PMA Predicts Future Growth of Organic Market

Photo by Wikimedia Commons

Source: Presence Marketing News, November 2017

Author: Steven Hoffman, Compass Natural Marketing

“Once merely a specialty item favored by the ‘uber health-conscious,’ organic food has widened its distribution channel, especially in retail formats, and has now become a staple in supermarkets around the world. The more accessible it becomes, the more its popularity rises.” So says the Produce Marketing Institute in an October 5, 2017, commentary. Organic achieved mainstream status due to consumer demand for transparency, especially about topics including food safety, chemical preservatives, genetically modified ingredients and pesticides, along with health concerns around diabetes, heart disease, cancer and more, which have affected food buying choices, said PMA.

“Consumers now expect to know the story behind their food before they’ll buy it. Is it locally sourced or imported from an international market? Is it produced in an ethical manner or does it come from a factory farm? If a food item doesn’t have a positive backstory, even if it’s cheaper, many consumers consider looking elsewhere. And some important components of a positive backstory include ‘natural,’ ‘organic,’ and ‘locally sourced,’ which can be major selling points despite the added costs. That shift helped transform organic produce from a niche underdog into a produce industry powerhouse, and it’s not slowing down,” said PMA.

Foods with organic and natural claims remain popular among households with children in the U.S., and organic strongly resonates with Hispanics, particularly Millennials and especially those with children. In fact, said PMA, parents in general are far more likely to embrace the positive reputation of organic.

However, PMA cautioned that households with children are on the decline. Meanwhile, the number of consumers that lack trust in the organic label remains steady, it said. Older consumers are the most likely to be unconvinced of the value of organic and are hesitant to spend more for organic products. Younger shoppers, PMA points out, while open to the benefits of organics, often can’t afford them.

PMA reported that the global organic food market was $110.25 billion in 2016, according to management consulting firm TechSci Research. Global organic food sales are expected to reach $262.85 billion by 2022. While Europe and North America make up the strongest demand for organic food, PMA suggested that intense competition in those regions means companies must also look elsewhere to gain a foothold.

# # #

Steven Hoffman is Managing Director of Compass Natural, providing brand marketing, PR, social media, and strategic business development services to natural, organic and sustainable products businesses. Contact steve@compassnatural.com.

Natural Products Industry Matures; Independents See Sales Growth

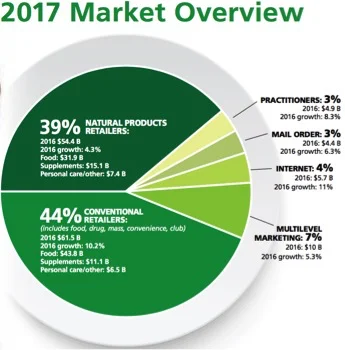

As the natural and organic products industry reached $141 billion in sales on 7.4% growth in 2016, Natural Foods Merchandiser’s 2017 Market Overview reports independents are starting to thrive again as the market shifts.

By Steven Hoffman

Source: Natural Foods Merchandiser, July/August 2017, published by New Hope Network

As a new Managing Editor back in 1986 with the Natural Foods Merchandiser, I was charged with conducting, analyzing and reporting on the natural products industry’s annual retail market overview survey. I recall spending late evenings poring over data with New Hope Network founder Doug Greene to determine overall sales, growth categories and emerging trends. That was when the industry was just breaking $5 billion in sales – a fraction of what it is today.

Thirty years later, the natural and organic products industry is maturing, reaching $141 billion in sales on growth of 7.4% in 2016, according to the 2017 Market Overview, published in the July/August 2017 edition of Natural Foods Merchandiser (NFM) in partnership with Nutrition Business Journal, with additional data provided by SPINS and the Organic Trade Association’s annual organic industry survey.

Over this time, the natural, organic and better-for-you products sector has become widely recognized as a hotbed of innovation and growth in the overall food industry. Point in fact, the Amazon – Whole Foods Market deal announced in June promises to be a game changer not just for the natural products landscape, but also for the entire retail food market worldwide.

Independents Find Stronger Footing

Yet, as the market shifts, independents that have been able to weather the past few years may now find themselves in a stronger position, according to NFM’s 2017 Market Overview.

While sales growth was modest among independent natural products retailers – sales grew 4.3% to $54.4 billion, or 39% of overall natural products sales in 2016 – NFM also reported that 69% of natural products stores surveyed recorded a sales increase, and 72% noted they did not have a competitor open up in their neighborhood in the last year.

“It may go against conventional wisdom, but well-managed and strongly positioned independent grocers can coexist with big retail. While large, often publicly held chains may have scale and strong financial backing, independent grocers are often more agile, enabling them to move quickly to address emerging trends and shifting consumer preferences,” the editors of Food Dive observed in a July 19, 2017, report.

“The difference between the corporate model, which you would now have to say includes Whole Foods, and the authentic, community-owned independent, is becoming clearer every day,” retail specialist Jay Jacobowitz of Retail Insights told NFM. “Those who embrace that authenticity and are passionate about serving their unique community will do well.”

Jacobowitz also noted that while the natural products industry may be maturing, there are areas of the country, including the East South Central region (Missouri, Alabama, Tennessee and Kentucky), that are far from saturated. “It’s a big country, and the big boys can’t be everywhere at once,” Jacobowitz said. “There are still opportunities out there.”

Independents also are more nimble in that they can feature local products, and are often the first to take advantage of such emerging product trends as cannabidiol, or CBD, a new category driving growth in dietary supplements and personal care.

Conventional Retailers Own 44% of Natural Products Market Share

During this time, razor-thin margins, increased competition and price wars impacted large mainstream grocery chains, as well as of some of the “supernaturals.” Kroger reported its first decrease in same store sales in 13 years in March 2017, NFM reported, and Whole Foods Market struggled with declining same store sales throughout 2016, prompting shareholder activism in April 2017 from Jana Partners, which held an 8.8% stake in Whole Foods, and ultimately, the announced sale to Amazon in June 2017.

Other publicly traded supernatural chains, including Natural Grocers and Sprouts, saw their stocks decline in 2016 as a result of increased competition from all sides. Natural Grocers’ stock price continues to be depressed in 2017, though Sprouts’ stock price has rebounded.

Yet, through all that jockeying for market share, the bottom line is that conventional retailers, including food, drug, mass, convenience and club stores, now command the majority of natural and organic products sales.

According to NFM’s survey, in 2016 conventional retailers captured 44% – or $61.5 billion – of all natural and organic products sales, while traditional independent natural products retailers and chains claimed 39% ($54.4 billion) of overall natural and organic products sales in 2016. Additionally, while sales among independents grew a modest 4.3%, sales of natural and organic products among conventional retailers grew at double digits, or 10.2%, in 2016.

Here Comes the Internet

As consumers become ever more comfortable shopping on the Internet from the comfort of their homes, offices and mobile devices, ecommerce sales of natural and organic products grew 11% to $5.7 billion in 2016, capturing 4% of overall natural products sales, reported NFM’s Market Overview survey.

Online sales are sure to continue a strong growth curve, as ecommerce retailers such as Thrive Market, meal kit providers including GreenChef.com and independent brick and mortar retailers increase their online presence. Plus, a growing number of manufacturers are finding markets by creating their own online shopping pages and also by offering their products on Amazon, which continues its juggernaut as the dominant force in online retail. (With its acquisition of Whole Foods Market, it will be exciting to see how Amazon integrates and advances its brick and mortar and online retail strategies.)

The online channel is likely to capture significantly more market share in the next decade from brick and mortar stores, predicted a January 2017 report by Food Marketing Institute and Nielsen. Online sales could grow five-fold over the next 10 years, with U.S. consumers spending $100 billion on “food-at-home” items by 2025, FMI and Nielsen predicted. The report also found millennial shoppers surveyed were more willing to buy groceries online in the future than other consumer groups.

Health supplements, in particular, are benefitting from ecommerce, with $2.6 billion in online sales reported in 2016 by market research firm 1010Data. Brands that focus on “natural” products experienced the most online sales growth last year, 1010Data reported.

Herbal Blends, CBD Drive Supplement Sales Growth

Sales of herbal and homeopathic products increased 13.4% over the 52 weeks ending March 19, 2017, to reach a market value of nearly $2 billion, according to SPINS data shared in NFM’s Market Overview. Vitamin and supplement sales also grew 3.5% to approximately $12 billion in sales. Overall, SPINS reported 5% growth, valuing the total supplements market at approximately $14 billion.

SPINS also reported that sales of herbal blends grew 22% over the previous year, accounting for much of the herbal category’s success. According to research firm Mintel, consumers are responding to supplement formulas that call out benefits, rather than ingredients—and blends often meet that criteria, NFM reported.

Other top-performing supplements in 2016 include turmeric/curcumin and cannabidiol, or CBD, which is emerging as a leading supplement for anxiety and pain management. Despite the regulatory grey area surrounding CBD, sales of CBD supplements grew more than 1700% last year, primarily in the natural channel, reported Hemp Business Journal. Leading market research firm SPINS named CBD oil one of the “ingredients to watch” in its 2016 Trend Watch report.

Other supplement categories of note include organic supplements, which grew 7.4% in 2016. Retailers in NFM’s Market Overview survey also cited probiotics, bone broth and kombucha as top growth categories.

Other categories showing strong growth in 2016 include organic meat, fish and poultry (9.1% growth); organic beverages (6%); organic condiments (6.3%); and organic personal care and other products (8.1% growth in 2016).

The Indie Universe: Over 26,000 Independent Stores

Among NFM’s findings is that, among independent natural products retailers, on average, 60% of a store’s offerings are organic and 40% are described as “natural.” Also, roughly half of all sales in independent natural retail stores are from products that are “Non-GMO certified.”

Additionally, NFM estimates there are 26,042 independent stores in the U.S., including health food stores, natural foods stores and supermarkets, specialty food stores, personal care and herb shops and related boutiques and kiosks, and natural chains including Whole Foods Market, GNC, Vitamin Shoppe, Natural Grocers by Vitamin Cottage, Sprouts Farmers Market, PCC, Earth Fare, Fresh Thyme Farmers Market, MOMs Organic Market, and others.

Click here to download the complete 2017 Market Overview report, including all data charts, published in the July/August 2017 edition of Natural Foods Merchandiser.

# # #

Steven Hoffman is Managing Director of Compass Natural, a full service agency dedicated to Public Relations, brand marketing, digital communications, social media, and strategic business development in the healthy lifestyles market for natural, organic, regenerative and eco-friendly products and services. Contact steve@compassnatural.com.

Organic Products Growth Outpaces Overall Conventional Food Market; Hits 5 Percent Market Share

Source: Wikimedia Commons

Market Research

Author- Steven Hoffman

Published In- June 2017 Presence Marketing / Dynamic Presence Newsletter

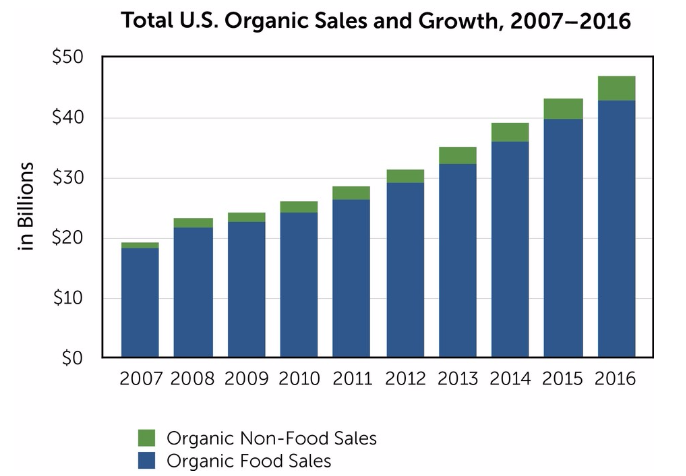

The news is just in from the Organic Trade Association (OTA) and it’s very good. Sales of organic products in the U.S. reached a record $47 billion in 2016, up from sales of $43.3 billion in 2015, reflecting overall growth of more than 8 percent. Compare that to a lackluster growth rate of less than 1 percent for the overall food industry, says OTA. Another significant first for the organic industry, reports OTA in its May 2017 Organic Industry Survey, is that organic food now accounts for more than 5 percent – 5.3 percent to be exact – of total U.S. food sales.

The organic industry is creating jobs, too, according to the OTA report. More than 60 percent of all organic businesses with more than five employees reported an increase of full-time employment in 2016, and said they planned to continue adding to their full-time work staff in 2017.

“Organic farmers are not just staying in business, they’re often expanding. Organic handling, manufacturing and processing facilities are being opened, enlarged and retooled. Organic farms, suppliers and handlers are creating jobs across the country, and the organic sector is growing and creating the kinds of healthy, environmentally friendly products that consumers are increasingly demanding,” said Laura Batcha, CEO and Executive Director of OTA. Produce – organic fruits and vegetables – accounted for nearly 40 percent of overall organic food sales. Growing at 8.4 percent in 2016 – almost three times the 3.3 percent growth rate of total fruit and vegetable sales – organic fruits and vegetables now account for nearly 15 percent of the produce Americans eat, says OTA. Organic meat and poultry products, too, marked record growth of more than 17 percent in 2016 to $991 million. The category is expected to top $1 billion in sales in 2017 as consumers demand transparency and awareness continues to grow about the benefits of organic over conventionally produced meat, poultry and dairy products.

Other organic food categories showing explosive growth included organic dips, growing 41 percent to $57 million, and organic spices, posting a 35 percent increase to $193 million. Of the overall $47 billion in sales of organic products, non-food organic items claimed nearly $4 billion of that total. Organic fiber, supplements and personal care products accounted for the majority of those sales, reporting nearly 9 percent growth in 2016.“Increasing consumer awareness that what we put on our body is as important as what we put in our body is driving the growth in organic fiber sales, while a growing desire for transparency, clean ingredients and plant-based products is spurring sales of organic supplements and personal care products,” OTA noted. “Organic products of all sorts are now found in the majority of kitchens and households across our country,” said Batcha. “But the organic sector is facing challenges to continue its growth. We need more organic farmers in this country to meet our growing organic demand, and the organic sector needs to have the necessary tools to grow and compete on a level playing field. That means federal, state and local programs that help support organic research, and provide the organic farmer with a fully equipped tool kit to be successful.”