely on digital disclosures. This decision impacts the "scan to learn more" approach that some large CPG companies had adopted. Brands that utilized digital links to manage label space must now redesign packaging to include clear, on-pack text or symbols accessible to the naked eye.

Highly Processed Ingredients: No More Hiding

Finally, the court found the USDA was incorrect in exempting highly processed foods—such as sugar from sugar beets or oil from canola—simply because the genetic material might not be detectable in the final refined product.

This "highly refined" exemption had been a major point of contention. Natural Grocers argued that even if the DNA is denatured or removed during processing, the ingredient still originates from a bioengineered crop system. The environmental and agricultural impacts remain, regardless of the final chemical structure of the sugar or oil.

"The court’s rejection of the ‘highly refined’ exemption reinforces an important principle: how food is made matters," noted Charlene Guzman, Communications Director of the Non-GMO Project, in a statement to Nosh. Brands that have relied on this exemption should expect closer scrutiny as the USDA revises its rules, particularly for ubiquitous ingredients like oils, sugars, and starches derived from GMO crops.

Heather Isely, Executive Vice President of Natural Grocers, stated that the decision reflects congressional intent. "Congress never intended to require the use of specific terms, the sole use of QR codes, or the exclusion of ingredients made from highly processed GMO crops," she said. "We are pleased the court recognized the shortcomings of the final rule and mandated corrections. Natural Grocers will remain actively engaged in the GMO regulatory process."

George Kimbrell, Legal Director of the Center for Food Safety, added that the ruling ensures consumers will eventually see "clear and accurate GMO label information."

The legal victory is consistent with Natural Grocers' long history of rigorous product standards. Founded in 1955 and with 168 stores across 21 states, the company has utilized a dynamic list—"Things We Won't Carry and Why"—to screen products. As stated in WholeFoods Magazine, if a company cannot verify non-GMO status, Natural Grocers will not stock the item.

The Supplement Industry’s Regulatory Tug-of-War

While the food industry assesses the implications of the GMO ruling, the dietary supplement sector is navigating a complex regulatory landscape. On one hand, the FDA is signaling potential flexibility regarding labeling requirements. On the other, Senator Dick Durbin has reintroduced legislation that could impose new registration requirements.

In a letter to the industry issued on Dec. 11, 2025, the FDA announced it is considering amendments to 21 C.F.R. § 101.93(d). This regulation currently governs the placement of the disclaimer required for structure/function claims under the Dietary Supplement Health and Education Act of 1994 (DSHEA).

Under current rules, supplements making claims such as "Supports heart health" must carry the standard disclaimer: "This statement has not been evaluated by the FDA. This product is not intended to diagnose, treat, cure, or prevent any disease." Regulations have historically required this disclaimer to appear on every single panel where a claim is made. For small bottles, this often leads to "label clutter," where the same disclaimer is repeated multiple times.

According to the National Law Review, the FDA is looking to remove the "each panel" requirement. Kyle Diamantas, FDA Deputy Commissioner for Human Foods, noted in the letter that revising this regulation would "reduce label clutter and unnecessary costs," aligning with the agency's historical enforcement posture.

Effective immediately, the FDA is exercising "enforcement discretion." The agency will not prioritize penalizing companies that do not repeat the disclaimer on every panel, provided the disclaimer appears at least once and is properly linked to the claims. However, companies should proceed with caution; this is a relaxation of placement frequency, not a removal of the disclaimer itself.

Not all experts view this relaxation as positive. Pieter Cohen, M.D., Associate Professor of Medicine at Harvard Medical School expressed concern to Nutraceutical Business Review, warning that reducing disclaimer visibility could mislead consumers. "Then you start saying things such as, ‘We only need it on the actual bottle.’ Then you let the print get smaller," Cohen noted, highlighting the tension between industry simplification and consumer protection.

Durbin Reintroduces the Dietary Supplement Listing Act

While the FDA offers potential labeling flexibility, Congress is considering increased oversight. On Jan. 17, 2026, Senator Dick Durbin reintroduced the Dietary Supplement Listing Act, aimed at modernizing FDA oversight through Mandatory Product Listing (MPL).

The core of the bill would require manufacturers to register products with the FDA, providing product names, ingredient lists, electronic copies of labels, allergen statements, and structure/function claims. This data would populate a public database accessible to consumers.

Senator Durbin’s argument is rooted in the growth of the sector. When DSHEA passed in 1994, there were approximately 4,000 supplements on the market. Today, the FDA estimates there are over 100,000. Durbin argues that the FDA cannot effectively regulate a market it cannot track. "FDA—and consumers—should know what dietary supplements are on the market and what ingredients are included in them. This is FDA’s most basic function," Durbin stated.

As reported by RiverBender, the bill has garnered endorsements from the American Medical Association, US Pharmacopeia, and Consumer Reports. However, the industry itself remains divided, illustrating a strategic difference between its two major trade associations.

A House Divided: CRN vs. NPA

The reintroduction of the Listing Act has reignited a debate between the Council for Responsible Nutrition (CRN) and the Natural Products Association (NPA).

The CRN supports the legislation, viewing transparency as a path to legitimacy and consumer trust. Steve Mister, President and CEO of CRN, stated, "In an era when the Administration has rightly called for more transparency about what we eat and how food is made, it makes sense to apply that same transparency to dietary supplements." The CRN views the registry as a tool to distinguish legitimate, responsible brands from "fly-by-night" actors selling tainted products, arguing that a federal registry is "a transparency tool—not a barrier to innovation."

Conversely, the NPA opposes the bill. Daniel Fabricant, Ph.D., President and CEO of NPA, characterizes it as unnecessary bureaucracy that burdens lawful companies while failing to stop bad actors. Fabricant argues that DSHEA already gives the FDA ample authority; the agency simply fails to use it.

As detailed in Nutrition Insight, NPA fears that the FDA could use the list to arbitrarily challenge ingredients, citing the recent (and reversed) attempt to ban NMN (nicotinamide mononucleotide) as an example of regulatory overreach. "This proposal will hand bureaucrats new leverage over lawful products, cool innovation, and punish companies investing in new science," Fabricant warned.

Conclusion: The Transparency Mandate

As the year progresses, the common thread connecting the Natural Grocers victory and the Durbin bill is transparency. In the food aisle, the courts have ruled that accessibility is key—labels must be readable without a smartphone and use terms the public understands. In the supplement aisle, the debate continues over whether transparency requires a federal database of every product on the market.

For business leaders, the takeaway is operational agility. Packaging workflows must be adaptable, supply chain documentation must be robust, and regulatory monitoring must be constant. The "clean label" trend is extending beyond ingredients to include the regulatory integrity of the package itself.

Natural Grocers has signaled it will remain active, with executive Heather Isely stating, "Natural Grocers will remain actively engaged in the GMO regulatory process." Brands wishing to remain on the shelves of such high-standard retailers must ensure their transparency efforts meet these rising expectations.

Steven Hoffman is Managing Director of Compass Natural Marketing, a strategic communications and brand development agency serving the natural and organic products industry. Learn more at www.compassnatural.com.

Presence Marketing’s Bill Weiland Shares ‘Bankable Trends’ at MAHA Institute Launch in D.C.

These comments by Presence Marketing’s founder and CEO were transcribed by Steven Hoffman, of Compass Natural Marketing, for Presence’s June 2025 newsletter.

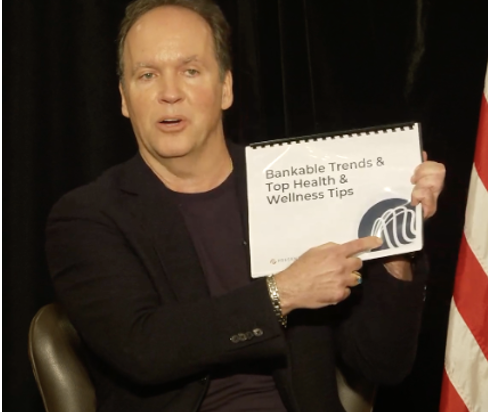

Bill Weiland, Founder and CEO of Presence Marketing, was called to Washington, D.C., on May 15 to speak as part of a full-day symposium presented by the MAHA Institute, a new organization dedicated to changing and championing federal policies and initiatives related to nutritious food, safe and sustainable agriculture, and health freedom, inspired by Robert F. Kennedy, Jr.’s MAHA movement. Bill spoke on a panel that also featured Bill Moses, founder of Kevita and Flying Embers; Daniel Fabricant, Ph.D., CEO of the Natural Products Association; and Steve Bullock, CEO of PerfectRx.

To view a recording of the full-day MAHA Institute event, visit here. Bill Weiland’s panel presentation begins at the 7:18:48 mark. Here, below, is a complete transcript of Bill’s remarks at the event.

Hello everybody, I’m Bill Weiland. I have been in the natural products industry for 46 years and a CEO for 35 years. My company is Presence Marketing. We represent natural and organic brands to conventional grocery stores and natural foods stores. But we’ve become ultra-influential in the food business, and I’ll give you some great examples.

First of all, to simplify our business, we’re building brands. We’ve built iconic brands for many years like Amy’s Kitchen, Clif Bar, Go Macro, Traditional Medicinals Teas. We work on services like innovation and product optimization. We’re also financiers — we write checks small and large, and we have all kinds of partners: angel investors, banks, venture capital groups, etc., so we raise serious capital for emerging and existing natural and organic brands.

I have been doing a report for 11 years I affectionately call “Bankable Trends” (with the Presence Marketing logo I consider the second most popular swoosh in America!). But I promised 11 years ago that I would never call one incorrectly and guess what, I’m batting a thousand. I can tell you what’s going to hit and what’s not. Let’s talk a little bit real quickly about what’s not. Crickets are not the next sushi; crickets are the next bug. Nobody’s eating ‘effin’ bugs, OK?

I’ll tell you what else people don’t want: lab food. Precision fermentation, no chance. Bio-identical dairy, no way. Cell-based meat? The cell ain’t gonna sell, and I promise you all of that is 100% accurate.

So, 11 years ago I called the collagen and bone broth trend. People are like, Bill, what the ‘H-E-double-hockey-sticks’ are you even talking about? What is this stuff? There was nothing in the channel except Grayslake Gelatin, right? And I said, well look, if you want to build muscle you eat steak, you eat chicken, you eat beans, you eat nuts — those amino acids will rebuild muscle tissue.

But if you want different benefits like bright taut skin, really high-level joint health as you age, great digestion, you need those amino acids around the joint of an animal. You can’t replicate those anywhere in nature. Glutamine, proline, glycine, alanine, arginine — very difficult to get. So, we went then and invested in and built brands like Bonafide Restorative Bone Broth, Vital Proteins, and Ancient Nutrition (we worked with Jordan Rubin and his team).

At the same time, 11 years ago we called ‘grain free.’ We always know the ‘why.’ Grain free — think about it. You capture the gluten free customer, you capture the customer who understands ‘anti-nutrients.’ You know, the phytic acid in grains, the lectins in beans, legumes and other vegetation, and how they bind with nutrients on a molecular level and make them inaccessible in the gut. So, grain free, the biggest percentage of sales is just people who say, ‘Hey, I don’t want a carbohydrate bomb. I want my cracker or tortilla to be calories of consequence.’

Let’s talk about seed oils and animal fats, now. So, we got after seed oils 15 years ago. We have a great partner in Boulder Canyon. We kept getting distribution, but their stuff kept getting discontinued when we got further and further away from Boulder. And I said guys, your canola, your safflower, your sunflower — I’ve got an idea. Let’s go with three platforms: coconut, olive, avocado — let’s build under those three higher value oils. Business has exploded and now they’re the number one chip in the country, many hundreds of millions of dollars, untold numbers of jobs and influence, and they’re retrofitting all products, now going completely seed oil free. Bobo’s came and saw me 10 years ago… I said use butter or coconut oil. They chose coconut oil. They were a small little business, cottage industry. Now, headed towards $200 million and killing it.

And let’s talk about how we’re building animal fat. This brand Masa is a proper tortilla chip cooked in beef fat. Incredible. You eat chips, you go to a Mexican restaurant, it’s kind of a gut bomb. I’m eating the plain flavor, scooping ceviche, scooping beef tartar — these are real food calories. You guys gotta try it!

I have another one here — we’re launching the first ancestral protein bar, Prima. This bar has grass fed collagen, grass fed whey, grass fed tallow, organic honey, simple ingredients. You eat one, you feel like Tarzan. We’ve got a brand called Somos, a Mexican food company that came to visit us recently at the affectionately named ‘Billagio,’ where we host meetings in Chicago. I told them if you want to build a big food company, launch refried beans cooked in tallow. Two SKUs are coming; they’ll be here for us to taste in 35 days; we’re going to launch them this calendar year. And then I’ve got a young couple of chefs — one of them is local here, Jesse & Ben’s — doing frozen french fries in either plant oils that are higher value or beef tallow.

Then just a quick primer on regenerative agriculture — my numbers, and I usually make my numbers — always, to be fair — I’m saying 18 years to 10% of all U.S. farmland will be farmed regeneratively.

That is the path that I see us on right now. Blocking and tackling with a little extra juice.

Also, I just want you to know that we’ve been acquired by a group called Platform. These guys are tremendous. It’s still business as usual for Presence Marketing except it feels like a little ‘Elonesque’ rocket fuel has been injected into us. But we’re gonna fight the good fight here long term, keep putting jobs on the board, keep influencing the quality of products — organic, natural — and I promise you we will have hundreds and hundreds of SKUs in the next three years launched that will be high quality beef and bison tallow based — no vegetable oils — duck fat (schmaltz!) or chicken fat and pork lard. So, we’ll continue doing our jobs. We are grateful to be here and continue to support the mission.

And here’s what I want to say to our friends across the aisle: This is such a layup. Don’t fight us on this one, Democrats. I’ll tell you this, this train is coming and you have two choices. Get on board or get out of the way. Let’s go MAHA.