Market Update: Organic and Plant-Based Food Sales

Originally Appeared in Presence Marketing News, August 2019

By Steven Hoffman

Rabobank: Organic Food Sales Growth Slows; Market to Hit $60 Billion by 2022

Between 2010 and 2016, organic food retail sales grew by an average of 10% per year, however, that growth has slowed to 5.9% for the past two years, says Rabobank. The international bank, known for its focus on food, predicts that organic food sales will reach $60 billion by 2022. While fruits and vegetables remain the top organic food category, representing 36% of all organic food purchases in 2018, even that category is showing signs of slowed growth, noted Rabobank Senior Analyst Roland Fumasi in a report by Food Navigator USA. “Organic produce availability has now become mainstream which means that the organic produce market will continue to more closely resemble the traditionally grown produce market,” Fumasi told Food Navigator USA. “Just a few short years ago, both organic produce prices and organic produce volumes were rising, indicating that demand expansion was occurring more rapidly than supply growth. However, there are indications that continued growth in the organic movement has partially been driven by lower prices for some of the top-selling organic product items.” Fumasi predicts that in a few years, demand for organic produce will see an increase in sales as millennials grow their income and start their own families.

Plant-based Food Sales Growing 5X Faster than Overall Food Sales

Plant-based food sales are growing like a weed, according to new research from the Plant Based Foods Association and the Good Food Institute. According to the research published in July 2019, U.S. retail sales of plant-based foods have grown 11% in the past year, bringing the total plant-based market value to $4.5 billion. Since April 2017, total plant-based food sales increased 31% according to the study. Additionally, plant-based foods unit sales are up 8.5%, compared to total U.S. food sales, which are flat, showing the overall health and momentum of the plant-based foods category. The data covers the total U.S. grocery marketplace and was commissioned from SPINS, a wellness-focused data technology company and retail analytics provider, says the Plant Based Foods Association (PBFA). According to PBFA, sales of the plant-based meat category alone is worth more than $800 million, with sales growth of 10% in the past year. Refrigerated plant-based meat is driving category growth with a 37% sales increase. Sales of plant-based milks, which grew 6% over the past year, now comprise 13% of the entire milk category, while cow’s milk sales have declined 3% over the same period. In addition, in the past year, plant-based yogurt has grown 39%, while conventional yogurt declined 3%; plant-based cheese has grown 19%, while conventional cheese is flat; and plant-based ice cream and frozen novelty has grown 27%, while conventional ice cream and frozen novelty has grown just 1%, according to the PBFA study.

Good Food Insights: Natural Continues to Set the Pace

Here’s some good news for natural products marketers, writes New Hope Network’s Bob Benenson: Natural product sales are growing five times faster than conventional product sales nationally—in the Multi-Outlet (MULO) channel, a.k.a. traditional grocery chains. Here’s the even better news: Natural product growth in this channel, where the vast majority of Americans get their groceries, outstrips conventional growth in all seven regions of the U.S., as defined by SPINS, the leading data market research firm for the natural, organic and specialty products industry. Along with FamilyFarmed’s Good Food Accelerator, Naturally Chicago and Esca Bona, SPINS is a collaborator in the Good Food Insights series. Based on the annual State of Good Food Report, derived from SPINS’ analysis of MULO market data for the 52 weeks ending May 19, 2019, while natural products comprise 9% of total sales in the MULO channel, sales in this category grew 5% over the study period, compared to 1% growth for conventional products. “Conventional retailers are recognizing that the rise of natural is an ongoing historic and generational shift, not a fad. And as they address consumer demand by adding more natural products to their shelves, they are jump-starting further growth in the sector,” writes Benenson. According to SPINS, California has the largest MULO market share of natural products at 14%, followed by the Northeast, with 12% MULO market share for natural products. The South-Central states recorded the lowest MULO market share, with only 6% of sales attributed to natural products. According to Andrew Henkel, SVP of Brand Growth Solutions at SPINS, the forerunner regions have the biggest consumer bases that are apt to adopt a “good food and natural products lifestyle.” “Parts of the country that have significant urban, progressive consumer bases are indicators of where the rest of the country is going to go,” Henkel told New Hope Network.

A New Public Private Partnership, the Colorado Hemp Advancement & Management Plan (CHAMP), Is Set to Strengthen the State’s Leadership Position in Hemp

Originally appeared in the Let’s Talk Hemp Blog & Newsletter

By Steven Hoffman

With the passage in 2012 of marijuana legalization in Colorado, the hemp industry also got an early start in the state, and Colorado is now considered one of the country’s epicenters of hemp agriculture, manufacturing and production. To further that leadership position, Governor Jared Polis has created a unique new public-private initiative, the Colorado Hemp Advancement & Management Plan (CHAMP). His priority in establishing the CHAMP initiative is for “Colorado to remain an innovating force in the promotion of this high-value agricultural commodity,” says the CHAMP website.

Led by Betsy Markey, former Representative to U.S. Congress and current cabinet member of the Polis administration and Executive Director of the Colorado Office of Economic Development and International Trade, along with Colorado Commissioner of Agriculture Kate Greenberg, CHAMP is a year-long statewide initiative that brings together state, local and tribal agencies, as well as industry experts in cultivation, testing, research, processing, finance, economics and marketing. The collaborative effort to help formulate a blueprint for Colorado’s hemp industry includes the Colorado Department of Agriculture, Governor’s Office, Department of Public Health and Environment, Department of Revenue, Department of Regulatory Agencies, Office of Economic Development and International Trade, Department of Public Safety, Colorado Commission of Indian Affairs, Department of Higher Education, local governments and industry experts.

“We had one of the first hemp programs in the country,” Greenberg recently told Westword Magazine. “We’ve got pretty incredible experience in Colorado; our state is set up for it, and our governor is all about hemp. It’s a fantastic time to be doing this work in Colorado, so I think by all accounts, we are ahead of the game. Our intent is to stay there,” she said. In addition to serving as Colorado Commissioner of Agriculture, Greenberg is the former Western Program Director of the National Young Farmers Coalition.

When asked about how to handle issues like “hot” hemp (hemp that exceeds the legal limit of THC), Greenberg said, “Before CHAMP, we didn’t have an avenue to figure these things out, so we took leadership in creating a structure that will allow regulatory agencies, industries, Native tribes, learning institutions and farmers to sit around a table and actually develop answers. There are still so many questions about the X, Y and Z of hemp — like interstate transport [and] how the Department of Public Safety can determine what is hemp and what is not. All of those questions finally have a table to sit at,” Greenberg said.

“CHAMP… is a huge, coordinated effort that includes anyone who has a stake in the game across Colorado, but it’s also going to be open-sourced,” Greenberg continued. “We’ve been talking to other states that don’t have programs, and are offering our expertise. We don’t see this as something we need to hold on to and keep away from everyone. We’ve got a national and international industry with this now, and we can’t keep it within closed borders in Colorado. This is going to have to include interstate commerce, and we really see our creativity and desire to bring in thought leaders as ways to continue our leadership,” she added.

“One way to establish our leadership is getting our state plan into the USDA. We’re in close communication with the USDA to make sure they see us as a partner in this, and that we are a resource. Submitting our state plan is big here, just to make sure our state’s hemp program is still a leader. Another one is the larger CHAMP report, which will show what it takes to grow our hemp industry beyond the Farm Bill. This is a big-vision process,” Greenberg said.

The CHAMP initiative is divided into eight “Stakeholder Groups,” including Research & Development and Seed; Cultivation; Transportation; Testing; Processing; Manufacturing (Food Commodities); Marketing; and Banking and Insurance. The stakeholder groups are scheduled to meet this summer and fall. In addition, leaders of the CHAMP initiative will hold several public meetings, with the first scheduled for Friday, August 16, 2019, in Hesperus, CO. To RSVP for the public meeting and for more information, visit https://www.colorado.gov/pacific/agplants/champ-initiative.

Editor’s Note: Morris Beegle, Co-founder of We Are for Better Alternatives (WAFBA), producer of the NoCo Hemp Expo, Southern Hemp Expo, Hemp on the Slope, Hawaii Hemp Expo and the Let’s Talk Hemp Podcast and Newsletter, was appointed to serve on the CHAMP Marketing Stakeholder Group. In addition, Steven Hoffman of Compass Natural, public relations agency of record for WAFBA and Editor of the Let’s Talk Hemp Newsletter, was also named to the CHAMP Marketing Stakeholder Group.

Leading Hemp Heritage: Renowned Environmental Activist Winona LaDuke Plans to Revitalize Hemp as an Emerging Enterprise to Create a Green Economy for the Next Generation of Native American Farmers

As Hemp Popularity Builds Nationwide, LaDuke Plans First Modern-Day, Hemp-Based Textile Mill in Minnesota with the Support of Local Farmers and Crowd Funding to Revitalize the Fiber Industry on Native American Soil to Grow for the Future.

White Earth Reservation, MN (August 13, 2019) – In the treaty territories and reservation of the Anishinaabeg, or the Ojibwe people, Winona LaDuke is planning the next economy. "Hemp is a cornerstone of a post petroleum economy and needs to be reintegrated into rural farming, particularly Indigenous farming," says Winona LaDuke who is poised to elevate her Hemp and Heritage Farm by launching a national crowd-sourcing initiative to further protect the Earth and revitalize the once vibrant hemp-fiber industry in Minnesota.

Winona’s Hemp & Heritage Farm, located near the White Earth Reservation in Northern Minnesota, is working with the Anishinaabe Agricultural Institute to build a new locally-grown economy based on food, energy, and fiber through a new hemp production facility on LaDuke's own independent land adjacent to nearby tribal lands. Hemp mills are not new to Minnesota, but they have not been active since the government shut them down in 1944. According to Hempology, the 11 hemp mills that were built in 1943 were forced to shut down one year later by the U.S. government, citing lack of needs due to ‘war purposes.’

Essentially, farmers suffered financial despair, as they were expecting to reap a significant profit thanks to hemp’s bounty. Ultimately, the farmers had nowhere to turn to manufacture their crops due to the government orders to shut down.

Nearly 70 years later, Winona LaDuke was one of the first participants in 2016 to receive an official industrial permit to grow hemp in the state of Minnesota. Winona’s vision is to generate local wealth in her community by establishing a farm that prospers from native heritage foods and also by implementing renewable hemp farming practices. In addition, her goal is to restore the land and provide farmers with the financial hope they deserve by cultivating industrial hemp.

“Sustainably speaking, hemp has been misunderstood for so many years. Not anymore. Hemp is our seed of hope. We plant these seeds and I see our future in which we flourish,” explains LaDuke. “When I work in our fields, I know my ancestors are watching us all. Our prophecies call this the time of the seventh fire, and we are instructed to choose a green or scorched path. This is the green path- fiber hemp and hemp overall is the key to the post petroleum economy. It’s time to wean ourselves from a hydrocarbon economy, and move back to a carbohydrate economy. The Green path is here”.

Winona’s Hemp and Heritage Farm is on a mission to make hemp not only the solution, but the key stimulator for economic growth in the region. “We’re raising more than $250,000 to launch our hemp mill fiber and textile operations. The main purpose for the mill is to make fiber for clothing and eventually high-quality paper, rope, food products and sustainable housing materials,” says LaDuke. “Native people have been working with hemp for centuries and our indigenous leaders are urging us to move forward and be there for the farmers of today to grow our future together,” she shares.

Hemp vs Cotton

Research indicates that cotton needs about 50 percent more water per season than hemp, which can grow with little irrigation. More than 70% of the global cotton harvest comes from irrigated land, which poses a risk for groundwater contamination. Hemp takes very little water and is strong enough to grow in fields without depleting our natural resources.

Food, Energy & Fuel

Winona’s Hemp and Heritage Farm utilizes solar power for its buildings, and horse-based energy in their fields. Vegetables and supplying food to the community is another passion of Winona’s. “We grow food such as corn, potatoes, squash, beans and other vegetables that focuses on regenerative farming and most importantly focuses on reduced petroleum agriculture,” explains LaDuke. “The future is organic; it’s green and local.”

Kickstart Campaign

Join Winona LaDuke and her fundraising efforts to fight climate change, build community, stimulate a new economy, and preserve the Anishinaabe Akiing territory, a beautiful land of biodiversity and pristine waters in Minnesota.

About Winona’s Hemp & Heritage Farm

Winona’s Hemp and Heritage Farm is about moving forward with our ancestral wisdom to create the regenerative economies our children deserve to inherit. Winona’s Hemp & Heritage Farm works with both tribal and non-tribal organic producers to create a value-added hemp industry to make paper, clothing and hemp food products. Visit www.winonashemp.com.

About Winona LaDuke

Winona LaDuke is an author, economist and expert working on issues of sustainable development, renewable energy and food systems. She lives and works on the White Earth Reservation in northern Minnesota, and is a two time Vice Presidential candidate with Ralph Nader for the Green Party. Winona is Program Director of Honor the Earth, where she works internationally on climate change and environmental justice with Indigenous communities. Winona has farmed for 20 years. Winona received her B.A. in Economics from Harvard University and her M.A. in Community Economic Development at Antioch University.

Media Contact:

Steven Hoffman, Compass Natural, 303.807.1042, steve@compassnatural.com

Can Unilever Stop Massive Plastic Pollution of Our Oceans?

Originally Appeared in Presence Marketing News, August 2019

By Steven Hoffman

An estimated 1 million ocean animals are killed each year as a result of plastic pollution. Now, one of the world’s biggest plastic polluters – Unilever – has made it a top priority to reduce plastic pollution. According to CNBC, on any given day, 2.5 billion people use Unilever products that comprise 400 household brands, yet the company knows its $158-billion market cap has come as the expense of the environment. According to Unilever, the company invests more than $1 billion annually on research and development, of which new plastics innovation is a component. In 2018, Unilever’s brands most committed to sustainability, including such “sustainable living” brands as Ben and Jerry’s, Seventh Generation and Pukka Herbs, grew 46% faster than the rest of its business and delivered 70% of its turnover growth.

“All of Unilever's brands are on a journey towards reducing their environmental footprint and increasing their positive social impact. Sustainable living brands are those that are furthest ahead on the journey to achieving the company’s ambitious sustainability goals,” Unilever said in a statement. As a result of its initiatives, the consumer giant says it has cut down on plastic use by 15% and is beginning to use bioplastics and refillable metal bottles for bodycare and other items. Since the company signed on in 1017 to an Ellen MacArthur Foundation initiative called The New Plastics Economy, Unilever committ3ed to making all of its plastic packaging either reusable, recyclable or compostable by 2025. Addressing the issue of packaging is a great way to start changing the way plastic is used, Shelie Miller, a University of Michigan professor who studies packaging and sustainability, told CNBC. “Packaging is produced to become waste,” she says. “That makes it unique among manufactured goods.” Natural products manufacturers can find a wealth of sustainable packaging resources at OSC2’s Climate Collaborative: https://www.climatecollaborative.com/packaging_resources, and at New Hope Network: https://www.newhope.com/manufacturing-and-supply-business-resources/what-can-my-brand-do-help-solve-our-plastics-problem.

Hemp Happenings This Summer

Originally Appeared in Presence Marketing News, August 2019

By Steven Hoffman

Compass Natural is pleased to organize the following hemp leadership events.

Colorado Governor Jared Polis to Give Keynote Speech at AHPA Hemp-CBD Supplement Congress, August 16, Denver

Colorado Governor Jared Polis will present the keynote speech during the American Herbal Products Association (AHPA) Hemp-CBD Congress on Friday, August 16, 2019, in Denver. The address by Gov. Polis helps set the national stage for the vitality of the hemp industry and the positive economic impact the commodity will have for farmers and for dietary supplement companies nationwide, says AHPA. Currently, the industry is navigating a rapidly evolving legal, regulatory and financial landscape on how to manufacture and market dietary supplement products with hemp or hemp-derived ingredients including cannabidiol (CBD).

“We’re proud that Governor Polis will present AHPA’s keynote presentation. His participation is integral to the future of hemp and we look forward to continuing to be a voice of the herbal products industry and share his groundbreaking message to our 500+ leading members,” said Michael McGuffin, President of AHPA. “This collaboration with Governor Polis solidifies his plans to make good on the promise he made in January to position and help shape the future of industrial hemp.” The two-day congress includes speakers from USDA and FDA, plus legal and regulatory experts, farmers and producers, manufacturers, retailers and hemp and dietary supplement association leaders. Presence Marketing’s VP of Innovation and Brand Development, Tracy Miedema, will speak at the event, and Presence Marketing / Dynamic Presence will also be a featured Sponsor Partner of the AHPA Hemp-CBD Summit. Visit http://www.ahpa.org.

Photo: Office of Colorado Governor Jared Polis

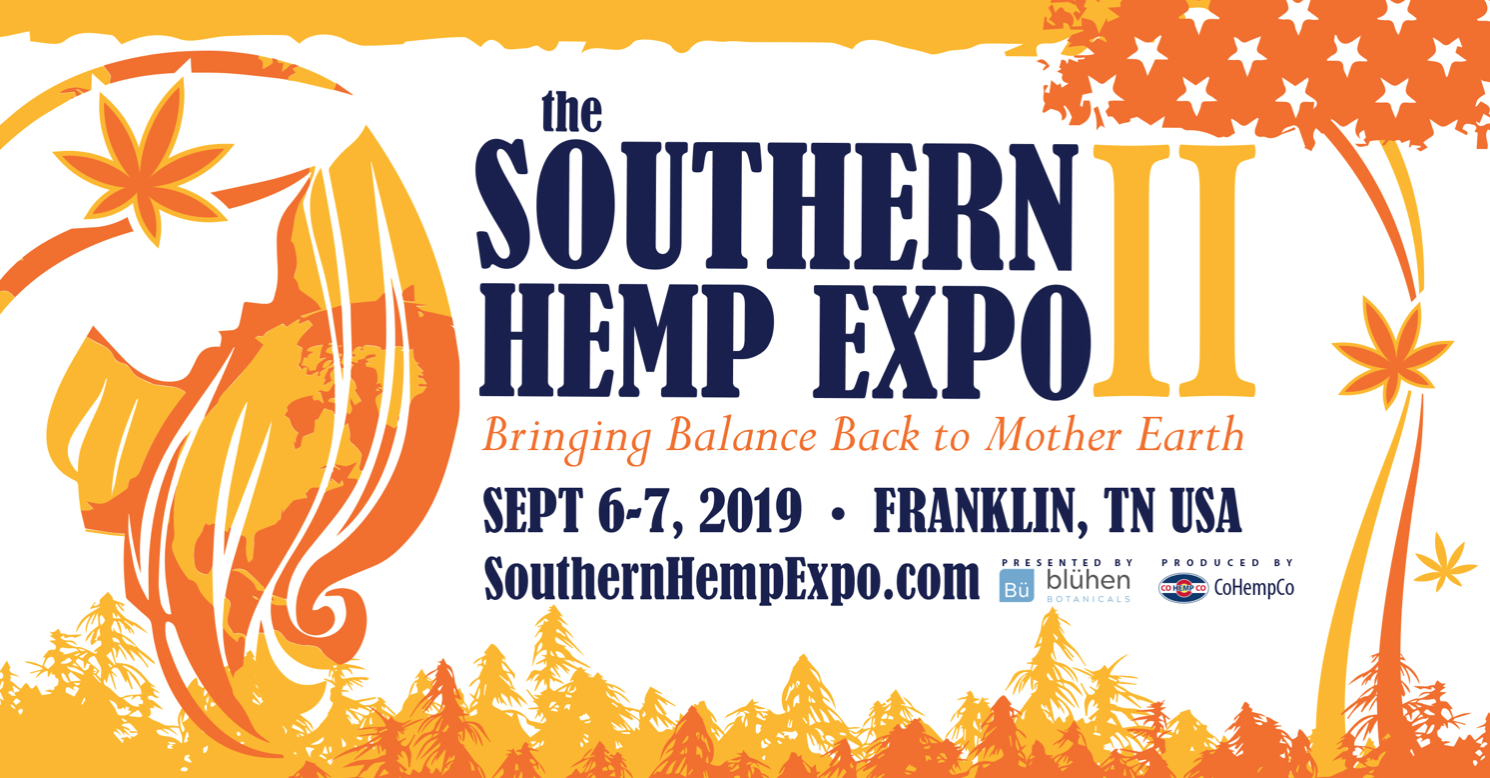

Second Annual Southern Hemp Expo Returns to Tennessee, Unites Rapidly Growing Hemp Industry

More than 5,000 farmers, entrepreneurs, investors, manufacturers, retailers, and consumers will gather at this year’s 2nd Annual Southern Hemp Expo, a program-rich conference, exhibition and trade show structured specifically for the rapidly growing industrial, nutritional, and therapeutic hemp industries, held at Williamson County AG Expo Park in Franklin, TN, Sept. 6-7, 2019.

Participants at the 2019 Southern Hemp Expo will learn about the exploding hemp market, which is expected to surge to more than $26 billion in sales by 2025. This year’s Southern Hemp Expo will include a business and investment conference; hemp farm symposium; industry day with a business-to-business expo hall; general public day with an expo hall for consumers; workshops and demonstrations; and networking and entertainment. Attendees will receive up-to-date information about federal and state legislation and regulations, current trends in CBD and hemp supplements; the latest developments in processing, technology and innovation; certification, compliance and lab testing; and breeding, genetics, seeds and clones, and more. Exhibit space and sponsorship opportunities for the Southern Hemp Expo are available online at www.southernhempexpo.com. Southern Hemp Expo is produced by the Colorado Hemp Company—which has been producing the NoCo Hemp Expo, the world’s largest hemp industry gathering, in Colorado since 2014.

The Economic Power of Hemp and Its Impact on Mother Earth

Second Annual Southern Hemp Expo Returns to Tennessee, Unites Industry Experts, Innovative Brands, Farmers & Investors in Rapidly Growing Industry

FRANKLIN, TN (July 2, 2019) – After a well-received inaugural event that drew more than 4,000 people last year in Nashville, the 2nd Annual Southern Hemp Expo (SHE)—a robust and program-rich trade show structured specifically for the rapidly growing industrial, nutritional, and therapeutic hemp industries—will be held at Williamson County AG Expo Park in Franklin, TN, on Sept. 6-7, 2019. Exhibit space and sponsorship opportunities for the Southern Hemp Expo are available online at www.southernhempexpo.com.

More than 5,000 farmers, entrepreneurs, investors, manufacturers, retailers, and consumers will gather at this year’s Southern Hemp Expo, produced by the Colorado Hemp Company—which has been producing the NoCo Hemp Expo, the world’s largest hemp industry gathering, in Colorado since 2014. The second annual SHE event is sponsored by Presenting Sponsor Blühen Botanicals, a Knoxville, TN-based producer of premium hemp extracts. In addition to serving as a leader in hemp processing and extraction, Blühen Botanicals recently opened a flagship retail hemp store in Old City Knoxville in May 2019.

Participants at the 2019 Southern Hemp Expo will learn about the exploding hemp market, which is expected to surge to more than $26 billion in sales by 2025. The Expo will feature nearly 150 sponsors and exhibitors, and more than 60 experts and leaders in the hemp industry speaking on the “Let’s Talk Hemp” stage.

“The runaway success of the first-ever Southern Hemp Expo blew us away last year, and that was even before the 2018 Farm Bill legalized the production and sale of hemp and hemp-derived products across the country,” said Colorado Hemp Company co-founder Morris Beegle, producer of NoCo Hemp Expo and SHE.

This year’s Southern Hemp Expo will include a business and investment conference; hemp farm symposium; industry day with a business-to-business expo hall; general public day with an expo hall for consumers; workshops and demonstrations; and networking and entertainment. Attendees will receive up-to-date information about federal and state legislation and regulations, current trends in CBD and hemp supplements; the latest developments in processing, technology and innovation; certification, compliance and lab testing; and breeding, genetics, seeds and clones, and more.

“Demand for hemp today is creating tremendous business opportunities for farmers, producers, and retailers in the South and throughout the U.S.,” Beegle said. “The Southern Hemp Expo serves as an important national gathering of business leaders, entrepreneurs, investors and others who are creating a market for all things made from hemp – from building materials and bioplastics to fashion, CBD supplements, cosmetics and much, much more.”

Tennessee Emerging as a Hemp Powerhouse

Experts believe Tennessee, which allowed farmers to grow hemp in 2015, is on target to potentially become a top hemp producing state. In 2018, 226 farmers grew hemp on a total of 4,700 acres in Tennessee. This year, more than 2,600 farmers and businesses are licensed to grow hemp or CBD in the state, an increase of 1,100% in just one year. Nationwide, nearly 80,000 acres of hemp were planted in 2018, with Montana, Colorado, Oregon, Kentucky and Tennessee listed as the five top producing states.

SHE sponsors include Presenting Sponsor Blühen Botanicals, along with GenCanna, LabCanna, ProVerde Laboratories, Restorative Botanicals, Myco Sativa, CV Sciences, Orange Photonics, Palmetto Harmony, Vote Hemp, Key to Life, Eurofins and more.

Reasons to Attend the 2nd Annual Southern Hemp Expo:

“Let’s Talk Hemp” Business Conference

“Let’s Talk Hemp” Farm Symposium

Investment Strategies for Entrepreneurs

Industry Day with B2B Expo Hall

General Public Day with Expo Hall

Workshops and Demonstrations & the Pono Art Zone

Farm Equipment, Tools & Machinery

Networking, Parties & Entertainment

Up-to-Date Information on Federal & State Legislation & Regulations

Current Trends in CBD & Hemp Supplements

The Future of Smokable Hemp Flower

Latest Developments in Processing Technology & Innovation

Certification, Compliance & Lab Testing

Breeding, Genetics, Seeds & Clones

Biomass, Bulk Flower, Isolate, Distillate, Full & Broad Spectrum

Retail and Wholesale Sales Strategies & More

Limited Exhibit Space and Sponsorship Opportunities Still Available, Apply Today!

Exhibit space and sponsorship opportunities for the Southern Hemp Expo are still available online at www.southernhempexpo.com.

Tickets Available Now

Business Conference, Farm Symposium, Industry and GA Tickets are now on sale at www.southernhempexpo.com.

About the Southern Hemp Expo

The Southern Hemp Expo is produced by the Colorado Hemp Company, a division of WAFBA LLC (We Are For Better Alternatives), based in Loveland, CO, and producer of NoCo Hemp Expo, the world’s largest trade show and conference for industrial hemp. WAFBA is founder of TreeFreeHemp paper and printing services and the Colorado Hemp Company. Areas of focus include product and brand development, event production, consulting and advocacy. Learn more at SouthernHempExpo.com, and find us on Facebook and Twitter.

Contact

Steven Hoffman, Compass Natural, 303.807.1042, steve@compassnaturalmarketing.com

Morris Beegle, Colorado Hemp Company, 970.541.0448, info@southernhempexpo.com

# # #

Beyond “Best By” – MOM’s Organic Market CEO Ate Expired Food for a Year

Photo: Pexels

Originally appeared in Presence Marketing News, July 2019

By Steven Hoffman

“I mean, I ate heavy cream I think 10 weeks past date, and then meat sometimes a good month past its date. It didn’t smell bad. Rinse it off, good to go,” Scott Nash shared with the Washington Post in a June 18, 2019, interview. Nash is the founder and CEO of MOM’s Organic Market based in Rockville, MD, with 19 stores in four Eastern states. According to the Post, Nash consumed yogurt months after the expiration date printed on the label, and tortillas a year past their expiration date. It was all part of his year-long experiment to test the limits on food that had passed its expiration date. Nash blogged about that experiment in February 2019.

Of course, you can get very sick eating expired food, but more often than not we're throwing away food that is perfectly safe to eat. Some foods, such as deli meats, unpasteurized milk and cheeses, and prepared foods like potato salad that you don't reheat, probably should be thrown away after their “Use By” date for safety reasons. However, in many cases, the Post reports, expiration dates do not indicate when the food stops being safe to eat; rather, they tell you when the manufacturer thinks that particular product will stop looking and tasting its best.

Why does it matter? A lot of good, safe food gets thrown away, generating unnecessary food waste in landfills and greenhouse gas emissions. The FDA estimates that we throw out a third of our food, worth $161 billion a year, and the agency believes that confusion over expiration dates may be contributing a significant portion of that waste, reported Popular Science.

In an effort to find a solution for clearer package date labels, in 2017, the grocery industry, led by the Grocery Manufacturers Association and the Food Marketing Institute, announced a voluntary standard on food-date labeling. Together, they narrowed a number of date-label terms down to two: "Best if Used By" and "Use By." "Best if used by" describes product quality, meaning that the product might not taste as good past the date but is safe to eat. "Use by" is for products that are highly perishable and should be used or disposed of by that date.

To help dispel confusion, the FDA announced on May 23, 2019, that it is supporting the food industry’s efforts to standardize the use of the term “Best if Used By” on its packaged food labeling “if the date is simply related to optimal quality – not safety,” said the agency in a statement. Studies have shown that this best conveys to consumers that these products do not have to be discarded after the date if they are stored properly, the agency said. “We expect that over time, the number of various date labels will be reduced as industry aligns on this ‘Best if Used By’ terminology,” said Frank Yiannas, FDA Deputy Commissioner for Food Policy and Response. “This change is already being adopted by many food producers.”

When it comes to food safety, the FDA said that manufacturers can put whatever terminology they want to convey health risk. While the FDA is encouraging manufacturers to use "Best if Used By" terminology as a best practice, it is not required by law. There is no federal law that requires dates on food, except for infant formula, which is required to bear a “Use By” date, reports the FDA. Other industry experts have suggested using language that indicates shelf life after opening or the date when the product was packed.

“They’re trying to bring clarity to the descriptor of the date,” MOM’s Organic Market’s Scott Nash said. “OK, that’s great, that’s better than what we have now. But I think some things just shouldn’t be dated.”

FDA advises consumers to routinely examine foods that are past their “Best if Used By” date to determine if the quality is sufficient for use. “If the products have changed noticeably in color consistency or texture, consumers may want to avoid eating them,” FDA advises. FDA also developed a FoodKeeper App for Apple and Android phones, designed to promote understanding of food and beverage storage to maximize freshness and quality.

FDA says its efforts are part of a White House initiative called Winning on Food Waste, a collaboration between the FDA, USDA and the Environmental Protection Agency to educate consumers on ways to reduce food waste and how to do it safely without risking illness from consuming spoiled food.

Learn More:

Winning on Reducing Food Waste

FDA Letter to Food Industry, May 23, 2019

FDA’s Food Waste and Loss Resource Page, May 23, 2019

Upcoming:

Southern Hemp Expo, September 6-7, 2019, Franklin, Tennessee – Learn about the exploding market for “all things hemp” – from bioplastics to CBD – at the second annual Southern Hemp Expo, the largest hemp exposition and conference in the Eastern U.S., featuring an investors summit, business conference, agriculture symposium and a full exhibition hall. Visit www.SouthernHempExpo.com. To exhibit, sponsor and for info, contact steve@compassnatural.com.

Butter Labeling Wars: Wisconsin Dairy Industry Takes On Plant-based “Butter”

Photo: Pexels

Originally appeared in New Hope’s IdeaXchange, July 2019

By Steven Hoffman

Until recently, the U.S. dairy industry remained relatively quiet regarding the proliferation of plant-based products that use words such as “milk,” “yogurt” and “cheese. Now, lobbyists and policymakers for dairy producers in Wisconsin, the nation’s leading producer of butter made from cow’s milk and the state that calls itself “America’s Dairyland,” want to limit use of the word on plant-based products, such as the best-selling vegan “butter” sold by Miyoko’s Kitchen, reported Bloomberg News.

This past spring, Wisconsin’s Department of Agriculture, Trade and Consumer Protection (DATCP) instructed supermarkets to remove nondairy products that use the term “butter” on labels, based on complaints from dairy producers that these products don’t comply with the state’s definition of butter, which requires that butter be made from dairy-based milk or cream. After being singled out and pulled from several stores, Miyoko’s agreed to affix a sticker to the label that read “vegetable spread.”

Companies such as Miyoko’s are riding a wave of popularity for plant-based products, especially dairy alternatives, reports Fortune. Plant-based milk retail sales totaled $1.8 billion for the year ending May 25, 2019, a 6.5% increase, according to data shared from Nielsen. Cheese substitute sales totaled $117 million, showing 17.4% growth. Cashew butters were up to $12.6 million, representing an increase of 4.9%, Fortune reported.

Changing consumer preferences toward plant-based foods are often cited as a chief cause of dairy’s slow decline, however, vegan products using labels such as “milk” – or in this case, “butter” – are seen by the milk lobby as misleading consumers to unfairly steal market share.

An official at DATCP said the agency is not planning to enforce labeling laws on other dairy products, such as “milk,” however, it will follow the FDA’s lead in this regard. Regarding butter, however, “It’s been an important product.” Wisconsin products more than one third of all butter sold in the U.S., Fortune reported.

FDA, for its part, may seek to restrict use of such traditional dairy terms by plant-based food producers. As part of its Nutrition Innovation Strategy, FDA announced it is modernizing standards of identity, which “define through regulation certain characteristics, ingredients, and quality of specific foods,” said an agency statement from Scott Gottlieb, who served as FDA commissioner at the time of the strategy’s launch. However, a review commissioned by the Plant Based Foods Association (PBFA) reported that 76% of people who commented to the FDA were in favor of allowing plant-based products to continue using dairy terminology.

“The entire debate over the use of the term milk and other dairy terms on plant-based foods and beverages is a solution in search of a problem,” Good Karma Foods CEO Doug Radi told Food Navigator USA in January 2019. “Plant-based foods that can directly replace dairy-based products make use of the same terminology (e.g. milk, butter, cheese) because they serve the same purposes and are used in almost exactly the same way as their dairy counterparts (in cereal, a glass, smoothies, coffee, etc.) Consumers understand words in context,” he said. “Consumers think these words represent proper descriptors for the products and do not believe we are trying to pass off our products as a dairy product. In fact, we would not be successfully doing so, as consumers buying our products are looking for alternatives to dairy,” Radi added.

Hemp Harassment: Leading Online Retailer Thrive Market Forced to Cease Sales of All Hemp and CBD Products in Banking Backlash

Originally Appeared in Let’s Talk Hemp Newsletter, June 2019

By Steven Hoffman

In a seeming backlash to the burgeoning hemp economy, hemp and CBD retailers, industry associations and other hemp-centric businesses are being denied or threatened with denial of banking, credit card processing and other key business services, including a national newswire service that announced this past month it will no longer accept press releases from hemp companies, and is, in fact, deleting all existing and previously issued press releases related to hemp and CBD from its online archives. It is a disturbing trend in an industry that was made legal across the U.S. as a result of the 2018 Farm Bill and is projected to grow to $26.6 billion by 2025.

It has forced such retailers as leading online natural products grocer Thrive Market to cease sales of all hemp and CBD products, a best-selling category over the past 18 months on its nationally recognized ecommerce site. The member-based online retailer boasts more than 500,000 members. “In early June, we received a notice from our merchant processor demanding that we cease the sale of all hemp and CBD products on Thrive Market. We unfortunately have no choice but to comply, and we’ll begin removing our assortment as early as Thursday, June 20,” wrote Thrive Market’s cofounder and CEO Nick Green in his blog on June 17. As of this writing, clicking on that assortment link takes you to a blank product page on Thrive Market’s website.

Meanwhile, the U.S. Hemp Authority, a not-for-profit trade group developing certification standards for the industry, lost payment processing services in June after being dropped by its vendor, Stripe, based in San Francisco, reported Hemp Today on June 20. According a report in CNN Business, Stripe said it dropped the U.S. Hemp Authority’s account because of liability concerns, despite the fact that the trade organization is not a seller of any hemp products. “We’re being told we’re high risk. We’re actually trying to minimize human risk,” Hemp Authority president Marielle Weintraub told CNN.

Abrupt Notice

Since a leading credit card processor, Elavon, a subsidiary of U.S. Bank, abruptly notified its hemp and CBD clients in March 2019 that it had recategorized hemp and CBD merchants as a “prohibited business type” and was backing out within 45 days of handling payment processing for such companies, a number of hemp businesses have been scrambling to establish secure and durable payment processing relationships. According to one estimate by Philippa Burgess, cofounder of MMJ FinSol, a Denver-based financial services solutions company for hemp, cannabis and other “high-risk” businesses, Elavon’s policy changes affected up to 40,000 CBD companies.

Another merchant processor, Fortress Payment Technologies, in May 2019 notified all its ecommerce customers selling CBD products that they would no longer be able to process Visa credit card payments through the bank. Some sellers received less than eight hours’ notice of these changes, reported Folium Biosciences, a vertically integrated hemp-derived phytocannabinoid producer based in Colorado Springs. The company recently launched a CBD/hemp friendly financial services platform for its customers to help remove the financial hurdles faced by the CBD industry, it said.

Kyle Rapoza, cofounder of Vermont-based Mansfield Provisions, which distributes CBD products online and through brick and mortar retail partnerships, lost credit card processing services for his company in late May 2019, when Elavon stopped doing business with the hemp industry. He explained to Ganjapreneur Magazine that, in the wake of Elavon’s action, many of the industry operators he knows and does business with are moving back to high risk (and high fee) accounts. Rapoza has since been able to access more traditional business accounts through a state credit union, Ganjapreneur reported.

Biggest Challenge Facing the Hemp Industry

It’s a “difficult time” for the industry as it related to financial services, which he called “the biggest challenge in the industry right now,” Jonathan Miller, general counsel for Kentucky-based industry association Hemp Roundtable, told Ganjapreneur. “The law, we believe, is clear that since the [2018 Farm Bill], hemp and CBD are no longer controlled substances. There should be no concern whatsoever that there would be violations of federal law to engage in commerce. …Unfortunately, there is a lot of misinformation – it’s banks, it’s credit card companies, it’s merchant services that have been refusing to do business with these hemp and CBD companies.”

Because banks have been so hesitant to serve hemp and CBD businesses despite the legalization of hemp in the Farm Bill, U.S. Senators Mitch McConnell (R-KY) and Ron Wyden (R-OR) – chief proponents of legalizing hemp – in April 2019 sent individualized letters to four federal banking and financial regulatory institutions, imploring them to prevent banking discrimination of the hemp industry, reported Cannalaw Blog.

In addition, when pressed by U.S. Senator Jon Tester (D-MT) at a hearing in June 2019, Marijuana Moment reported that Federal Reserve board member Michelle Bowman pledged to inform banks that they can service hemp businesses. When Tester asked specifically how the Fed is advising institutions when it comes to hemp, Bowman responded, “We have not told them that they cannot bank them.” Tester countered that while he and Bowman might be on the same page, it is possible that banks were hearing a different message—hence why hemp businesses have said that they’re still experiencing difficulties accessing credit. Tester said clarification is especially important at this stage because of fallout from trade wars with China and Mexico, as hemp represents a potentially lucrative crop for American farmers. “I would agree with you. We would not discourage banks from banking these types of customers,” Bowman said. “We’ll try to clarify that. Hemp is not an illegal crop.”

What, No Press Releases?

While certain merchant banks seek to stifle hemp industry growth through the denial of critical financial services, another service provider in the media newswire business seeks to silence its voice.

One leading hemp industry media and event production company, Colorado Hemp Company, based in Loveland, CO – producer of the NoCo Hemp Expo, Southern Hemp Expo, and the Let’s Talk Hemp weekly newsletter and podcast – was recently informed by its newswire service, ReleaseWire, that it will not post or distribute any new press releases that mention hemp, and in addition, it was deleting all existing and previous press releases mentioning hemp that Colorado Hemp Company had posted in the past. In a policy update issued on May 8, 2019, ReleaseWire, one of the nation’s leading online national newswire services, issued the following statement, after which it began informing hemp-centric businesses that not only were they not accepting new press releases for distribution, they were deleting all existing press releases and archives related to cannabis, hemp or CBD:

“ReleaseWire was recently contacted by our credit card processor and informed that they have a policy in place that restricts merchants, including ReleaseWire, from linking to, or providing information about, marijuana, cannabis, CBD, hemp and related products. As such, we have been instructed by our credit card processor that we must not only stop taking press release submissions on these topics, but we must remove any existing press releases and related content from our site. They have provided us with a small window of time to complete this process or risk losing the ability to process credit cards.”

Meanwhile, other newswire services including Cision, owner of PR Newswire and PRWeb, continue to accept and publish hemp, CBD and cannabis related press releases on behalf of clients.

Hemp Friendly Payment Processors

So which payment processors are willing to serve hemp and CBD companies? One such processor, Adept Payments, says on its website that it helps high risk businesses, including vape, CBD, adult, casinos and more.

While financial services group, Edward Jones, has no official policy about outreach to the hemp industry, a broker in Bend, OR, contacted Hemp Industry Daily to say he was offering a “full spectrum of banking, investment, insurance and financial planning services to hemp farmers.” Officially, Edward Jones is “looking at the provision in the Farm Bill that addresses hemp growing,” John Boul, manager of global media relations for the St. Louis-based Edward Jones told Hemp Industry Daily in April 2019.

Square, a leading online payment processor, recently soft-launched credit card processing for CBD companies, but the program is still in beta testing phase and is by invitation only. Former credit card processing professional and current blogger Phillip Parker, who describes his site, CardPaymentOptions.com, as a credit card processing watchdog group, posted a guide to the Best Merchant Accounts for Hemp Products in June 2019. Also, Merchant Maverick, a self-described comparison website that reviews and rates credit card processors, mobile payment services and other small business software, published a guide to the Best CBD Oil Merchant Account Providers in April 2019.

For CBD sellers on Shopify and other major ecommerce platforms, a recently launched processor, Organic Payment Gateways, advertises that its mission is to help people in the CBD business process payments online, and that its payment gateways work smoothly with Shopify, WooCommerce and others. Leap Payments, Instabill and other services promote that they are dedicated to ensuring CBD businesses “can accept debit and credit card payments just like any other business can.”

So, for now, you won’t find any hemp or CBD products at Thrive Market, however, the ecommerce retailer says it won’t give up without a fight. “We believe that ethical and sustainable hemp is another cause worth fighting for, so rest assured that we will be working behind the scenes in the coming weeks to get hemp products back on Thrive Market,” Nick Green wrote in his blog. “In fact, we’re already in conversations with a new processing partner to try to make that happen.”

Kroger, Nation’s Largest Supermarket, to Carry CBD in Nearly 1,000 Stores

Originally Appeared in Let’s Talk Hemp Newsletter, June 2019

By Steven Hoffman

As the hemp and CBD market continues to evolve at hyper-speed, the nation’s largest supermarket chain, Kroger, announced it is joining Walgreens, CVS, Vitamin Shoppe, GNC, Nieman Marcus and other major retailers that have all started carrying CBD products in their stores.

Kroger, which made a “meaningful investment” in Boulder, CO-based natural foods chain Lucky’s Market, which itself is a leading seller of CBD products, announced on June 11 that it will now sell hemp-derived CBD topical products, including creams, balms and oils, in 945 Kroger-owned stores across 17 states, reported CNBC News, which referred to CBD as “one of the hottest consumer trends.”

“Like many retailers, we are starting to offer our customers a highly-curated selection of topical products like lotions, balms, oils and creams that are infused with hemp-derived CBD,” said Kristal Howard, head of corporate communications and media relations at Kroger, in a statement. “CBD is a naturally occurring and non-intoxicating compound that has promising benefits and is permitted within federal and state regulations. Our limited selection of hemp-derived CBD topical products is from suppliers that have been reviewed for quality and safety,” she added.

Consumer interest in and demand for products made with cannabinoid compounds or CBD derived from hemp extract is at a fever pitch. Hemp Industry Daily projects hemp-derived CBD retail sales will surge to as much as $7.5 billion by 2023, up from about $1 billion in sales in 2019.

Yet, while CBD derived from hemp is now legal thanks to the 2018 Farm Bill passed by Congress late last year, the FDA maintains that companies still can’t add CBD to food or sell it as a dietary supplement. However, with so many CBD supplements and CBD-infused food and beverage products already on the market, the FDA on May 31 held a public hearing to learn more about the issue and hear from hemp industry representatives, manufacturers, advocates and others as it considers its position regarding sales of these products.

For major retailers, selling CBD-infused, topical beauty and skin-care products brings less legal risk, which may explain why retailers such as Kroger, Nieman Marcus and others are starting to offer those types of products first. Given the explosive growth of the market, big box retailers Walmart and Target are also reported to be exploring the potential for hemp and CBD-related products in their stores.

Kroger, headquartered in Cincinnati, OH, is the world’s largest grocery retailer, with fiscal 2018 sales of $121.2 billion, and operating stores under names including Kroger, King Soopers, Ralph’s, Dillon’s, City Market, Fry’s, QFC, Mariano’s, Fred Meyer, Harris Teeter and others. Kroger also is a leading seller of healthy lifestyles products – it’s sales of natural and organic products alone exceeded $16 billion in 2017. Kroger’s private label organic brand, Simple Truth, with sales exceeding $2 billion, is one of the largest natural and organic brands in the U.S.

Kroger says it will sell the CBD products in Arizona, Arkansas, Colorado, Illinois, Indiana, Kansas, Kentucky, Michigan, Missouri, Nevada, Oregon, South Carolina, Tennessee, West Virginia, Washington, Wisconsin and Wyoming.